from Miles Franklin

France’s Ruling Class Calls Up Law Enforcement as the People Have Decided to Live Freely

by Mac Slavo

SHTF Plan

Against the dictate of the French ruling class, many have decided to live freely in the wake of more draconian COVID-19 restrictions. Because of this, the masters of the country have called on their “enforcers” to make sure the slaves continue to comply with their edicts.

Members of the French ruling class have vowed to increase their enforcement presence on the streets this weekend as they struggle to enforce a 6 pm-6 am curfew on those willing to live freely during attempts at further enslavement. The masters claim they need the slaves to comply amid soaring Covid-19 infections across the country and in the capital, according to a report by RT.

“If the police find groups of people in which respect for social distancing cannot be guaranteed, in particular on the banks of the Seine and in public parks and gardens, they are instructed to proceed with their evacuation,” the Paris police department confirmed on Friday, as it announced the mobilization of 4,400 officers this weekend. The police also urged people to ensure they reduce their social contacts to a maximum of six people and avoid any travel outside the Paris metropolitan area in order to prevent spreading the virus to other regions exert control and keep those pesky slaves that want to be free in line.

Why This Top is So Hard to Short

by Rick Ackerman

RickAckerman.com

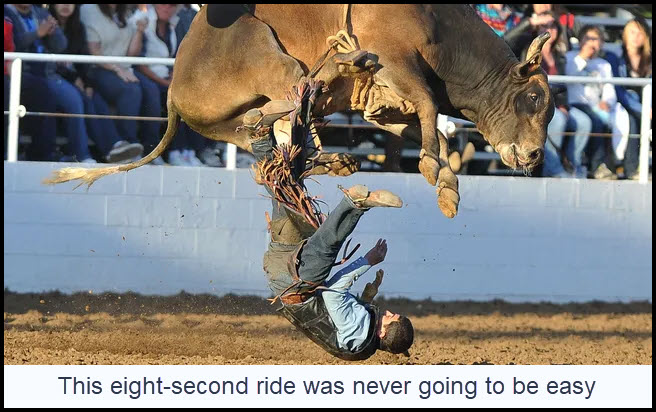

No one said it would be easy to get short at the top. This bull market is proving especially challenging to fade because the herd knows how grotesquely overvalued stocks are. With so many traders eager to bet the ‘don’t’ line, the broad averages have started to behave like El Diablo (see photo above). The Dow has staged three 600-point-plus rallies-to-nowhere since peaking two weeks ago, but none lasted for more than a day. Although bull riders must hang on for eight seconds to claim a prize, traders could conceivably have to endure weeks or even months of loco price action to hit it big. Many will get busted up badly trying.

No one said it would be easy to get short at the top. This bull market is proving especially challenging to fade because the herd knows how grotesquely overvalued stocks are. With so many traders eager to bet the ‘don’t’ line, the broad averages have started to behave like El Diablo (see photo above). The Dow has staged three 600-point-plus rallies-to-nowhere since peaking two weeks ago, but none lasted for more than a day. Although bull riders must hang on for eight seconds to claim a prize, traders could conceivably have to endure weeks or even months of loco price action to hit it big. Many will get busted up badly trying.

The ‘everything bubble’, as it is called, is wherever one looks: stocks, bonds, real estate, art…African American Barbie dolls. There are more homes listed for $5 million and up than there are Smiths in the Manhattan phone directory. Ironically, gold and silver are among the few investable assets that are not in a bubble. That tells you how badly the players have misjudged the risks of a financial cataclysm. They’ve gone all-in on bitcoin instead, as though scarcity alone could make cryptocurrency money, a store of value or a hedge against the crash that is coming.

Why This Penny Stock Has Multi-Billion Dollar Potential with Trillion Energy CEO Art Halleran

Trillion Energy (CSE:TCF – OTC:TCFF – FSX:3P2N) offers investors two genuine opportunities to create billions of dollars of market cap within two years explains CEO Art Halleran. Trillion is currently grossly undervalued with a market cap of only about US$20M while it owns infrastructure and gas reserves worth hundreds of millions of dollars. Furthermore, the company expects to be cash-flowing US$4M+/month in just 18 months from now. But over the next 1-2 years Trillion will be pursuing massive returns for its investors through exploration programs at its 49% owned SASB gas project in the Black Sea just off the cost of Turkey and at its 100% owned license of 42,833 hectares oil exploration block in southern Turkey which covers the northern extension of the prolific Iraq/Zagros Basin.

Trillion Energy’s SASB gas field is located just 100km south of the largest gas discovery in 30 years in Europe (14 TCF) and is the only nearology play in the region. Art has said that only a 1 TCF discovery would move Trillion from a penny stock to a $10+ stock quickly. Art stated, “so on our [license] block, we’re going to be looking for deeper potential because we have the same source rocks [as the 14 TCF discovery]. And the idea is we have to look for the reservoir rocks, but at the same time now, we are going to apply for a technical evaluation permit for maybe a hundred thousand hectares. And what that does is gives us the ability to take a large piece of land around a block and do geological studies to evaluate for similar type prospects that we have on our block, but also for deeper and different type of deposits that potentially could be a lot larger.”

Trillion Energy will also be drilling next year its oil exploration license in southern Turkey in pursuit of a billion-plus dollar payday. Art pointed out that because they are in Turkey not Iraq they are in a safe location and their cost of drilling is about 1/6 the cost south of the border. Yet Trillion benefits from the same geology that has produced billions of dollars of oil wealth south of the border: “We have the same geology. We have the same reservoirs, the same source rocks. We have oil seeps that the oil has been tested, which is identical to the oil that’s produced in northern Iraq. And we have a location there that’s defined by seismic. We own it one hundred percent. We have a large landholding and we are drill-ready. And it’s an exploration location and if we hit even a small field compared to what we see south of the border, our shares are multiples of $10 value, right? Because you’re talking fifty million barrels recoverable, a hundred million barrels recoverable. With a hundred million barrels we’ll have a market cap value of basically $4 to $5 billion.”

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Silver One Finds More Bonanza Grade Silver with Greg Crowe

from Kerry Lutz's Financial Survival Network

Our 2020 trip to Silver One’s (sponsor) Hawthorne, Nevada Candelaria Project demonstrated that the company was on to something big. Candelaria is one of richest silver mines in Nevada history and is now ready to enter its next phase. Recent drill results intersected 1,032 g/t Ag over 3.05 Meters with a 12.2-meter zone averaging 407 g/t along with 0.55 g/t of AU. Nearly two-thirds of its 15,000-meter program have been drilled. Twenty-five out of 30 holes were successfully finished. The assays of 13 holes have expanded the down-dip mineralization an additional 250 meters to the north at Mount Diablo and an additional 100 meters to the north-northeast of the Northern Belle pit. This is great news because it has proven Crowe’s belief that mineralization is far more extensive than previously believed and that there’s lots more yet to be discovered.

The news keeps getting better, last year Silver One updated its 43-101 technical report on its abandoned heap leach pads. Pad 1 has 30 million ounces of silver and pad 2 has 15 million. This combined with other parts of Candelaria means that production options have been greatly expanded.

For a combination of cash and stock, Silver One is transferring its Mexican properties to Silverton Metals, thus increasing its cash hoard to help further fund its ambitious drill programs.

Cherokee and Phoenix, it’s two other projects are moving quickly ahead as well. Drill targets have been identified at Cherokee and geologic mapping has been completed on over 90% of the claim block.

Crowe is especially excited about Phoenix where a 417-pound fragment containing up to 70% silver recently found. Another smaller vein fragment returned almost 50% silver or 14,688 ounces per ton. They’re studying and surveying the area looking for more rich targets. On a nearby adjoining property, a porphyry copper deposit is being developed. Phoenix’s silver-bearing polymetallic veins may also be associated with a porphyry copper system at depth. So, stay tuned for more good news. We’re very happy shareholders.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

More Election Fraud, Medical Tyranny, Economic Update

Greg Hunter’s Weekly News Wrap-Up for March 5th, 2021

by Greg Hunter

USA Watchdog

Another week and more election fraud is uncovered. Now, 400,000 absentee ballots are “missing” in Georgia. Joe Biden won the state by a little less than 12,000 votes. The ballots are required by law to be kept, but now they are gone and no way to check them. There was more election fraud discovered in New Jersey and Mississippi as well, but the public is being told election fraud in the 2020 Election is a “myth.” That’s a huge lie, and everybody knows it, including the Republicans that worked so hard to put Joe Biden in office. Now, the Republican leaders are talking about “voter integrity.” Hey, I thought voter fraud was a “myth”????

Another week and more election fraud is uncovered. Now, 400,000 absentee ballots are “missing” in Georgia. Joe Biden won the state by a little less than 12,000 votes. The ballots are required by law to be kept, but now they are gone and no way to check them. There was more election fraud discovered in New Jersey and Mississippi as well, but the public is being told election fraud in the 2020 Election is a “myth.” That’s a huge lie, and everybody knows it, including the Republicans that worked so hard to put Joe Biden in office. Now, the Republican leaders are talking about “voter integrity.” Hey, I thought voter fraud was a “myth”????

Dr. Simone Gold was arrested by nearly two dozen heavily armed FBI agents. Dr. Gold was at the U.S. Capital January 6th with a bullhorn warning anybody that would listen about the dangers of taking “experimental” Covid 19 (CV19) vaccines. Yes, you heard correctly, the vaccines are only approved for “emergency use.” This means the CV19 vaccines are experimental. Vaccine companies have no idea what will happen long term, but short term, Dr. Gold says they can cause miscarriages and also cause young women to be sterile. Dr. Gold did walk through the Capitol building on Jan 6th but caused zero damage and did nothing violent. Dr. Gold thinks the FBI raided her home and broke down her front door to intimidate her and anyone else that would tell the truth about CV19 vaccines and non-vaccine treatments such as hydroxychloroquine, zinc, and Ivermectin that have proven very good results for fighting CV19. Medical tyranny is here and alive and well in America.

The Global Financial End-Game

by Charles Hugh Smith

Of Two Minds

The over-indebted, overcapacity global economy an only generate speculative asset bubbles that will implode, destroying the latest round of phantom collateral.

The over-indebted, overcapacity global economy an only generate speculative asset bubbles that will implode, destroying the latest round of phantom collateral.

For those seeking a summary, here is the global financial endgame in fourteen points:

1. In the initial “boost phase” of credit expansion, credit-based capital ( i.e. debt-money) pours into expanding production and increasing productivity: new production facilities are built, new machine and software tools are purchased, etc. These investments greatly boost production of goods and services and are thus initially highly profitable.

2. As credit continues to expand, competitors can easily borrow the capital needed to push into every profitable sector. Expanding production leads to overcapacity, falling profit margins and stagnant wages across the entire economy.

Goodbye Personal Mobility

by Karl Denninger

Market-Ticker.org

The era of personal freedom is over.

The era of personal freedom is over.

I won’t live to see it finally die, in all probability, and if I do I’m not sure I will care. I’m 57; by the time it really matters I’ll be too decrepit to give a crap when all is said and done.

But my daughter, she’s ****ed. She’s talked about — and ordered her life — to be able to travel and enjoy both the country and, until the raving, rabid idiocy of the Coof-Karens started, other nations as well as a young woman. She’s done that because unlike 99% of the young “adults” today, who aren’t really adults at all, she’s figured out that “The land of the free” is an illusion and worse, not long from now she won’t be able to do those things at all.

It’s not that there will be “vaccine passports” and similar stupidity; no, that may well happen, but that’s not the problem.

Market Report: Falling Open Interest

by Alasdair MacLeod

Gold Money

Gold and silver prices continued to decline this week, with gold falling $37 to $1696, and silver down $1.32 to $25.27 in European morning trade today. A notable feature is the continuing decline in Comex open interest in both metals, with gold OI at the lowest level since June 2019, and silver at 156,682 contracts the lowest since last December. The bullion banks appear to have defeated the RobinHood/Reddit physical silver squeeze.

Gold and silver prices continued to decline this week, with gold falling $37 to $1696, and silver down $1.32 to $25.27 in European morning trade today. A notable feature is the continuing decline in Comex open interest in both metals, with gold OI at the lowest level since June 2019, and silver at 156,682 contracts the lowest since last December. The bullion banks appear to have defeated the RobinHood/Reddit physical silver squeeze.

The next chart shows gold’s open interest history.

[…] It appears that bullion banks are finally winding down their exposure, and the most recently available position is shown in the table below.

One Bank Turn Apocalyptic: “The Fed Will Inevitably Move to YCC” as “Rates Are No Longer Anchored”

by Michael Lewitt, The Credit Strategist

Zero Hedge

Another week, another massive inflow into equity funds… just as the Nasdaq was about to get hammered with a painful 10% correction.

Another week, another massive inflow into equity funds… just as the Nasdaq was about to get hammered with a painful 10% correction.

According to BofA Chief Investment Strategist Michael Hartnett’s latest Flow Show note, $22.2Bn in new money flowed into equities last week, following the previous week’s massive $46.2Bn inflow which was the 3rd biggest on record, bringing the total 16 week inflow to $436BN, a stunning outlier as shown in the chart below.

[…] Addressing this massive tide of money, Wayne Wicker, chief investment officer at Vantagepoint Investment Advisers said that “Investors are looking at the market today and saying, ‘Wow, this is going to come back faster than I thought. I need to position myself accordingly. There’s a fear of missing out, of being under-invested.”

Canada Public Health Wants Children in Solitary Confinement

by Simon Black

Sovereign Man

Are you ready for this week’s absurdity? Here’s our Friday roll-up of the most ridiculous stories from around the world that are threats to your liberty, risks to your prosperity… and on occasion, inspiring poetic justice.

Are you ready for this week’s absurdity? Here’s our Friday roll-up of the most ridiculous stories from around the world that are threats to your liberty, risks to your prosperity… and on occasion, inspiring poetic justice.

White People Shouldn’t Translate Black Poetry

Amanda Gorman— a poet who happens to be Black— rose to notoriety after speaking at President Biden’s inauguration.

She is publishing a book of poetry, which will be translated into Dutch.

Gorman chose a female Dutch author to translate her work, but a Dutch activist journalist had other plans.

Why is Cuomo Being Thrown Under the Covid-Con Bus?

by Brian C. Joondeph, M.D.

American Thinker

Less than a year ago, New York Governor Andrew Cuomo was a darling of the left over his “leadership” in managing the COVID pandemic in his state. Last April, his daily press conferences were covered in full by Fox News and the other more sycophantic media networks, coverage on par with President Trump’s daily briefings.

Less than a year ago, New York Governor Andrew Cuomo was a darling of the left over his “leadership” in managing the COVID pandemic in his state. Last April, his daily press conferences were covered in full by Fox News and the other more sycophantic media networks, coverage on par with President Trump’s daily briefings.

None of the other 49 state governors’ press conferences received daily coverage by national media. In Colorado, Governor Polis’s press briefings were only shown on local news channels.

[…] Cuomo wrote a book called, American Crisis: Leadership Lessons from the COVID-19 Pandemic and received literary acclaim. The New York Times gushed,

Texas Has Hundreds of Thousands of Coronavirus Carriers. The Governor is Worried About ‘Hundreds’ of Covid-Positive Migrants.

Greg Abbott’s fear is hard to take seriously, but it jibes with hoary stereotypes about immigrants.

by Jacob Sullum

Reason.com

President Joe Biden this week said Texas Gov. Greg Abbott’s decision to lift most of his state’s remaining COVID-19 restrictions was “a big mistake” that reflected “Neanderthal thinking” about the pandemic. Biden inaccurately suggested that Abbott was dismissing the value of face masks because he was no longer legally requiring them, when in fact Abbott “strongly encouraged” Texans to continue covering their faces in public when they are in close proximity to other people.

President Joe Biden this week said Texas Gov. Greg Abbott’s decision to lift most of his state’s remaining COVID-19 restrictions was “a big mistake” that reflected “Neanderthal thinking” about the pandemic. Biden inaccurately suggested that Abbott was dismissing the value of face masks because he was no longer legally requiring them, when in fact Abbott “strongly encouraged” Texans to continue covering their faces in public when they are in close proximity to other people.

Abbott fired back on Twitter with an equally misleading charge against Biden, accusing him of promoting virus transmission by “recklessly releasing hundreds of illegal immigrants who have COVID into Texas communities.” That policy, he averred, is a “callous act that exposes Texans & Americans to COVID.”

A Time to Act

by Ted Butler

Silver Seek

Interest in silver and concerns about its price being artificially suppressed by excessive short selling are now at levels never seen before. While those concerns are well-founded, in my opinion, too often the remedy for what to do about it is less clear.

Interest in silver and concerns about its price being artificially suppressed by excessive short selling are now at levels never seen before. While those concerns are well-founded, in my opinion, too often the remedy for what to do about it is less clear.

Since silver and silver futures trading is regulated by the US Commodity Futures Trading Commission (CFTC), it is the statutory first line of defense against market manipulation. Here’s something that will take only a few moments and has always worked in the past in assuring the agency will, at least, address the issue directly.

If you are concerned that the silver price is being artificially influenced by excessive and manipulative short selling, please email or send a copy of the enclosed letter to the CFTC. If you would like, substitute my name with your name, but please send it to the addresses of the Commissioners I’ve included.

Inflation or Deflation? Here’s How it Will All End.

Market researcher Luke Gromen is confident he has the answer

by Adam Taggart

Chris Martenson’s Peak Prosperity

Highly-respected market researcher Luke Gromen concludes that we’re living in a unique period of history given that we currently facing three massive threats:

- the first bursting global sovereign debt bubble in over 100 years

- the first time in 50+ years that foreign central banks are no longer financing the US economy (i.e., they have stopped growing their holdings of US Treasurys)

- the US’ long-standing “petrodollar” advantage is eroding as other countries increasingly strike deals to trade key commodities in non-USD currencies

As these challenges mount, how will they resolve?

Gold’s Momentum Selloff

by Adam Hamilton

Zeal LLC

Gold has suffered unrelenting selling in the last couple months, hammering it and its miners’ stocks much lower. Those outsized anomalous losses have left sentiment in tatters, with overpowering bearishness universal. Gold’s thrashing had nothing to do with fundamentals, it was driven by cascading momentum selling in gold futures and gold-ETF shares. But such dumping is finite, increasingly likely to exhaust itself.

Gold has suffered unrelenting selling in the last couple months, hammering it and its miners’ stocks much lower. Those outsized anomalous losses have left sentiment in tatters, with overpowering bearishness universal. Gold’s thrashing had nothing to do with fundamentals, it was driven by cascading momentum selling in gold futures and gold-ETF shares. But such dumping is finite, increasingly likely to exhaust itself.

Last summer, gold rocketed 40.0% higher out of last March’s COVID-19-lockdown-spawned stock panic. That massive upleg left this metal extraordinarily overbought, guaranteeing a correction to rebalance both sentiment and technicals. That came right on schedule, with gold dropping 13.9% over 3.8 months into the end of November. That healthy selloff was in line with this bull’s precedent, leaving gold sufficiently oversold.

Gold’s three prior corrections during this secular bull had averaged 14.3% losses over 4.1 months.

The Jobs Recovery, Compared to the “Good Times” Trend

by Wolf Richter

Wolf Street

February confirms: V-shaped jobs recovery petered out in October about two-thirds into it.

February confirms: V-shaped jobs recovery petered out in October about two-thirds into it.

In February, “households” reported that 150.2 million people were working – including gig workers – bringing the number of working people back to a level first seen in December 2015 (red line in the chart below), according to the Bureau of Labor Statistics’ jobs report this morning. This was up by 208,000 from January. Over the four months since October, households reported an increase of 570,000 jobs.

The BLS basis its jobs data on two separate surveys: of households and of “establishments” – companies, non-profits, and government entities, not including all self-employed people. These establishments had 143.05 million employees (green line) in February, up by 379,000 employees from January. Over the four months since October, formal employment at establishments has risen by 503,000 jobs.

Top Cuomo Aides Edited Report to Hide Nursing Home Death Toll Ahead of Book Release

by Tim Pearce

Daily Wire

Top aides of Democratic New York Gov. Andrew Cuomo reportedly pressured state health department officials to alter a report to remove the total number of nursing home residents who died from the coronavirus.

Top aides of Democratic New York Gov. Andrew Cuomo reportedly pressured state health department officials to alter a report to remove the total number of nursing home residents who died from the coronavirus.

The report comes as the embattled governor faces accusations of covering up the impact of the pandemic on New York’s elderly population, as well as allegations of sexual harassment from two former staff members. The governor’s aides’ purported role in editing the health department report suggests that the cover up of New York’s nursing home data began much earlier than previously thought and as Cuomo began writing a book touting his leadership during the pandemic.