by Daily Bell Staff

The Daily Bell

2016 Campaign’s Populist Tone Rankles America’s CEOs … Chief executives at big American companies are increasingly frustrated by the populist tone of the presidential campaign, and concerns are mounting in boardrooms and corner offices that anti-business rhetoric may solidify even after the November election. – Wall Street Journal

This Wall Street Journal article makes the point that Trump has positioned himself at the head of an increasingly anti-business GOP.

More:

The GOP “has been captured by a large number of people who basically do not like big,” said Judd Gregg, a Republican former U.S. senator and governor of New Hampshire, who sits on the board of Honeywell International Inc.

By default, there’s nothing wrong with “big.” Theoretically, big business can mean economies of scale and economic efficiency. The oversized corporations of the US, however, are not natural products of the market. Instead, they are the artificial results of government policy.

[…] The history of economic central planning is not exactly glorious. The Soviet Union’s economy finally collapsed in the late 1980s, but not before over 20 million of its citizens had been murdered. The People’s Republic of China started implementing meaningful economic reforms in 1978, after having terminated the existence of over 45 million of its own people. Central planning in Nazi Germany was admittedly successful in bringing down the domestic unemployment rate, but the success of its wider economic legacy is debatable. Gu¨nter Reiman in ‘The Vampire Economy: doing business under Fascism’ highlights the process involved in, for example, a German carmaker of the regime purchasing 5,000 rubber tyres:

[…] The history of economic central planning is not exactly glorious. The Soviet Union’s economy finally collapsed in the late 1980s, but not before over 20 million of its citizens had been murdered. The People’s Republic of China started implementing meaningful economic reforms in 1978, after having terminated the existence of over 45 million of its own people. Central planning in Nazi Germany was admittedly successful in bringing down the domestic unemployment rate, but the success of its wider economic legacy is debatable. Gu¨nter Reiman in ‘The Vampire Economy: doing business under Fascism’ highlights the process involved in, for example, a German carmaker of the regime purchasing 5,000 rubber tyres: According to George Soros, China’s debt collapse has begun…

According to George Soros, China’s debt collapse has begun…

European Union finance ministers split over whether to impose restrictions on banks’ holdings of government bonds, as German Finance Minister Wolfgang Schaeuble found scant support from skeptical colleagues for his push to overhaul existing rules.

European Union finance ministers split over whether to impose restrictions on banks’ holdings of government bonds, as German Finance Minister Wolfgang Schaeuble found scant support from skeptical colleagues for his push to overhaul existing rules. WASHINGTON (MarketWatch) — The Fed does what it wants and plays favorites. And as a result it’s lost the trust of the American people.

WASHINGTON (MarketWatch) — The Fed does what it wants and plays favorites. And as a result it’s lost the trust of the American people.

The first U.S. LNG shipment will soon arrive in Europe, marking a new era for energy on the continent. Cheniere Energy’s newly completed Sabine Pass facility on the U.S. Gulf Coast recently sent a shipment of American liquefied natural gas, which should arrive in Portugal within a few days.

The first U.S. LNG shipment will soon arrive in Europe, marking a new era for energy on the continent. Cheniere Energy’s newly completed Sabine Pass facility on the U.S. Gulf Coast recently sent a shipment of American liquefied natural gas, which should arrive in Portugal within a few days. With the U.S. dollar continuing to trade near recent lows and gold trading near $1,240, today a 50-year market veteran warned King World News that a massive reset of the world financial system is coming.

With the U.S. dollar continuing to trade near recent lows and gold trading near $1,240, today a 50-year market veteran warned King World News that a massive reset of the world financial system is coming. 2016 is turning out to be a year where global central bankers are finding out what they cannot do.

2016 is turning out to be a year where global central bankers are finding out what they cannot do. It’s that time of year again…

It’s that time of year again… We used to live in “democracies”, meaning that once upon a time we voted-in governments who at least attempted to represent the People whom they supposedly serve. In the United States, the death of that democracy dates back at least a century.

We used to live in “democracies”, meaning that once upon a time we voted-in governments who at least attempted to represent the People whom they supposedly serve. In the United States, the death of that democracy dates back at least a century.

In the aftermath of the most signifiant geopolitical event of my lifetime, the attacks of September 11,2001, the U.S. government proceeded to concoct a fairytale for public consumption in order to advance imperial ambitions overseas and a implement a domestic surveillance state at home. This should be obvious to everyone by now.

In the aftermath of the most signifiant geopolitical event of my lifetime, the attacks of September 11,2001, the U.S. government proceeded to concoct a fairytale for public consumption in order to advance imperial ambitions overseas and a implement a domestic surveillance state at home. This should be obvious to everyone by now.

My grandfather was something of a Renaissance Man.

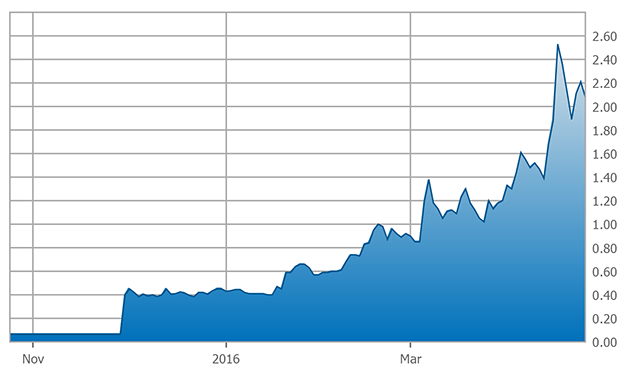

My grandfather was something of a Renaissance Man. Another interesting week, in that the price of silver separated from the price of gold. The former went no nowhere, while the latter gained over 4.5%.

Another interesting week, in that the price of silver separated from the price of gold. The former went no nowhere, while the latter gained over 4.5%.

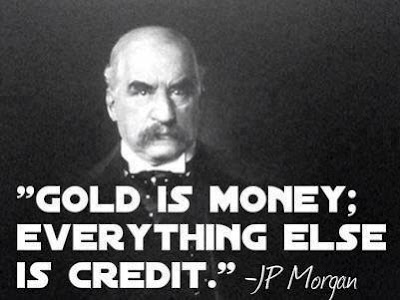

Ever since the Federal government took the U.S. off he gold standard in 1971, political and financial agencies have tried their best to program the American people to believe that gold has no monetary value. This of course was done to ensure trust and confidence in the fiat Federal Reserve Note, and to propagate the illusion that debt was money, which allowed for a continued expansion of both the currency and government spending.

Ever since the Federal government took the U.S. off he gold standard in 1971, political and financial agencies have tried their best to program the American people to believe that gold has no monetary value. This of course was done to ensure trust and confidence in the fiat Federal Reserve Note, and to propagate the illusion that debt was money, which allowed for a continued expansion of both the currency and government spending.