from Ben Shapiro

Silver Eagle Sales Blow Pass 30 Million & Prepare For Fireworks As Investment Demand Surpasses Industrial Demand

by Steve St. Angelo

SRSRocco Report

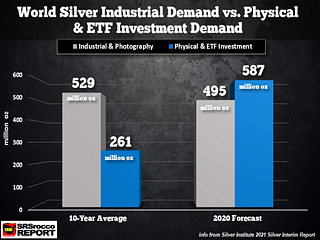

U.S. Silver Eagle sales this year are RED HOT pushing total silver investment demand to record highs. According to the U.S. Mint’s most recent update, Silver Eagle sales in 2020 have surpassed 30 million and may continue to increase over the next few weeks in December. Also, for the first time ever, total silver investment demand exceeded industrial demand by a wide margin.

U.S. Silver Eagle sales this year are RED HOT pushing total silver investment demand to record highs. According to the U.S. Mint’s most recent update, Silver Eagle sales in 2020 have surpassed 30 million and may continue to increase over the next few weeks in December. Also, for the first time ever, total silver investment demand exceeded industrial demand by a wide margin.

So, for the analysts who continue to harp on “Industrial Demand” as an important factor for the silver market to focus on in the future, I say… RUBBISH. And, if you have been reading my analysis for several years, I’ve stated over and over again, that industrial demand will become less of a driver of the silver price in the future.

Thus, when I read the Zerohedge article today, Saxo Bank, 2021 Will Be A “Reality Check On Extend-And-Pretend” – Saxo Bank Unveils Its ‘Outrageous Predictions’ For The Year Ahead, quoting the following about silver in 2021.

Gold’s Bullish Fundamentals

by Craig Hemke

Sprott Money

Over the past few weeks, we’ve tried often to remind you that the year 2020 is unfolding almost identically to the year 2019…at least in terms of COMEX precious metal prices. COMEX gold fell from early September to late December last year and then resumed its uptrend as the fundamental factors that had been driving price began to reassert themselves. The same thing is happening now.

Over the past few weeks, we’ve tried often to remind you that the year 2020 is unfolding almost identically to the year 2019…at least in terms of COMEX precious metal prices. COMEX gold fell from early September to late December last year and then resumed its uptrend as the fundamental factors that had been driving price began to reassert themselves. The same thing is happening now.

If you need a refresher, here are two recent links on this topic:

– Time for a Turn

– 2020 Is 82% Finished

And what are those “fundamental factors that have been driving price” for the past two years? Here are just a few…

Let’s start with negative interest rates. You likely know how negative “real” rates are a key long-term correlation for gold prices. However, straight up negative nominal rates are the single most bullish factor ever created by man. Why? Because while it takes some additional thought and understanding to grasp the importance of inflation-adjusted interest rates, just about anyone can look at a -1.0% sovereign bond or bank rate and think that there must be a better deal out there somewhere. “Gold doesn’t pay a dividend” sure beats the heck out of “negative interest”.

Louisiana Joins Texas In Motion Against GA, MI, PA, & WI After SCOTUS Denies Trump Ally’s Bid To Decertify Biden’s PA Win

Millions of Louisiana citizens, and tens of millions of our fellow citizens in the country, have deep concerns regarding the conduct of the 2020 federal elections,” said AG Jeff Landry

by Zero Hedge

Info Wars

Attorney General Jeff Landry issued the following statement regarding the ongoing controversies over the 2020 federal election and the new motion put forward by the State of Texas before the U.S. Supreme Court:

Attorney General Jeff Landry issued the following statement regarding the ongoing controversies over the 2020 federal election and the new motion put forward by the State of Texas before the U.S. Supreme Court:

“Millions of Louisiana citizens, and tens of millions of our fellow citizens in the country, have deep concerns regarding the conduct of the 2020 federal elections. Deeply rooted in these concerns is the fact that some states appear to have conducted their elections with a disregard to the U.S. Constitution. Furthermore, many Louisianans have become more frustrated as some in media and the political class try to sidestep legitimate issues for the sake of expediency.

Weeks ago, on behalf of the citizens of Louisiana, my office joined many other states in filing a legal brief with the United States Supreme Court urging the Justices to look into the conduct of the election in Pennsylvania where their state court ignored the U.S. Constitution in regard to the conduct of the election. The U.S. Constitution in Article 1, Section 4, states plainly:

Gold’s Long Consolidation Has Ended, Headed to All-Time Highs, but the Big Surprise Will Be Silver and Mining Stocks

from King World News

It is important at times like this to take a step back and look at the big picture in the gold and silver markets.

It is important at times like this to take a step back and look at the big picture in the gold and silver markets.

Gold

December 8 (King World News) – Sentiment in the precious metals and mining share markets hit one of the lowest levels of the entire bull market last week. The timing of that capitulation in sentiment was perfect since gold has now finished its long consolidation and is headed to new all-time highs.

Inflation is Back, Big-Time

by John Rubino

Dollar Collapse

The conventional view of inflation is that it’s not only low, but dangerously low and in need of aggressive stimulus.

But that view is increasingly hard to defend, given all the things that are soaring in price. Consider:

[…] The above charts are for industrial commodities that, while not something individual consumers tend to buy (and therefore not part of the official “cost of living”) do affect the price of consumer goods. When they go up, so eventually do the prices of cars, TVs and buildings.

Speaking of buildings, the next chart shows US home prices – which have been rising steadily since the bottom of the last recession – steepening this year. Note the upward inflection at the far-right. Home prices are now higher than they were during the previous decade’s housing bubble, and they’re accelerating.

Texas Sues Georgia, Michigan, Pennsylvania and Wisconsin at U.S. Supreme Court Over Election

from Zero Hedge

The state of Texas filed a lawsuit at the US Supreme Court against Georgia, Michigan, Pennsylvania and Wisconsin on the grounds that various changes to their voting rules or procedures – either through the courts or via executive actions – violated the Electors Clause of the Constitution because they did not go through the legislatures.

Texas also argues that differences in rules and procedures in different counties within the same state violates the Constitution’s Equal Protection Clause, and that “voting irregularities” occurred in these states as a result.

The lawsuit, filed shortly before midnight on Monday, asks the Supreme Court to allow their legislators to directly appoint electors, according to Breitbart.

From the filing:

The Latest Updates from Martin Armstrong – 2020.12.08

by Martin Armstrong

Armstrong Economics

The South Resisting the Tyranny from the North

The South Resisting the Tyranny from the North

The Energy Crisis During the Panic of 1873

Do the COVID Restrictions Show How Stupid Politicians Really Are?

Market Talk – December 7, 2020

COVID-19 Vaccine Warnings Women Should Not Get Pregnant for at least 2 months after Vaccination

Bring on 2021

by J. Robert Smith

American Thinker

It was in the musical Camelot (the movie) when King Pellinore (Lionel Jefferies) advises Arthur (Richard Harris) that the “uglier the truth, the truer the friend who tells you.”

It was in the musical Camelot (the movie) when King Pellinore (Lionel Jefferies) advises Arthur (Richard Harris) that the “uglier the truth, the truer the friend who tells you.”

Now, with mere weeks to go before the year changes, we have to confront an ugly truth. 2020 is just prelude to crises and conflicts to come. When they end, we cannot say. The 2020s may prove a troubled decade. I don’t pretend to have a crystal ball. But there are matters we can be sure of. One need only survey the scene — the wreckage, really — of 2020 to understand that America faces the gravest risks to its existence as a free and united country in 160 years.

From the vantage point of 2019, had we been told what to expect in 2020, we would have dismissed it all as fiction.

Yet, here we are at the end of 2020, and the year’s facts put fiction to shame: A viral contagion exported from mainland China that amounts to an act of aggression.

Are You Preparing for the Wrong Disaster?

by Simon Black

Sovereign Man

Global cooling was the big fear in the early 1970s, believe it or not.

Global cooling was the big fear in the early 1970s, believe it or not.

Experts in climate, ecology, and geology from top universities like Stanford and Brown all seemed to form a consensus that a new ice age would be upon us by 2020.

By 1988, the major fear had shifted to global warming, with United Nations experts predicting entire countries would be underwater by the year 2000, due to melting ice caps.

In 2002 scientists predicted that there would be a catastrophic worldwide famine within a decade if everyone didn’t give up eating meat.

In 2008, climatologists said the Arctic would be free of ice by 2018– Al Gore said the ice would be gone by 2013.

Universal Student Debt Forgiveness is Regressive, Say Economists

Plus: Uber abandons self-driving autos, on being “both loud and silenced,” and more…

by Elizabeth Nolan Brown

Reason.com

Wiping out student loan debt for American college graduates would benefit the wealthy much more than it benefits less privileged students, according to a new working paper from the National Bureau of Economic Research. “Blacks and Hispanics would also benefit substantially less than balances suggest,” the authors say.

Wiping out student loan debt for American college graduates would benefit the wealthy much more than it benefits less privileged students, according to a new working paper from the National Bureau of Economic Research. “Blacks and Hispanics would also benefit substantially less than balances suggest,” the authors say.

In the paper, titled “The Distributional Effects of Student Loan Forgiveness,” economists Sylvain Catherine and Constantine Yannelis conclude that universal student loan “forgiveness would benefit the top decile as much as the bottom three deciles combined.”

Not all student-loan-forgiveness schemes would have the same effects, they note:

There are a number of ways in which debt can be discharged, with important distributional implications. For example, forgiveness can be universal, capped or targeted to specific borrowers. These debt cancellation policies can benefit different socioeconomic and ethnic groups. This paper explores their distributional impacts. We find that the benefits of universal debt forgiveness policies largely accrue to high-income borrowers, while forgiveness through expanding income-contingent loan plans instead favors middle-income borrowers.

Transgender Students in Locker Rooms and Bathrooms

by Penka Arsova

LaCorte News

The Supreme Court declined to take up a case that demanded an Oregon school reverse policy allowing transgender students to use bathrooms and locker rooms that match their identity.

The Supreme Court declined to take up a case that demanded an Oregon school reverse policy allowing transgender students to use bathrooms and locker rooms that match their identity.

The appeal was brought to the Supreme Court by the advocacy group Parents for Privacy, on behalf of parents from Oregon. The plaintiffs argued that students should use locker rooms and bathrooms based on their sex assigned at birth and not gender identity.

The parents wanted the school district in a rural town near Oregon’s capital city to reverse the decision to grant transgender student Elliot Yoder access to the boy’s bathroom. They claimed that the policy infringed on the privacy rights of the other students.

Previous court decision: A court in Dallas, Oregon sided with the defendants, as well as a federal appeals court in San Francisco, with the judges saying that the policy does not violate the constitutional rights of students or Title IX, which prohibits discrimination based on sex in education programs or activities that receive federal financial assistance.

Is Silver (Finally!) Set to “Cross the Rubicon”?

by David Smith

Silver Seek

History is full of intriguing sayings coming down to us from other cultures that inform our thinking and behavior.

History is full of intriguing sayings coming down to us from other cultures that inform our thinking and behavior.

“Managing a large state is like cooking a small fish.” – Lao Tzu.

“A stitch in time saves nine.” – A 1700’s sewing reference.

“Healing is a matter of time; sometimes a matter of opportunity.” – Hippocrates.

One I especially like tracks back to Julius Caesar after ending his governance of the Roman province of Gaul and being ordered to disband his army. Under no circumstances was he to come closer with it than a small stream outside of Rome.

Yet Ceasar decided to cross the Rubicon and march on the capital, knowing there was no turning back and his likely fate if the venture failed. He supposedly told his men “The die has been cast!”

Why the 2020 Election Was Neither Free nor Fair

by Joel B. Pollak

Real Clear Politics

The 2020 presidential election was neither free nor fair.

The 2020 presidential election was neither free nor fair.

Much of the debate has focused on the question of “voter fraud” — whether alleged violations of the rules moved enough votes in key states to overturn the outcome, or whether speculative theories about hacked voting machines and software should be taken seriously. These claims remain unproven.

But while voting is the most important event in an election, it is not the only event, but the culmination of a process.

There are common international standards about what makes an election “free and fair.” These criteria, summarized by the Inter-Parliamentary Union, include: the “absolute” right to a secret ballot; the right to “express political opinions without interference; [t]o seek, receive and impart information and to make an informed choice”; the right of candidates to “equal opportunity of access to the media”; the “right of candidates to security”; freedom of association, and others.

Many of these were violated in 2020.

Bull Market? Had Three Dow Stocks Not Been Removed in August, 43 Percent of Dow Stocks Would be Negative Year-to-Date

by Pam Martens and Russ Martens

Wall Street on Parade

There has been a lot of bullish talk about the Dow Jones Industrial Average reaching 30,000 for the first time in history. But the underpinnings of the bellwether Dow index look a lot less rosy.

There has been a lot of bullish talk about the Dow Jones Industrial Average reaching 30,000 for the first time in history. But the underpinnings of the bellwether Dow index look a lot less rosy.

Replacing three of the Dow Jones Industrial Average stocks on August 31 looked like a desperate move by S&P Dow Jones Indices, the folks that oversee that stock index. One of the stocks replaced, Exxon Mobil, had been a Dow component for 92 years, joining the Dow in 1928 under the name Standard Oil of New Jersey. Exxon was replaced with Salesforce, a company that only went public in 2004. Salesforce describes itself as a “customer relationship management platform,” explaining that “We help your marketing, sales, commerce, service and IT teams work as one from anywhere — so you can keep your customers happy everywhere.” If that sounds a little nebulous to you, it should. But the stock price has been on a rip for the past four years so Wall Street loves it.

No Privacy, No Property: The World in 2030 According to the WEF

by Antony P. Mueller

Mises.org

The World Economic Forum (WEF) was founded fifty years ago. It has gained more and more prominence over the decades and has become one of the leading platforms of futuristic thinking and planning. As a meeting place of the global elite, the WEF brings together the leaders in business and politics along with a few selected intellectuals. The main thrust of the forum is global control. Free markets and individual choice do not stand as the top values, but state interventionism and collectivism. Individual liberty and private property are to disappear from this planet until 2030 according to the projections and scenarios coming from the World Economic Forum.

The World Economic Forum (WEF) was founded fifty years ago. It has gained more and more prominence over the decades and has become one of the leading platforms of futuristic thinking and planning. As a meeting place of the global elite, the WEF brings together the leaders in business and politics along with a few selected intellectuals. The main thrust of the forum is global control. Free markets and individual choice do not stand as the top values, but state interventionism and collectivism. Individual liberty and private property are to disappear from this planet until 2030 according to the projections and scenarios coming from the World Economic Forum.