from Blaire White

Defense Secretary: U.S. “Will Strike” Iran at “Time & Place of Our Choosing”

by Mac Slavo

SHTF Plan

The war rhetoric is continually ramping up. Not only are there talks of committing cyberattacks against Russia, but the United States defense secretary is saying the U.S. will strike Iran at a time and place of their choosing.

U.S. Defense Secretary Lloyd Austin won’t say who was behind a recent rocket attack on an American airbase in Iraq, but his eyes are on Iran, and he says the US will strike again “at a time and place of our own choosing.” Keep your eyes open. This attack on American bases in Iraq has all the markings of a false flag.

False Flag Potential in the Middle East: Iran, Syria, and Israel

Where’s Biden Hidin’? Even CNN Begins Asking Questions, as President Goes Record Time Without Press Conference with Q&A

Biden has gone longer without giving a Q&A press conference than any US president in modern history.

by RT

Info Wars

Joe Biden has gone longer without giving a press conference with questions and answers than any US president in modern history. Now the elation of his inauguration’s worn off, even his allied media are beginning to wonder why.

Joe Biden has gone longer without giving a press conference with questions and answers than any US president in modern history. Now the elation of his inauguration’s worn off, even his allied media are beginning to wonder why.

Monday marked Joe Biden’s 47th day in office, and also his 47th without appearing before the press to take questions. The president has sat down to several taped interviews, and has given brief soundbites to reporters at events, but not a single proper Q&A session has materialized.

He has gone longer without holding a press conference than any of his 15 most recent predecessors, all of whom faced the media within their first 33 days in office. Donald Trump waited 27 days, while Barack Obama – Biden’s old boss – held his first after just 20 days.

Many in the mainstream media were ecstatic when Biden was inaugurated, after four years of sometimes open hostility toward Trump. Yet even the most pro-Biden liberal news outlets are beginning to demand an appearance from the president.

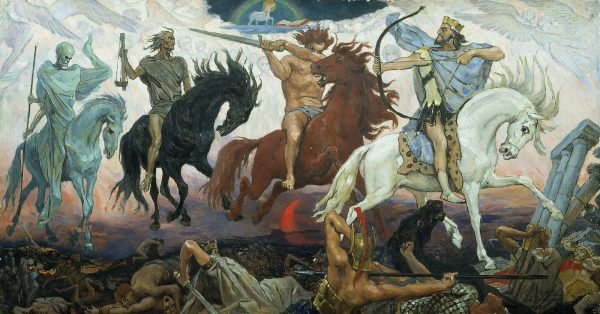

Rumors of War, Pestilences, and Earthquakes in Diverse Places…

by Michael Snyder

End of the American Dream

Most people still don’t realize this, but the truth is that we have entered an apocalyptic time in human history. War, natural disasters, disease outbreaks, economic problems and civil unrest are all in the headlines on a daily basis already, and they are all going to be a bigger part of our lives moving forward. Those that have been hoping that our lives would soon “return to normal” will be greatly disappointed, because what we have experienced so far is just the beginning.

Most people still don’t realize this, but the truth is that we have entered an apocalyptic time in human history. War, natural disasters, disease outbreaks, economic problems and civil unrest are all in the headlines on a daily basis already, and they are all going to be a bigger part of our lives moving forward. Those that have been hoping that our lives would soon “return to normal” will be greatly disappointed, because what we have experienced so far is just the beginning.

Now that the warmongers are back in control in Washington, we should expect a steady stream of war rumors from now on.

This week, we are being told that the Biden administration is quite eager to make the Russians “pay” for the Solar Winds hack that was first reported last December. According to the New York Times, the Biden administration is getting ready to initiate a series of “clandestine” cyberattacks that will seriously hurt Russia…

Three Absolutely Shocking Charts, Plus Look at Who Just Said Big Gains Ahead for Gold and Mining Stocks

from King World News

Here is a look at 3 absolutely shocking charts, plus look at who just said investors should expect big gains ahead for gold and mining stocks.

Here is a look at 3 absolutely shocking charts, plus look at who just said investors should expect big gains ahead for gold and mining stocks.

Big Gains Ahead

March 8 (King World News) – Fred Hickey: On top of very low Gold DSI, HGNSI & BPGDM we have latest COT report which showed Managed Money (those pesky hedge funds) with another big drop in their net long positions to the lowest level since May 2019 (big rally followed). Their positions nearly cut in 1/2 past month.

May be a little more “pain” due to rising yields, but I look at it as a little more “opportunity” to buy near lows. Managed Money (hedge funds) net long positions down to just 45.9K contracts – that’s down over 80% from 2020 highs. Most of the “pain” is behind us. Big gains are ahead…

More Stimulus For Robinhooders with John Rubino

from Kerry Lutz's Financial Survival Network

John Rubino is back for another weekly installment… Saudi oil terminal bombed, oil at $70. Rising inflation and rising commoditiy prices are happening now. YCC can it work and what are the unintended consequences. Let’s see what happens to yield curve control when the inflation rate kicks up like it’s doing now? NFTs are using blockchain to create a digital asset: Non-fungible token. Jack Dorsey is turning the first Tweet into a NFT. Labron James dunk video sold for $200,000. Banksey painting! Burned and turned into NFT… $90,000 becomes $400,000. There are too damn many dollars sloshing around! Normal stuff doesn’t exist any more.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Bonds Away with Chris Vermeulen

from Kerry Lutz's Financial Survival Network

Founder and Chief Market Strategist of The Technical Traders, Chris Vermeulen shared his views on various markets and precious metals. Stock Market – Sector rotation into the Dow and Transport Index doing well. It’s flock not a shift. Stuck under the 50 day moving average. Small caps and Dow are holding up well vis-a-vis the Nasdaq. Where can you go and find value? There’s so much money searching for the next move. It could be getting a little overheated. Energy is the way to go. It’s leading the way and where the money’s flowing.

No Bonds for You – Bonds Away. Fear is creeping in. Investors not trusting US Bond Market. People are indifferent to bonds. Investors aren’t buying any defensive positions. We’re getting closer to a deeper correction. Not a whole lot of changes in interest rates. The market is getting long of tooth.

$1400 Robinhood Subsidy Check record flows going into the market and coming out. Just a matter of time till it runs out of steam. Another market push coming. Next leg down is coming. Where’s the money going? 1-2 weeks. Avoid the chop. Big moves equal big haircuts.

Gold and Silver could see the bottom fall out. A running consolidation. Silver still has a bearish consolidation. Stay on the sidelines and get in when the dust settles. Majority of investors have been very tech heavy. If you’re in it you’ve probably seen the worst. A little more to come. Long term bull flag patterns. Dollar is playing a big part in it. Fear among big investors. Global money is moving to the dollar. Charts are saying move to cash. Music is coming to an end. Sidelines are a great place to be when corrections rear their ugly head.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Oh Really, It’s Just Democrats?

by Karl Denninger

Market-Ticker.org

Things that make you spit coffee on your keyboard in the morning....

Democrats’ disastrous trade and economic policies “have made American workers compete with the slave labor,” Sen. Josh Hawley, R-Mo., told “Fox News Primetime” Friday.

“Working folks, communities have suffered as the jobs are shipped off to China and shipped overseas to the lowest bidder,” Hawley told host Lawrence Jones before claiming Democrats have allowed that to happen “in order to get rich.”

The time has come, Hawley continued, to “bring those jobs back to create opportunities in our urban core and rural areas for American workers.”

Ok, so the Republicans had 2 years of both Houses of Congress plus the White House.

Did they pass wage and environmental parity tariffs, as I have urged for two decades, to stop this?

Nope.

Liquidity Tsunami Foiled: Why This Has Major Implications for Markets

from Zero Hedge

Exactly one month ago we explained that the US economy and capital markets were about to be flooded with a $1.1 trillion liquidity wave as the Treasury drew down the amount of cash held in the Treasury General Account which would plunge to just $800 billion by March 31, down a record $929BN from $1.729 trillion at Dec 31, 2020.

In other words as of early February, the Treasury expected the decline in the TGA cash balance this quarter – which is being spent to fund last December’s fiscal stimulus – to be the main driver of funding needs (for an intro primer on this topic, please see “U.S. Treasury’s cash drawdown – and why markets care“).

The CDC is About to Be Canceled by Google and Facebook for Covid Heresy

by Simon Black

Sovereign Man

On Friday afternoon, the US Centers for Disease Control and Prevention (still called the CDC, even though they added a ‘P’) released a heretical report about mask-wearing and COVID-19.

On Friday afternoon, the US Centers for Disease Control and Prevention (still called the CDC, even though they added a ‘P’) released a heretical report about mask-wearing and COVID-19.

The report, authored by at least a dozen medical doctors, PhD researchers, and, bizarrely, a handful of attorneys, examined how mask mandates across the US affected COVID cases and death rates.

You’d think with all of the media propaganda about mask effectiveness… and all the virtue signaling, with politicians and reporters appearing on live TV wearing masks… that the data would prove incontrovertibly and overwhelmingly that masks have saved the world.

But that’s not what the report says.

Climate Warriors Silent on Covid Mask Pollution

by Brian C. Joondeph, M.D.

American Thinker

Masks have been permanent staple of American life for the past year. Recommendations change like spring weather, from none to one to two or more, all based on flimsy evidence from the “follow the science” crowd.

Masks have been permanent staple of American life for the past year. Recommendations change like spring weather, from none to one to two or more, all based on flimsy evidence from the “follow the science” crowd.

Last March, the World Health Organization recommended no masks for individuals “unless they are sick with COVID or caring for someone who is sick.”

The esteemed Dr. Anthony Fauci agreed saying, “There’s no reason to be walking around with a mask… And, often, there are unintended consequences.” How right he was, in an unintended way.

Last month, Dr. Fauci made the case for two masks. After all, if one is good, two or more must be better. Try that with your prescription medications and see how that works out.

Ted Butler: A Time to Act

Yesterday in Gold, Silver, Platinum and Palladium

by Ed Steer

Silver Seek

The gold price was sold quietly lower from the 6:00 p.m. open in New York on Thursday evening — and a new low tick for this move down was set a few minutes after 9 a.m. China Standard Time on their Friday morning. From that juncture the price crept quietly and unevenly higher until the dollar index ‘rally’ ended about ten minutes before the London open — and the price was sold a bit lower until 9 a.m. GMT. From that point it began creep/chop quietly higher until a few minutes before the 1:30 p.m. COMEX close in New York — and was then sold down a bit until around 2:10 a.m. in after-hours trading. I didn’t do a whole heck of a lot after that.

The gold price was sold quietly lower from the 6:00 p.m. open in New York on Thursday evening — and a new low tick for this move down was set a few minutes after 9 a.m. China Standard Time on their Friday morning. From that juncture the price crept quietly and unevenly higher until the dollar index ‘rally’ ended about ten minutes before the London open — and the price was sold a bit lower until 9 a.m. GMT. From that point it began creep/chop quietly higher until a few minutes before the 1:30 p.m. COMEX close in New York — and was then sold down a bit until around 2:10 a.m. in after-hours trading. I didn’t do a whole heck of a lot after that.

The low and high ticks in gold were recorded by the CME Group as $1,683.00 and $1,705.70 in the April contract. The April/June price spread differential in gold at the close on Friday was $3.10…June/August was $2.20 — and August/October was $2.00.

New CDC Guidance Says Vaccinated People Can Do a Tiny Bit of Socializing

But the vaccinated are still expected to wear masks and socially distance when in public.

by Robby Soave

Reason.com

The Centers for Disease Control and Prevention (CDC) released new guidance on Monday that permits fully vaccinated people to gather indoors with a small number of unvaccinated people, but still recommends masking and social distancing in public places.

The Centers for Disease Control and Prevention (CDC) released new guidance on Monday that permits fully vaccinated people to gather indoors with a small number of unvaccinated people, but still recommends masking and social distancing in public places.

“There are some activities that fully vaccinated people can resume with minimal risk,” said CDC Director Rochelle Walensky at a press briefing.

After receiving the second dose of a vaccine (or the single-dose Johnson & Johnson shot) and waiting the necessary two-week period, vaccinated individuals can safely socialize with other vaccinated people, since there is virtually zero risk of a severe negative health outcome. The vaccinated can gather with the unvaccinated as well, but because it’s theoretically possible for vaccinated individuals to transmit COVID-19 to the unvaccinated, the CDC is recommending that these gatherings include only members of one household—and no one who falls into a COVID-19 risk category (such as the elderly).

What Lowest Electricity Sales to End Users Since 2009 Say About Shifts in the Pandemic Economy, Working from Home, Commercial & Industrial Activity, and Public Transit

by Wolf Richter

Wolf Street

And by source? in 2020, coal collapsed to record low, natural gas dominated, wind and solar surged, while hydro and nuclear remained roughly flat.

And by source? in 2020, coal collapsed to record low, natural gas dominated, wind and solar surged, while hydro and nuclear remained roughly flat.

Electricity sales to all end users – households, office buildings, industrial buildings, and the like – have been on a dreary trajectory since 2008 for electric utilities overall in the US, despite economic and population growth, as these customers have invested in more efficient electrical equipment such as LED light bulbs and new air conditioners, and better thermal insulation, while at the same time, more manufacturing has been offshored.

And then came the Pandemic. By customer type, electricity sales show the shifts in the economy as millions of jobs evaporated, and as other jobs were switched from desk farms in office towers to working from home, while many retailers and restaurants closed, industrial plants reduced activity, and usage of commuter rail collapsed.

This is Why Biden Does Not Address the World

by Martin Armstrong

Armstrong Economics

The vast majority of people who voted for Biden did so because they hated Trump. Well, it looks like they got what they deserved. The problem is, the rest of us got what we tried to avoid. This is total BS that every economist left – right – center agreed to this $1.9 trillion package and the so-called “unify the nation” Biden promised was just a campaign slogan. They rejected every amendment of the Republicans so there is no way everyone agreed on this. When Ronald Reagan was president, they were screaming because the National Debt hit $1 trillion. Biden is spending nearly twice the entire national debt accumulated from World War I, World War II, Korea, and Vietnam.

The vast majority of people who voted for Biden did so because they hated Trump. Well, it looks like they got what they deserved. The problem is, the rest of us got what we tried to avoid. This is total BS that every economist left – right – center agreed to this $1.9 trillion package and the so-called “unify the nation” Biden promised was just a campaign slogan. They rejected every amendment of the Republicans so there is no way everyone agreed on this. When Ronald Reagan was president, they were screaming because the National Debt hit $1 trillion. Biden is spending nearly twice the entire national debt accumulated from World War I, World War II, Korea, and Vietnam.

We would NOT need such a stimulus package if the politicians did not lockdown the economy, destroyed businesses deliberately, killed people in nursing homes like Cuomo because he was too busy chasing his secretary around the desk, and world leaders were not kissing up to Schwab. NO GOVERNMENT in 6,000 years has EVER locked down its economy because of a virus. Just amazing.

Texas Shows the Way on Covid Rationality

by Karol Markowicz

NYPost.com

Last week, a US state decided to throw off the shackles of prolonged pandemic restrictions that have done very little good and much harm. That state will reopen libraries, museums, houses of worship and most businesses at full capacity.

Last week, a US state decided to throw off the shackles of prolonged pandemic restrictions that have done very little good and much harm. That state will reopen libraries, museums, houses of worship and most businesses at full capacity.

No uproar ensued. The state in question was, of course, deep-blue Connecticut. A day earlier, however, when the governors of Texas and Mississippi announced their states were reopening, they got a very different reception. When Texas Gov. Greg Abbott also noted he will be lifting the statewide mask mandate, the liberal establishment reacted as if had vowed to personally inject the novel coronavirus into the bodies of Lone Star residents.

President Biden slammed the move as “Neanderthal thinking.” NBC’s Lester Holt declared the country at “an unsettling crossroad tonight.” Centers for Disease Control and Prevention boss Rochelle Walensky warned against a “premature lifting of these prevention measures.” Federal coronavirus guru Anthony Fauci called the news “inexplicable” and said “now is not the time to pull back.”

Why Europe’s Left Wants a European Financial Superstate

by Philipp Bagus

Mises.org

In an open letter to the EU Commission with the title Joint Letter: Reshaping the European Fiscal Framework, on February 17, 2021, a coalition of left-wing and green politicians, think tanks, and trade unions unsurprisingly led by George Soros made an appeal for a permanent common EU budget with the possibility of borrowing to support investments that advance the Green Deal and other pharaonic projects. In addition to the permanent EU budget, the letter calls for overriding and making more flexible EU fiscal rules and supporting fiscal policy with further monetary policy measures by the European Central Bank. What to say about these proposals? The permanent EU budget and the possibility of the EU to issuing debt have always been the pipe dream of socialist politicians who want a European superstate. This proposal would be an important step toward such a goal, as from then on the emerging European central state could assume more powers and further grow. The brakes would be off. Again and again socialists have tried to take advantage of crises to move closer to the goal of a European central state by creating new European institutions and increasing the power of the already existing ones. Now the covid-19 crisis is the perfect excuse to make another effort and create facts.

In an open letter to the EU Commission with the title Joint Letter: Reshaping the European Fiscal Framework, on February 17, 2021, a coalition of left-wing and green politicians, think tanks, and trade unions unsurprisingly led by George Soros made an appeal for a permanent common EU budget with the possibility of borrowing to support investments that advance the Green Deal and other pharaonic projects. In addition to the permanent EU budget, the letter calls for overriding and making more flexible EU fiscal rules and supporting fiscal policy with further monetary policy measures by the European Central Bank. What to say about these proposals? The permanent EU budget and the possibility of the EU to issuing debt have always been the pipe dream of socialist politicians who want a European superstate. This proposal would be an important step toward such a goal, as from then on the emerging European central state could assume more powers and further grow. The brakes would be off. Again and again socialists have tried to take advantage of crises to move closer to the goal of a European central state by creating new European institutions and increasing the power of the already existing ones. Now the covid-19 crisis is the perfect excuse to make another effort and create facts.