by Rick Ackerman

RickAckerman.com

Bears looking for some relief will not likely get it on Friday. Seasonality alone would argue that the manic short-squeeze of the last three days will continue as traders approach the three-day Fourth of July weekend. Even more bullish is that at the apex of Thursday’s thrust, the E-Mini S&Ps exceeded a key peak recorded last week by a small but technically significant 1.00 point. That refreshed the bullish energy of the intraday charts, making any pullback from these levels a potential buying opportunity. Check out Friday’s E-Mini S&P tout for further details, including a ‘counterintuitive’ entry signal that tripped as we went to press.

Bears looking for some relief will not likely get it on Friday. Seasonality alone would argue that the manic short-squeeze of the last three days will continue as traders approach the three-day Fourth of July weekend. Even more bullish is that at the apex of Thursday’s thrust, the E-Mini S&Ps exceeded a key peak recorded last week by a small but technically significant 1.00 point. That refreshed the bullish energy of the intraday charts, making any pullback from these levels a potential buying opportunity. Check out Friday’s E-Mini S&P tout for further details, including a ‘counterintuitive’ entry signal that tripped as we went to press.

In perfect order out of chaos fashion, the elite are now showing their hand.

In perfect order out of chaos fashion, the elite are now showing their hand. Negative Revisions Coming

Negative Revisions Coming

And Manhattan condo prices plummet 14.5% in 3 months.

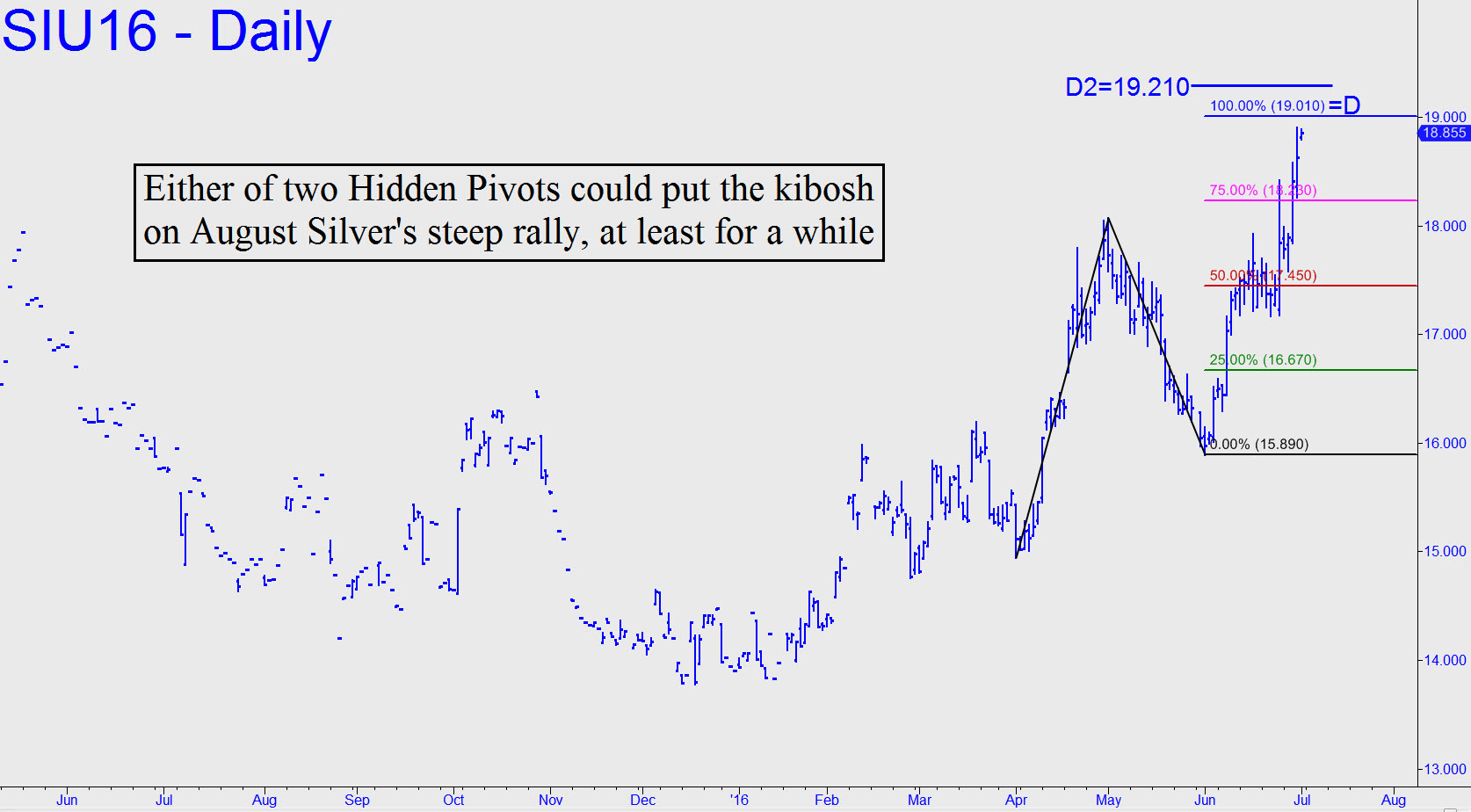

And Manhattan condo prices plummet 14.5% in 3 months. By popular request, I’ve added Comex Silver to the list of touts tonight — and not a moment too soon, evidently, since the September contract is closing fast on a 19.010 target that looks capable of putting the kibosh on the rally, at least for a short while. A marginally higher target at 19.210 would be in play if the lower number is exceeded by more than 2-3 cents. Either way, Silver’s parabolic rise since early June is due for a rest, so we should pay heed to the technical signs. Aggressive play calls for shorting at either of these Hidden Pivots, but I would strongly suggest that you use ‘camouflage’ to initiate the trade, since even a few ticks of adversity in this vehicle can be expensive.

By popular request, I’ve added Comex Silver to the list of touts tonight — and not a moment too soon, evidently, since the September contract is closing fast on a 19.010 target that looks capable of putting the kibosh on the rally, at least for a short while. A marginally higher target at 19.210 would be in play if the lower number is exceeded by more than 2-3 cents. Either way, Silver’s parabolic rise since early June is due for a rest, so we should pay heed to the technical signs. Aggressive play calls for shorting at either of these Hidden Pivots, but I would strongly suggest that you use ‘camouflage’ to initiate the trade, since even a few ticks of adversity in this vehicle can be expensive. Look, up in the sky! It’s a bird! It’s a plane! No, it’s… it’s… Janet Yellen in a helicopter with bags of cash.

Look, up in the sky! It’s a bird! It’s a plane! No, it’s… it’s… Janet Yellen in a helicopter with bags of cash. In his new book Who Needs the Fed?, John Tamny makes a convincing case that the Federal Reserve is wholly unnecessary. Chapter after chapter, he offers examples of individuals engaging in credit transactions and explains how any government manipulation of these transactions is counterproductive or, at best, unnecessary.

In his new book Who Needs the Fed?, John Tamny makes a convincing case that the Federal Reserve is wholly unnecessary. Chapter after chapter, he offers examples of individuals engaging in credit transactions and explains how any government manipulation of these transactions is counterproductive or, at best, unnecessary. The establishments operation fear had painted a relentless propaganda picture all year for a significant rise in UK interest rates following a Brexit outcome that was destined to send consumer borrowing rates soaring, which at the time I repeatedly warned was just NOT going to happen for the fundamental reason that BrExit induced uncertainty would make a rate hike LESS likely as the last thing the Bank of England would want to do is to add to market uncertainty i.e. the complete opposite to REMAIN propaganda. In fact I stated that a BrExit could even result in a rate CUT as the following excerpt illustrates:

The establishments operation fear had painted a relentless propaganda picture all year for a significant rise in UK interest rates following a Brexit outcome that was destined to send consumer borrowing rates soaring, which at the time I repeatedly warned was just NOT going to happen for the fundamental reason that BrExit induced uncertainty would make a rate hike LESS likely as the last thing the Bank of England would want to do is to add to market uncertainty i.e. the complete opposite to REMAIN propaganda. In fact I stated that a BrExit could even result in a rate CUT as the following excerpt illustrates: The defeat of the “remains” on June 23 was one of the great days in my life. Yet I am an American. Why should I care?

The defeat of the “remains” on June 23 was one of the great days in my life. Yet I am an American. Why should I care? Look at this surprising information as gold and silver continue to surge.

Look at this surprising information as gold and silver continue to surge. Current Rally Impressive, But…

Current Rally Impressive, But…

Yesterday’s mystery meeting on the tarmac between former President Bill Clinton and Attorney General Loretta Lynch has now been clarified.

Yesterday’s mystery meeting on the tarmac between former President Bill Clinton and Attorney General Loretta Lynch has now been clarified. The Bank of England is preparing to unleash another round of monetary stimulus as it battles to contain the economic fallout of The UK’s decision to leave EU.

The Bank of England is preparing to unleash another round of monetary stimulus as it battles to contain the economic fallout of The UK’s decision to leave EU. Tony Sanders made a confoundedly interesting observation today.

Tony Sanders made a confoundedly interesting observation today.