from Bill Still

The Real Reason to Invest in Silver… It’s the Fundamentals

by Steve St. Angelo

SRSRocco Report

The best reason to own silver is based upon underlying market fundamentals. However, most of the markets today aren’t being valued by fundamentals, but rather on Fed and Central Bank interventions. This has destroyed the ability for investors and markets to properly value most assets.

The best reason to own silver is based upon underlying market fundamentals. However, most of the markets today aren’t being valued by fundamentals, but rather on Fed and Central Bank interventions. This has destroyed the ability for investors and markets to properly value most assets.

I, as well as many precious metals analysts have received some ridicule for getting it wrong on the price movements of gold and silver since 2012. Of course, no one was complaining when the silver price moved up from an average $6.67 in 2004 to $35.12 in 2011.

Sure, we precious metals analysts deserve some criticism for not foreseeing how much monetary printing the Fed and Central Banks would do as well as the massive corruption and deceit conducted by the top banks in the world.

Guaranteed Contract Income: A Once-in-a Decade Opportunity

by Zach Scheidt

Daily Reckoning

“Dad! You’re such a control freak!!”

“Dad! You’re such a control freak!!”

No one ever said raising teenage daughters would be easy…

The outburst came after I said no to my 13-year-old daughter’s request to go to a questionable concert. Thankfully, being called a “control freak” didn’t really get under my skin. After all, it’s my job to be in control and make wise decisions for my kids.

Being called a “control freak” may not be your idea of a compliment. But when it comes to managing your investments, it sure pays to be a control freak.

Why “The Grave Dancer” Is Cashing Out Once Again

by Justin Spittler

Casey Research

Sam Zell has called the top again…

Sam Zell has called the top again…

Zell is a real estate mogul and self-made billionaire. He made a fortune buying property for pennies on the dollar during recessions in the 1970s and 1990s. This earned him the nickname “The Grave Dancer.”

Zell was also one of the only real estate gurus to spot the last property bubble and get out before it popped. In February 2007, he sold $23 billion worth of office buildings. U.S. commercial property prices peaked nine months later and went on to plunge 42%.

Aussie Dollar Plunges As Inflation Slumps To Record Low

from Zero Hedge

Despite surging commodity prices in China – which must be real and represent demand growth and price increases, right? – Aussie core inflation slowed to the weakest on record as headline prices unexpectedly fell last quarter (CPI -0.2%). RBA Rate-cut odds tripled instantly sending AUD down over 1.2% (its biggest drop in 2 months). Perhaps, just perhaps, that collossal credit injection in Q1 via China did not make it into the AsiaPac economy after all and merely fueled a speculative frenzy in commodities that merely “looks” like a recovery?

The Reserve Bank of Australia looks at two core inflation measures — trimmed mean and weighted median — and Wednesday’s report showed:

The FOMC’s Cirque du Merde

by David Kranzler

Investment Research Dynamics

Silver continues to trade DIFFERENTLY, in a positive manner that it has not done in YEARS. The potential for the silver price to explode in the very near future is all there. The shares continue to maintain their own positive tone and refuse to give up much ground on corrections. – Bill Murphy from GATA’s Midas report

Nearly the entire precious metals investing community looks at the Comex options expiration and the Fed’s FOMC meetings with trepidation, as historically those two events have triggered a massive Comex paper attack on the price of the metals. Having both events back to back in the same week elicits even more fear. Of course, Goldman Sachs commodities clown, Jeffrey Currie, was on CNBC again today calling for $1000 gold. This guy has absolutely no shame about continuously making an idiot of himself with his price predictions for gold.

How To Become a Perpetual Traveler/Prior Taxpayer (PT) And Legally Never Pay Tax Again

by Jeff Berwick

Dollar Vigilante

I was recently on Truth Is Stranger Than Fiction where we discussed how to live as a Perpetual Traveler/Prior Taxpayer (PT).

Living the PT lifestyle is not as hard as it may seem. In fact, in today’s day and age it is quite easy. And it has the benefit of being able to live as freely as possible and legally not be obligated to pay taxes in any jurisdiction.

In fact, during the show, I told the host how easy it would be for him to do it… and he was shocked. You can see it here:

Market Talk – April 26th, 2016

by Martin Armstrong

Armstrong Economics

Unfortunately, it was just the Nikkei that prevented a positive “clean-sweep” for core Asian indices today. The Nikkei remains nervous ahead of the BOJ despite the JPY showing no signs of reversing its recent weakness, as YTD it remains down 7.5%. China and Hang Seng both saw late rallies take them back into positive territory closing +0.5% higher on the day. A weaker JPY has boosted the Nikkei this evening and so in late US trading the Nikkei joins the rally (currently up 1%).

Unfortunately, it was just the Nikkei that prevented a positive “clean-sweep” for core Asian indices today. The Nikkei remains nervous ahead of the BOJ despite the JPY showing no signs of reversing its recent weakness, as YTD it remains down 7.5%. China and Hang Seng both saw late rallies take them back into positive territory closing +0.5% higher on the day. A weaker JPY has boosted the Nikkei this evening and so in late US trading the Nikkei joins the rally (currently up 1%).

Federal Reserve Appointees and Their Campaign Contributions

by Paul-Martin Foss

Mises.org

Federal Reserve Board Governor Lael Brainard’s campaign contributions are in the news today, as she recently maxed out her contributions to Hillary Clinton’s presidential campaign. According to CNBC, Brainard is the only Federal Reserve Board Governor since 1990 to donate to a presidential campaign. While it isn’t illegal for Fed Governors to contribute to political campaigns, Fed officials have avoided making such contributions in order to avoid the appearance of impropriety and avoid compromising the Fed’s claims of political independence.

Harvey Organ’s Daily Gold & Silver Report – 2016.04.26

Comex silver hits its all time open interest high at 206,000 contracts despite a low price/China continues to have USA dollar outflows: IIF expects this yr almost 600 billion USA dollarrs will leave Chinese shores/Chinese steel and Iron ore prices falter badly in China/Richmond mfg fed index falls badly as does USA consumer confidence/Apple and Twitter disappoint badly and thus the markets will open badly tomorrow

by Harvey Organ

Harvey Organ’s Blog

[…] Today we got a little surprise in that gold rebounded from its lows to close at $1243.20 at comex closing time and silver was up 11 cents at $17.11 The comex options expiry had little effect on both metals. In silver, we now have an all time high in silver OI at 206,037 which represents 1.03 billion oz. Generally when you get a record high OI, you also have high prices for your commodity. In silver in blows my mind that we have a record OI and a low price of silver. It shows you the damage that the bankers inflicted upon us.

[…] Today we got a little surprise in that gold rebounded from its lows to close at $1243.20 at comex closing time and silver was up 11 cents at $17.11 The comex options expiry had little effect on both metals. In silver, we now have an all time high in silver OI at 206,037 which represents 1.03 billion oz. Generally when you get a record high OI, you also have high prices for your commodity. In silver in blows my mind that we have a record OI and a low price of silver. It shows you the damage that the bankers inflicted upon us.

Please remember that even though comex options have expired we still have London’s LBMA and OTC to contend with. They expire on Friday morning.

Wayne Allyn Root – Everything’s Coming Up Trump

from Financial Survival Network

Wayne Allyn Root has been a big Trump supporter almost from the get go. Now we’re getting down to the final lap and Trump is looking like the winner. Of course in politics as in sports, it all comes down to not taking anything for granted and not resting until the prize is won. But Cruz and Kasich have real issues and their attempt at a alliance is having unintended negative consequences. And it may not matter in the end, Trump is coming on strong, with his likely sweep of 5 primaries today. Be prepared for Republican Nominee Trump. And get ready for Crooked Hillary!

Wayne Allyn Root has been a big Trump supporter almost from the get go. Now we’re getting down to the final lap and Trump is looking like the winner. Of course in politics as in sports, it all comes down to not taking anything for granted and not resting until the prize is won. But Cruz and Kasich have real issues and their attempt at a alliance is having unintended negative consequences. And it may not matter in the end, Trump is coming on strong, with his likely sweep of 5 primaries today. Be prepared for Republican Nominee Trump. And get ready for Crooked Hillary!

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

G. Edward Griffin – A Crash Course on Money & Freedom (Episode #664)

We are rapidly losing our freedom, so says G. Edward Griffin.

We are rapidly losing our freedom, so says G. Edward Griffin.

Griffin is the author of the seminal work The Creature from Jekyll Island, he is the President of the American Media/Reality Zone and the force behind the Freedom Force International Movement.

This is Mr. Griffin’s third time on Creating Wealth.

He shares his wealth of information on the beginning of the Federal Reserve, the way our freedom is being depleted and the monetary scam which is our un-repayable debt.

Just go to JasonHartman.com and get started now!

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

Keith Neumeyer: Silver, More Rare Than the Market Understands

by Rory

The Daily Coin

For the past three plus years I have been asking how silver and gold have always been available when we can see stress in the markets all through the supply chain. According to several prominent analyst, and producers, global silver and gold production declined in 2015. In Mexico alone silver production is down approximately 6%. According to some of the information that we reviewed, here at The Daily Coin, silver production increased due to the low price of silver.

For the past three plus years I have been asking how silver and gold have always been available when we can see stress in the markets all through the supply chain. According to several prominent analyst, and producers, global silver and gold production declined in 2015. In Mexico alone silver production is down approximately 6%. According to some of the information that we reviewed, here at The Daily Coin, silver production increased due to the low price of silver.

Silver has become a just-in-time product. With Eric Sprott, Sprott Assets, recently announcing a $5 billion addition of physical silver to the PSLV ETF we shall see what is happening with the silver market at the institutional level.

Keith Neumeyer also explains how a large electronics manufacturer recently contacted his company, First Majestic, regarding the acquisition of silver for their manufacturing processes. This screams of a very, very tight supply of silver in large quantities. Where is metal coming from?

Self-Professed Time-Traveller Pretty Sure He’ll Win U.S. Presidency

from Toronto Sun

If Donald Trump or Hillary Clinton don’t resonate with American voters, they always have Andrew Basiago — a presidential candidate who is pretty sure he’s going to become “either president or vice-president” between 2016 and 2028, according to information he’s gathered time travelling.

If Donald Trump or Hillary Clinton don’t resonate with American voters, they always have Andrew Basiago — a presidential candidate who is pretty sure he’s going to become “either president or vice-president” between 2016 and 2028, according to information he’s gathered time travelling.

Cheekily calling his campaign “a time for truth,” Basiago, 54, brags on his site that he “served bravely in the two secret U.S. defence projects in which time travel on Earth and voyages to Mars were first undertaken.”

Basiago — who has made similar claims in the past — also said he’s helped several former presidents make important decisions by gathering knowledge through time travelling. Now it’s his turn.

Uncertain Measures of Uncertainty; Fed Uncertainty Principle Revisited

by Mike ‘Mish’ Shedlock

Mish Talk

Fed Chair Janet Yellen has been harping about the “uncertain” outlook for the US economy for years on end.

Perhaps this was inspiration for economists to devise an absurd new index that allegedly measures the amount of uncertainty in the economy.

Before diving into measures of uncertainty, let’s view a few Yellen uncertainty citations.

The Only Android Phone You Should Buy

by Karl Denninger

Market-Ticker.org

I’ve been under an NDA and thus couldn’t post this for a while, but with the now-released Marshmallow update for the Priv BlackBerry has elevated itself to being the only Android-based smartphone you can purchase if you have any concern for actual security.

Let me explain.

Security is always a balance between hassle and safety.

That is, you can always design an extremely secure paradigm for something, but as you do so the hassle factor tends to increase. At a certain point people say “**** it” and start cheating. This is why “password re-use rules” tend to get violated by the user putting a sticky note on their terminal, for example; if you say “must be 10+ character, must contain at least one number, one special character and both upper and lower case alpha, and must not be any of the last 10 passwords” you’re inviting the user to write it down.

Decline of the Anglosphere is the Result of Deliberate Planning

by Daily Bell Staff

The Daily Bell

Barack Obama and the end of the Anglosphere … When supporters of the Vote Leave campaign sketch out a future for Britain outside the EU, they often point to the Anglosphere of English-speaking nations — bequeathed by Britain’s imperial past. So Barack Obama’s intervention in Britain’s EU referendum last week was a potentially devastating moment for the Brexit campaign. – Financial Times

This fascinating article openly explores the diminishment of Anglosphere power. It is especially important because it positions the subsiding as an evolutionary trend rather than what it really is: a deliberate policy.

And it does so within the context of Brexit – the upcoming vote in Britain on whether or not to stay in the EU.

But the article’s ramifications go far beyond Brexit. It is as if the topic of Brexit is being used as a launching platform to present a much larger repositioning of the Anglosphere itself.

Peter Boockvar – Inflation is Going to Massively Impact the World in 2016

from King World News

Inflation is going to massively impact the world in 2016!

Inflation is going to massively impact the world in 2016!

Peter Boockvar: Following the poor 2 year note auction yesterday, the 5 year auction was just mediocre. The yield was above the when issued and the bid to cover was below the 12 month average. The upside was in the level of direct and indirect bidders which took about 70% of the auction vs the one year average of 66%…

[…] Peter Boockvar continues: Bottom line, US Treasury yields have been on the rise and it’s not because the economic data has improved.

Could Trump Beat Clinton in New York? Yes.

by Michael Krieger

Liberty Blitzkrieg

[…] I continue to see Hillary Clinton as one of the most overrated political figures in American history, and Donald Trump as one of the most underrated. This is why I think “the experts” are wrong about the outcome of a potential Clinton vs. Trump showdown in the general election.

[…] I continue to see Hillary Clinton as one of the most overrated political figures in American history, and Donald Trump as one of the most underrated. This is why I think “the experts” are wrong about the outcome of a potential Clinton vs. Trump showdown in the general election.

Hillary’s weaknesses are obvious. I’ve highlighted new shameless transgressions or scandals on these pages virtually every day for several months now. Furthermore, the fact that the grassroots campaign juggernaut known as the Sanders movement seemingly came out of nowhere, proves there’s a huge ideological vacuum on left just asking to be filled in light of Clinton’s neoconservative candidacy.

Report: Cyber Attackers Infect Nuclear Power Plant Systems With Computer Virus

by Mac Slavo

SHTF Plan

The threat of a large-scale terrorist attack caused by chemical, biological, radiological or nuclear weapons of mass destruction has been at the forefront of investigations in recent months, so much so that in March the White House issued a warning highlighting the four most likely scenarios for a nuclear attack on U.S. soil.

Following the attack in Brussels earlier this year it was learned that terrorists had not only targeted nuclear facilities in Belgium, but that the chief of the power plant in question had been staked out, recorded and followed. A security guard at the nuclear plant also died under mysterious circumstances.

Now, according to a report from Zero Hedge, another nuclear plant has been targeted, this time with a virus that has infected its computer systems:

Is Your Grandma Smoking Weed?

Investing in Marijuana Trends

by Jimmy Mengel

Outsider Club

My grandmother sent me an email this week…

My grandmother sent me an email this week…

The fact that she emailed me wasn’t strange — we email each other all the time. She’s a sophisticated lady, who is always turning me onto hip food trends, Netflix documentaries, and even makes an occasional appearance on Facebook. But it was the topic of the email that really resonated with me, as it was one that we had never discussed before.

You see, she had read one of my articles on the benefits of medical marijuana, and the huge investment possibilities of such a new, exciting industry. Now, like any doting grandma, she told me how proud she was and how much she enjoyed my writing. But what she said next was very interesting… and it’s the reason I’m even writing about it in the first place.

Home Prices Rose 5.3% Year-Over-Year in February

by Jill Mislinski

Financial Sense

With today’s release of the February S&P/Case-Shiller Home Price, we learned that seasonally adjusted home prices for the benchmark 20-city index were up month over month at 0.7%. The seasonally adjusted year-over-year change has hovered between 4.8% and 5.7% for the last twelve months.

With today’s release of the February S&P/Case-Shiller Home Price, we learned that seasonally adjusted home prices for the benchmark 20-city index were up month over month at 0.7%. The seasonally adjusted year-over-year change has hovered between 4.8% and 5.7% for the last twelve months.

The adjacent column chart illustrates the month-over-month change in the seasonally adjusted 20-city index, which tends to be the most closely watched of the Case-Shiller series. It was up 0.7% from the previous month. The nonseasonally adjusted index was up 5.4% year-over-year.

Investing.com had forecast a 0.8% MoM seasonally adjusted increase and 5.5% YoY nonseasonally adjusted for the 20-city series.

The “Fracklog Trigger”: Why 500,000 Barrels of Shale Crude Could Hit the Market at Any Moment

from Zero Hedge

Yesterday, when reading through Pioneer’s results we stumbled on something unexpected: not only was the company pumping more than its had previously guided, but announced it was waiting for $50/barrel to reactivate five to ten horizontal drilling rigs. To wit:

- producing 222 thousand barrels oil equivalent per day (MBOEPD), of which 55% was oil; production grew by 7 MBOEPD, or 3%, compared to the fourth quarter of 2015, and was significantly above Pioneer’s first quarter production guidance range of 211 MBOEPD to 216 MBOEPD; oil production grew 10 thousand barrels oil per day during the quarter, or 9%, compared to the fourth quarter;

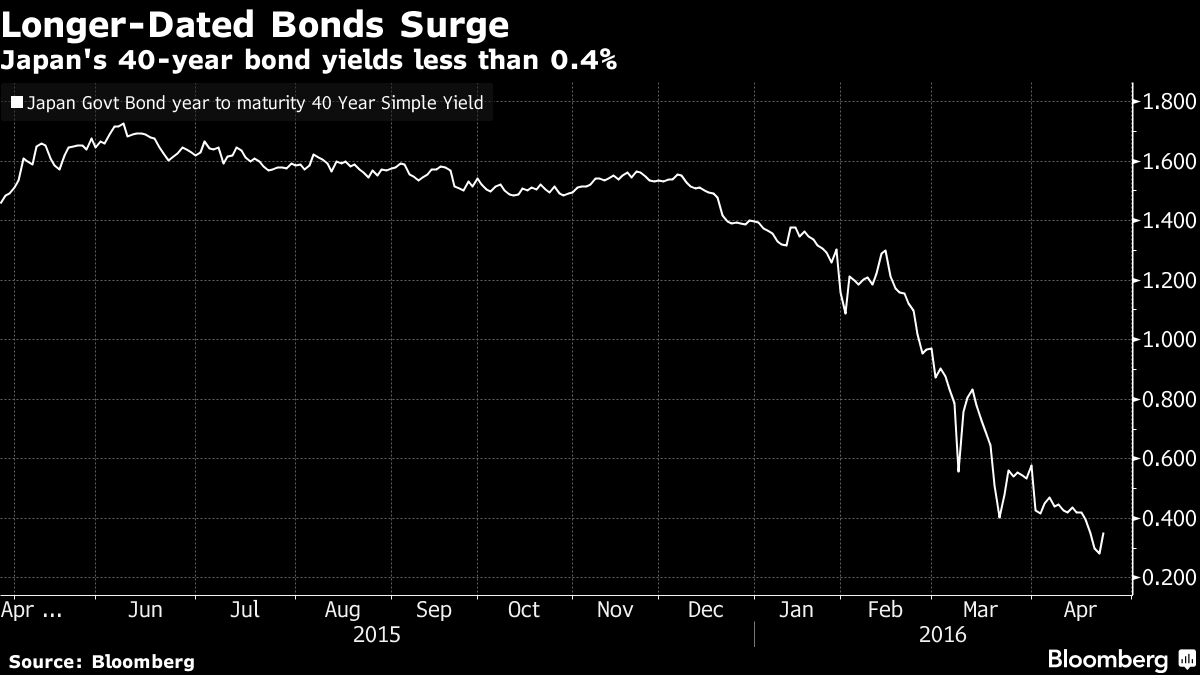

It’s Dangerous Out There in the Bond Market

by Anchalee Worrachate and Anooja Debnath

Bloomberg.com

Bond investors are taking bigger risks than ever before.

Bond investors are taking bigger risks than ever before.

Yields on $7.8 trillion of government bonds have been driven below zero by worries over global growth, meaning money managers looking for income are pouring into debt with maturities of as long as 100 years. Central banks’ policy is exacerbating matters, as the unprecedented debt purchases to spur their economies have soaked up supply and left would-be buyers with few options.

[…] While demand has shown few signs of abating, investors are setting themselves up for damaging losses if average yields rise even a little from their rock-bottom levels. Based on a metric called duration, a half-percentage point increase would result in a loss of about $1.6 trillion in the global bond market, according to calculations based on data compiled by Bank of America Corp.