from Financial Survival Network

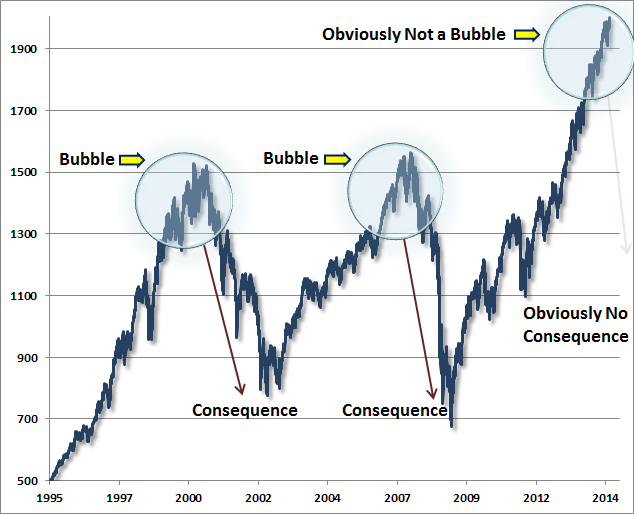

Gordon T. Long and Charles Hugh Smith recently did a blockbuster presentation on the evolution of Crony Capitalism in America.

Gordon T. Long and Charles Hugh Smith recently did a blockbuster presentation on the evolution of Crony Capitalism in America.

They traced its route causes and the damage that is currently being inflicted upon the country and the population from it. Today Gordon and I discussed possible strategies that individuals can to take avoid the negative effects of Crony Capitalism and thrive nonetheless.

The goal is simple and with a little bit of work anyone can do it.

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

We spoke with

We spoke with

We had our regular Monday chat with

We had our regular Monday chat with  It’s time for another Manipulation Monday meetup with

It’s time for another Manipulation Monday meetup with

Just when it looked like the fun was about to begin, Detroit’s noisiest and perhaps most obnoxious creditor, bond insurer Syncora agreed to a settlement. It’s clearly a case of the squeeky wheel getting the oil. Initally they were slated to lose $400 million, most of it going to keep the insolvent Detroit pension fund paying out to retirees. Now, they will lose much less and the bankruptcy will move ahead much faster, everybody’s a winner, right?

Just when it looked like the fun was about to begin, Detroit’s noisiest and perhaps most obnoxious creditor, bond insurer Syncora agreed to a settlement. It’s clearly a case of the squeeky wheel getting the oil. Initally they were slated to lose $400 million, most of it going to keep the insolvent Detroit pension fund paying out to retirees. Now, they will lose much less and the bankruptcy will move ahead much faster, everybody’s a winner, right?

We caught up with

We caught up with

When it comes to taxes and the IRS, there’s nobody out there like

When it comes to taxes and the IRS, there’s nobody out there like

Today we spoke with a brand new guest, automotive expert

Today we spoke with a brand new guest, automotive expert

How does an ordinary guy like

How does an ordinary guy like