by Patrick O’Hare

Financial Sense

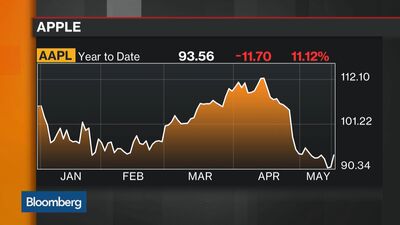

The first quarter earnings reporting period is nearly complete with over 90% of the S&P 500 having reported results for the March quarter. What we have learned to this point is that the first quarter earnings decline was not as bad as expected. Still, the first quarter reporting period can’t really be thought of as being good either.

The first quarter earnings reporting period is nearly complete with over 90% of the S&P 500 having reported results for the March quarter. What we have learned to this point is that the first quarter earnings decline was not as bad as expected. Still, the first quarter reporting period can’t really be thought of as being good either.

According to S&P Capital IQ, aggregate S&P 500 earnings per share (EPS) are estimated to be down 6.0% year-over-year in the first quarter. When we published our earnings preview on April 8, it was thought first quarter EPS would be down 7.9%.

ICBC Standard Bank Plc expanded its push into London’s precious metals market by agreeing to buy one of Europe’s largest vaults from Barclays Plc.

ICBC Standard Bank Plc expanded its push into London’s precious metals market by agreeing to buy one of Europe’s largest vaults from Barclays Plc. – Hedge funds have taken a record net-long silver position – CFTC data shows

– Hedge funds have taken a record net-long silver position – CFTC data shows You spend almost all your time thinking of what stocks to buy…

You spend almost all your time thinking of what stocks to buy… LONDON, May 16 Gold rose 1 percent on Monday, recovering from its biggest weekly loss since mid-March, as stock markets eased after soft Chinese data, boosting interest in the metal as an alternative asset, and the dollar weakened against the euro.

LONDON, May 16 Gold rose 1 percent on Monday, recovering from its biggest weekly loss since mid-March, as stock markets eased after soft Chinese data, boosting interest in the metal as an alternative asset, and the dollar weakened against the euro. Over the weekend, I sat down with Stig and Preston of The Investors Podcast. One of the questions they asked me was, “what are the three biggest risks you see right now?” I responded:

Over the weekend, I sat down with Stig and Preston of The Investors Podcast. One of the questions they asked me was, “what are the three biggest risks you see right now?” I responded: The case for an interest-rate increase in June “looks to be pretty strong,” said Richmond Fed President Jeffrey Lacker on Monday.

The case for an interest-rate increase in June “looks to be pretty strong,” said Richmond Fed President Jeffrey Lacker on Monday.

A modest blip higher in the USD…

A modest blip higher in the USD… If your response is going to be anything related to ‘no one cares what you think’ stop reading now and go elsewhere. You’re coming here either interested in why, or to add to your list of reasons you don’t like me. I’m ok with both.

If your response is going to be anything related to ‘no one cares what you think’ stop reading now and go elsewhere. You’re coming here either interested in why, or to add to your list of reasons you don’t like me. I’m ok with both. With gold and silver remaining firm and gold and silver shares surging once again, today Peter Boockvar says the backdrop for gold and silver could not be better in a world of monetary madness.

With gold and silver remaining firm and gold and silver shares surging once again, today Peter Boockvar says the backdrop for gold and silver could not be better in a world of monetary madness. By their manipulations and deceit they prove that which they seem to fear, that their economic and monetary theory is nonsense, and is failing, for it cannot stand on its own. And that the people will not be fooled forever.

By their manipulations and deceit they prove that which they seem to fear, that their economic and monetary theory is nonsense, and is failing, for it cannot stand on its own. And that the people will not be fooled forever. Good Day… And a Marvelous Monday to you! A very nice weekend for yours truly, as we kicked it off with a family party / shower for Kathy’s nephew who’s getting married this summer, and ended with the kids all in the pool yesterday, and the sky an umbrella blue, and warm sun… No wait! It ended with a Blues and Cardinals win last night! Van Morrison greets me this morning with his great song: Moondance… Van Morrison is one of my fave artists through the years going back to Brown Eyed Girl, and up to his latest stuff, that just doesn’t get air play any longer…

Good Day… And a Marvelous Monday to you! A very nice weekend for yours truly, as we kicked it off with a family party / shower for Kathy’s nephew who’s getting married this summer, and ended with the kids all in the pool yesterday, and the sky an umbrella blue, and warm sun… No wait! It ended with a Blues and Cardinals win last night! Van Morrison greets me this morning with his great song: Moondance… Van Morrison is one of my fave artists through the years going back to Brown Eyed Girl, and up to his latest stuff, that just doesn’t get air play any longer… […] Europe seems to be in a referendum frenzy these days. In early May, the Hungarian government confirmed its decision to hold a referendum on the European Commission’s plan to distribute asylum seekers among member states. In April, Dutch citizens voted against the European Union Association Agreement with Ukraine in a referendum organized by a Euroskeptic organization. In June, the United Kingdom will hold a crucial vote on whether to leave the European Union altogether. The three votes have a common denominator: EU citizens are mostly being asked to decide on issues connected to the process of Continental integration.

[…] Europe seems to be in a referendum frenzy these days. In early May, the Hungarian government confirmed its decision to hold a referendum on the European Commission’s plan to distribute asylum seekers among member states. In April, Dutch citizens voted against the European Union Association Agreement with Ukraine in a referendum organized by a Euroskeptic organization. In June, the United Kingdom will hold a crucial vote on whether to leave the European Union altogether. The three votes have a common denominator: EU citizens are mostly being asked to decide on issues connected to the process of Continental integration. For many of us concerned with liberty, the letters “NDAA” have come to symbolize Washington’s ongoing effort to undermine the US Constitution in the pursuit of constant war overseas. It was the National Defense Authorization Act (NDAA) for 2012 that introduced into law the idea that American citizens could be indefinitely detained without warrant or charge if a government bureaucrat decides they had assisted al-Qaeda or “associated forces that are engaged in hostilities against the United States.” No charges, no trial, just disappeared Americans.

For many of us concerned with liberty, the letters “NDAA” have come to symbolize Washington’s ongoing effort to undermine the US Constitution in the pursuit of constant war overseas. It was the National Defense Authorization Act (NDAA) for 2012 that introduced into law the idea that American citizens could be indefinitely detained without warrant or charge if a government bureaucrat decides they had assisted al-Qaeda or “associated forces that are engaged in hostilities against the United States.” No charges, no trial, just disappeared Americans. President Nicolas Maduro has declared a 60-day state of emergency in Venezuela on 13 May, giving him extended authority to deal with the current economic crisis in his country. He has cited threats from within his country as well as from the US for imposing the measure.

President Nicolas Maduro has declared a 60-day state of emergency in Venezuela on 13 May, giving him extended authority to deal with the current economic crisis in his country. He has cited threats from within his country as well as from the US for imposing the measure. BUENOS AIRES — A judge in Argentina on Friday indicted former President Cristina Fernández de Kirchner and other officials on charges of manipulating the nation’s Central Bank during the final months of her administration.

BUENOS AIRES — A judge in Argentina on Friday indicted former President Cristina Fernández de Kirchner and other officials on charges of manipulating the nation’s Central Bank during the final months of her administration.

For half a century, Americans have been largely unable to visit Cuba and have had to rely on the US government and media for an understanding of the political, social and economic conditions there. What has been described as the “American Berlin Wall” has been successful in providing Americans with quite an inaccurate view.

For half a century, Americans have been largely unable to visit Cuba and have had to rely on the US government and media for an understanding of the political, social and economic conditions there. What has been described as the “American Berlin Wall” has been successful in providing Americans with quite an inaccurate view.

U.S. stock futures were fighting to advance Monday, hovering near the flatline after a reading of New York-area manufacturing conditions fell sharply in May.

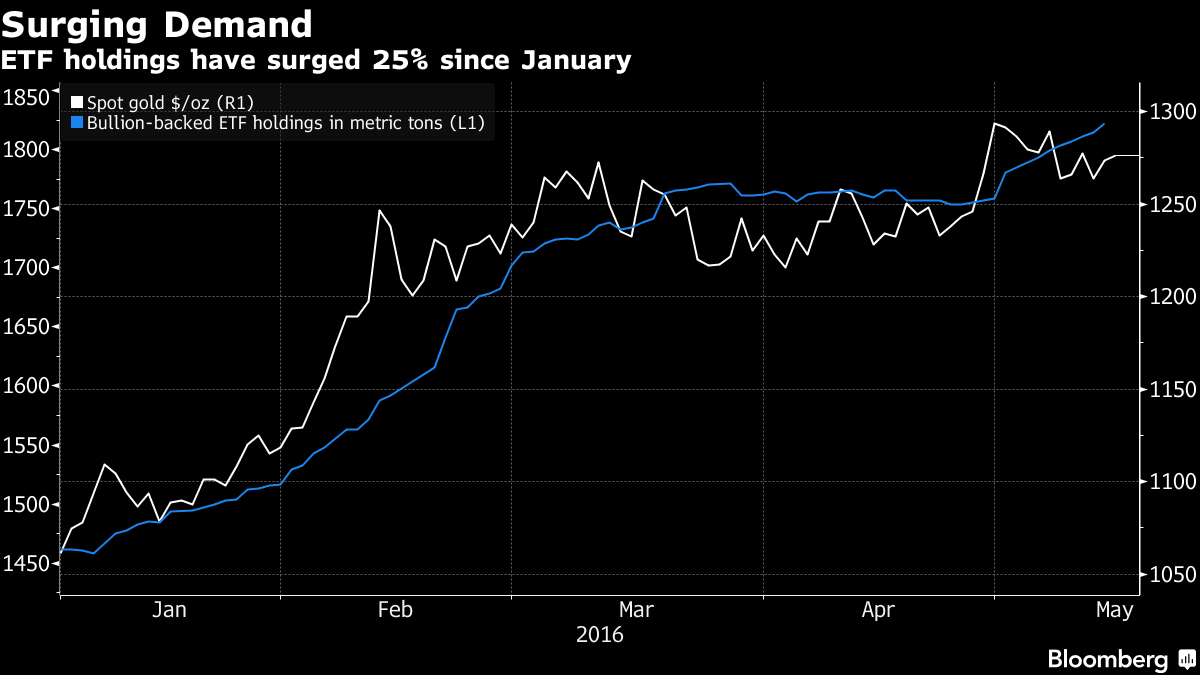

U.S. stock futures were fighting to advance Monday, hovering near the flatline after a reading of New York-area manufacturing conditions fell sharply in May. The great gold rush of 2016 is gathering pace. Holdings in exchange-traded funds have now surged by a quarter, with investors taking advantage of lower prices over the past two weeks to enlarge stakes on rising concern about central bank policy making worldwide.

The great gold rush of 2016 is gathering pace. Holdings in exchange-traded funds have now surged by a quarter, with investors taking advantage of lower prices over the past two weeks to enlarge stakes on rising concern about central bank policy making worldwide.