by Prof Michel Chossudovsky

Global Research

Control over monetary policy and macro-economic reform was the ultimate objective of the Coup d’Etat. The key appointments from Wall Street’s standpoint are the Central Bank, which dominates monetary policy as well as foreign exchange transactions, the Ministry of Finance and the Bank of Brazil (Banco do Brasil).

Control over monetary policy and macro-economic reform was the ultimate objective of the Coup d’Etat. The key appointments from Wall Street’s standpoint are the Central Bank, which dominates monetary policy as well as foreign exchange transactions, the Ministry of Finance and the Bank of Brazil (Banco do Brasil).

On behalf of Wall Street and the “Washington consensus”, the interim post coup “government” of Michel Temer has appointed a former Wall Street CEO (with U.S citizenship) to head the Ministry of Finance.

Henrique de Campos Meirelles, a former President of FleetBoston Financial’s Global Banking (1999-2002) and former head of the Central Bank under Lula’s presidency was appointed minister of finance on May 12.

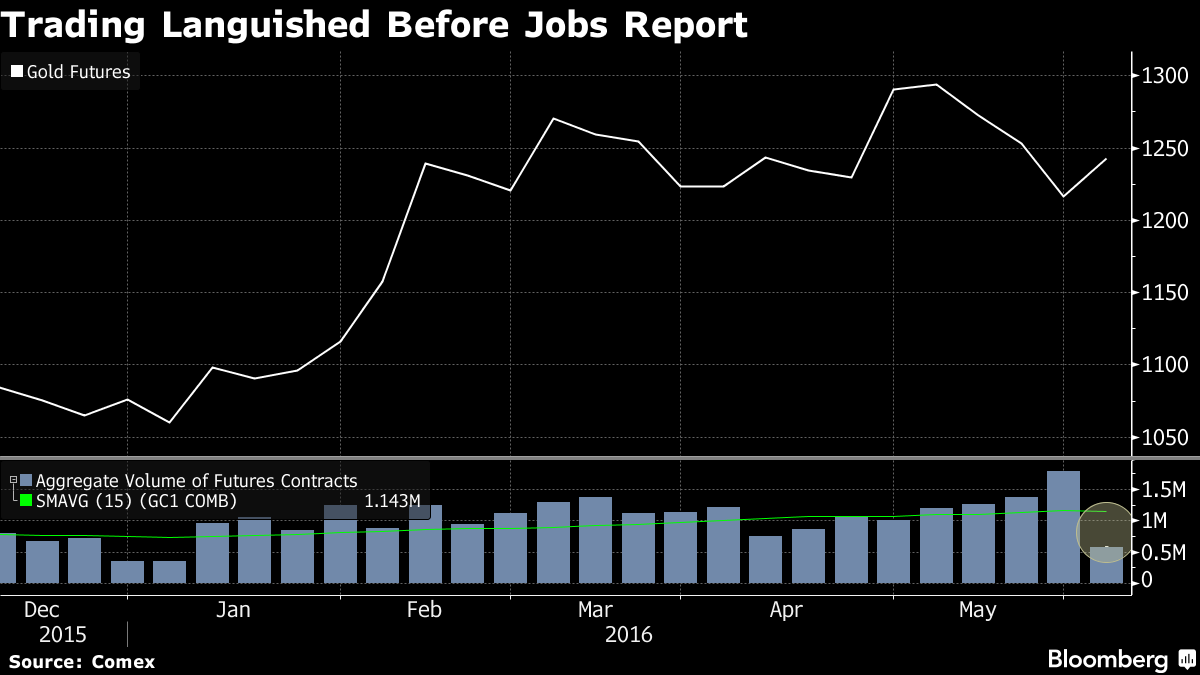

Gold has been rescued by U.S. payrolls. Again.

Gold has been rescued by U.S. payrolls. Again. Investing in depressed markets can lead to gigantic returns. It’s the core idea behind Casey Research founder Doug Casey’s most successful strategy… one that has made him more wealth than the average person can spend in 20 lifetimes.

Investing in depressed markets can lead to gigantic returns. It’s the core idea behind Casey Research founder Doug Casey’s most successful strategy… one that has made him more wealth than the average person can spend in 20 lifetimes.

Leaders face a no-win dilemma: any change of course will crash the system, but maintaining the current course will also crash the system.

Leaders face a no-win dilemma: any change of course will crash the system, but maintaining the current course will also crash the system.

Three years ago, I was fed up with the European Union. The policies emerging from Brussels were frustrating in their own right and seemed to be taking us inexorably towards an ever closer union.

Three years ago, I was fed up with the European Union. The policies emerging from Brussels were frustrating in their own right and seemed to be taking us inexorably towards an ever closer union.

It’s jobs day, the S&P just closed above 2,100, and traders are ready to strike up the band.

It’s jobs day, the S&P just closed above 2,100, and traders are ready to strike up the band. Libertarians face a tough choice this fall – chiefly because Libertarians have no desire to choose a “leader” for themselves or anyone else. The ideal choice would be to not have to choose at all. For us each to make choices for ourselves only – and leave everyone else alone.

Libertarians face a tough choice this fall – chiefly because Libertarians have no desire to choose a “leader” for themselves or anyone else. The ideal choice would be to not have to choose at all. For us each to make choices for ourselves only – and leave everyone else alone. Gold traders are paying the most in at least half a decade to maintain their bullish bets.

Gold traders are paying the most in at least half a decade to maintain their bullish bets.

The reality of Britain’s housing crisis can be easily lost in the statistics, which whilst painting a picture of continuing OUT OF CONTROL immigration, one of a building crisis year after year that, instead of net migration numbering in the tens of thousands as David Cameron has been iterating each year since he took power in 2010, instead as the latest data from the ONS once more illustrates, stands at well over 300k per year and trending towards 400k.

The reality of Britain’s housing crisis can be easily lost in the statistics, which whilst painting a picture of continuing OUT OF CONTROL immigration, one of a building crisis year after year that, instead of net migration numbering in the tens of thousands as David Cameron has been iterating each year since he took power in 2010, instead as the latest data from the ONS once more illustrates, stands at well over 300k per year and trending towards 400k. The physical silver bullion market is seeing a “perfect storm” brewing according to an article replete with some recent videos about the silver market by Rory Hall of the precious metals website, The Daily Coin.

The physical silver bullion market is seeing a “perfect storm” brewing according to an article replete with some recent videos about the silver market by Rory Hall of the precious metals website, The Daily Coin.

The U.S. has approximately $80 trillion of unfunded liabilities for social security, medicare and other entitlements sitting atop a work force that is rapidly aging and an economy that is lapsing into stasis. Yet in the midst of a campaign diatribe about Donald Trump’s alleged lack of preparation for the highest office in the land, the current White House occupant proved that in nearly eight years he has learned exactly nothing about the nation’s abysmal fiscal plight.

The U.S. has approximately $80 trillion of unfunded liabilities for social security, medicare and other entitlements sitting atop a work force that is rapidly aging and an economy that is lapsing into stasis. Yet in the midst of a campaign diatribe about Donald Trump’s alleged lack of preparation for the highest office in the land, the current White House occupant proved that in nearly eight years he has learned exactly nothing about the nation’s abysmal fiscal plight. The first few months of this year gave a little taste of what’s to come for the junior precious metals miners, if this is indeed the start of a new gold/silver bull market. Some sample charts:

The first few months of this year gave a little taste of what’s to come for the junior precious metals miners, if this is indeed the start of a new gold/silver bull market. Some sample charts: Stocks have been in a sweet spot over the past few months, rising from their mid-February lows to just a few points below their all-time closing highs of May 2015.

Stocks have been in a sweet spot over the past few months, rising from their mid-February lows to just a few points below their all-time closing highs of May 2015. The Nikkei (cash) really hit the tiles today (-2.3%) having received confirmation of the delay to the Sales Tax and its two year reschedule. The JPY saw the flight to quality resulting in a 1% rally to hit a 108.50 high. 10yr JGB’s traded from -10bp to -11.5bp. As stated yesterday it will not be long before we start to hear from concerned ratings agencies, as government debt now exceeds 200% of GDP. We did see some safe-haven moves away from Japan entirely with stronger closes in both China and Hang Seng markets. In late US futures trading the Nikkei has regained 1% while HSI and China 300 rallied 0.5%.

The Nikkei (cash) really hit the tiles today (-2.3%) having received confirmation of the delay to the Sales Tax and its two year reschedule. The JPY saw the flight to quality resulting in a 1% rally to hit a 108.50 high. 10yr JGB’s traded from -10bp to -11.5bp. As stated yesterday it will not be long before we start to hear from concerned ratings agencies, as government debt now exceeds 200% of GDP. We did see some safe-haven moves away from Japan entirely with stronger closes in both China and Hang Seng markets. In late US futures trading the Nikkei has regained 1% while HSI and China 300 rallied 0.5%. We are meant to be getting richer as a nation and yet many people feel that they are standing still. There are several reasons for that. One is taxation: it seems to be growing faster than the economy overall, reducing the share of the pie that people can spend as they wish.

We are meant to be getting richer as a nation and yet many people feel that they are standing still. There are several reasons for that. One is taxation: it seems to be growing faster than the economy overall, reducing the share of the pie that people can spend as they wish.