from misesmedia

A New Wrinkle in the Paper Gold Con Game

by Turd Ferguson

TF Metals Report

Here’s a story that came out earlier today. Maybe it’s just me but it’s easy to see a Bullion Bank plot here. For months, we’ve documented all of the various points of demand for gold in all its forms. And now, as The Bullion Bank Paper Derivative Pricing Scheme is being stretched to extremes, suddenly the LME wants to offer another form of paper gold with which to screw everyone.

And note who’s involved here…not only is it the LME working in conjunction with the Evil Of Evils Goldman Sachs, they’re all “working in conjunction” with The World Gold Council. IF ANYTHING SHOULD PROVE FOR YOU ONCE AND FOR ALL THE THE WGC IS A SHADY, NASTY AND WORTHLESS ORGANIZATION, THIS SHOULD DO IT! Here’s your link from Reuters detailing the news: http://uk.reuters.com/article/gold-contract-lme-idUKL6N0WR4PI

Black Pastors Across America Are Breaking the Law to Help Promote Hillary Clinton

by Michael Krieger

Liberty Blitzkrieg

Last night, I came across a very interesting article published in the Atlantic which highlighted the fact that according to a recent Pew Research survey, “28 percent of those who have attended black Protestant churches in the last few months heard their pastor support Hillary Clinton.” This is a pretty remarkably statistic considering it is illegal to do so.

Which brings up a related question. To what extent did this phenomenon play a role in Hillary Clinton’s sweeping victories across the south versus Bernie Sanders during the Democratic primary?

Here are a few excerpts from the Atlantic article:

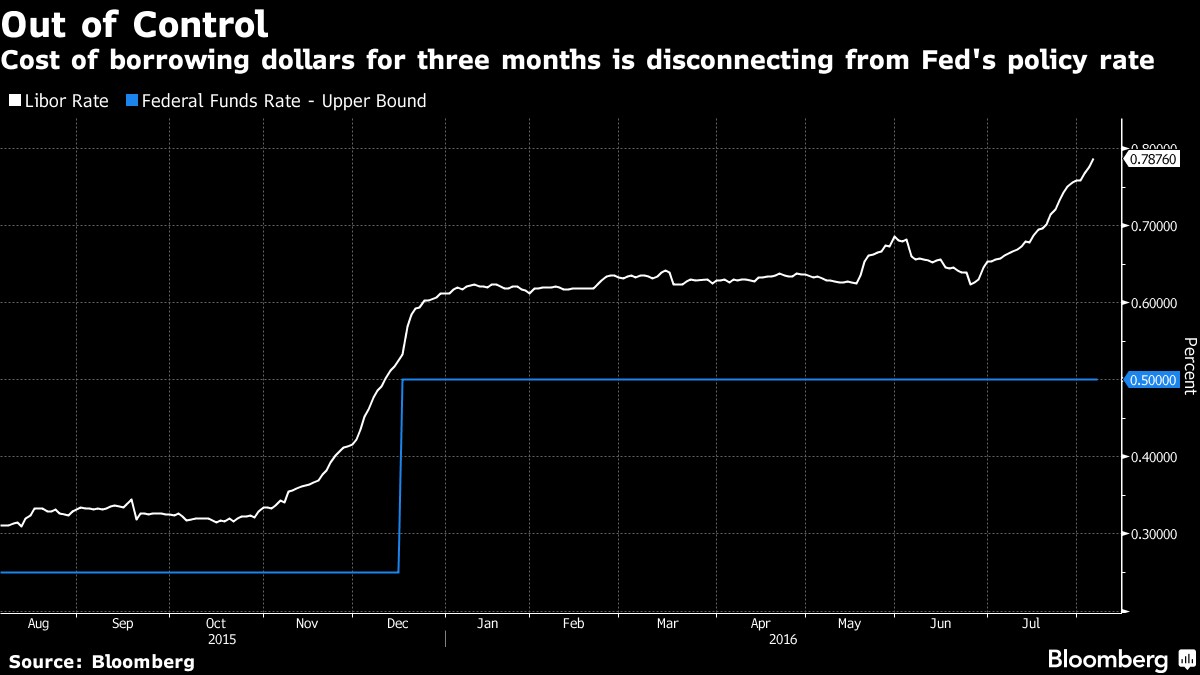

The Fed is Losing Control of Global Monetary Conditions: Chart

by Mark Gilbert

Bloomberg.com

Libor is coming unhinged (for a simple reason why, click here) from other borrowing costs and that has real implications for the cost of money in the real world. On this basis, the U.S. has already had an interest-rate increase, according to Bloomberg View’s Mark Gilbert. While there are plenty of market participants who favor the Austrian school of economics and would welcome the removal of central banks from the rate-setting mechanism, the change in money-market conditions is something the Fed should take into account as it ponders its next move.

Libor is coming unhinged (for a simple reason why, click here) from other borrowing costs and that has real implications for the cost of money in the real world. On this basis, the U.S. has already had an interest-rate increase, according to Bloomberg View’s Mark Gilbert. While there are plenty of market participants who favor the Austrian school of economics and would welcome the removal of central banks from the rate-setting mechanism, the change in money-market conditions is something the Fed should take into account as it ponders its next move.

The Latest Updates from Acting-Man – 2016.08.09

from Acting Man

Bank of England QE and the Imaginary “Brexit Shock” by Pater Tenebrarum

Bank of England QE and the Imaginary “Brexit Shock” by Pater Tenebrarum

Someone Else Did It First by Bill Bonner

The Great Silver Bubble by Keith Weiner

The Ultimate Absurdity by Bill Bonner

Financial Times: “Victory For Gold Bulls Is Only Just Beginning”

by Abid Pasha

GoldCore

The Financial Times published an interesting article today in which Diego Parrilla, author, investment expert and precious metals specialist, outlines the positive case for gold and why the gains seen this year are just the beginning of a new gold bull market:

The Financial Times published an interesting article today in which Diego Parrilla, author, investment expert and precious metals specialist, outlines the positive case for gold and why the gains seen this year are just the beginning of a new gold bull market:

[…] Parrilla begins:

“Gold prices have rallied more than 30 per cent since the lift-off in US interest rates in December. A sharp reversal in pricing, sentiment and positioning driven by a myriad macro and micro factors has left the gold bears and bulls as polarised as ever.

The bearish camp, which has featured prominent and respected analysts like Goldman Sachs, tends to have a constructive view on the US dollar, the ability to raise interest rates, normalise global monetary policy, and generally a benign view on the global economy and inflationary risks.

Consumer Spending Expectations Rise at Median-to-High End

by Mike ‘Mish’ Shedlock

Mish Talk

Consumer spending expectations have bounced a bit since the beginning of the year at the median level and at the high end. Despite the bounce, none of the trendlines have turned up.

[…] I created the above chart after downloading data from the New York Fed’s Survey of Consumer Expectations.

- The median and low-end spending expectations peaked in April of 2014. The high-end peaked in August of 2013.

- Compared to the Excel generated trendlines, there has been a decent bounce in spending expectations at the high vs. but no bounce at the low end.

- Compared to December of 2015, there has been a nice bounce at the median and high end, but not the low end.

- Compared to February of 2016, the only bounce is at the high end.

- None of the trendlines have turned up.

Here are a few other charts from the report.

Gold Stocks Versus Bullion: Inflation 101

by Stewart Thomson

Gold Seek

1. Gold price bulls and bears may all be getting a bit frustrated now, as gold refuses to follow their predicted paths, and simply meanders sideways.

1. Gold price bulls and bears may all be getting a bit frustrated now, as gold refuses to follow their predicted paths, and simply meanders sideways.

2. Please click here now. Double-click to enlarge this daily gold chart.

3. Gold is well-supported in the current price zone. Institutions are buyers on minor dips, but the next major move to the upside is unlikely to happen without a significant fundamental catalyst.

4. Janet Yellen makes an important speech at Jackson Hole later this month. For decades, I’ve viewed the August 7th – October 31st time period as US stock market “crash season”. If Janet causes the stock market to stumble with stronger words about a possible rate hike in September, that could quickly send gold towards my $1432 target.

Coca-Cola, Cronyism, and the War on Drugs

by Christopher J. O’Connell

Mises.org

It is well-known trivia that the original formula for Coca-Cola contained cocaine, but the lesser known history of Coca-Cola has other interesting components involving the government, cronyism, and the War on Drugs.

It is well-known trivia that the original formula for Coca-Cola contained cocaine, but the lesser known history of Coca-Cola has other interesting components involving the government, cronyism, and the War on Drugs.

The first federal drug law was the Harrison Narcotics Act passed in 1914, which criminalized the unlicensed sale of cocaine and opium products. But this is not why cocaine was removed from Coca-Cola. In fact, the cocaine alkaloid was removed from the formula for coke in 1903 due to pressures from negative press against cocaine use. To avoid angering and alienating a consumer base, the company removed the narcotic component of their product.

This is what we capitalists refer to as a “market regulation,” by the way, for all of you who believe that government is needed to regulate the reckless excesses of the free market.

The Phony Job Recovery

by Dr. Ron Paul

Ron Paul Institute

Last Friday saw the release of a bombshell jobs report, with headlines exclaiming that the US economy added over 250,000 jobs in July, far in excess of any forecasts. The reality was far more grim. Those “jobs” weren’t actually created by businesses – they were created by the statisticians who compiled the numbers, through the process of “seasonal adjustment.” That’s a bit of statistical magic that the government likes to pull out of its hat when the real data isn’t very flattering. It’s done with GDP, it’s done with job numbers, and similar manipulation is done with government inflation figures to keep them lower than actual price increases. In reality there are a million fewer people with jobs this month than last month, but the magic of seasonal adjustment turns that into a gain of 255,000.

Last Friday saw the release of a bombshell jobs report, with headlines exclaiming that the US economy added over 250,000 jobs in July, far in excess of any forecasts. The reality was far more grim. Those “jobs” weren’t actually created by businesses – they were created by the statisticians who compiled the numbers, through the process of “seasonal adjustment.” That’s a bit of statistical magic that the government likes to pull out of its hat when the real data isn’t very flattering. It’s done with GDP, it’s done with job numbers, and similar manipulation is done with government inflation figures to keep them lower than actual price increases. In reality there are a million fewer people with jobs this month than last month, but the magic of seasonal adjustment turns that into a gain of 255,000.

Hillary Clinton’s Health in Rapid Decline – Will She Even Make it to Election Day at This Rate?

by Michael Snyder

End of the American Dream

Hillary Clinton’s health is starting to become a major political issue, and there are many that believe that her health problems may force her to drop out before we even get to election day. On Sunday evening, the Drudge Report ran a photo of Hillary struggling to get up a set of stairs along with this headline: “2016: Hillary conquers the stairs”. Well, it turns out that particular photo was about six months old, but it sparked a much deeper debate about Hillary Clinton’s health. As you will see below, Clinton has been having seizures even while in public, she has been regularly having horrible coughing fits, she has a very large hole in her tongue that has not been explained, and she has been falling down way too often for a woman her age. No matter whether you are for her or against her, it should be apparent to everyone that this is a woman that has some very serious health issues.

Hillary Clinton’s health is starting to become a major political issue, and there are many that believe that her health problems may force her to drop out before we even get to election day. On Sunday evening, the Drudge Report ran a photo of Hillary struggling to get up a set of stairs along with this headline: “2016: Hillary conquers the stairs”. Well, it turns out that particular photo was about six months old, but it sparked a much deeper debate about Hillary Clinton’s health. As you will see below, Clinton has been having seizures even while in public, she has been regularly having horrible coughing fits, she has a very large hole in her tongue that has not been explained, and she has been falling down way too often for a woman her age. No matter whether you are for her or against her, it should be apparent to everyone that this is a woman that has some very serious health issues.

Why Doug Casey Thinks We Could See $5,000 Gold

by Justin Spittler

Casey Research

One of the world’s biggest central banks just swung its “sledgehammer.”

One of the world’s biggest central banks just swung its “sledgehammer.”

On Thursday, the Bank of England (BoE) launched its biggest stimulus package since the 2008–2009 financial crisis.

It cut its key interest rate to a record low. It started “printing” money again. And it announced a new “funding scheme.”

The BoE launched this massive easy money program to soften the blow of the “Brexit.” As you probably heard, Britain voted to leave the European Union (EU) on June 23. The historic event rattled Britain’s financial system.

Signs Are Silver Bull Market is Consolidating

Having hit a target, silver has formed what is believed to be an intermediate top over the past five weeks or so, which it should soon start to descend from, says technical analyst Clive Maund.

by Clive Maund

The Gold Report

Chilling Thing Twitter Said About San Francisco’s Office Bubble

by Wolf Richter

Wolf Street

Some of the smartest money got out last year.

Some of the smartest money got out last year.

Twitter is shaking up San Francisco. It’s the city’s 10th largest employer, and second largest tech employer, after Salesforce. But it hasn’t yet figured out, despite a decade of trying, how to make money. Last October, it announced that it would lay off 8% of its workforce. A couple of weeks ago, it reported a second-quarter net loss of $107 million along with disappointing user metrics and lousy projections. Its shares have lost 74% since their miracle-IPO-hype peak at the end of December 2014.

And now Twitter is dumping nearly one third of its total office space on the San Francisco sublease market.

Central Banks & The Week in Gold

by Gerardo Del Real

Outsider Club

What central banks giveth, central banks taketh away. Gold enjoyed the best first half in nearly four decades this week before Friday’s unexpectedly strong U.S. jobs report which trimmed nearly 2% off the gold price and over 3% off the silver price.

What central banks giveth, central banks taketh away. Gold enjoyed the best first half in nearly four decades this week before Friday’s unexpectedly strong U.S. jobs report which trimmed nearly 2% off the gold price and over 3% off the silver price.

The U.S. created 255,0000 new jobs in July, outpacing expectations of 185,000, and marking the second-straight healthy jobs figure in a row.

The prospect of the Fed possibly raising rates in September, or signaling a willingness to do so in December, was enough to send money out of gold, silver, copper, platinum, palladium, and oil.

The dollar meanwhile was up 0.5%.

Economic Data And Political Facts: Just Make It Up

by David Kranzler

Investment Research Dynamics

If the Government or the Fed or Hillary Clinton decides they don’t like reality, they just make it up. The BLS fabricates employment numbers, Hillary Clinton fabricates the truth and the Fed invents everything.

Rory Hall’s The Daily Coin has been one of the few alternative media blogs covering the Silk Road and the ongoing changes occurring at the IMF with its SDR. The IMF is looking at issuing a restructured SDR to include the yuan – it looks like it will be called the M-SDR but everything appears to be flux. If you are interested in seeing what is being proposed, take a look at this IMF Staff Note prepared for the G20: The Role Of The SDR

Morgan Stanley Expects Oil To Hit $35 In A Few Weeks: Here’s Why

from Zero Hedge

Morgan Stanley’s Adam Longson has been one of the most bearish sellside analysts on oil, and overnight he confirmed he isn’t going to change his opinion any time soon, and instead warns that while “a profit taking and short covering bounce in oil late in the week has led some to declare that the troubles are behind us” he believes that “very little has been addressed fundamentally to correct these problems. Greater headwinds lay ahead, especially for crude oil. In fact, we would argue that recent price action and developments may have exacerbated the situation.” Putting a number to his call: oil will slide to $35 in the next 1-3 months.

Bernanke Points a Finger

by Chuck Butler

Daily Pfennig

Good Day… And a Tom Terrific Tuesday to you! Boy, getting yesterday’s letter out became a real chore, that I hope to never have to go through again… I basically threw up my hands in the air, and said, “I might as well rewrite the whole letter!” Of course I was exaggerating, and frustrated, which isn’t a good combination for me. When I was a young man, my temper was so bad, and so easily set off, but somewhere along the way, I grew up… I think having kids did that! The Main Ingredient greets me today with their song: Everybody Plays The Fool… I’ve played the fool many a times in my life, but we don’t have to get into that today… HA!

Good Day… And a Tom Terrific Tuesday to you! Boy, getting yesterday’s letter out became a real chore, that I hope to never have to go through again… I basically threw up my hands in the air, and said, “I might as well rewrite the whole letter!” Of course I was exaggerating, and frustrated, which isn’t a good combination for me. When I was a young man, my temper was so bad, and so easily set off, but somewhere along the way, I grew up… I think having kids did that! The Main Ingredient greets me today with their song: Everybody Plays The Fool… I’ve played the fool many a times in my life, but we don’t have to get into that today… HA!

US Treasury Yields Go Negative Everywhere but Here

by John Rubino

Dollar Collapse

Negative interest rates are an existential threat for insurance companies, pension funds and other financial entities that need positive investment returns to survive.

Negative interest rates are an existential threat for insurance companies, pension funds and other financial entities that need positive investment returns to survive.

As rates on government bonds have gone negative in Europe and Japan, the above companies have been big buyers of US Treasury bonds, which still (for some reason) continue to offer positive yields.

But according to a Bloomberg analysis published today, Treasuries’ positive yield has recently evaporated when the cost of hedging currency fluctuations is included. Here’s an excerpt:

Memo to the Donald – Ten Great Deals to Save America

by David Stockman

David Stockman’s Contra Corner

[…] ……Unfortunately, it is too late to reverse the tidal wave of system failure that has been brewing for three decades now. It will soon end in a speculator implosion.

[…] ……Unfortunately, it is too late to reverse the tidal wave of system failure that has been brewing for three decades now. It will soon end in a speculator implosion.

Whether that crisis commences before November 8th or soon thereafter is largely immaterial. If the Trump campaign has the good sense to focus on the gathering economic storm clouds, it’s the one thing that could catalyze an out-with-the-bums uprising across Flyover America on Election Day.

So let us reiterate our thesis even more vehemently. The idea that the American economy has recovered and is returning to an era of healthy prosperity is risible establishment propaganda. It’s the present day equivalent of the Big Lie. It’s the reason why Hillary Clinton’s campaign to validate and extend the current malefic Wall Street/Washington regime is so reprehensible.

Dishonest and Disabled?

by Monty Pelerin

Monty Pelerin’s World

This election year is unlike any other. Both candidates are extremely unpopular. At least one is considered dishonest. But is Hillary dishonest and disabled? Most accept the first characterization and more are wondering about the second.

This election year is unlike any other. Both candidates are extremely unpopular. At least one is considered dishonest. But is Hillary dishonest and disabled? Most accept the first characterization and more are wondering about the second.

In politics, anything seemingly goes. Keeping that in mind, perhaps the following should be taken as a propaganda effort to boost Trump’s chances. Or perhaps it is serious, deadly serious for her and the country.

Gold and Silver – Skating on the Thin Ice

by Dr. Jeffrey Lewis

Silver Coin Investor

“The essence of propaganda consists in winning people over to an idea so sincerely, so vitally, that in the end they succumb to it utterly and can never escape from it.” – Goebbels

Central bank induced inflationary bubbles have succeeded in stoking yet another round of irrational exuberance. Or rather, what sadly boils down to ignorance and hope.

And behold once again the build up of short interest in real money as cracks in the thin ice become more and more obvious.

For gold and silver, a true conception of market risk by a mere cluster of new investors would trigger the final separation of futures from the spot price.