by Rick Ackerman

RickAckerman.com

We’re all bulls now, albeit with one foot planted on the fire escape. Thursday’s rally pushed the Dow Industrials and the S&Ps to yet another record high, even as U.S. productivity continued to sag, corporate earnings fell for a fourth consecutive quarter, and some of the biggest, savviest retailers in the country — Macy’s now leading the way — were wondering how they’ll survive. For a nation that generates two-thirds of its GDP from consumption and which is hard-wired to shop, the bleak picture for brick-and-mortar retail would ordinarily be regarded as a yellow flag for investors. Not this time, though. The central banks are operating at full-steam, new-car deals have helped push household debt to levels not seen since 2006, and inflated home prices — Alan Greenspan’s favorite source of ‘wealth’ — are within an inch of heights achieved just prior to the 2007-08 crash. We have no doubt that the stock market will eventually succumb to gravity, ending all of the giddiness. In the meantime, it’s all too clear that Americans, especially those in close proximity to Wall Street, will continue to party on.

We’re all bulls now, albeit with one foot planted on the fire escape. Thursday’s rally pushed the Dow Industrials and the S&Ps to yet another record high, even as U.S. productivity continued to sag, corporate earnings fell for a fourth consecutive quarter, and some of the biggest, savviest retailers in the country — Macy’s now leading the way — were wondering how they’ll survive. For a nation that generates two-thirds of its GDP from consumption and which is hard-wired to shop, the bleak picture for brick-and-mortar retail would ordinarily be regarded as a yellow flag for investors. Not this time, though. The central banks are operating at full-steam, new-car deals have helped push household debt to levels not seen since 2006, and inflated home prices — Alan Greenspan’s favorite source of ‘wealth’ — are within an inch of heights achieved just prior to the 2007-08 crash. We have no doubt that the stock market will eventually succumb to gravity, ending all of the giddiness. In the meantime, it’s all too clear that Americans, especially those in close proximity to Wall Street, will continue to party on.

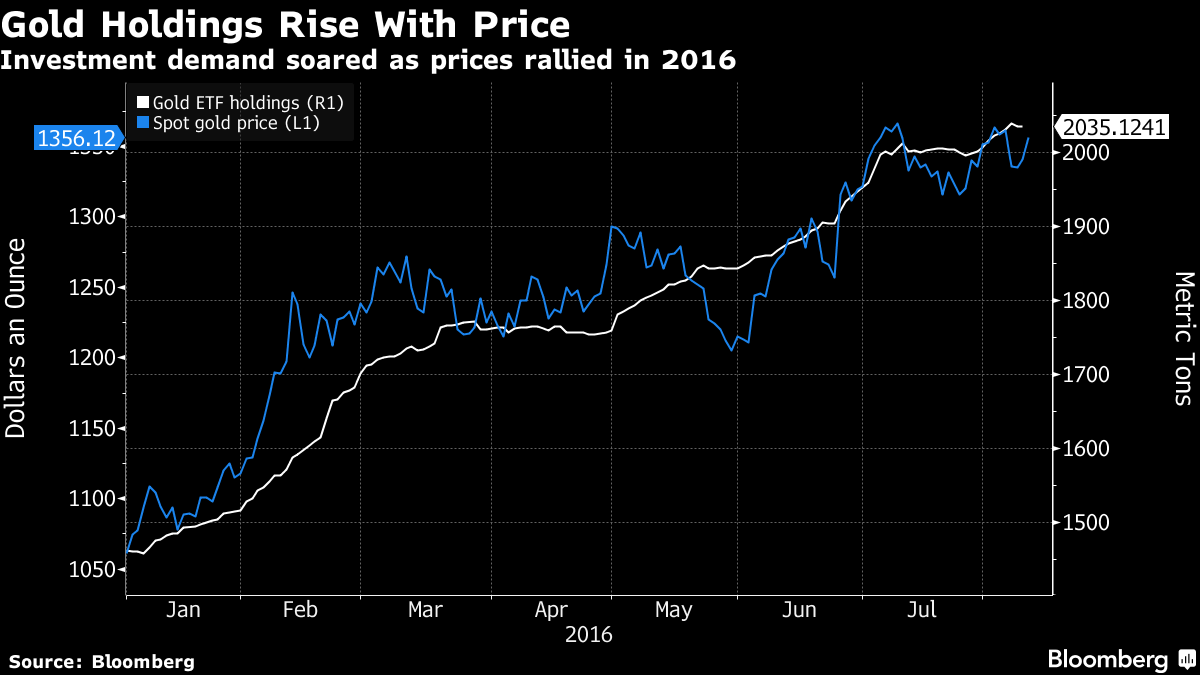

Investors bought record amounts of gold in the first half as concerns over Britain’s vote on European Union membership and U.S. presidential elections drove demand for a haven.

Investors bought record amounts of gold in the first half as concerns over Britain’s vote on European Union membership and U.S. presidential elections drove demand for a haven. Corporate America is bracing for tough times…

Corporate America is bracing for tough times…

LIBOR Pointing To Weaker Economy

LIBOR Pointing To Weaker Economy On the heels of gold’s biggest year-to-date surge in 36 years, a question arose: Is the gold market really manipulated?

On the heels of gold’s biggest year-to-date surge in 36 years, a question arose: Is the gold market really manipulated? The BREAKDOWN of the U.S. Market is now reaching Main Street. While the Fed and Central Banks continue to prop up the markets by purchasing Stocks, Bonds and everything including the kitchen sink, Americans are feeling the pain in many ways.

The BREAKDOWN of the U.S. Market is now reaching Main Street. While the Fed and Central Banks continue to prop up the markets by purchasing Stocks, Bonds and everything including the kitchen sink, Americans are feeling the pain in many ways. Yet another rather uneventful session made even worse by the fact that Japan had a national holiday. Early trading in the Shanghai tended to follow the weak US sentiment but despite flipping in both directions, eventually closed down but above the psychological 3k level. Hang Seng performed well and it could be said took a little confidence from the New Zealand rate cut as the NZ$ found strength following the decision. The Chinese Yuan was set 6.6255 by the PBoC with the of-shore market trading out at 6.6412. In late US trading the Nikkei futures have joined the rally and are currently trading 1% higher.

Yet another rather uneventful session made even worse by the fact that Japan had a national holiday. Early trading in the Shanghai tended to follow the weak US sentiment but despite flipping in both directions, eventually closed down but above the psychological 3k level. Hang Seng performed well and it could be said took a little confidence from the New Zealand rate cut as the NZ$ found strength following the decision. The Chinese Yuan was set 6.6255 by the PBoC with the of-shore market trading out at 6.6412. In late US trading the Nikkei futures have joined the rally and are currently trading 1% higher.

Apparently the Street is looking for a good Retail Sales number tomorrow because it will include Amazon’s ‘Prime Day’ promotion.

Apparently the Street is looking for a good Retail Sales number tomorrow because it will include Amazon’s ‘Prime Day’ promotion. Gold:1342.80 DOWN $1.80

Gold:1342.80 DOWN $1.80

Heike Hoffman is a 54-year old fruit merchant in a small town in western Germany.

Heike Hoffman is a 54-year old fruit merchant in a small town in western Germany. The good news is there is a way to avoid failure and stagnation: avoid the mainstream like the plague.

The good news is there is a way to avoid failure and stagnation: avoid the mainstream like the plague. There’s something big and scary going on behind the scenes but, as usual, the public isn’t reading about it on the front pages of the newspapers.

There’s something big and scary going on behind the scenes but, as usual, the public isn’t reading about it on the front pages of the newspapers.

Reporting from Tijuana, Mexico…

Reporting from Tijuana, Mexico…