from Kitco NEWS

The Chilling Thing Subprime Retailer Conn’s Said About the Sudden Deterioration in New Accounts

by Wolf Richter

Wolf Street

Rising first-payment defaults and 60-day delinquencies, which are “leading indicators,” caused the retailer to become “prudent.” Shares plunged 33%.

Rising first-payment defaults and 60-day delinquencies, which are “leading indicators,” caused the retailer to become “prudent.” Shares plunged 33%.

Conn’s – a retailer with 137 stores in 14 states that sells household goods and electronics to subprime customers preferably financed at blistering interest rates or on a lease-to-own basis – had a five-year anniversary of a crash on December 10.

Its shares plunged 33% on Tuesday after it reported earnings, on issues that included credit deterioration among its subprime customers.

Monopolies Aren’t Bad if Not Abused

by Karl Denninger

Market-Ticker.org

That’s what Tim Crook just said.

Of course he then said “but we’re not one.”

Uh huh.

Every contract, combination in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several States, or with foreign nations, is declared to be illegal. Every person who shall make any contract or engage in any combination or conspiracy hereby declared to be illegal shall be deemed guilty of a felony, and, on conviction thereof, shall be punished by fine not exceeding $100,000,000 if a corporation, or, if any other person, $1,000,000, or by imprisonment not exceeding 10 years, or by both said punishments, in the discretion of the court.

And…

Marc Faber’s 3 Currency Picks for 2020: Gold, Silver, Platinum

by Mike ‘Mish’ Shedlock

Mish Talk

Please tune into This Week in Money for an excellent interview of Marc Faber by Howe Street’s Jim Goddard.

Goddard asked Faber what currencies he liked. Without hesitation, Faber replied, gold, silver, and platinum.

The interview with Faber starts a bit after 8 minute mark and lasts for about 30 minutes.

Faber also discusses, valuations, the US and Canadian dollar, oil, China, and the recession.

When it Becomes Serious You Have to Lie: Update on the Repo Fiasco

from Zero Hedge

Authored by Michael Lebowitz and Jack Scott via RealInvestmentAdvice.com,

Occasionally, problems reveal themselves gradually. A water stain on the ceiling is potentially evidence of a much larger problem. Painting over the stain will temporarily relieve the unsightly condition, but in time, the water stain will return. This is analogous to a situation occurring within the banking system. Almost three months after water stains first appeared in the overnight funding markets, the Fed has stepped in on a daily basis to “re-paint the ceiling” and the problem has appeared to vanish. Yet, every day the stain reappears and the Fed’s work begins anew. One is left to wonder why the leak hasn’t been fixed.

Problems Galore

…don’t think badly of yourself if you find it harder and harder. The insanity is reaching levels unexpected.

by Bob Rinear

The International Forecaster

Just a few short weeks ago, it was Thanksgiving, my favorite Holiday. We take a day to enjoy our friends and family, and say our prayers of thanks for all the good things we have. It was peaceful and for a day, no markets to fret over, no lunatic politicians to lie to us. Just a wonderful nice day.

Just a few short weeks ago, it was Thanksgiving, my favorite Holiday. We take a day to enjoy our friends and family, and say our prayers of thanks for all the good things we have. It was peaceful and for a day, no markets to fret over, no lunatic politicians to lie to us. Just a wonderful nice day.

But that certainly didn’t mean that all the ills of this world had mystically gone away, no on the contrary. They’ve gotten progressively worse.

I’m not going to dissect the IG report, other than to say that Horowitz was an Obama appointee, that just so happened to be the same guy who exonerated Hillary Clinton. After she smashed her cell phones, and after she deleted 33,000 emails, and after she cleared her hard drive with BleachBit. Of course his report says there was no bias. ( Eyeroll)

The response has been exactly what I’d expect. The left thinks everyone is exonerated, and no one did anything wrong. The right is blowing flares out of their noses, saying “Are you kidding me?!?!?!?”

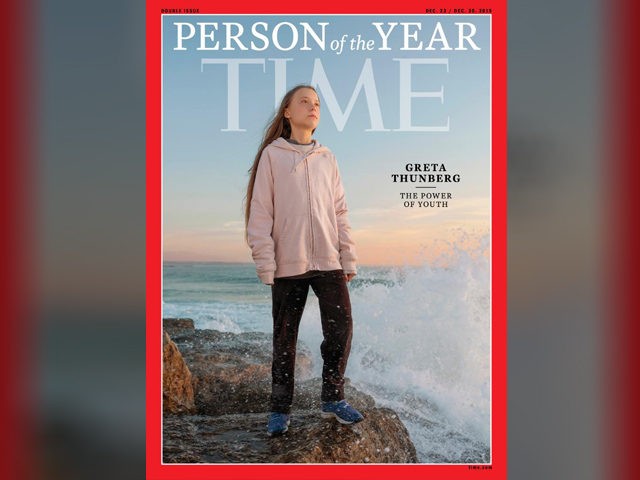

Greta Thunberg Named TIME’s 2019 Person of the Year

by Joshua Caplan

Breitbart.com

Teenage climate activist Greta Thunberg is TIME’s 2019 Person of the Year, the magazine announced on Wednesday.

Teenage climate activist Greta Thunberg is TIME’s 2019 Person of the Year, the magazine announced on Wednesday.

The 16-year-old, who has become the public face of climate change activism since leading school strikes in her home country of Sweden, topped President Donald Trump and House Speaker Nancy Pelosi (D-CA) to win the accolade. “I’d like to tell my grandchildren that we did everything we could,” she told TIME magazine. “And we did it for them and for the generations to come.”

Earning Your Risk is Key to Longevity in Trading

by Larry Benedict

Casey Research

Chris’ note: Today, we’re sending you a special edition of the Dispatch to pass on a key insight from Larry Benedict, one of the best traders in the business.

Chris’ note: Today, we’re sending you a special edition of the Dispatch to pass on a key insight from Larry Benedict, one of the best traders in the business.

Larry has spent decades working for hedge funds and making money hand over fist. In fact, when he was actively running hedge funds, Larry didn’t have a single losing year from 1990 to 2010.

That kind of long-term success in trading is unheard of… but Larry wants you to know that you can achieve it, too.

Former Top Mexican Official Arrested for Drug-Trafficking Conspiracy with Top Cartel, DOJ Says

by Ryan Saavedra

Daily Wire

Federal prosecutors revealed on Tuesday that authorities have charged Genaro Garcia Luna, the former Secretary of Public Security in Mexico from 2006 to 2012, for his involvement in an alleged drug trafficking conspiracy with Mexico’s largest and most powerful drug cartel and for making false statements.

Federal prosecutors revealed on Tuesday that authorities have charged Genaro Garcia Luna, the former Secretary of Public Security in Mexico from 2006 to 2012, for his involvement in an alleged drug trafficking conspiracy with Mexico’s largest and most powerful drug cartel and for making false statements.

“According to the indictment and other court filings by the government, from 2001 to 2012, while occupying high-ranking law enforcement positions in the Mexican government, Garcia Luna received millions of dollars in bribes from the Sinaloa Cartel in exchange for providing protection for its drug trafficking activities,” the Department of Justice said in a statement. “From 2001 to 2005, Garcia Luna led Mexico’s Federal Investigation Agency, and from 2006 to 2012, he served as Mexico’s Secretary of Public Security, controlling Mexico’s Federal Police Force.”

Americans Are Lonely, Miserable and Depressed – the Legacy of a Society That Has Rejected Family, Faith and Patriotism

by Michael Snyder

The Economic Collapse Blog

What in the world has happened to us? Once upon a time, America was made up of tightly-knit communities that were united by family, faith and patriotism, but now we are more isolated than ever before. Of course one of the biggest reasons for this is the fact that we are all spending countless hours staring at screens instead of interacting with real people, and this is something that I covered in a previous article. However, our fundamental beliefs are also significantly shaping how we behave. For the past couple of generations, we have de-emphasized family, faith and patriotism as a nation, and instead we have become an extremely “me-centered” society that is primarily focused on doing whatever makes ourselves happy in the moment. But this single-minded pursuit of individual happiness has resulted in much of the country being perpetually mired in loneliness, depression and/or addiction.

What in the world has happened to us? Once upon a time, America was made up of tightly-knit communities that were united by family, faith and patriotism, but now we are more isolated than ever before. Of course one of the biggest reasons for this is the fact that we are all spending countless hours staring at screens instead of interacting with real people, and this is something that I covered in a previous article. However, our fundamental beliefs are also significantly shaping how we behave. For the past couple of generations, we have de-emphasized family, faith and patriotism as a nation, and instead we have become an extremely “me-centered” society that is primarily focused on doing whatever makes ourselves happy in the moment. But this single-minded pursuit of individual happiness has resulted in much of the country being perpetually mired in loneliness, depression and/or addiction.

U.S. Bank Lending Crisis is Not a “Temporary Hiccup” – BIS

from GoldCore

– The Bank for International Settlements — the central bank of central banks says that the ongoing mayhem in the U.S. repo market which began in September and has seen over $3 trillion pumped into the U.S. banking system suggests that there is a very serious structural problem at the heart of the U.S. financial system

– Hedge funds exacerbated the turmoil in the repo market with their thirst for borrowing cash to juice up returns on their trades.

Already Inside Gates of Hell – Bill Holter with Greg Hunter

Bill Holter – Confidence Going to Break Biggest Debt Bubble in History

by Greg Hunter

USA Watchdog

Financial writer Bill Holter says revelations this week from the DOJ Inspector General about the FBI spying on everything Trump, and the ongoing criminal investigation on the origins of the Trump Russia hoax, are going to be a disaster for the financial markets. Holter explains, “We are financially and socially inside the gates of Hell. If you see big name arrests, and obviously from the previous administration all the way up to the top, you are going to see an awful lot of happy people and an awful lot of freaked out people that could lead to civil war. From a financial standpoint, I don’t see how markets can stand up with the amount of leverage in the system. At this point, they are already having a problem holding that leverage up. Just from the standpoint of foreigners looking at the U.S., foreigners will probably pull their capital hard and fast.”

Financial writer Bill Holter says revelations this week from the DOJ Inspector General about the FBI spying on everything Trump, and the ongoing criminal investigation on the origins of the Trump Russia hoax, are going to be a disaster for the financial markets. Holter explains, “We are financially and socially inside the gates of Hell. If you see big name arrests, and obviously from the previous administration all the way up to the top, you are going to see an awful lot of happy people and an awful lot of freaked out people that could lead to civil war. From a financial standpoint, I don’t see how markets can stand up with the amount of leverage in the system. At this point, they are already having a problem holding that leverage up. Just from the standpoint of foreigners looking at the U.S., foreigners will probably pull their capital hard and fast.”

If you want to see real trouble brewing behind the scenes in the banking world, look no further than the repo market, where banks get funding and liquidity on a nightly basis. Some nights, $100 billion or more is doled out to keep the system from locking up. Unlike the financial meltdown in 2008, hedge funds now make up 20% of the repo funding market. Here at the end of the year, Holter says few institutions have ready cash on hand and have leverage many times over. Holter contends, “Assuming the numbers are real, hedge funds are prone to bank runs. Hedge funds are prone to large liquidations. The banks who have been funding the overnight repo market now seem to fear a run in the hedge fund market. . . .

Art Cashin – What to Watch from the Fed Today, Plus on This Day…

from King World News

Art Cashin discusses what to expect from the Fed today, plus on this day…

Art Cashin discusses what to expect from the Fed today, plus on this day…

On this day…

December 11 (King World News) – Art Cashin: On this day in 1930, American savers, the Federal Reserve and a Republican President all got a nasty surprise. The banking system had been shaky for a year or two but it looked like things might finally be beginning to stabilize. That is until this day.

On this day, a major financial institution, The Bank of the United States went belly up. And, with it went the savings, “in whole or in part”, of over 400,000 depositors.

The Wile E. Coyote Economy with Bob Hoye

from Financial Survival Network

Bob Hoye is back… Bull and bear markets have been with us throughout history. Bubbles are a natural result of events. Bob took the price of gold in senior currency terms from the 1700’s on and there’s regular pattern. Gold runs up in price, using a relative strength index and the gold to silver ratio. The real price of gold represents profitability of the gold miners. In 2011 the gold bear hit. It based and now it has broken out of the range. The real price turns up and then it’s off to the races for the mining sector. We’re in the early stages of a major golden bull, with minor interruptions. It’s the one sector in a post bubble recession that will do well. Inverted yield curve means a recession is on the way, always!

Bob Hoye is back… Bull and bear markets have been with us throughout history. Bubbles are a natural result of events. Bob took the price of gold in senior currency terms from the 1700’s on and there’s regular pattern. Gold runs up in price, using a relative strength index and the gold to silver ratio. The real price of gold represents profitability of the gold miners. In 2011 the gold bear hit. It based and now it has broken out of the range. The real price turns up and then it’s off to the races for the mining sector. We’re in the early stages of a major golden bull, with minor interruptions. It’s the one sector in a post bubble recession that will do well. Inverted yield curve means a recession is on the way, always!

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

Headline Driven Markets Mean Big Gains and Potential Losses with Gary Wagner

from Financial Survival Network

Gary Wagner returns to the program… Sunday is a big day. More China tariffs or not? 2019 has been an incredible year for gold. We saw a $1370 ceiling and this year it broke through resistance. We could see a big spike come Sunday or Monday or it could hover in this range for a while. We’re right below a 50 percent retracement – $1481 – if we breakthrough it we could be looking at $1500 and then up from there. Rally began at $1270 and stopped at $1565. But these numbers are irrelevant whether Trump does or doesn’t. The power of the media cycle cannot be underestimated.

Gary Wagner returns to the program… Sunday is a big day. More China tariffs or not? 2019 has been an incredible year for gold. We saw a $1370 ceiling and this year it broke through resistance. We could see a big spike come Sunday or Monday or it could hover in this range for a while. We’re right below a 50 percent retracement – $1481 – if we breakthrough it we could be looking at $1500 and then up from there. Rally began at $1270 and stopped at $1565. But these numbers are irrelevant whether Trump does or doesn’t. The power of the media cycle cannot be underestimated.

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

Sin Taxes & Other Orwellian Methods of Compliance That Feed the Government’s Greed

by John W. Whitehead

The Rutherford Institute

“Of all tyrannies, a tyranny sincerely exercised for the good of its victim may be the most oppressive. It may be better to live under robber barons than under omnipotent moral busybodies. The robber baron’s cruelty may sometimes sleep, his cupidity may at some point be satiated, but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience.” – C.S. Lewis

“Taxman,” the only song written by George Harrison to open one of the Beatles’ albums (it featured on the band’s 1966 Revolver album), is a snarling, biting, angry commentary on government greed and how little control “we the taxpayers” have over our lives and our money.