from Boom Bust

Danish Central Bank Stumbles with Its Currency Peg to the Euro

by Uffe Merrild

Mises.org

Denmark has been mentioned a few times during the American election campaign by Democrats who favor larger government and high redistribution of income, but also pundits like Paul Krugman have written about Denmark in his October 19th column at The New York Times. Fortunately most of his fiscal and general economic Keynesian points have been refuted in Episode 6 of Contra Krugman by Thomas Woods and Robert Murphy. But, some points regarding monetary policy need attention as well.

The Danish currency, the “krone,” was initially pegged in 1982 to the powerful and relatively low-inflationary German deutsche mark. The reason to introduce the fixed exchange rate policy was to avoid high inflation, loose monetary policy and to restrain the Danish politicians who had by then brought the country near bankruptcy. The fixed exchange-rate policy earned such tremendous political success that it has been in effect for 34 years and even today no other policy option is seriously considered.

The Great Illusion is Now Coming to an End

from King World News

On the heels of continued uncertainty in global markets, one of the greats in the business warns the great illusion is now coming to an end.

On the heels of continued uncertainty in global markets, one of the greats in the business warns the great illusion is now coming to an end.

By James Howard Kunstler, of Kunstler.com

May 19 (King World News) – The elephant’s not even in the room, which is why the 2016 election campaign is such a soap opera. The elephant outside the room is named Discontinuity. That’s perhaps an intimidating word, but it is exactly what the USA is in for. It means that a lot of familiar things come to an end, stop, don’t work the way they are supposed to — beginning, manifestly, with the election process now underway in all its unprecedented bizarreness…

Harvey Organ’s Daily Gold & Silver Report – 2016.05.19

Gld adds 4.45 tonnes of gold with the price of gold down $19.50?/China fires another shot across the bow by devaluing the yuan by the most since last August/Vicious raid against gold and silver today but gold/silver equity shares rise/Egyptian passenger aircraft goes down in the Mediterranean subject to a terrorist attack/Suspected loci was the Charles de Gaulle airport in Paris/5 banks including Deutsche bank and Bank of America sued for fraud and price fixing in agency bonds/Eliz Holmes of Theranos admits that her billion dollar company is a fraud/Philly mfg index plummet to negative territory again

by Harvey Organ

Harvey Organ’s Blog

[…] Yesterday I wrote the following:

[…] Yesterday I wrote the following:

“No doubt that the entire trading of gold and silver today was orchestrated by our crooked banks. They were massively selling paper gold throughout the night and early morning. Even the one billion dollar bid for gold early this morning did not spook the crooks. At 2 pm they released the beige book report and the Fed stated that it is likely that they will raise rates in June. The USA should raise rates but the problem will be China who has threatened to lower dramatically the yuan and in so doing would absolutely kill Japan, South Korea and the emerging markets. Besides no Fed would be stupid enough to raise rates three months before a USA election.”

Money is Power: How to Take Back Yours from the Government

by Simon Black

Sovereign Man

Almost one year ago to the day, I introduced you to Joe— a US Army combat veteran who lost his leg while deployed to Afghanistan in 2010.

Joe’s story was unfortunately all too familiar… except for one major twist.

Joe’s particular wound was so severe that the Army had to amputate nearly all of his right leg, practically up to his hip.

Now, it’s a rather sad statement that the United States of America is home to the most advanced prosthetic technology in the world.

The Latest Updates from The Daily Bell – 2016.05.19

Unintended Consequences, Part 1: Easy Money = Overcapacity = Deflation

by John Rubino

Dollar Collapse

Somewhere back in the depths of time the world got the idea that easy money — that is, low interest rates and high levels of government spending — would produce sustainable growth with modest but positive inflation. And for a while it seemed to work.

Somewhere back in the depths of time the world got the idea that easy money — that is, low interest rates and high levels of government spending — would produce sustainable growth with modest but positive inflation. And for a while it seemed to work.

But that was an illusion. What actually happened was textbook, long-term, surreally-vast misallocation of capital in which individuals, companies and governments were fooled into thinking that adding new factories, stores and infrastructure at a rate several times that of population growth would somehow work out for the best.

China, as with so many other things, was the epicenter of this delusion.

Ralph Acampora & Chris Waltzek on GoldSeek Radio – May 19, 2015

by Chris Waltzek

GoldSeek Radio

Leading Wall Street technician, Ralph Acampora of Altaira Wealth Management returns to the show with an overview of key support levels in the markets. The yearlong trading range in US equities includes wide swings of 2,000 points in the Dow Jones Industrials, due in part to rate hike indecision on the part of policymakers as well as uncertainty over the upcoming November election. Meanwhile, the Eurozone is grappling with Grexit issues, which is stifling economic growth. Nevertheless, our guest assures listeners that both domestic and EU equities markets will likely rebound from current levels; US stocks could reach new zeniths this year. Ralph Acampora agrees with several recent guests that gold and silver have seen their lows; selloffs present buying opportunities to increase portfolio exposure.

Leading Wall Street technician, Ralph Acampora of Altaira Wealth Management returns to the show with an overview of key support levels in the markets. The yearlong trading range in US equities includes wide swings of 2,000 points in the Dow Jones Industrials, due in part to rate hike indecision on the part of policymakers as well as uncertainty over the upcoming November election. Meanwhile, the Eurozone is grappling with Grexit issues, which is stifling economic growth. Nevertheless, our guest assures listeners that both domestic and EU equities markets will likely rebound from current levels; US stocks could reach new zeniths this year. Ralph Acampora agrees with several recent guests that gold and silver have seen their lows; selloffs present buying opportunities to increase portfolio exposure.

Insurer Sues US Government For $223 Million In Obamacare Related Back Payments

from Zero Hedge

In yet another development in the train wreck that is Obamacare, while we know that the legislation is failing individuals and businesses, the government is now failing to live up to its obligations made to the insurers who chose to participate in the healthcare exchanges.

[…] The Affordable Care Act set up what is called a risk-corridor program to entice insurers to participate. Essentially the program limits the risk of loss an insurer can take due to its participation in the healthcare exchange by being reimbursed for part of the loss. The program works the other way as well, meaning that if an insurer profits above a certain threshold, those profits get paid into the program.

Hikes Data Dependent Says NY Fed: So, Let’s Look at the Data

by Mike ‘Mish’ Shedlock

Mish Talk

Economic Snapshot

Yesterday, Fed minutes show that Fed Chair Janet Yellen is on a mission to convince the market that a rate hike is on the table for June.

Today, New York Fed president William C. Dudley gave an Economic Press Briefing on the state of the U.S. economy.

Let’s take a look at the briefing and the “Economic Snapshot” data the Fed presented.

Dealing Desk: Hawkish Tone Shakes Market

by Kelly-Ann Kearsey

Gold Money

This week, clients have been net buying in silver and palladium, whilst net selling gold and platinum.

This week, clients have been net buying in silver and palladium, whilst net selling gold and platinum.

Clients have been speculating the market and have been taking advantage of the price reduction as silver dipped below the psychological level of $17.00/oz

GoldMoney’s clients have favoured the Singapore, Canadian, and London vaults this week with less preference being shown for the Swiss vaults.

Kelly-Ann Kearsey, Dealing Manager at GoldMoney, said that all eyes were on the release of the US Federal Reserve minutes from the April meeting. Gold dropped more than 1% on Wednesday after the release, hitting a spot session low of $1,262.45/oz whilst the US dollar reached a three-week high.

Probably Not, Incidentally…

by Karl Denninger

Market-Ticker.org

This headline is almost-certainly false.

Want to extend your cat’s nine lives? Stop feeding her human food and get her moving.

I don’t know anyone who feeds their cat what we’d call “human food.”

I know a lot of people (like damn near everyone) who feeds their cat packaged “cat food” sold in various places. If you look at the labels on said catfood you will find that a huge majority of them contain a lot of various grain products, all of which are by definition high-glycemic.

They’re used because they’re cheap, incidentally.

How many carbs does the natural diet of a cat — that is, a mouse or bird — have?

Negative Interest Rates: A Tax in Sheep’s Clothing

by Christopher J. Waller, Executive Vice President and Director of Research

St. Louis Fed

If you pick up any principles of economics textbook, there will typically be a discussion of taxes and tax incidence. Tax incidence describes who bears the burden of a tax. For example, suppose the government levies a payroll tax on a firm. The burden of the tax may be borne by the firm, the workers or the firm’s customers.

If you pick up any principles of economics textbook, there will typically be a discussion of taxes and tax incidence. Tax incidence describes who bears the burden of a tax. For example, suppose the government levies a payroll tax on a firm. The burden of the tax may be borne by the firm, the workers or the firm’s customers.

How can this be if the firm is responsible for paying the tax? The firm may bear the burden of the tax by accepting lower after-tax profits. However, the firm can pass the tax onto its workers by paying them lower wages or hiring fewer workers. The firm can also pass the tax onto its customers by charging them a higher price for the firm’s output. In general, all parties bear some portion of the tax.

Fox News Poll: Clinton’s Negatives Surpass Trump’s

by Dana Blanton

FOX News

American voters dislike Hillary Clinton and Donald Trump.

American voters dislike Hillary Clinton and Donald Trump.

A record 61 percent have a negative view of the likely Democratic nominee, according to a Fox News poll released Wednesday. That’s up from 58 percent in March.

Fifty-six percent have an unfavorable view of Trump — though that’s actually good news for Donald. Because it was 65 percent two months ago (that was a record high).

Thirty-seven percent have a favorable opinion of Clinton, down two points from 39 percent in March, establishing a new low. The likely Republican nominee’s favorable jumped over the same time period: 41 percent view Trump positively, up from 31 percent in March.

Obamacare Rates Rise in New York, and So Does Political Risk

by Zachary Tracer

Bloomberg.com

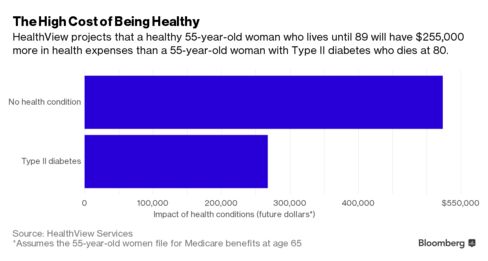

The rates Americans pay for coverage through Obamacare are going up, as New York joins the list of states where insurers are seeking big increases in premiums under the program, adding risk for the law as the U.S. presidential election heats up.

The rates Americans pay for coverage through Obamacare are going up, as New York joins the list of states where insurers are seeking big increases in premiums under the program, adding risk for the law as the U.S. presidential election heats up.

New York’s health insurers are seeking to raise the amount that customers pay for individual Obamacare plans by an average of 17.3 percent for 2017. That’s alongside sharp increases in Florida, where insurers are looking for 17.7 percent more, and Washington State, where health plans are seeking a 13.5 percent increase from customers.

That sticker shock for Obamacare customers could spell trouble for the law and its supporters.

UK Could Need Interest Rate Cuts Even if Voters Shun Brexit, Admits Bank of England Official

The Bank of England has held its rates at 0.5pc since March 2009

by Szu Ping Chan, and Peter Spence

Telegraph.co.uk

The Bank of England must stand ready to slash interest rates towards zero if the economy does not bounce back quickly from its current malaise, according to a top official.

Gertjan Vlieghe, an external member of the Monetary Policy Committee (MPC), signalled that he would vote for more stimulus even if the UK voted to remain in the EU next month and he did not see “convincing evidence” of a rapid improvement in the economy.

Speaking at the London Business School, Mr Vlieghe said the EU referendum posed “challenges” for setting interest rates as policymakers try to separate “short-lived” uncertainty, due to the referendum, from more persistent factors dragging on growth.

Russia Frets About Risk of “Recession” in China

by Wolf Richter

Wolf Street

What do they see that we don’t?

What do they see that we don’t?

Russia’s economy has been shrinking five quarters in a row, though in the first quarter of 2016, it contracted at an annual rate of “only” 1.2%, after having contracted 3.7% in 2015, the longest recession in two decades. The budget deficit has swollen to 8.6% of GDP in April – way beyond the 3% the government is projecting for the year. It might require additional and unpopular budget cuts.

So the jump in oil prices recently, while not nearly enough, is a huge economic relief for the world’s largest oil & gas exporter.

Bloomberg Markets on the Return of the Gold Standard

by David Gordon

Mises.org

A recent article in Bloomberg Markets by Michelle Jamrisko brings welcome news. “The gold standard is one of the oldest ideas about money, but the hardest of hard-money hawks sense an opening to breathe new life into it.” Unfortunately, those in search of information about the gold standard and its supporters will find little of use in the article.

Most obviously, the article omits one item of no slight significance. It never explains what the gold standard is. The closest the article comes to an explanation is this: “Decades ago, the amount of cash circulating in a country was often limited by the stash of bullion held in its coffers.” According to this account, under a gold standard, the government cannot issue an unlimited amount of money: its ability to create money is limited by the amount of gold on hand. Shortly after, Jamrisko says, “Of course, full restoration of the system that reigned in the U.S. for a century through the 1970s is almost inconceivable.” By her reference to “the 1970s”, it’s apparent that she is talking about the arrangement in place until Nixon closed the “gold window” in 1971.

Starving Venezuelans Fed Up With Maduro: “We Want Food!”

by Mac Slavo

SHTF Plan

Venezuela’s problems are sure to get worse before they get better.

Right now the nation, at the hands of socialist dictator President Nicolas Maduro, is headed for the bottom.

Weeks of rationed food and electricity, a shortage of basic necessities and spiraling inflation is taking its toll, and the regime is quickly descending into all out hell.

Now, people are beyond fed up with the conditions and are moving towards support for Maduro’s ouster… that, and they want to eat… food.

It is no laughing matter. Shortages have already prompted poaching animals and looting has become widespread.

Fed: “Immoral, Unconstitutional, Disaster.”

by Chris Campbell

Laissez Faire Books

“Even after all these years,” Ron Paul said at a recent CATO event, “of studying and reading and trying to figure out the system, I have come to a very fair and balanced position on the Federal Reserve.

“Even after all these years,” Ron Paul said at a recent CATO event, “of studying and reading and trying to figure out the system, I have come to a very fair and balanced position on the Federal Reserve.

“I think there’s no doubt that the Federal Reserve is immoral. It’s unconstitutional. And it’s a disaster. We don’t need it.”

Also, we might add, its policies have created one of the most terrifying financial tidal waves this world has seen.

“The hand-writing’s on the wall,” Paul goes on. “I think that’s what we’re facing today. That the dollar reserve standard, which the world has embraced for forty years, has come to an end. I don’t think there’s any admission to that yet. And they believe that they can patch it up.

Donald Trump’s True Colors Emerge as He Snuggles Up to Wall Street

by Michael Krieger

Liberty Blitzkrieg

Earlier this week, in the post Donald Trump Will Meet War Criminal Henry Kissinger, I pointed out the following:

Since clinching the Republican nomination, Trump’s true colors have started to emerge. He named a former Goldman Sachs partner to run his fundraising efforts, he named petty authoritarian, gangster wannabe Chris Christie to run his transition team, and he chose “everyone’s a terrorist” Rudy Giuliani as his planned head of the domestic gestapo, the Department of Homeland Security. He’s also been endorsed by Orc King Sheldon Adelson, who said he was prepared to spend $100 millionto get him elected. Now he’s off to kiss the blood-soaked hands of Henry Kissinger.

Apparently, that was just the beginning. Now he’s out publicly pandering to Wall Street in ways even Hillary Clinton wouldn’t dare do.

The Wall Street Journal reports:

Jaw-Dropping Account About How the Terrifying Endgame is Unfolding in Real-Time

from King World News

With a wild start to the 2016, today a legend in the business sent King World News a powerful piece about how the terrifying endgame is unfolding in real-time.

With a wild start to the 2016, today a legend in the business sent King World News a powerful piece about how the terrifying endgame is unfolding in real-time.

The Terrifying Endgame

By John Ing, Maison Placements

May 19 (King World News) – Former Obama Chief of Staff, Rahm Emanuel, once said, “never let a serious crisis go to waste.” During the 2008 panic collapse, the US government bailed out big business, took over General Motors, fattened the big Wall Street banks and even nationalized mega institutions Fannie Mae and Freddie Mac. As a result, government became even bigger with an insatiable appetite for revenues and to no surprise, the economy remains in a funk. Eleven states in the US now have more people on welfare than they do employed. No wonder there is a populist backlash against Wall Street because today, the “too big to fail” institutions became not only bigger but, “too big not to fail.”

Here’s How Easy it is to Lose Money in the Stock Market Right Now…

by Greg Guenthner

Daily Reckoning

Trading’s not supposed to be easy. But this is getting ridiculous…

Trading’s not supposed to be easy. But this is getting ridiculous…

The major averages were sprinting to their fourth whipsaw day in row Wednesday. As if this choppy action didn’t create enough confusion, the Fed’s now whispering that it might raise rates next month. By the end of the trading day, the major averages were mostly breakeven as traders dumped utilities and jumped into bank stocks…

The market’s a hot mess once again. After a brutal start to the year and an improbable run off its lows, the S&P 500 has sagged back to breakeven on the year. It doesn’t matter if you’ve bet big on breakouts or breakdowns this year. If you didn’t take the money and run, you’re right back where you started—or worse.

Special Supplement: Counterfeit Coins? You Get What You Pay For

by Andrew Hoffman

Miles Franklin

Miles Franklin has been in business for 27 years – with an A+ Better Business Bureau rating, and not a single registered complaint since opened our doors in 1989. The company is still owned by the father and son team that founded it, Andy and David Schectman; and our brokers, on average, have been selling bullion since the early 1980s. For a variety of reasons – from our sterling reputation; to competitive sale prices; the industry’s best “buyback” prices (particularly for Miles Franklin customers); an industry-leading storage program, featuring per ounce pricing; and of course, this entirely FREE blog, we emphatically believe Precious Metal dealers are decidedly not “commodities” – even if our primary products are.

House Panel Delivers Puerto Rico Crisis Bill, Debt Looms

by Daniel Bases and Susan Heavey

Reuters.com

U.S. lawmakers on Thursday began coalescing around revised bipartisan legislation to help address Puerto Rico’s unpayable debt burden that now threatens a full-blown humanitarian crisis.

Released close to midnight on Thursday, the House Natural Resources Committee’s revised bill includes a strong oversight board to direct how and when the island pays its bills and leaves many provisions of earlier proposals in place.

Puerto Rico has already defaulted on some of its roughly $70 billion in debt while trying to cope with a 45 percent poverty rate among its 3.5 million U.S. citizens.

The bill also keeps language that would allow Puerto Rico to cut repayments to creditors without their consent, known as a ‘cramdown.’