from FinancialSurvivalNet

Joe aka “SilverFuturist”, someone who we met at Hard Assets NY, and his lovely companion “Jackie O” appeared live today on our radio show on 1490WGCH in Greenwich, CT. We talked extensively about using new media to reach people who wouldn’t ordinarily be concerned about such lofty matters. His YouTube channel has gotten over 2.5 million views, and it’s growing every month. We also talked about money: what it is, and what’s happening to it, as well as the best way to acquire metals. We hope you find their take on things as interesting as we did.

Joe aka “SilverFuturist”, someone who we met at Hard Assets NY, and his lovely companion “Jackie O” appeared live today on our radio show on 1490WGCH in Greenwich, CT. We talked extensively about using new media to reach people who wouldn’t ordinarily be concerned about such lofty matters. His YouTube channel has gotten over 2.5 million views, and it’s growing every month. We also talked about money: what it is, and what’s happening to it, as well as the best way to acquire metals. We hope you find their take on things as interesting as we did.

Click Here to Listen to the Audio

(Direct Download HERE)

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

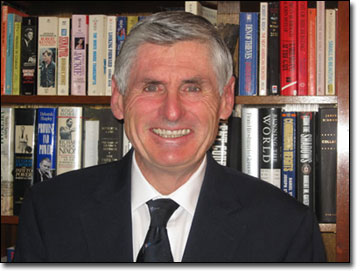

Gordon Long is an engineer, and he has had a long career with larger Fortune 500 companies. He’s also had the opportunity to do a startup and run his own company, from the ground up. He’s an expert in chaos theory and a definite believer in tipping points. He’s quite certain the current economic numbers are faked. Inflation is far greater than admitted to by the government. Accordingly, GDP is way, way overstated, using a hither to unknown method known as “Imputation.” While the government is out there cooking the books, economic activity is actually declining, and the middle class is in danger of extinction. Irrespective of what GDP is stated to be, the underlying truth cannot be denied, the crisis continues in full force and effect.

Gordon Long is an engineer, and he has had a long career with larger Fortune 500 companies. He’s also had the opportunity to do a startup and run his own company, from the ground up. He’s an expert in chaos theory and a definite believer in tipping points. He’s quite certain the current economic numbers are faked. Inflation is far greater than admitted to by the government. Accordingly, GDP is way, way overstated, using a hither to unknown method known as “Imputation.” While the government is out there cooking the books, economic activity is actually declining, and the middle class is in danger of extinction. Irrespective of what GDP is stated to be, the underlying truth cannot be denied, the crisis continues in full force and effect.  “Ranting” Andy Hoffman joins us for another fun filled wrap up of all the wonderful things that aren’t happening in the world. He sees Facebook as further confirmation of a completely corrupt financial system careening out of control. When the elites deliberately overprice and overhype the biggest tech IPO in history and then see it crash and burn, then you know something important is happening. Combine that with the obvious rise in nationalism across Europe and you know the seeds have been sewn for something truly cataclysmic. With flocks of “black swans” circling the world’s financial centers, waiting to descend at the exact worst moment, it’s time to buckle our seat belts and get ready. It’s important to understand the crisis, which began in late 2007, has not ended. It was perhaps dormant for a couple of years, but it has reared its ugly head and once it takes its course, nothing will be the same, except “Ranting” Andy that is.

“Ranting” Andy Hoffman joins us for another fun filled wrap up of all the wonderful things that aren’t happening in the world. He sees Facebook as further confirmation of a completely corrupt financial system careening out of control. When the elites deliberately overprice and overhype the biggest tech IPO in history and then see it crash and burn, then you know something important is happening. Combine that with the obvious rise in nationalism across Europe and you know the seeds have been sewn for something truly cataclysmic. With flocks of “black swans” circling the world’s financial centers, waiting to descend at the exact worst moment, it’s time to buckle our seat belts and get ready. It’s important to understand the crisis, which began in late 2007, has not ended. It was perhaps dormant for a couple of years, but it has reared its ugly head and once it takes its course, nothing will be the same, except “Ranting” Andy that is.  Eric Sprott had just finished his keynote address at the Hard Assets investment conference in NYC when he took a few minutes from his busy schedule to speak with FSN. While being rational about the recent decline, he was no happier about it than anyone else. Eric understands these markets better than almost, and he’s built his fortune and reputation on the sector. Through his ETF’s, his various investment and financing vehicles, he’s a dominant figure in the industry. Eric says he has no intentions of selling. He made some very poignant points about numerous countries facing their Minsky Moments, the time when the government concludes it can no longer service its debt, let alone pay it off. The number of countries arriving at this crucial event is rising dramatically. So all any of us can do is simply wait and see. If you’re confident in your decisions and understand the system is in a full-scale existential crisis, there’s really nothing else you can do.

Eric Sprott had just finished his keynote address at the Hard Assets investment conference in NYC when he took a few minutes from his busy schedule to speak with FSN. While being rational about the recent decline, he was no happier about it than anyone else. Eric understands these markets better than almost, and he’s built his fortune and reputation on the sector. Through his ETF’s, his various investment and financing vehicles, he’s a dominant figure in the industry. Eric says he has no intentions of selling. He made some very poignant points about numerous countries facing their Minsky Moments, the time when the government concludes it can no longer service its debt, let alone pay it off. The number of countries arriving at this crucial event is rising dramatically. So all any of us can do is simply wait and see. If you’re confident in your decisions and understand the system is in a full-scale existential crisis, there’s really nothing else you can do. Ron Hera delivers a stinging rebuke to the economic boosters who claim the recovery is well under way and there’s no need to worry about anything and the last thing you need is gold and silver. When educational loans are factored out, food stamp recipients are up, and debt is actually down. In the past decade, the Dow hasn’t had any growth, and when you factor in taxes and inflation, it has actually gone down. Of course gold and silver are the best protection for wealth and these commodities always have been. With the fear of inflation always present, resource based investing is probably a wise move. It provides leverage and the potential to provide a hedge against rising prices. Many of the companies that Ron has recommended in the past have worked out extremely well.

Ron Hera delivers a stinging rebuke to the economic boosters who claim the recovery is well under way and there’s no need to worry about anything and the last thing you need is gold and silver. When educational loans are factored out, food stamp recipients are up, and debt is actually down. In the past decade, the Dow hasn’t had any growth, and when you factor in taxes and inflation, it has actually gone down. Of course gold and silver are the best protection for wealth and these commodities always have been. With the fear of inflation always present, resource based investing is probably a wise move. It provides leverage and the potential to provide a hedge against rising prices. Many of the companies that Ron has recommended in the past have worked out extremely well. Danielle and I finally met face to face at the Hard Assets investment conference in New York City. One of the great things about FSN is the ability to meet people and make new friends around the world. I’ve been interviewing her and having economic discussions for many months. So holding an interview live was a lot of fun. We talked a lot about the recent precious metals correction. Personally, I believe it’s temporary and defies all reason. The Elites are no doubt behind it, this is their last ditch effort to somehow salvage the world economic system that has served them so well, for so long.

Danielle and I finally met face to face at the Hard Assets investment conference in New York City. One of the great things about FSN is the ability to meet people and make new friends around the world. I’ve been interviewing her and having economic discussions for many months. So holding an interview live was a lot of fun. We talked a lot about the recent precious metals correction. Personally, I believe it’s temporary and defies all reason. The Elites are no doubt behind it, this is their last ditch effort to somehow salvage the world economic system that has served them so well, for so long. As a regular listener to FSN, you know we are extremely interested in seeing the US tap into and exploit its vast natural resources. Recent advances in hydro-fracking technology have led to massive increases in domestic energy production, but they have also caused numerous environmental debates. Finally last week, the Federal Government handed down its much dreaded rules on the practice, which were surprisingly mild and uncontroversial.

As a regular listener to FSN, you know we are extremely interested in seeing the US tap into and exploit its vast natural resources. Recent advances in hydro-fracking technology have led to massive increases in domestic energy production, but they have also caused numerous environmental debates. Finally last week, the Federal Government handed down its much dreaded rules on the practice, which were surprisingly mild and uncontroversial.  Dan Collins has been living in China for the past 15 years; he started as an exchange student, but he never left. Dan has worked for a number of large corporations there, at one point as a high level executive for GM China. With this unique perspective, he believes China is in a controlled slowdown, and the government will effectively manage the decline and keep the country crash free and growing for many years. Of course with Europe imploding (China’s largest customer) and many other ominous clouds on the horizon, it’s really impossible to know. But one thing is for certain, if you want to get rich in China, you need to be a high level communist party member. Many of them are billionaires, but there are a lot of other wealthy people in this emerging super power, and they want what we in the United States have taken for granted for many years. Unlike the emerging and growing underclass in the United States, they’re willing to work for it. So if you want to know about China, then you need to hear from Dan, someone who’s right in the thick of things. Find out more about his work at

Dan Collins has been living in China for the past 15 years; he started as an exchange student, but he never left. Dan has worked for a number of large corporations there, at one point as a high level executive for GM China. With this unique perspective, he believes China is in a controlled slowdown, and the government will effectively manage the decline and keep the country crash free and growing for many years. Of course with Europe imploding (China’s largest customer) and many other ominous clouds on the horizon, it’s really impossible to know. But one thing is for certain, if you want to get rich in China, you need to be a high level communist party member. Many of them are billionaires, but there are a lot of other wealthy people in this emerging super power, and they want what we in the United States have taken for granted for many years. Unlike the emerging and growing underclass in the United States, they’re willing to work for it. So if you want to know about China, then you need to hear from Dan, someone who’s right in the thick of things. Find out more about his work at  Joe (aka ‘

Joe (aka ‘ When Alasdair Macleod started

When Alasdair Macleod started  Jason Burack came back to the show to discuss energy and precious metals, two of his favorite topics. With the global panic now occurring, no one is quite sure of what exactly anything is worth. When unbacked paper currencies hit crisis periods they become unsound measures of value. This is currently one of the biggest problems confronting the global financial system. How do you value goods and services with inherently unhealthy currencies? It becomes harder and harder as the crisis deepens, but Jason is quite confident the metals and energy sectors will continue to be the places where investors focus their efforts. Jason’s upcoming Energy report promises to uncover a number of undervalued plays that could pay off big, if energy prices merely stay in their current range. Should the price of energy rise from here, the profits could be substantial.

Jason Burack came back to the show to discuss energy and precious metals, two of his favorite topics. With the global panic now occurring, no one is quite sure of what exactly anything is worth. When unbacked paper currencies hit crisis periods they become unsound measures of value. This is currently one of the biggest problems confronting the global financial system. How do you value goods and services with inherently unhealthy currencies? It becomes harder and harder as the crisis deepens, but Jason is quite confident the metals and energy sectors will continue to be the places where investors focus their efforts. Jason’s upcoming Energy report promises to uncover a number of undervalued plays that could pay off big, if energy prices merely stay in their current range. Should the price of energy rise from here, the profits could be substantial. Jim Rogers is a global financial luminary. He’s called the market right so many times that even the Main Stream Media half listens when he speaks. They don’t want to understand what he’s saying, but they do listen. And now he’s saying that gold may take a breather in 2012, that you need to be following your passion and you should be thinking about farming, not trading. The world is changing, has always been changing and always will be. The key is to get out ahead of the change and use it to help you find your calling.

Jim Rogers is a global financial luminary. He’s called the market right so many times that even the Main Stream Media half listens when he speaks. They don’t want to understand what he’s saying, but they do listen. And now he’s saying that gold may take a breather in 2012, that you need to be following your passion and you should be thinking about farming, not trading. The world is changing, has always been changing and always will be. The key is to get out ahead of the change and use it to help you find your calling. The Value Guys Stock Talk Show (Formerly The Value Line Observer) have been doing a show on value stock investing for over 6 years. They’ve done hundreds of shows talking about stocks that appear undervalued, drinking liberally, and warning the audience about the potential adverse effects their imbibing could have on listener’s portfolio returns. But they’ve been Wall Street professionals for over 30 years (31.3 to be exact) and they understand how the game is played.

The Value Guys Stock Talk Show (Formerly The Value Line Observer) have been doing a show on value stock investing for over 6 years. They’ve done hundreds of shows talking about stocks that appear undervalued, drinking liberally, and warning the audience about the potential adverse effects their imbibing could have on listener’s portfolio returns. But they’ve been Wall Street professionals for over 30 years (31.3 to be exact) and they understand how the game is played. Ty Andros joined us today for The Wrap. He was full of good cheer and optimism about the world financial system. Not really, but at least gold and silver are great buys right now. Remember, we’ve been telling you for at least a month that some horrible news is coming down the pike. It’s starting to come out now, and it is extremely ugly. Banks are blowing up like improvised, explosive devices in Afghanistan. So, look for more of the same because the monetary system is on knife’s edge. The situation is becoming clearer by the day; within several months, there will probably be no one left on the planet who believes anything a bank or government claims about anything, let alone the economy. Be prepared, that’s the best you can do!

Ty Andros joined us today for The Wrap. He was full of good cheer and optimism about the world financial system. Not really, but at least gold and silver are great buys right now. Remember, we’ve been telling you for at least a month that some horrible news is coming down the pike. It’s starting to come out now, and it is extremely ugly. Banks are blowing up like improvised, explosive devices in Afghanistan. So, look for more of the same because the monetary system is on knife’s edge. The situation is becoming clearer by the day; within several months, there will probably be no one left on the planet who believes anything a bank or government claims about anything, let alone the economy. Be prepared, that’s the best you can do! George Matheis, Jr. of

George Matheis, Jr. of  As chief technology investment strategist for Casey Research, Alex Daley is always on the lookout for the next and greatest technological advancement. It’s in his blood, and it’s his life’s mission. There are so many incredible innovations occurring everywhere around the globe. In fact, healthcare and manufacturing are going through major advances that will leave these sectors unrecognizable. In medicine alone, diagnostics are advancing to the point where doctors now know whether certain cancer medications will be effective on particular patients or not. This is a huge advancement that will improve lives, save money, and make major profits for certain companies. Similarly, manufacturing is about to embrace a new technique that will completely change the dynamics of how products are designed, built, and distributed. The world is not going to look the same, and Alex has the ability to see into the future. He understands that the number of opportunities available to society and its investors has never been greater.

As chief technology investment strategist for Casey Research, Alex Daley is always on the lookout for the next and greatest technological advancement. It’s in his blood, and it’s his life’s mission. There are so many incredible innovations occurring everywhere around the globe. In fact, healthcare and manufacturing are going through major advances that will leave these sectors unrecognizable. In medicine alone, diagnostics are advancing to the point where doctors now know whether certain cancer medications will be effective on particular patients or not. This is a huge advancement that will improve lives, save money, and make major profits for certain companies. Similarly, manufacturing is about to embrace a new technique that will completely change the dynamics of how products are designed, built, and distributed. The world is not going to look the same, and Alex has the ability to see into the future. He understands that the number of opportunities available to society and its investors has never been greater. Don Watkins, of the Ayn Rand Institute for Individual Rights, was appalled by a recent commencement address by Virginia Governor Bob McDonnell, who urged graduates to devote their work and lives to serving their fellow and less fortunate beings. Don argues, as do I, your highest purpose is in best serving your own needs and desires. By doing so, you automatically enable many others to realize their potential, and you take the burden off society and help place it where it truly belongs, on the individuals shoulders. This concept was what once helped make America great; this individualistic focus is what’s needed to bring the world out of its current psychological, emotional, and economic depression. The best part of this theory is no matter what your station is in life, there’s a place and a skill set at which you will excel. It’s really that simple.

Don Watkins, of the Ayn Rand Institute for Individual Rights, was appalled by a recent commencement address by Virginia Governor Bob McDonnell, who urged graduates to devote their work and lives to serving their fellow and less fortunate beings. Don argues, as do I, your highest purpose is in best serving your own needs and desires. By doing so, you automatically enable many others to realize their potential, and you take the burden off society and help place it where it truly belongs, on the individuals shoulders. This concept was what once helped make America great; this individualistic focus is what’s needed to bring the world out of its current psychological, emotional, and economic depression. The best part of this theory is no matter what your station is in life, there’s a place and a skill set at which you will excel. It’s really that simple. Peter Grandich weighed in on the latest precious metals rout; he’s not worried and neither am I. All the reasons we bought gold in the first place are still present and actually increasing. Central bank buying, excessive money printing, and all sorts of economic and monetary mayhem are occurring. Now is not the time to lose confidence or hope in a better tomorrow. We helped Peter celebrate his daughter’s 20th birthday because when it comes down to it, while money and economic circumstances are important, they are not the most important things in our lives. When it comes to lasting satisfaction, happiness, and contentment, they aren’t even close to our family and our friends. In trying times like we are experiencing now, it is extremely important to remember this over and over again.

Peter Grandich weighed in on the latest precious metals rout; he’s not worried and neither am I. All the reasons we bought gold in the first place are still present and actually increasing. Central bank buying, excessive money printing, and all sorts of economic and monetary mayhem are occurring. Now is not the time to lose confidence or hope in a better tomorrow. We helped Peter celebrate his daughter’s 20th birthday because when it comes down to it, while money and economic circumstances are important, they are not the most important things in our lives. When it comes to lasting satisfaction, happiness, and contentment, they aren’t even close to our family and our friends. In trying times like we are experiencing now, it is extremely important to remember this over and over again. “Ranting” Andy Hoffman gives us the update on the lastest precious metals slam down; the reasons to own gold and silver couldn’t be stronger. If the prices stay down this low, don’t be surprised to witness a major flood of buying. We’re also getting into the Indian Wedding Season, which will result in increased demand along with massive sovereign central bank purchases. This is worse than 2008, and banks are blowing up all over Europe. Spain has just bailed out its third largest bank. Who’s going to bail out Spain? Greece is planning to reneg on its debt. Who knows which other nations are going to follow Greece to the blessed pastures in the land of sovereign default.

“Ranting” Andy Hoffman gives us the update on the lastest precious metals slam down; the reasons to own gold and silver couldn’t be stronger. If the prices stay down this low, don’t be surprised to witness a major flood of buying. We’re also getting into the Indian Wedding Season, which will result in increased demand along with massive sovereign central bank purchases. This is worse than 2008, and banks are blowing up all over Europe. Spain has just bailed out its third largest bank. Who’s going to bail out Spain? Greece is planning to reneg on its debt. Who knows which other nations are going to follow Greece to the blessed pastures in the land of sovereign default. Gary Wagner of

Gary Wagner of  Thom Reilly was manager of Clark County Nevada from 2001 to 2006; he got out just before the crash. When it comes to understanding our insane economic world or municipal labor contracts and benefits, he has an insider’s understanding. He’s written a book

Thom Reilly was manager of Clark County Nevada from 2001 to 2006; he got out just before the crash. When it comes to understanding our insane economic world or municipal labor contracts and benefits, he has an insider’s understanding. He’s written a book  Stefan Molyneux of

Stefan Molyneux of