from RT America

Harvey Organ’s Daily Gold & Silver Report – 2016.06.17

Latest poll tonight shows BREXIT firmly in the lead/Massive paper gold deposit into GLD of 7.13 tonnes/Huge withdrawal of 5.418 million oz of silver from the SLV/ Unbelievable COT report showing a massive 54,726 contracts supplied short by commercials/China throws out Apple with respect to Apple 6 sales as sthey state patent infringement/expect an all out battle here!/The Fed’s greatest hawk goes ultra dove!!

by Harvey Organ

Harvey Organ’s Blog

[…] The June gold contract is an active contract. Last night we had a poor sized 4 notices filed last night, for 400 oz to be served upon today. The total number of notices filed in the first 12 days is enormous at 15,141 for 1,514,100 oz. (47.094 tonnes)

[…] The June gold contract is an active contract. Last night we had a poor sized 4 notices filed last night, for 400 oz to be served upon today. The total number of notices filed in the first 12 days is enormous at 15,141 for 1,514,100 oz. (47.094 tonnes)

ii) in silver we had 207 notices filed for 1,035,000 oz.. Total number of notices served in the 10 days: 409 for 2,045,000 oz

Let us have a look at the data for today.

Several months ago the comex had 303 tonnes of total gold. Today, the total inventory rests at 274.09 tonnes for a loss of 29 tonnes over that period.

Now is the Time to Be Looking at the World’s ‘Forgotten’ Precious Metal

by Simon Black

Sovereign Man

In our daily conversations, we regularly discuss how important it is to own real assets– especially precious metals.

There’s so much risk in the financial system right now. Just consider your own bank account, for example.

If you’re in the West, more than likely your bank is -extremely- illiquid, meaning that they only keep a small portion of your funds in reserve.

The rest of your money is gambled away in the latest investment fad; and as we’ve reported recently, banks are once again making low-money down home loans to subprime borrowers with YOUR money.

Market Report: Gold Sets New Post-Bear Market High

by Alasdair MacLeod

Gold Money

Precious metals had a strong performance this week, so much so that yesterday gold soared through the $1308 level, long regarded as the technical point which confirms, once breached, that the bear market is over.

Precious metals had a strong performance this week, so much so that yesterday gold soared through the $1308 level, long regarded as the technical point which confirms, once breached, that the bear market is over.

Having closed at $1276 last Friday, yesterday gold traded as high as $1314, and silver at $17.84. Then the news that a Labour MP had been shot in her constituency, accompanied by unfounded rumours that the referendum might be postponed, reversed sterling’s downtrend. Equity markets rallied, and precious metal prices dropped, losing all the week’s gains in just a few hours. The turnaround in the gold price was $33, to close down $14 on a volatile day, and silver lost 35 cents to close at $17.22.

Stock Market Rallies on Murder of Jo Cox; Wall Street Journal Defends It

by Pam Martens and Russ Martens

Wall Street on Parade

The U.S. stock market was mired in red ink yesterday morning with every major Wall Street bank trading down on news that multiple polls in Britain were showing that a majority of citizens were in favor of the United Kingdom withdrawing from the European Union (EU). A referendum vote on the issue is to be held next Thursday.

The U.S. stock market was mired in red ink yesterday morning with every major Wall Street bank trading down on news that multiple polls in Britain were showing that a majority of citizens were in favor of the United Kingdom withdrawing from the European Union (EU). A referendum vote on the issue is to be held next Thursday.

Then, at 12:17 p.m. New York time yesterday, Bloomberg News printed the following headline: “U.K. Lawmaker Jo Cox Is Murdered, Silencing Brexit Debate.” Cox was a Member of Parliament from the Labour Party who was an advocate for the U.K. remaining in the EU. Cox, a mother of two children, was shot and stabbed by a man said to be in favor of Brexit, the term for a British exit from the EU. On the news of her death, which fueled the market perception that it would dampen the zeal to leave the EU, the pound and euro rallied along with the Dow Jones Industrial Average and Wall Street bank stocks.

Remain Group Tries to Capitalize on Murder of Jo Cox: Will it Work?

by Mike ‘Mish’ Shedlock

Mish Talk

Following the senseless murder of UK parliament member and Remain backer Jo Cox, the remain forces have come out to politicize her death, as expected.

[…] Please consider Merkel Warns Politicians Against Inflaming Hatred.

Angela Merkel on Friday warned that the killing of British MP Jo Cox should serve as a stark reminder to politicians to avoid inflammatory language.

“This is a terrible precedent,” said the German chancellor. “The overall lesson must be that we behave with respect to each other, including when we have different political beliefs?.?.?.?Otherwise radicalisation will definitely not be stopped.”

Critics of the Brexit campaign seized on the killing to attack the Brexiters. In France, Marion Van Renterghem, a reporter at Le Monde, the daily paper, tweeted: “The lovely face of Jo Cox will become the symbol of an absurd and suicidal referendum.”

Will Hillary Survive Barrage of Email Leaks From Russia and WikiLeaks?

by Daily Bell Staff

The Daily Bell

Hillary Clinton’s emails are a non-scandal … Given longstanding weaknesses in the State Department system, she made a rational decision. The pseudo-scandal over Hillary Clinton’s emails bubbled up again with the recent release of the State Department Inspector General’s report. – USA Today

Richard Ben-Veniste has written an editorial at USA Today that argues Hillary’s decision to keep her emails out of State Dept. hands was understandable and even prudent.

He argues that the State Dept. system itself is flawed and has been hacked numerous times. He believes the entire US government system is subject to hacking and not nearly so secure as has been portrayed.

More:

Gundlach: Central Banks Don’t Understand Their Policies—and ‘They’re Out of Control’

by Everett Rosenfeld and Christine Wang

CNBC.com

Central banks are “out of control” because they don’t understand the consequences of their own policies, according to Jeffrey Gundlach, the chief executive officer at DoubleLine Capital.

Central banks are “out of control” because they don’t understand the consequences of their own policies, according to Jeffrey Gundlach, the chief executive officer at DoubleLine Capital.

Speaking with CNBC’s “Halftime Report” on Friday, the bond guru projected that markets are actually likely to see another round of negative interest rates before central bankers realize they aren’t working and that fiscal stimulus may be the better option.

“The policies that they’re implementing don’t have the consequences that they’re looking for,” he said.

Chief among those policy mistakes, Gundlach said, is negative rates.

Why There’s a New Kind of Housing Crisis

Nearly one-third of survey respondents said they’d had to scramble to cover a mortgage or rent payment in the past few years

by Andrea Riquier

Market Watch

America has a housing crisis, and most Americans want policy action to address it.

America has a housing crisis, and most Americans want policy action to address it.

That’s the conclusion of an annual survey released Thursday by the MacArthur Foundation.

The “crisis” is no longer defined by the layers of distress left behind after the subprime bubble burst, but about access to stable, affordable housing.

A vast majority of respondents – 81% – said housing affordability is a problem, and one-third said they or someone they know has been evicted, foreclosed on, or lost their housing in the past five years.

Over half the respondents, 53%, said they’d had to make sacrifices over the past three years to be able to pay their mortgage or rent.

Silver Wildcats – And The Day Futures Died – Part 1

From Legends to Bankers

by Dr. Jeffrey Lewis

Silver Coin Investor

Yes, there has always been price manipulation.

Yes, there has always been price manipulation.

There will always be price manipulation.

From the time of Caesar, through the American Civil War and into the 20th and 21st centuries.

Equities, interest rates, bonds, currencies, and futures.

From wheat to silver, the Maine potato default, and the onion debacle, futures trading has been subject to all manner of interference.

California Tops France as World’s 6th Largest Economy

from Zero Hedge

While Illinois’ economy is bigger than Saudi Arabia’s, as we detailed previously, it is California that reigns supreme among America’s states (until the next tech crash). In fact, as Bloomberg reports, according to state data released this week, California has overtaken France as the world’s sixth-largest economy, fueled by strong growth and the U.S. dollar’s gains against foreign currencies.

In order to help put America’s GDP of $18 trillion in 2015 into perspective, the following chart compares the GDP of US states to other country’s entire national GDP…

How to Be a Marijuana Millionaire

by Chris Campbell

Laissez Faire Books

It was July of 2011 when the knuckleheads at the DEA ruled that marijuana has “no accepted medical use” and should remain a Schedule 1 drug under federal law.

It was July of 2011 when the knuckleheads at the DEA ruled that marijuana has “no accepted medical use” and should remain a Schedule 1 drug under federal law.

If you don’t know what a “Schedule 1” drug is, it’s a drug that…

1.) Has a high potential for abuse

2.) Has no accepted medical treatment use

3.) And isn’t safe to consume

Despite mountains of evidence to the contrary, the brainiacs at the DEA still asserted that marijuana should remain under the same classification as bath salts and heroin.

30 Blocks of Dog Sh!t & Sugar Taxes

by James Quinn

The Burning Platform

Earlier this week I left for work on a cool crisp sunny morning at 6:30 am. Traffic seemed lighter than usual. Even the Schuylkill Expressway was moving smoothly. I just knew it was going to be one of those rare 45 minute uneventful commutes. Boy was I mistaken. Half way down the Schuylkill traffic came to a grinding halt. I flipped on the traffic report and found out there was a bad bus accident near Girard Avenue blocking two lanes. My delightful commute had turned into a house of horrors. We inched along at 5 mph for the next five miles.

Earlier this week I left for work on a cool crisp sunny morning at 6:30 am. Traffic seemed lighter than usual. Even the Schuylkill Expressway was moving smoothly. I just knew it was going to be one of those rare 45 minute uneventful commutes. Boy was I mistaken. Half way down the Schuylkill traffic came to a grinding halt. I flipped on the traffic report and found out there was a bad bus accident near Girard Avenue blocking two lanes. My delightful commute had turned into a house of horrors. We inched along at 5 mph for the next five miles.

My Plan B was in effect. I’d get off at Belmont Avenue and take that to Girard Avenue (Route 30) and then down to 34th Street where I usually end up in the morning. Of course, hundreds of other drivers chose the same Plan B. The ramp to get off the Schuylkill and onto Belmont was jammed. I eventually got onto Belmont and proceeded past City Line Avenue and into the jungles of West Philly. My day got even better when there was an accident on Belmont in the right lane that delayed my commute further. But I eventually made it to the intersection of Belmont and Girard, making my left turn into Squalor.

Gold-Stock Summer Breakout?

by Adam Hamilton

Zeal LLC

The red-hot gold stocks surged again this week in an apparent early-summer breakout. This strong buying is defying their seasonally-weak odds this time of year. Investors are flocking back to the miners as gold powers higher on also-counter-seasonal strong investment buying. Such unprecedented gold-stock strength in early June highlights how undervalued the miners remain relative to gold, but is suspect.

The red-hot gold stocks surged again this week in an apparent early-summer breakout. This strong buying is defying their seasonally-weak odds this time of year. Investors are flocking back to the miners as gold powers higher on also-counter-seasonal strong investment buying. Such unprecedented gold-stock strength in early June highlights how undervalued the miners remain relative to gold, but is suspect.

Summers are usually lackluster times for gold, and thus silver and their miners’ stocks. These summer doldrums exist for a couple reasons. Gold simply enjoys no recurring demand spikes driven by cultural or income-cycle factors in June and July unlike during most of the rest of the year. It’s before the Asian-harvest, Indian-wedding-season, and Christmas gold buying that flares up like clockwork in second halves.

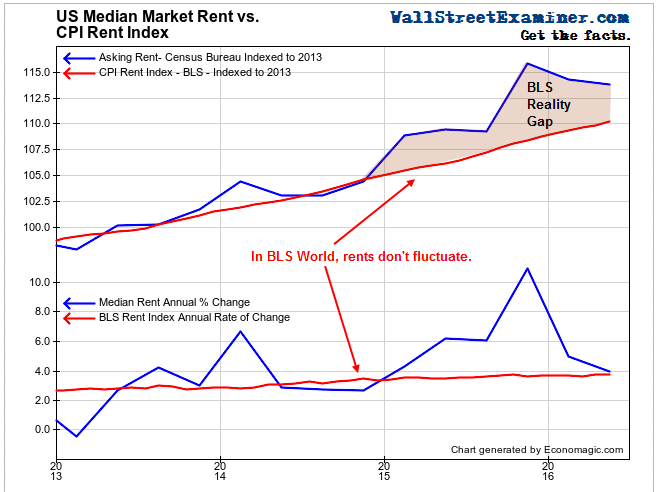

These Two Charts Show Exactly How BLS Shrinks the CPI

by Lee Adler

Wall Street Examiner

This chart shows how much the BLS suppresses rent inflation in its CPI measure. It’s a major tool the government uses to suppress CPI.

This chart shows how much the BLS suppresses rent inflation in its CPI measure. It’s a major tool the government uses to suppress CPI.

[…] A problem with the economic establishment’s focus on the CPI to measure “inflation” is that the CPI was never intended to measure “inflation” per se. Its purpose has always been to index government benefits, salaries, and contracts. The goal is to keep costs down by manipulating index to increase at the lowest possible rate that the BLS can present to the public with a straight face and the pretense of statistical accuracy.

The biggest tool that the BLS gives for manipulating CPI is the idea that housing prices do not count toward inflation because houses are assets, not consumption goods.

“Emergency” Article – The Dumbest, Most Desperate Manipulation Excuse Ever

by Andrew Hoffman

Miles Franklin

It’s 3:00 AM MST Friday morning, and I had ZERO intention of writing an article today – having just published my must listen “Central banks are dead, and here’s the real end game” audioblog less than 24 hours ago. However, given that I received more emails from frustrated readers yesterday, following the most egregious Cartel raid of the past 15 years, I thought I’d put this together to assuage your fears – and let you know all’s well in the historic PM bull market, that is still in the first inning of what will ultimately be an unprecedentedly long, extra-inning game.

Not that the absolutely amount of yesterday’s PM declines were particularly large – let alone, as half of silver’s “decline” has already been recouped as I write. Or that there was anything uncommon about the paper attacks; despite an historic day of “PM-bullish, everything-else-bearish” news, featuring the Fed completely capitulating on its fraudulent “rate hike” propaganda. I mean, even after gold decidedly took out early May’s high of $1,303/oz, the Cartel attacked at the 2:15 AM EST London “pre-market” open for the 657th time in the past 754 trading days; and later on, at 11:30 AM EST, which has recently replaced the decade-long, tried-and-true 12:00 PM EST “cap of last resort” as a “key attack time” of choice.

How to Use the Gold-to-Silver Ratio?

by Arkadiusz Sieron

Silver Seek

We have debunked the myth that gold-to-silver ratio should revert to its “true” level around 16. The predominant range for the ratio in modern times is rather well between 40 and 80. Moreover, the notion that the gold-to-silver ratio should revert to some historical average makes no sense. The relative valuation between these two precious metals depends on market forces, like the health of the world economy and monetary demand for both metals, or industrial demand for silver. Such factors change over time. For example, gold has nowadays much higher monetary demand compared to silver than in the past, which largely explains why the average ratio in the 21st century was on average higher than earlier.

We have debunked the myth that gold-to-silver ratio should revert to its “true” level around 16. The predominant range for the ratio in modern times is rather well between 40 and 80. Moreover, the notion that the gold-to-silver ratio should revert to some historical average makes no sense. The relative valuation between these two precious metals depends on market forces, like the health of the world economy and monetary demand for both metals, or industrial demand for silver. Such factors change over time. For example, gold has nowadays much higher monetary demand compared to silver than in the past, which largely explains why the average ratio in the 21st century was on average higher than earlier.

Sensational Murder of MP Leads to Suspension of Brexit Campaign, “Vote in Limbo”

by Mac Slavo

SHTF Plan

There are serious economic, social and political issues at stake in the world right now, and those fighting for them are fighting dirty.

Only the day before last, SHTF pointed out that the bankers-that-be have put a gun to the head of the economy, and would do anything to scare the British out of voting for a Brexit.

See: Bankers Threaten Brexit “Chaos, Fear and Emergency Measures” But Threat of Collapse Already Exists

But who could have any idea that things would get this much out of control…

As Zero Hedge notes:

Gold Bull Breakout Stars: Agnico Eagle and OceanaGold

by Jason Simpkins

Outsider Club

One of the most explosive bull markets in history peaked in 2011, and then precious metals were brutally slammed.

One of the most explosive bull markets in history peaked in 2011, and then precious metals were brutally slammed.

This is what happens in a commodities cycle.

Demand snowballs and suppliers overproduce, trying to make as much money as they can. The resulting oversupply overwhelms the market, and prices crater.

We see this not just with gold and silver but also with oil. Indeed, oil prices have tumbled as low as $30 twice in the past eight years. Each time they rebounded rather quickly, delivering gains of 100%, 200%, and even 300%.

Crude Chewed Up by Another False Breakout…

by Greg Guenthner

Daily Reckoning

The stock market is grinding up the bulls every single time it gets within spitting distance of its highs.

The stock market is grinding up the bulls every single time it gets within spitting distance of its highs.

And tumbling stocks aren’t the only culprits that are chewing up portfolios…

A handful of nasty false breakouts and breakdowns are creating a treacherous environment for traders and investors alike. Just when you think you have something figured out, the market throws a wrench in your gears.

You don’t have to search very far to find the effects of these whipsaw moves. Just look at gold futures over the past 24 hours. After launching to two-year highs above $1,318 Thursday morning, gold started to slip. It’s lost more than $25 since noon yesterday—and now it’s back below $1,300 once again.

Hints of FX Intervention as Central Banks Debate Brexit Response

by Patrick Graham and Anirban Nag

Reuters UK

Warnings from officials in Japan and Switzerland on Thursday left financial markets wondering about what central banks are planning behind the scenes if Britain votes to leave the European Union next week.

It is five years since major monetary authorities waded in to currency markets in a concerted push to quell gains for the yen after a shattering earthquake in Japan.

Such coordinated action in the era of floating exchange rates is rare, and central banks have so far restricted themselves to promises to provide any funding banks might need in the event of a stormy aftermath to next Thursday’s referendum.

Officials told Reuters earlier this week the European Central Bank would pledge to backstop markets in tandem with the Bank of England after a vote to leave.

Strength of Gold Affirmed by Mainstream Media, Not Dependent on Brexit

by Daily Bell Staff

The Daily Bell

Gold price hit another high this week – how can you invest? – The Week

Gold price hit another high this week – how can you invest? – The Week

Gold didn’t just have a good week, it’s having a good year.

Gold prices have moved up significantly since May 2014 and gained even more momentum since the beginning of 2016. Gold is the best performing major asset class this year.

A spate of positive articles in the mainstream media regarding the progress of both gold and silver contribute to a sense of building momentum. The regular negative, mainstream coverage that gold and silver receive is lessening.

Thursday, metals progress against the dollar slowed, at least in part because of the murder of Jo Cox in Britain.

Nowcast GDP Estimate Dips to 2.1%, GDPNow at 2.8%

by Mike ‘Mish’ Shedlock

Mish Talk

The last FRNBY Nowcast report was on June 3.

It’s been two weeks since the last report. Why the delay? The answer is last Friday was caught in a blackout period before the FOMC meeting this week.

In contrast to the Atlanta Fed GDPNow Model, the Nowcast model declined since the last estimate.

Please consider the June 17 FRNBY Nowcast Report.

New York State Senator Introduces Unconstitutional, Anti-Free Speech Legislation

by Michael Krieger

Liberty Blitzkrieg

[…] It seems everywhere you turn, U.S. politicians at all levels of government are incessantly scheming to figure out ways to further erode the civil liberties of the American public. Earlier this month, a particularly egregious example emerged from the state of New York. It relates to an anti-First Amendment executive order issued by Governor Andrew Cuomo, followed one day later by similar legislation introduced by a state Senator. In case you aren’t up to speed on the issue, here’s a little background.

From The Huffington Post:

Alert: Whistleblower Maguire Warns Massive Stampede Into Gold Taking Place as Elites Lose Control

from King World News

On the heels of the chaos in England related to Brexit, today whistleblower and London metals trader Andrew Maguire told King World News that a massive stampede into gold is taking place as the elites have now visibly lost control of the system.

On the heels of the chaos in England related to Brexit, today whistleblower and London metals trader Andrew Maguire told King World News that a massive stampede into gold is taking place as the elites have now visibly lost control of the system.

But first, below is a chart showing the price of gold (as reflected through the ETF GLD), after Andrew Maguire’s remarkable KWN interview just 14 days ago:

[…] Andrew Maguire: “Technical traders looking to sell the synthetic gold market structure — beware. We are in uncharted territory. At no time in history has the world watched as central planners visibly lose control (of the system)…