by Bob Bauman

The Sovereign Investor

In CONGRESS, July 4, 1776.

In CONGRESS, July 4, 1776.

The unanimous Declaration of the thirteen United States of America,

When in the Course of human events, it becomes necessary for one people to dissolve the political bands which have connected them with another, and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature’s God entitle them, a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation.

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.

Continue Reading at TheSovereignInvestor.com…

Hillary Clinton Did Not Really Jeopardize National Security, Despite Accusations

Hillary Clinton Did Not Really Jeopardize National Security, Despite Accusations

I keep hearing that the “Chicken Little’s” are once again being proved wrong. We keep being shown chart, after chart, after chart, after chart how the market recovers from perilous sell-offs. This is expressed as “proof” the “market” doesn’t want to go down, and has legs to vault ever higher.

I keep hearing that the “Chicken Little’s” are once again being proved wrong. We keep being shown chart, after chart, after chart, after chart how the market recovers from perilous sell-offs. This is expressed as “proof” the “market” doesn’t want to go down, and has legs to vault ever higher. In a video making the rounds in social media last week, conservative author Mark Dice performs a series of man-on-the-street interviews to show how most Americans have no idea what Independence Day commemorates. The punch line comes at the end when Dice finds a young woman who can quote the document that he apparently thinks we commemorate on Independence Day. She says a few lines out loud and then Dice high-fives her.

In a video making the rounds in social media last week, conservative author Mark Dice performs a series of man-on-the-street interviews to show how most Americans have no idea what Independence Day commemorates. The punch line comes at the end when Dice finds a young woman who can quote the document that he apparently thinks we commemorate on Independence Day. She says a few lines out loud and then Dice high-fives her. On Wednesday through Friday, the price of silver spiked massively. It ended the week about $2 higher than the previous week. The last time we recall silver price action like this was about 3 years ago, in August 2013. That one week, the price rose about $2.50. Before that was a week in August 2012, with a price gain of about $2.70. Previously, January 2012, +$2.50. Earlier was Oct 2011, +$4. The biggest was in April 2011, +$4.20.

On Wednesday through Friday, the price of silver spiked massively. It ended the week about $2 higher than the previous week. The last time we recall silver price action like this was about 3 years ago, in August 2013. That one week, the price rose about $2.50. Before that was a week in August 2012, with a price gain of about $2.70. Previously, January 2012, +$2.50. Earlier was Oct 2011, +$4. The biggest was in April 2011, +$4.20. In CONGRESS, July 4, 1776.

In CONGRESS, July 4, 1776.

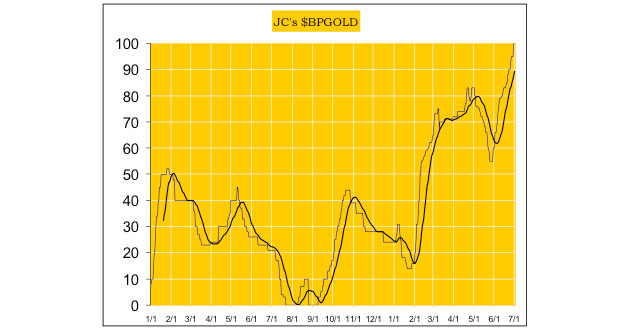

Our proprietary cycle indicator reached 100% this week, which is the highest level ever. It cannot go higher, but prices can remain firm at current levels.

Our proprietary cycle indicator reached 100% this week, which is the highest level ever. It cannot go higher, but prices can remain firm at current levels. Editor’s note: The markets and our offices are closed for the holiday. So for today’s Dispatch, we’re featuring a recent essay from Bonner Private Portfolio editor Chris Mayer, one of the best stock pickers in the business.

Editor’s note: The markets and our offices are closed for the holiday. So for today’s Dispatch, we’re featuring a recent essay from Bonner Private Portfolio editor Chris Mayer, one of the best stock pickers in the business. As a general rule, the most successful man in life is the man who has the best information

As a general rule, the most successful man in life is the man who has the best information It depends on how cynically you want to look at this but I think the most cynical interpretation is the correct interpretation. – IRD on SGT Report

It depends on how cynically you want to look at this but I think the most cynical interpretation is the correct interpretation. – IRD on SGT Report The price of silver popped above $20/oz (USD) last night. Woo-hoo! Silver is “rallying”, and happy days are here again. Really? How soon we forget.

The price of silver popped above $20/oz (USD) last night. Woo-hoo! Silver is “rallying”, and happy days are here again. Really? How soon we forget. Silver futures aren’t taking it easy during the Independence Day holiday.

Silver futures aren’t taking it easy during the Independence Day holiday. Gold prices may hit all-time highs in the next 18 months amid low to negative global bond yields, said a fund manager on Monday, joining a chorus of bullish calls on the safe haven commodity.

Gold prices may hit all-time highs in the next 18 months amid low to negative global bond yields, said a fund manager on Monday, joining a chorus of bullish calls on the safe haven commodity. Three former Barclays traders have been found guilty of conspiracy to defraud after a three-month trial at Southwark Crown Court.

Three former Barclays traders have been found guilty of conspiracy to defraud after a three-month trial at Southwark Crown Court.

Nigel Farage, UKIP leader and passionate advocate for the UK to leave the European Union, announced unexpectedly today that he is stepping down as party leader, just days after he led a successful, and historic, campaign to Leave the European Union. Speaking in Westminster, Farage said the Brexit referendum was about Britons taking their country back, and having succeeded at that, Farage now “wants his life back.” His resignation completes the recent chaos in UK politics which has seen both the Conservative and Labour parties scramble to find new leadership in the aftermath of the Brexit vote.

Nigel Farage, UKIP leader and passionate advocate for the UK to leave the European Union, announced unexpectedly today that he is stepping down as party leader, just days after he led a successful, and historic, campaign to Leave the European Union. Speaking in Westminster, Farage said the Brexit referendum was about Britons taking their country back, and having succeeded at that, Farage now “wants his life back.” His resignation completes the recent chaos in UK politics which has seen both the Conservative and Labour parties scramble to find new leadership in the aftermath of the Brexit vote. On this day 240 years ago, New England’s most famous independent wholesaler, John Hancock, and Congress’s stenographer, Charles Thomson, signed a parchment. We celebrate that signing annually, often by setting off low-tariff fireworks imported from China.

On this day 240 years ago, New England’s most famous independent wholesaler, John Hancock, and Congress’s stenographer, Charles Thomson, signed a parchment. We celebrate that signing annually, often by setting off low-tariff fireworks imported from China. Gold and silver have been the standout winners in the fallout from Britain’s decision to leave the European Union according to Bloomberg. They compiled three charts showing how “precious” Brexit is for gold and silver.

Gold and silver have been the standout winners in the fallout from Britain’s decision to leave the European Union according to Bloomberg. They compiled three charts showing how “precious” Brexit is for gold and silver. Global gold holdings have expanded by more than 500 metric tons since bottoming in January in a signal of investors’ rising concern about slowing growth, a Federal Reserve that’s probably on hold and the ructions caused by Britain’s vote to quit the European Union.

Global gold holdings have expanded by more than 500 metric tons since bottoming in January in a signal of investors’ rising concern about slowing growth, a Federal Reserve that’s probably on hold and the ructions caused by Britain’s vote to quit the European Union.