by Rick Ackerman

RickAckerman.com

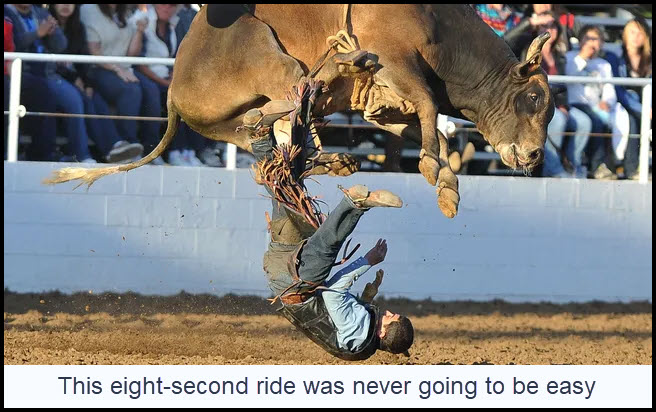

No one said it would be easy to get short at the top. This bull market is proving especially challenging to fade because the herd knows how grotesquely overvalued stocks are. With so many traders eager to bet the ‘don’t’ line, the broad averages have started to behave like El Diablo (see photo above). The Dow has staged three 600-point-plus rallies-to-nowhere since peaking two weeks ago, but none lasted for more than a day. Although bull riders must hang on for eight seconds to claim a prize, traders could conceivably have to endure weeks or even months of loco price action to hit it big. Many will get busted up badly trying.

No one said it would be easy to get short at the top. This bull market is proving especially challenging to fade because the herd knows how grotesquely overvalued stocks are. With so many traders eager to bet the ‘don’t’ line, the broad averages have started to behave like El Diablo (see photo above). The Dow has staged three 600-point-plus rallies-to-nowhere since peaking two weeks ago, but none lasted for more than a day. Although bull riders must hang on for eight seconds to claim a prize, traders could conceivably have to endure weeks or even months of loco price action to hit it big. Many will get busted up badly trying.

The ‘everything bubble’, as it is called, is wherever one looks: stocks, bonds, real estate, art…African American Barbie dolls. There are more homes listed for $5 million and up than there are Smiths in the Manhattan phone directory. Ironically, gold and silver are among the few investable assets that are not in a bubble. That tells you how badly the players have misjudged the risks of a financial cataclysm. They’ve gone all-in on bitcoin instead, as though scarcity alone could make cryptocurrency money, a store of value or a hedge against the crash that is coming.