The UK Supreme Court is emerging as the chief line of resistance against EU hegemony

by Ambrose Evans-Pritchard

Telegraph.co.uk

The British judiciary has begun to draw its sword. For the first time since the European Court asserted supremacy and launched its long campaign of teleological conquest, our own judges are fighting back.

The British judiciary has begun to draw its sword. For the first time since the European Court asserted supremacy and launched its long campaign of teleological conquest, our own judges are fighting back.

It is the first stirring of sovereign resistance against an imperial ECJ that acquired sweeping powers under the Lisbon Treaty, and has since levered its gains to claim jurisdiction over almost everything.

What has emerged is an EU supreme court that knows no restraint and has been captured by judicial activists – much like the US Supreme Court in the 1970s, but without two centuries of authority and a ratified constitution to back it up.

Chris welcomes Robert Kiyoaski, America’s ‘Rich Dad’ back to the show – he just added $1 million of gold to his Fort Knox sized stockpile. The author of Second Chance: for Your Money, Your Life and Our World (2015) and the Rich Dad book series author also penned two books with Presidential candidate, Donald Trump:, Why We Want You to Be Rich and The Midas Touch meant to guide the middle and working classes to prosperity. The discussion includes comments from the former Fed Chairman, Alan Greenspan, who noted in a recent TV interview that the US could face martial law, in similar fashion as Venezuela, formerly the economic powerhouse of South America. The $700 million to $3 trillion spent to bailout the US financial system in 2008-2009 Credit Crisis was sufficient to payoff the mortgage debt of the 10 million US foreclosures with money left over – instead it was directed to the financial system, primarily to the benefit of shareholders / bondholders.

Chris welcomes Robert Kiyoaski, America’s ‘Rich Dad’ back to the show – he just added $1 million of gold to his Fort Knox sized stockpile. The author of Second Chance: for Your Money, Your Life and Our World (2015) and the Rich Dad book series author also penned two books with Presidential candidate, Donald Trump:, Why We Want You to Be Rich and The Midas Touch meant to guide the middle and working classes to prosperity. The discussion includes comments from the former Fed Chairman, Alan Greenspan, who noted in a recent TV interview that the US could face martial law, in similar fashion as Venezuela, formerly the economic powerhouse of South America. The $700 million to $3 trillion spent to bailout the US financial system in 2008-2009 Credit Crisis was sufficient to payoff the mortgage debt of the 10 million US foreclosures with money left over – instead it was directed to the financial system, primarily to the benefit of shareholders / bondholders. As the June 23rd BREXIT (the UK-wide referendum to leave the EU) vote draws near, the polls indicate a close result. Those urging a vote for the UK to remain inside the EU are suggesting increasingly dire economic consequences that would follow a yes vote by the British people to leave. Voices from London, Brussels, and Washington have all put immense pressure on British voters to bend to the will of the elites. To listen to their commentary one would think that apocalypse was just around the corner. But is there any substance to their warnings?

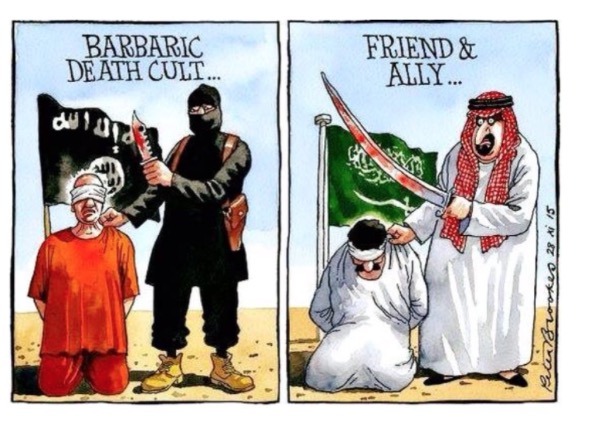

As the June 23rd BREXIT (the UK-wide referendum to leave the EU) vote draws near, the polls indicate a close result. Those urging a vote for the UK to remain inside the EU are suggesting increasingly dire economic consequences that would follow a yes vote by the British people to leave. Voices from London, Brussels, and Washington have all put immense pressure on British voters to bend to the will of the elites. To listen to their commentary one would think that apocalypse was just around the corner. But is there any substance to their warnings? Saudi Arabia has banned financial products that amount to a short-position against the rial. The measure indicates high degree to which the peg is starting to come under attack. The government has announced a wave of layoffs in the public sector. This is an absolute first. The Middle East was considered beyond economics because of oil. Everything is changing.

Saudi Arabia has banned financial products that amount to a short-position against the rial. The measure indicates high degree to which the peg is starting to come under attack. The government has announced a wave of layoffs in the public sector. This is an absolute first. The Middle East was considered beyond economics because of oil. Everything is changing.

Hope to ever get out of debt in your lifetime? Hope that these guys don’t find you first.

Hope to ever get out of debt in your lifetime? Hope that these guys don’t find you first.

With the Dow up a mere 66 points on Wednesday, the stock market appeared to be marking time ahead of the next buying binge.

With the Dow up a mere 66 points on Wednesday, the stock market appeared to be marking time ahead of the next buying binge.

Imagine the immense stack of papers that accompanies a home purchase closing.

Imagine the immense stack of papers that accompanies a home purchase closing. It’s official. The bear market in commodities is over…

It’s official. The bear market in commodities is over… It’s all about uncertainty. From the now very real prospect of a Trump presidency to the still greater likelihood of Brexit – which could in turn trigger a domino effect of Eurosceptic rebellion across Europe – rarely has the political landscape looked quite so turbulent, unpredictable and therefore threatening to economic stability as it does now.

It’s all about uncertainty. From the now very real prospect of a Trump presidency to the still greater likelihood of Brexit – which could in turn trigger a domino effect of Eurosceptic rebellion across Europe – rarely has the political landscape looked quite so turbulent, unpredictable and therefore threatening to economic stability as it does now. Later this week, dozens of the most important men in the world are going to gather at an ultra-luxury hotel in Dresden, Germany to discuss the future of the planet. What will happen at this meeting will not be televised, and the mainstream media in the United States will almost entirely ignore it, but decisions will be made at this conference that will affect the lives of every man, woman and child on the entire globe. Of course I am talking about the Bilderberg Group, and for decades you were labeled a “conspiracy theorist” if you even acknowledged that it existed.

Later this week, dozens of the most important men in the world are going to gather at an ultra-luxury hotel in Dresden, Germany to discuss the future of the planet. What will happen at this meeting will not be televised, and the mainstream media in the United States will almost entirely ignore it, but decisions will be made at this conference that will affect the lives of every man, woman and child on the entire globe. Of course I am talking about the Bilderberg Group, and for decades you were labeled a “conspiracy theorist” if you even acknowledged that it existed. We know that central banks and governments have lost the plot. When the crisis started in 2006, U.S. short rates were 5%. In 2008 they were down to zero and have virtually stayed there ever since.

We know that central banks and governments have lost the plot. When the crisis started in 2006, U.S. short rates were 5%. In 2008 they were down to zero and have virtually stayed there ever since. Is the job market for professionals unraveling?

Is the job market for professionals unraveling? Gold is rallying again. The dollar’s not.

Gold is rallying again. The dollar’s not. During this week’s precious metals update, Tom Cloud discusses what it was really like during the Hunt Brothers silver buying spree and the 1980’s Silver Mania. Tom also answers several questions about the silver retail market and shares what precious metals products his big clients have been buying.

During this week’s precious metals update, Tom Cloud discusses what it was really like during the Hunt Brothers silver buying spree and the 1980’s Silver Mania. Tom also answers several questions about the silver retail market and shares what precious metals products his big clients have been buying.