Markets are not prepared to deal with this emerging risk

by Sue Chang

Market Watch

The Federal Reserve is trying to send the markets a message, but one Deutsche Bank economist says people are just not getting it — there is a looming threat to the economy and it’s not another recession or a crisis.

The Federal Reserve is trying to send the markets a message, but one Deutsche Bank economist says people are just not getting it — there is a looming threat to the economy and it’s not another recession or a crisis.

“Many clients I meet worry that the biggest macro risk on the horizon is another financial crisis,” said Torsten Slok, Deutsche Bank’s chief international economist.

But the bigger threat, according to Slok, is accelerating inflation.

“This is what the Fed is trying to tell us when they repeatedly point out that we are near full employment,” he said.

Market Report: Miners suffer sharp sell-off on bearish UBS note

Market Report: Miners suffer sharp sell-off on bearish UBS note I was up to my eyeballs in stocks. “If I’m wrong, we’re done,” I told my wife.

I was up to my eyeballs in stocks. “If I’m wrong, we’re done,” I told my wife.

This could get very ugly!

This could get very ugly! Around the world, a change that has been slowly gathering momentum seems to be accelerating: everywhere we look, we see the public revelation of political and economic corruption.

Around the world, a change that has been slowly gathering momentum seems to be accelerating: everywhere we look, we see the public revelation of political and economic corruption. Kyle Bass, the hedge-fund manager who’s wagering on a slowdown in China’s economy, said Hong Kong’s property market is in “free fall” and the credit expansion in Southeast Asian emerging markets will unravel.

Kyle Bass, the hedge-fund manager who’s wagering on a slowdown in China’s economy, said Hong Kong’s property market is in “free fall” and the credit expansion in Southeast Asian emerging markets will unravel.

With continued uncertainty in global markets, investors are wondering what’s next for gold, silver and the mining shares.

With continued uncertainty in global markets, investors are wondering what’s next for gold, silver and the mining shares.

Göran H., a reader from Sweden, recently sent me a note asking the following…

Göran H., a reader from Sweden, recently sent me a note asking the following… […] As soon as our crooked bankers saw the likes of the open interest in gold and silver they knew that they had to whack despite the awful news on the jobless front today. We are now very close at an all time record high OI for silver and yet the price is 32.00 less per oz. Generally, the CFTC state that these things correct themselves. We have now had 5 years of high silver OI with a low price and that destroys their mantra which is in bold as you enter the CFTC offices, namely that the futures market is a price discovery mechanism and that future price discovery of any commodity will lead to the correct price. Obviously our bought and paid for regulators have destroyed their motto with respect to the precious metals.

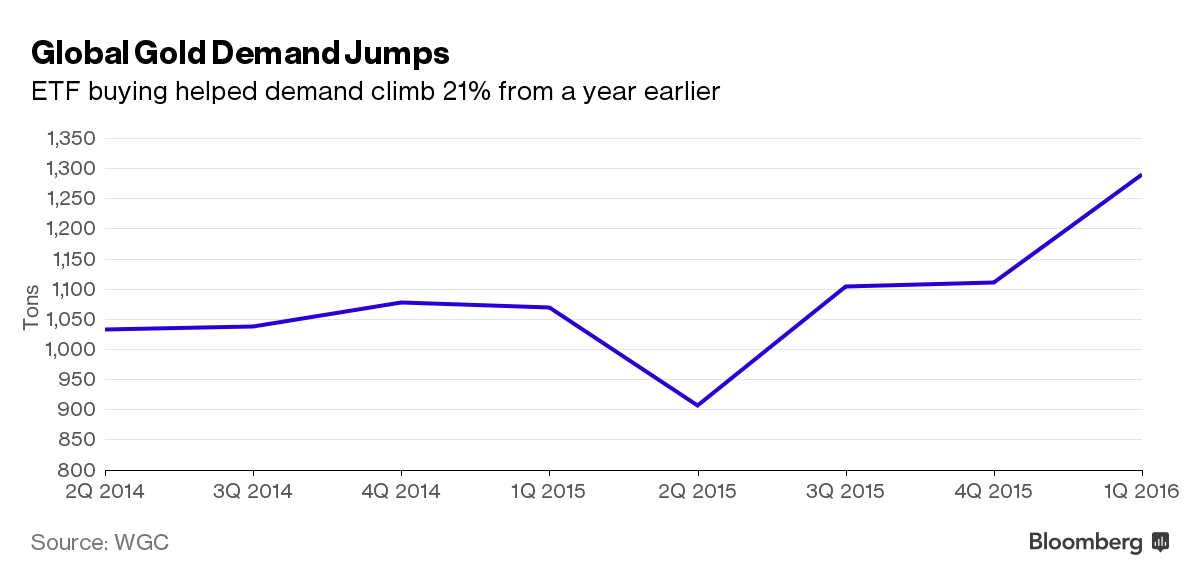

[…] As soon as our crooked bankers saw the likes of the open interest in gold and silver they knew that they had to whack despite the awful news on the jobless front today. We are now very close at an all time record high OI for silver and yet the price is 32.00 less per oz. Generally, the CFTC state that these things correct themselves. We have now had 5 years of high silver OI with a low price and that destroys their mantra which is in bold as you enter the CFTC offices, namely that the futures market is a price discovery mechanism and that future price discovery of any commodity will lead to the correct price. Obviously our bought and paid for regulators have destroyed their motto with respect to the precious metals. Gold demand surged to the second-highest level ever as investors piled into funds, doubling investment in the metal.

Gold demand surged to the second-highest level ever as investors piled into funds, doubling investment in the metal.

Nicole Gelinas is the author of After the Fall:Saving Capitalism From Wall Street – and Washington. She is also a contributing editor to the Manhattan Institute’s City Journal and a columnist for the NY Post and a contributing writer to the NY Times. She shares her thoughts on the personal finance strategies of the US working class, how the government is quick to hand out support to the financial industry while ignoring the voting public and why she thinks people are even considering Donald Trump in this year’s election. She acknowledges the vast Wall Street conspiracy that we indeed live in interesting times.

Nicole Gelinas is the author of After the Fall:Saving Capitalism From Wall Street – and Washington. She is also a contributing editor to the Manhattan Institute’s City Journal and a columnist for the NY Post and a contributing writer to the NY Times. She shares her thoughts on the personal finance strategies of the US working class, how the government is quick to hand out support to the financial industry while ignoring the voting public and why she thinks people are even considering Donald Trump in this year’s election. She acknowledges the vast Wall Street conspiracy that we indeed live in interesting times.

Macy’s reports horrendous earnings and Italian banks finally reveal their non-performing loans. Share prices plunge accordingly. China, meanwhile, admits that it’s over-leveraged and promises to stop borrowing. In other words, wherever you look, a global slowdown is coming and a massive devaluation will soon be the only politically feasible solution.

Macy’s reports horrendous earnings and Italian banks finally reveal their non-performing loans. Share prices plunge accordingly. China, meanwhile, admits that it’s over-leveraged and promises to stop borrowing. In other words, wherever you look, a global slowdown is coming and a massive devaluation will soon be the only politically feasible solution. I’m sitting in a café in an upscale part of Sao Paulo, Brazil, a short walk from the Renaissance Hotel, watching the news come in about the impeachment of Brazil’s president Dilma Rousseff.

I’m sitting in a café in an upscale part of Sao Paulo, Brazil, a short walk from the Renaissance Hotel, watching the news come in about the impeachment of Brazil’s president Dilma Rousseff. The European Parliament has voted by an overwhelming majority to deny China the coveted prize of market economy status, warning that it would leave Europe’s battered industries vulnerable to a devastating flood of subsidized Chinese goods.

The European Parliament has voted by an overwhelming majority to deny China the coveted prize of market economy status, warning that it would leave Europe’s battered industries vulnerable to a devastating flood of subsidized Chinese goods. David Gurwitz, Managing Director at Nenner Research returns to the show; David and his business partner Dr. Charles Nenner apply their mathematical constructs to the market to glean information about future price levels. Through cycles analysis of market time-series and a target algorithm, their team of analysts make forecasts among a variety of asset classes, including stocks, bonds and currencies (Yen, Euro, Canadian and the US dollar). They offer a free 1 month trial to their newsletter to Goldseek.com Radio listeners. Subscribers receive new editions each Mon., Wed. and Fri, plus charts and global macro analysis each Sunday. Their work suggests a new bull market is underway in the precious metals sector, with current gold support at $1,190. If $1,500 is surpassed, the bull market could culminate with a $2,000+ gold price in the coming years.

David Gurwitz, Managing Director at Nenner Research returns to the show; David and his business partner Dr. Charles Nenner apply their mathematical constructs to the market to glean information about future price levels. Through cycles analysis of market time-series and a target algorithm, their team of analysts make forecasts among a variety of asset classes, including stocks, bonds and currencies (Yen, Euro, Canadian and the US dollar). They offer a free 1 month trial to their newsletter to Goldseek.com Radio listeners. Subscribers receive new editions each Mon., Wed. and Fri, plus charts and global macro analysis each Sunday. Their work suggests a new bull market is underway in the precious metals sector, with current gold support at $1,190. If $1,500 is surpassed, the bull market could culminate with a $2,000+ gold price in the coming years.