by Mac Slavo

SHTF Plan

Greg Mannarino of TradersChoice.net has been keeping a close eye on stock and bond markets. He has been accurately predicting major turning points in these markets for years.

While everyone in the mainstream appears to know that something is seriously amiss with the economy, no one is warning the retail investor, despite the fact that billions of dollars are being shifted out of broader markets and into safe haven assets like gold and silver.

Unless some miracle happens, the next large move for this market is down…

Their bottom line… a lot of these companies are coming in below the mark… but the market is still in this topping phase… the fear/greed index remains at an extreme, so we should not be surprised to see this…

Anecdotal Skepticism vs. Actual Data

Anecdotal Skepticism vs. Actual Data Editor’s note: It’s been a month since “Brexit”…the historic event that wiped out more than $3 trillion from the global stock market in two days.

Editor’s note: It’s been a month since “Brexit”…the historic event that wiped out more than $3 trillion from the global stock market in two days. A nasty quarter at the epicenter of the Great American Oil Bust.

A nasty quarter at the epicenter of the Great American Oil Bust.

All is not so well within the elite’s New World Order. Their tried and true template of Problem-Reaction-Solution is in full gear as chaos reigns throughout the globe, which is exactly how the globalists like to see events unfold. Chaos [Problem] leads to unnerving situations [Reaction] amongst the masses that eventually cry out for resolve and a return to “normalcy” [Solution, but only as intended by the elites]. Invariably, a return to some kind of order requires the giving up of freedoms, and it often entails tightening the noose of economic hardship.

All is not so well within the elite’s New World Order. Their tried and true template of Problem-Reaction-Solution is in full gear as chaos reigns throughout the globe, which is exactly how the globalists like to see events unfold. Chaos [Problem] leads to unnerving situations [Reaction] amongst the masses that eventually cry out for resolve and a return to “normalcy” [Solution, but only as intended by the elites]. Invariably, a return to some kind of order requires the giving up of freedoms, and it often entails tightening the noose of economic hardship. The Fed was cocked and primed to deliver a 25 basis point increase in the federal funds rate on June 15. But on June 3, the BLS announced that nonfarm payrolls increased a paltry 38,000 in May. This monthly random number prompted the Fed to stand down on its interest rate increase. Then on June 23, the UK voters surprised the smart money by voting to have the UK leave the EU. Globally, the prices of risk assets swooned for a couple of days. The FOMC was thanking its lucky stars that the May nonfarm payroll report caused it to hold off on its planned rate increase for June 15.

The Fed was cocked and primed to deliver a 25 basis point increase in the federal funds rate on June 15. But on June 3, the BLS announced that nonfarm payrolls increased a paltry 38,000 in May. This monthly random number prompted the Fed to stand down on its interest rate increase. Then on June 23, the UK voters surprised the smart money by voting to have the UK leave the EU. Globally, the prices of risk assets swooned for a couple of days. The FOMC was thanking its lucky stars that the May nonfarm payroll report caused it to hold off on its planned rate increase for June 15. The modern gospel of personal prosperity and selective privilege, exceptionalism by whatever criteria a group may choose to exclude and oppress the other, although it has appeared throughout history many times and in many forms, may be one of the worst and most insidious sins against the Spirit.

The modern gospel of personal prosperity and selective privilege, exceptionalism by whatever criteria a group may choose to exclude and oppress the other, although it has appeared throughout history many times and in many forms, may be one of the worst and most insidious sins against the Spirit.

On the heels of some fierce trading last week in the dollar, gold and silver, below is an extremely important update on the war that is raging in the gold and silver markets.

On the heels of some fierce trading last week in the dollar, gold and silver, below is an extremely important update on the war that is raging in the gold and silver markets.

The dust has yet to fully settle on last week’s failed coup attempt in Turkey. Accusation has followed counter-accusation, but in the minefield of blatantly biased media and agenda-driven anonymous reports sourcing unnamed officials there is so much confusion that only those involved in the plot know for sure what really happened (or maybe not!).

The dust has yet to fully settle on last week’s failed coup attempt in Turkey. Accusation has followed counter-accusation, but in the minefield of blatantly biased media and agenda-driven anonymous reports sourcing unnamed officials there is so much confusion that only those involved in the plot know for sure what really happened (or maybe not!).

Munich police said at least eight people died and several others were injured in at least one shooting that they suspect is a terror attack in the city late Friday.

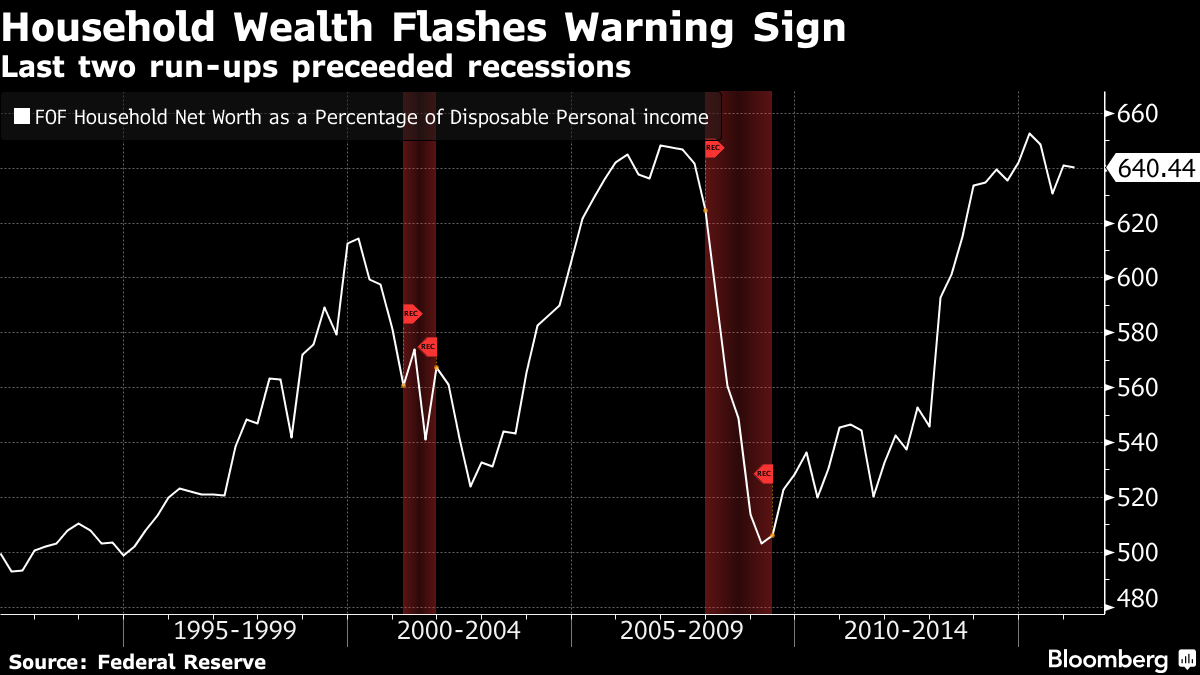

Munich police said at least eight people died and several others were injured in at least one shooting that they suspect is a terror attack in the city late Friday. Americans are about as wealthy as they’ve ever been—and that’s a worry?

Americans are about as wealthy as they’ve ever been—and that’s a worry?