by Michael Krieger

Liberty Blitzkrieg

If you aren’t paying close attention to what’s happening in Europe, you may be surprised by the extent of “elite” panic at the notion that the British people could decide to leave the EU. Here’s just one example, from Donald Tusk, president of the European Council.

If you aren’t paying close attention to what’s happening in Europe, you may be surprised by the extent of “elite” panic at the notion that the British people could decide to leave the EU. Here’s just one example, from Donald Tusk, president of the European Council.

Why is it so dangerous? No one can foresee what the long-term consequences would be. As a historian, I fear that Brexit could be the beginning of the destruction of not only the E.U., but also of Western political civilization.

While there’s no doubt that a Brexit will result in major disruptions to the status quo system, isn’t that the point? Moreover, that’s some downright apocalyptic talk by Mr. Tusk. What’s driving it?

Look, up in the sky!

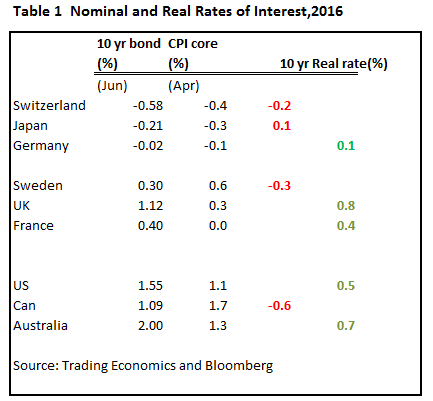

Look, up in the sky! Over the past month, the global bond markets have been sending out signals that all is not well with the global economies. Initially, the surge in negative nominal rates in Europe and Japan rattled many investors in both the fixed income and equities markets. This historic development suggests that large-scale investors are anticipating low growth and disinflation for many more years. Simultaneously, the yield curve, especially in the US, has been flattening, again signalling that growth is slowing, giving the policy makers considerable pause in their deliberations on the course of future interest rates. This blog examines both these developments to help the reader understand the signals coming out of the bond markets around the world.

Over the past month, the global bond markets have been sending out signals that all is not well with the global economies. Initially, the surge in negative nominal rates in Europe and Japan rattled many investors in both the fixed income and equities markets. This historic development suggests that large-scale investors are anticipating low growth and disinflation for many more years. Simultaneously, the yield curve, especially in the US, has been flattening, again signalling that growth is slowing, giving the policy makers considerable pause in their deliberations on the course of future interest rates. This blog examines both these developments to help the reader understand the signals coming out of the bond markets around the world.

I wrote a book a couple of months ago about some of the basics of investing. The book has done well and it seems to have struck a cord with readers. In the book I try to explain that by listening to the “Experts” investors are doing themselves a disservice. When the “Experts” get it dead wrong, they don’t pay, you do. So why not take some responsibility for your own investment decisions? The Gurus don’t care if you make money; they only care if they make money.

I wrote a book a couple of months ago about some of the basics of investing. The book has done well and it seems to have struck a cord with readers. In the book I try to explain that by listening to the “Experts” investors are doing themselves a disservice. When the “Experts” get it dead wrong, they don’t pay, you do. So why not take some responsibility for your own investment decisions? The Gurus don’t care if you make money; they only care if they make money. A lot of good economic theory boils down to the acronym TANSTAAFL, which stands for “There Ain’t No Such Thing As A Free Lunch”. TANSTAAFL is an unavoidable law of economics, because everything must be paid for one way or another. Furthermore, attempts by policymakers to get around this law invariably result in a higher overall cost to the economy. Unfortunately, central bankers either don’t know about TANSTAAFL or are naive enough to believe that their manipulations can provide something for nothing. They seem to believe that the appropriate acronym is CBCCFLAW, which stands for “Central Banks Can Create Free Lunches At Will”.

A lot of good economic theory boils down to the acronym TANSTAAFL, which stands for “There Ain’t No Such Thing As A Free Lunch”. TANSTAAFL is an unavoidable law of economics, because everything must be paid for one way or another. Furthermore, attempts by policymakers to get around this law invariably result in a higher overall cost to the economy. Unfortunately, central bankers either don’t know about TANSTAAFL or are naive enough to believe that their manipulations can provide something for nothing. They seem to believe that the appropriate acronym is CBCCFLAW, which stands for “Central Banks Can Create Free Lunches At Will”.

Most people want to be free to do as they wish. Yet, they don’t want the responsibility of being free. They are afraid that if they are 100% free and responsible for their actions, they might fail.

Most people want to be free to do as they wish. Yet, they don’t want the responsibility of being free. They are afraid that if they are 100% free and responsible for their actions, they might fail. With major markets all over the globe on the move, today James Turk not only told King World News that the world is headed for another terrifying collapse, and discussed the scary part regarding why it will be even worse this time around.

With major markets all over the globe on the move, today James Turk not only told King World News that the world is headed for another terrifying collapse, and discussed the scary part regarding why it will be even worse this time around. […] Analysis

[…] Analysis According to the figures in the 2016 World Silver Survey, Americans now lead the world in physical silver investment. This is quite an interesting change as India has been the number one market for silver bar demand in the past.

According to the figures in the 2016 World Silver Survey, Americans now lead the world in physical silver investment. This is quite an interesting change as India has been the number one market for silver bar demand in the past. What national boundaries can be considered as just? In the first place, it must be recognized that there are no just national boundaries per se; that real justice can only be founded on the property rights of individuals. If fifty people decided voluntarily to set up an organization for common services or self-defense of their persons and properties in a certain geographical area, then the boundaries of that association, based on the just property rights of the members, will also be just.

What national boundaries can be considered as just? In the first place, it must be recognized that there are no just national boundaries per se; that real justice can only be founded on the property rights of individuals. If fifty people decided voluntarily to set up an organization for common services or self-defense of their persons and properties in a certain geographical area, then the boundaries of that association, based on the just property rights of the members, will also be just. Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Goldman Sachs slashed its 2016 estimate of U.S. demand for equities by nearly half on Monday, citing a weaker appetite for stocks among retail investors as the market struggles to break free from its range-bound trading amid global uncertainty.

Goldman Sachs slashed its 2016 estimate of U.S. demand for equities by nearly half on Monday, citing a weaker appetite for stocks among retail investors as the market struggles to break free from its range-bound trading amid global uncertainty.

At a most troubled moment in history, both major political parties appear set to nominate time-bomb candidates for president with a fair percentage chance of blowing up their own campaigns and the parties themselves.

At a most troubled moment in history, both major political parties appear set to nominate time-bomb candidates for president with a fair percentage chance of blowing up their own campaigns and the parties themselves.

In

In  Recently an article appeared in Forbes magazine that recommended a universal basic income (UBI) for all citizens. The writer, who is from the UK, argues that:

Recently an article appeared in Forbes magazine that recommended a universal basic income (UBI) for all citizens. The writer, who is from the UK, argues that: