from Kerry Lutz's Financial Survival Network

Dr. John Huber returns… What does they term insanity really mean? It’s actually a legal term when a person doesn’t not know the difference between right and wrong at a particular moment when a crime was committed. Mental health professionals deal with mental disease and personality disorders. Finally, there are new approaches in this area. Many efforts to treat the mentally ill, until recently, have been ineffective. Now, there’s great hope that mental illness and personality disorders can be effectively treated with hallucinogens? Society is desperately seeking ways to help these people change for the better. You can teach some people to change their behavior, but changing their thoughts isn’t going to happen.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

The incontestable incompetence of the USSA’s monopolies, institutions and agencies is about to take center stage in 2021.

The incontestable incompetence of the USSA’s monopolies, institutions and agencies is about to take center stage in 2021. News broke on Monday that a federal district court judge in Detroit – an Obama nominee – dismissed Sidney Powell’s Michigan lawsuit. Her ruling was what one would expect from an activist judge, in that it was entirely partisan. We need to hope and pray that the Supreme Court has better caliber justices.

News broke on Monday that a federal district court judge in Detroit – an Obama nominee – dismissed Sidney Powell’s Michigan lawsuit. Her ruling was what one would expect from an activist judge, in that it was entirely partisan. We need to hope and pray that the Supreme Court has better caliber justices.

Rent collection data from 11.5 million rental apartments.

Rent collection data from 11.5 million rental apartments. The 2020 election has put on display a growing rift within the conservative movement and the Republican Party. As theWashington Examiner notes this week, “The dividing lines have only deepened since media organizations called the election for his challenger Joe Biden.”

The 2020 election has put on display a growing rift within the conservative movement and the Republican Party. As theWashington Examiner notes this week, “The dividing lines have only deepened since media organizations called the election for his challenger Joe Biden.” One of the first lessons in an economics class is every action has a cost. That is in stark contrast to lessons in the political arena where politicians virtually ignore cost and talk about benefits and free stuff. If we look only at the benefits of an action, policy or program, then we will do anything because there is a benefit to any action, policy or program.

One of the first lessons in an economics class is every action has a cost. That is in stark contrast to lessons in the political arena where politicians virtually ignore cost and talk about benefits and free stuff. If we look only at the benefits of an action, policy or program, then we will do anything because there is a benefit to any action, policy or program. Growing income and wealth inequality were on my (and probably your) radar screen long before COVID-19 came along. The pandemic has made them both more obvious and more urgent. The actions by the Federal Reserve have widened the gap. We are now in a situation where society’s upper echelon can easily stay safe and prosperous while the lower segments live precariously and dangerously.

Growing income and wealth inequality were on my (and probably your) radar screen long before COVID-19 came along. The pandemic has made them both more obvious and more urgent. The actions by the Federal Reserve have widened the gap. We are now in a situation where society’s upper echelon can easily stay safe and prosperous while the lower segments live precariously and dangerously. Well, we knew it was coming, and we’re surprised it took so long, honestly.

Well, we knew it was coming, and we’re surprised it took so long, honestly. November non-farm payrolls gained 245,000, only about half the mean forecast – and down from October’s 610,000. It was the weakest job growth since April’s employment debacle. U.S. equities rallied on the disappointing news. A few Bloomberg headlines captured the aura: “Stocks Gain as Jobs Miss Boosts Stimulus Bets;” “Fed Case for Fresh Action Gets Stronger on Soft U.S. Jobs Report;” and “Jobs Data Was a ‘Perfect Miss’ for Fed and Aid.”

November non-farm payrolls gained 245,000, only about half the mean forecast – and down from October’s 610,000. It was the weakest job growth since April’s employment debacle. U.S. equities rallied on the disappointing news. A few Bloomberg headlines captured the aura: “Stocks Gain as Jobs Miss Boosts Stimulus Bets;” “Fed Case for Fresh Action Gets Stronger on Soft U.S. Jobs Report;” and “Jobs Data Was a ‘Perfect Miss’ for Fed and Aid.” The Supreme Court on Tuesday rejected an appeal by Pennsylvania Republicans that would have blocked certification of the state’s election results.

The Supreme Court on Tuesday rejected an appeal by Pennsylvania Republicans that would have blocked certification of the state’s election results. If nearly 40 percent of the entire nation anticipates spending the next 12 months in “survival mode”, that is not a good sign for what the coming year will bring. Traditionally, Americans have looked forward to the turn of the year with tremendous optimism, but this time around things are very, very different. 2020 brought us the COVID pandemic, tremendous violence and civil unrest in our major cities, and the greatest economic downturn since the Great Depression of the 1930s. Sadly, a large chunk of the country is anticipating more difficulties in the coming months, because one recent survey found that 38 percent of all Americans plan to spend 2021 in “survival mode”…

If nearly 40 percent of the entire nation anticipates spending the next 12 months in “survival mode”, that is not a good sign for what the coming year will bring. Traditionally, Americans have looked forward to the turn of the year with tremendous optimism, but this time around things are very, very different. 2020 brought us the COVID pandemic, tremendous violence and civil unrest in our major cities, and the greatest economic downturn since the Great Depression of the 1930s. Sadly, a large chunk of the country is anticipating more difficulties in the coming months, because one recent survey found that 38 percent of all Americans plan to spend 2021 in “survival mode”…

Retired Army Gen. Lloyd Austin, who President-elect Joe Biden selected as his secretary of defense, was accused during the Obama administration of downplaying the threat posed by ISIS, allegations Austin vehemently denied at the time but could be a roadblock to his Senate confirmation.

Retired Army Gen. Lloyd Austin, who President-elect Joe Biden selected as his secretary of defense, was accused during the Obama administration of downplaying the threat posed by ISIS, allegations Austin vehemently denied at the time but could be a roadblock to his Senate confirmation. Today the U.S. Supreme Court declined to intervene on behalf of Donald Trump allies who challenged a 2019 Pennsylvania law that allowed voting by mail without any special justification. The plaintiffs, led by Rep. Mike Kelly (R–Pa.), sought to reverse Pennsylvania’s election results, which gave Joe Biden a lead of 81,660 votes, by arguing that the expansion of absentee voting violated the state constitution. The Pennsylvania Supreme Court rejected their petition with prejudice on November 28, concluding that it was filed much too late. Today’s one-sentence order, which rejected the plaintiffs’ request for an emergency injunction without a recorded dissent, leaves that ruling undisturbed.

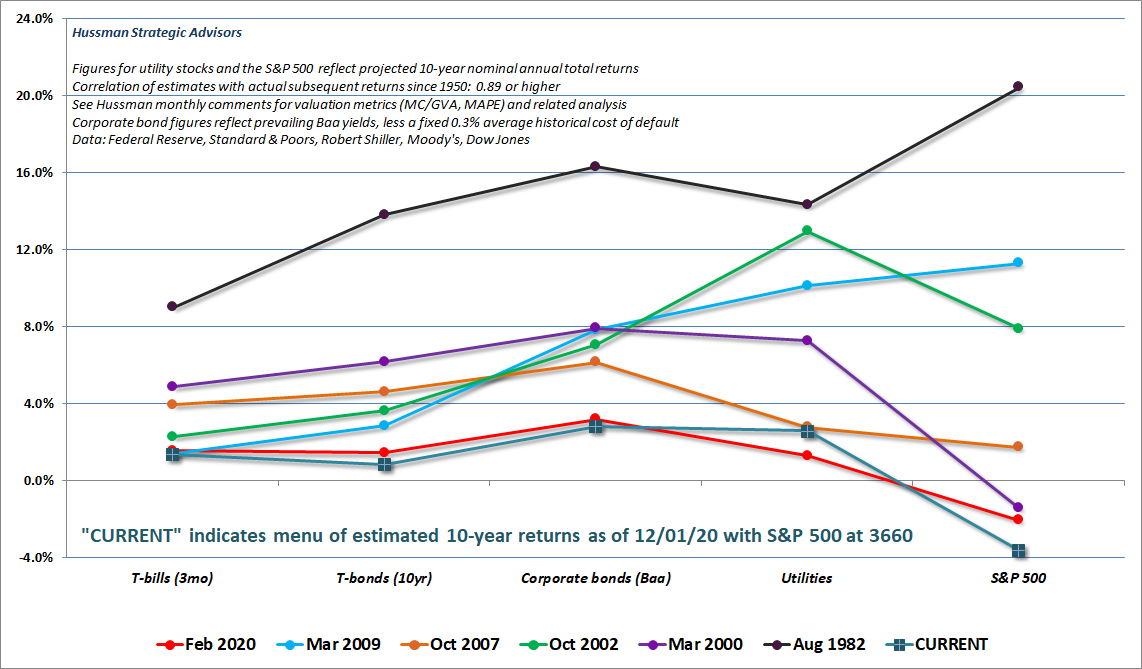

Today the U.S. Supreme Court declined to intervene on behalf of Donald Trump allies who challenged a 2019 Pennsylvania law that allowed voting by mail without any special justification. The plaintiffs, led by Rep. Mike Kelly (R–Pa.), sought to reverse Pennsylvania’s election results, which gave Joe Biden a lead of 81,660 votes, by arguing that the expansion of absentee voting violated the state constitution. The Pennsylvania Supreme Court rejected their petition with prejudice on November 28, concluding that it was filed much too late. Today’s one-sentence order, which rejected the plaintiffs’ request for an emergency injunction without a recorded dissent, leaves that ruling undisturbed. One of the most insidious ideas foisted on investors by Wall Street, in tacit cooperation with activist policy makers at the Federal Reserve, is the fiction that zero interest rates offer investors “no alternative” but to speculate in risky securities.

One of the most insidious ideas foisted on investors by Wall Street, in tacit cooperation with activist policy makers at the Federal Reserve, is the fiction that zero interest rates offer investors “no alternative” but to speculate in risky securities.