by Stratfor

Financial Sense

[…] China is not as economically secure as it seems. Convulsions in its financial markets have heightened global investor risk aversion and have added volatility in recent quarters. Try as they may, Chinese policymakers have been unable to stem the massive outflow of capital brought on by the current winter of dollar liquidity. Beijing seems perfectly content to bide its time, pumping audacious and improbable amounts of credit into the system, much as it has done in the past. But this time, neither the markets nor the Chinese people are confident that such aggressive stimulus policies will work. The veneer of Beijing’s efficient, competent and formidable autocracy has fractured, and through the cracks seep China’s geostrategic ambition—and the integrity of its currency.

The corruption is on every front. And it is pretty obvious that the two party system has thoroughly rotted through, and its decrepitude obvious to all the onlookers.

The corruption is on every front. And it is pretty obvious that the two party system has thoroughly rotted through, and its decrepitude obvious to all the onlookers. One of the reasons I founded Outsider Club — several years ago now! — was because of the fallout from the financial crisis and the Establishment’s response to it.

One of the reasons I founded Outsider Club — several years ago now! — was because of the fallout from the financial crisis and the Establishment’s response to it.

Venezuela declared five-day weekends for government workers and said it was seeking international help to save its power grid amid a drought that threatens the capital’s main source of electricity.

Venezuela declared five-day weekends for government workers and said it was seeking international help to save its power grid amid a drought that threatens the capital’s main source of electricity.

Apple investors may be hoping that the Fed decision later Wednesday will divert away the spotlight’s glare this morning. That’s shining down and melting stocks in the pre-open, hours after the iconic company reported its first drop in sales in 13 years, along with other ugly numbers.

Apple investors may be hoping that the Fed decision later Wednesday will divert away the spotlight’s glare this morning. That’s shining down and melting stocks in the pre-open, hours after the iconic company reported its first drop in sales in 13 years, along with other ugly numbers. While the GDX did not strike its upside resistance, it may have come close enough to consider it having topped. The question now is how do we view the coming “correction.”

While the GDX did not strike its upside resistance, it may have come close enough to consider it having topped. The question now is how do we view the coming “correction.” It’s been about 15 years now since passenger airliners struck the World Trade Center towers on 9/11, and we are still suffering the consequences of that day, though perhaps not in the ways many Americans might believe.

It’s been about 15 years now since passenger airliners struck the World Trade Center towers on 9/11, and we are still suffering the consequences of that day, though perhaps not in the ways many Americans might believe. The letter below came to me from Oxford University where I was a post-graduate.

The letter below came to me from Oxford University where I was a post-graduate. It may seem odd talking about sell signals at the beginning of a new bull market for silver, but let us get into perspective what bull markets are all about. Silver has seen strong buying in the retail sector as investors snap up silver eagles and similar bullion coins. Likewise, the silver ETFs as a group are near record levels.

It may seem odd talking about sell signals at the beginning of a new bull market for silver, but let us get into perspective what bull markets are all about. Silver has seen strong buying in the retail sector as investors snap up silver eagles and similar bullion coins. Likewise, the silver ETFs as a group are near record levels.

Britain’s struggling manufacturing and construction sectors dragged down UK growth in the first three months of the year amid concerns about the global recovery.

Britain’s struggling manufacturing and construction sectors dragged down UK growth in the first three months of the year amid concerns about the global recovery.

Silver bullion prices are likely to rise further as there is “supply trouble brewing” as strong industrial and investment demand are confronted by declining supply.

Silver bullion prices are likely to rise further as there is “supply trouble brewing” as strong industrial and investment demand are confronted by declining supply. The government has criminalized so many mundane activities that the average American unknowingly commits three felonies a day. That’s according to a study by Harry Silverglate, a civil liberties lawyer.

The government has criminalized so many mundane activities that the average American unknowingly commits three felonies a day. That’s according to a study by Harry Silverglate, a civil liberties lawyer. Is gold, often scoffed at as being an unproductive asset, more productive than cash? If so, what does it mean for asset allocation?

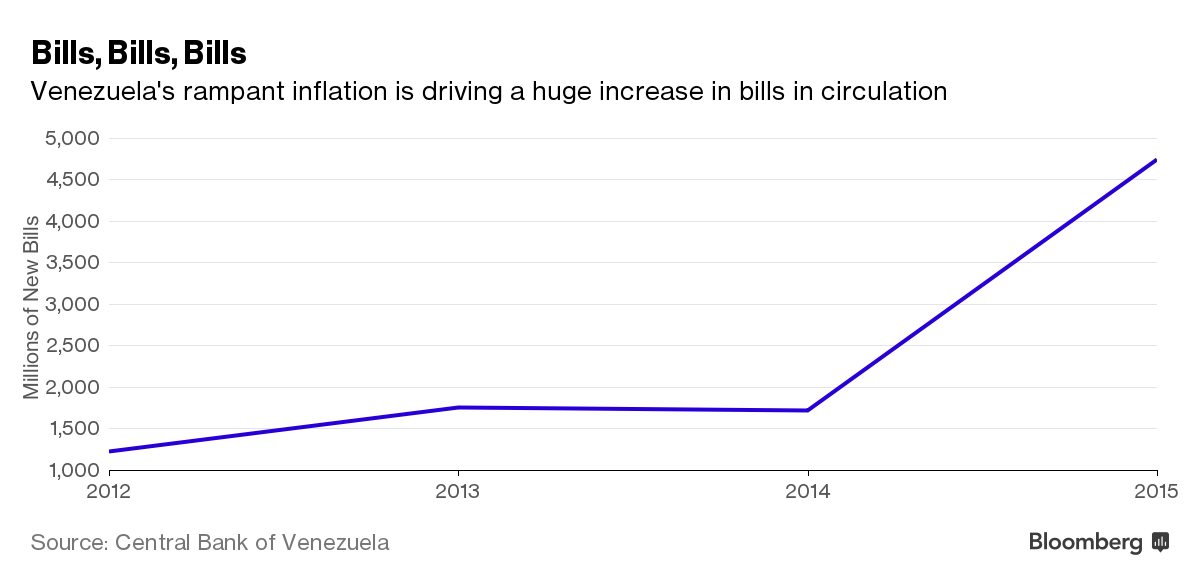

Is gold, often scoffed at as being an unproductive asset, more productive than cash? If so, what does it mean for asset allocation? Venezuela’s epic shortages are nothing new at this point. No diapers or car parts or aspirin — it’s all been well documented. But now the country is at risk of running out of money itself.

Venezuela’s epic shortages are nothing new at this point. No diapers or car parts or aspirin — it’s all been well documented. But now the country is at risk of running out of money itself. What’s the difference between “boots on the ground” and military personnel wearing boots who are engaged in combat – and perhaps dying – on the ground? If you can answer that question convincingly, perhaps you’d like to apply for John Kirby’s job, because he’s not doing it very successfully. Kirby is the State Department spokesman who, in answer to a question from a reporter about the 250 US troops being sent to Syria, denied President Obama ever said there’d be “no boots on the ground” in Syria. Here’s the

What’s the difference between “boots on the ground” and military personnel wearing boots who are engaged in combat – and perhaps dying – on the ground? If you can answer that question convincingly, perhaps you’d like to apply for John Kirby’s job, because he’s not doing it very successfully. Kirby is the State Department spokesman who, in answer to a question from a reporter about the 250 US troops being sent to Syria, denied President Obama ever said there’d be “no boots on the ground” in Syria. Here’s the  The other morning one of the dogs was waiting for me at the door with a muzzle full of porcupine quills. The look on his face, a mix of pain and humiliation almost broke my heart. He’d done it before and I was certain he’d learned his lesson, but a male that hasn’t been neutered is a wild card. I dressed quickly and grabbed a pair of work gloves then took him into the shop with me and set to work with a pair of hemostats and patience. There is no easy way to remove quills but if you grasp them firmly about a half inch from where they protrude in order to get a good grip on each one and pull in the opposite direction of where it entered, you stand a fair chance of extracting them intact.

The other morning one of the dogs was waiting for me at the door with a muzzle full of porcupine quills. The look on his face, a mix of pain and humiliation almost broke my heart. He’d done it before and I was certain he’d learned his lesson, but a male that hasn’t been neutered is a wild card. I dressed quickly and grabbed a pair of work gloves then took him into the shop with me and set to work with a pair of hemostats and patience. There is no easy way to remove quills but if you grasp them firmly about a half inch from where they protrude in order to get a good grip on each one and pull in the opposite direction of where it entered, you stand a fair chance of extracting them intact. “Flashing a recession signal.”

“Flashing a recession signal.”

“My friends,” Dr. Michael Munger once wrote, “generally dislike politicians, find democracy messy and distasteful, and object to the brutality and coercive excesses of foreign wars, the war on drugs, and the spying of the NSA.

“My friends,” Dr. Michael Munger once wrote, “generally dislike politicians, find democracy messy and distasteful, and object to the brutality and coercive excesses of foreign wars, the war on drugs, and the spying of the NSA. Bill Kristol – the Gartman of Politics?

Bill Kristol – the Gartman of Politics?