from Kerry Lutz's Financial Survival Network

According to precious metals expert Ted Butler, $1950 on gold is the line of demarcation. That’s when the Technical Funds jump in with two feet and start buying up every available ounce. The banks are short and underwater by at least $10 billion. They either have to deliver the metals or buy back the position. $350 million ounces of silver is too tall an order to fill. The last thing they really want to do is a buy back, because that will light a fire under the market and drive it to all time highs. Either they keep it under control or they lose control. If they decide to buy back or run for cover, that could blow the lid off. They’ve been playing this dangerous game well for many years, so perhaps they can hold off a while longer. But eventually, something’s got to give.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

There is no way a status quo that is completely dependent on the permanent expansion of these interlocking extremes, asymmetries and imbalances can unwind them all and retain its myriad parasitic elites.

There is no way a status quo that is completely dependent on the permanent expansion of these interlocking extremes, asymmetries and imbalances can unwind them all and retain its myriad parasitic elites. Gold had a nice run last week. It traded up from $1,769 per ounce on Monday, November 30, to $1,842 per ounce by the close on Friday, December 4. That’s a 4.1% gain, not a bad week’s work. Gold’s trading at about the same level today. Still, this mini-rally has to be put in the context of the steep tumble that preceded it.

Gold had a nice run last week. It traded up from $1,769 per ounce on Monday, November 30, to $1,842 per ounce by the close on Friday, December 4. That’s a 4.1% gain, not a bad week’s work. Gold’s trading at about the same level today. Still, this mini-rally has to be put in the context of the steep tumble that preceded it.

Global market share of 1%. But market cap equals combined total of Toyota, Volkswagen (VW, Audi, Porsche, etc.), Daimler, GM, BMW, Honda, and Ford. Raised $10 billion in three months by selling shares.

Global market share of 1%. But market cap equals combined total of Toyota, Volkswagen (VW, Audi, Porsche, etc.), Daimler, GM, BMW, Honda, and Ford. Raised $10 billion in three months by selling shares.

As we head into winter, health authorities are telling us to stay at home as much as possible and to keep contact with others at a minimum. They are telling us that we must do this for our own good, but the truth is that the mental health of the American people has been absolutely devastated by the various restrictions that have been imposed since the COVID pandemic first began. Coming into this year, suicide was at an all-time record high in the United States and more Americans were on anti-depressants than ever before. Unfortunately, the COVID lockdowns have made things even worse. The following is an excerpt from a study that was released just a few days ago…

As we head into winter, health authorities are telling us to stay at home as much as possible and to keep contact with others at a minimum. They are telling us that we must do this for our own good, but the truth is that the mental health of the American people has been absolutely devastated by the various restrictions that have been imposed since the COVID pandemic first began. Coming into this year, suicide was at an all-time record high in the United States and more Americans were on anti-depressants than ever before. Unfortunately, the COVID lockdowns have made things even worse. The following is an excerpt from a study that was released just a few days ago… Every couple of years I refresh the long wave view for precious metals with a big cycle review.

Every couple of years I refresh the long wave view for precious metals with a big cycle review. The legacy of President Donald Trump will be measured against the diminishment of his enemies.

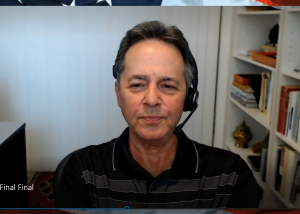

The legacy of President Donald Trump will be measured against the diminishment of his enemies. Analyst, professional trader and financial writer Rick Ackerman says don’t expect the trillions of dollars of borrowed money given away in government stimulus to save the economy. It will not. Ackerman explains, “For every dollar of debt we create, we only get 33 cents of growth. . . . The stimulus is having less and less of an effect, and because it has less of an effect, it stimulates the stimulators to do even more stimulating, which essentially means more borrowing. So, that’s what’s called a debt trap, and we are very much in it. . . . There is no question you get a shot in the arm on the consumer spending side and also with asset inflation with the real estate market and stock market. Don’t kid yourself, you are not creating sustainable growth to pay off that borrowing. We are not going to grow our way out of this.”

Analyst, professional trader and financial writer Rick Ackerman says don’t expect the trillions of dollars of borrowed money given away in government stimulus to save the economy. It will not. Ackerman explains, “For every dollar of debt we create, we only get 33 cents of growth. . . . The stimulus is having less and less of an effect, and because it has less of an effect, it stimulates the stimulators to do even more stimulating, which essentially means more borrowing. So, that’s what’s called a debt trap, and we are very much in it. . . . There is no question you get a shot in the arm on the consumer spending side and also with asset inflation with the real estate market and stock market. Don’t kid yourself, you are not creating sustainable growth to pay off that borrowing. We are not going to grow our way out of this.” When Money Dies, Adam Fergusson’s cautionary account of hyperinflation in Weimar-era Germany, is the book Americans desperately need to read today.

When Money Dies, Adam Fergusson’s cautionary account of hyperinflation in Weimar-era Germany, is the book Americans desperately need to read today.

This week, gold and silver rallied on Monday and Tuesday before drifting lower subsequently and ending up little changed on the week. In morning trade in Europe today, gold traded at $1835, down $3 from last Friday’s close, while on the same timescale silver lost 30 cents at $23.86. Volumes on Comex were low.

This week, gold and silver rallied on Monday and Tuesday before drifting lower subsequently and ending up little changed on the week. In morning trade in Europe today, gold traded at $1835, down $3 from last Friday’s close, while on the same timescale silver lost 30 cents at $23.86. Volumes on Comex were low. Rep. Bill Pascrell (D-NJ) is demanding that 126 House Republicans that supported a lawsuit challenging the 2020 presidential election not be seated during the upcoming congressional term that starts next month.

Rep. Bill Pascrell (D-NJ) is demanding that 126 House Republicans that supported a lawsuit challenging the 2020 presidential election not be seated during the upcoming congressional term that starts next month. “Men . . . go mad in herds, while they only recover their senses slowly, and one by one.” So wrote Scottish journalist Charles Mackay in his 1841 book Extraordinary Popular Delusions and the Madness of Crowds, which for good reason to this day remains in print.

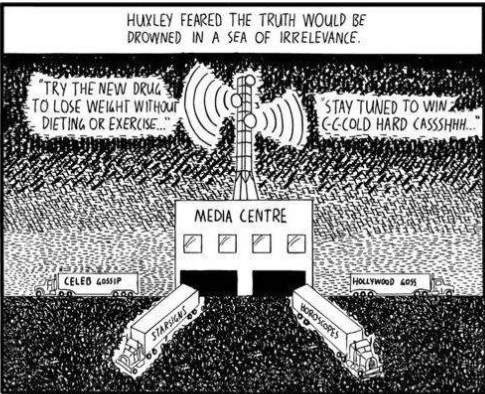

“Men . . . go mad in herds, while they only recover their senses slowly, and one by one.” So wrote Scottish journalist Charles Mackay in his 1841 book Extraordinary Popular Delusions and the Madness of Crowds, which for good reason to this day remains in print.