by Dr. Paul Craig Roberts

PaulCraigRoberts.org

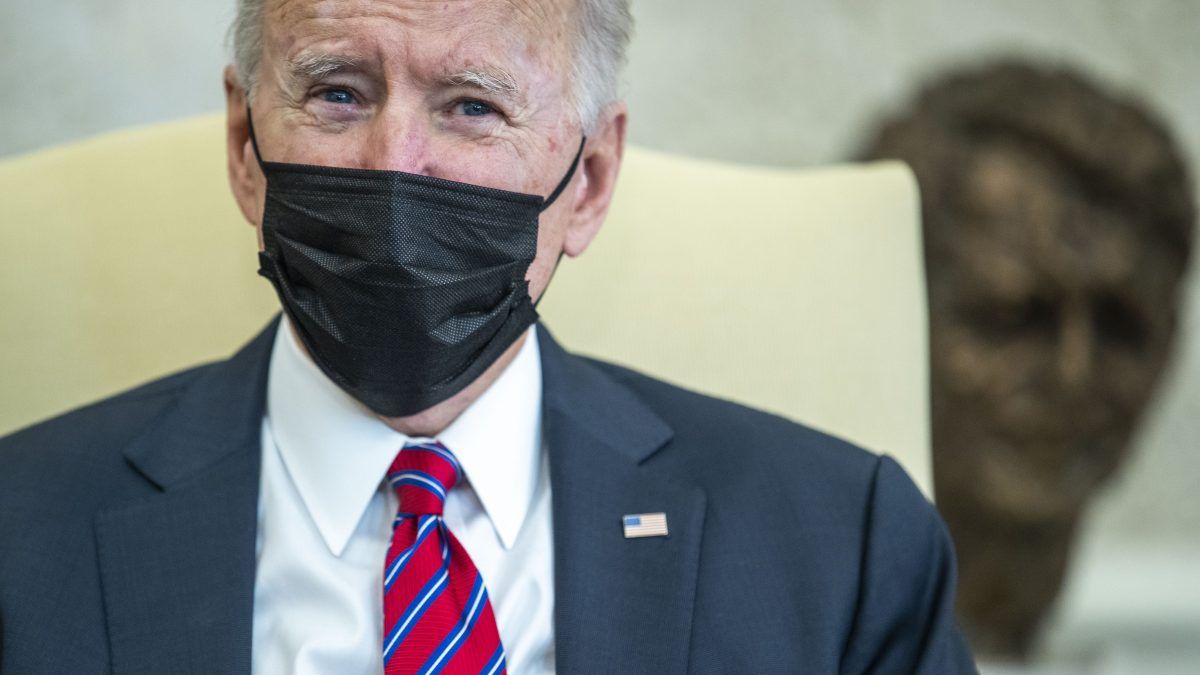

Gregory Hood explains why many Trump voters fear that they are being criminalized for opposing Biden’s agendas. Hood writes that illegitimate president Joe Biden has called for “constant, unrelenting immigration.” Biden said a non-white majority will be “a source of our strength.” Biden also said, “English jurisprudential culture, a white man’s culture” has “got to change.” Racism, Biden said, has been “built into every aspect of our system.” https://www.unz.com/ghood/regime-takes-aim-at-white-advocates/

Hood points out that Biden has assembled a government that regards white patriotic conservative Americans as likely dangerous members of “white supremacist militias” prone to violence. The “MEGA terrorist” image created by the media is being used to pass a domestic terrorism bill to silence dissenters from the anti-Constitutional, anti-white direction our country is being taken.

Whether or not we agree with Hood’s perspective, the image that Biden is creating of Trump voters is the antithesis of unity. Biden is isolating and demonizing a large percentage of American citizens.

The deaths and severe injuries from the COVID-19 vaccine are continuing to stack up. Here’s a question: how likely is it that the ruling class blames these deaths on COVID-21?

The deaths and severe injuries from the COVID-19 vaccine are continuing to stack up. Here’s a question: how likely is it that the ruling class blames these deaths on COVID-21? Today, I want to have a conversation about something you may not want to discuss: Your future.

Today, I want to have a conversation about something you may not want to discuss: Your future. The Reddit WallStreetBets group is unleashing the silver price, but this will trigger real panic into gold and silver.

The Reddit WallStreetBets group is unleashing the silver price, but this will trigger real panic into gold and silver.

When it comes to the shares of GameStop, most of the mainstream media’s focus has been on the Reddit message board commentators who stood to make millions of dollars from boosting the stock price. It’s a good bet that the SEC, FBI, Financial Stability Oversight Council, Senate and House investigators are setting their sights on those who stood to make…not millions but billions. The overarching question will be: did any of the big players engage in a direct role on Reddit or incentivize the people posting on the Reddit message board, WallStreetBets, to hawk the shares of GameStop.

When it comes to the shares of GameStop, most of the mainstream media’s focus has been on the Reddit message board commentators who stood to make millions of dollars from boosting the stock price. It’s a good bet that the SEC, FBI, Financial Stability Oversight Council, Senate and House investigators are setting their sights on those who stood to make…not millions but billions. The overarching question will be: did any of the big players engage in a direct role on Reddit or incentivize the people posting on the Reddit message board, WallStreetBets, to hawk the shares of GameStop. “Ease up on the executive actions, Joe,” The New York Times urged recently inaugurated President Biden last week. While supportive of the president’s broadly progressive agenda, the newspaper’s editorial board found his flurry of executive orders and other unilateral actions both troubling and vulnerable to easy reversal by future presidents. “This is no way to make law,” the Times added.

“Ease up on the executive actions, Joe,” The New York Times urged recently inaugurated President Biden last week. While supportive of the president’s broadly progressive agenda, the newspaper’s editorial board found his flurry of executive orders and other unilateral actions both troubling and vulnerable to easy reversal by future presidents. “This is no way to make law,” the Times added. On March 12, 1989, a research fellow at CERN named Tim Berners-Lee submitted a paper to the agency’s senior management, proposing a new way to organize information across computer networks.

On March 12, 1989, a research fellow at CERN named Tim Berners-Lee submitted a paper to the agency’s senior management, proposing a new way to organize information across computer networks.

The unbacked paper money system is an economically and socially destructive system—with far-reaching and harmful economic and social consequences beyond what most people would imagine. Fiat money is inflationary; it benefits some at the expense of many others; it causes boom-and-bust cycles; it corrupts the morality of society; it will ultimately end in a major bust; and it leads to overindebtedness.

The unbacked paper money system is an economically and socially destructive system—with far-reaching and harmful economic and social consequences beyond what most people would imagine. Fiat money is inflationary; it benefits some at the expense of many others; it causes boom-and-bust cycles; it corrupts the morality of society; it will ultimately end in a major bust; and it leads to overindebtedness. In all of the years that I have written about precious metals, I have never seen anything like this. The corporate media is breathlessly reporting that “the Reddit Army” plans to do to silver what it did to GameStop, and this has caused a frenzy of buying and a severe shortage of physical silver at dealers all across the United States. If things are this crazy already, what is going to happen when the short squeeze actually begins? For now, “the Reddit Army” is still primarily focused on GameStop and other stocks that major hedge funds have been relentlessly short selling, and in recent days members of that army have actually been purchasing billboard ads to celebrate their success…

In all of the years that I have written about precious metals, I have never seen anything like this. The corporate media is breathlessly reporting that “the Reddit Army” plans to do to silver what it did to GameStop, and this has caused a frenzy of buying and a severe shortage of physical silver at dealers all across the United States. If things are this crazy already, what is going to happen when the short squeeze actually begins? For now, “the Reddit Army” is still primarily focused on GameStop and other stocks that major hedge funds have been relentlessly short selling, and in recent days members of that army have actually been purchasing billboard ads to celebrate their success… Less than one week after advising Americans that wearing two or even three masks would be ‘more effective’ against the spread of coronavirus, Dr Fauci has done a complete 180 (again) and admitted that there is no data to suggest it will make any difference.

Less than one week after advising Americans that wearing two or even three masks would be ‘more effective’ against the spread of coronavirus, Dr Fauci has done a complete 180 (again) and admitted that there is no data to suggest it will make any difference. […] In the aftermath of the disgraceful Jan. 6 riot at the U.S. Capitol, the American ruling class has flexed its muscles like never before.

[…] In the aftermath of the disgraceful Jan. 6 riot at the U.S. Capitol, the American ruling class has flexed its muscles like never before.