by Nathan Bond

Mises.org

Nathan Bond, 30, is an entrepreneur and the cofounder of Rifle Paper Co., based in Winter Park, Florida. Founded in 2009, the company has since expanded worldwide. We recently spoke with Bond about his support for the Mises Institute and how Austrian economics has impacted the way he does business.

THE AUSTRIAN: How did you first discover the Mises Institute?

NATHAN BOND: I believe it was sometime around 2008 following the housing bubble. I was in my early 20s at the time and trying to make sense of the situation, and the Mises Institute as well as fellow travelers in Austrian economic circles seemed to be the only ones who had any truly developed (or at least convincing) work on why booms and busts even happen. From there, I was immediately taken in by how engaging the material was and refreshed to discover an economic methodology that puts the emphasis on human behavior and the choices of individuals rather than a bunch of aggregates.

TA: Why did you decide that the Mises Institute was something you wanted to support?

Be afraid… be very afraid…

Be afraid… be very afraid…

NOTE TO READERS

NOTE TO READERS Arbitrage is simple. It’s either buying something and selling it for more, or creating something from virtually nothing — and using that massive arbitrage opportunity to create wealth.

Arbitrage is simple. It’s either buying something and selling it for more, or creating something from virtually nothing — and using that massive arbitrage opportunity to create wealth. August may be a big month for the metals, and we could see a taste of things to come next week with a Comex PM option expiry and an FOMC decision.

August may be a big month for the metals, and we could see a taste of things to come next week with a Comex PM option expiry and an FOMC decision. The world’s biggest economy is unraveling.

The world’s biggest economy is unraveling. […] UK economy contracts at steepest pace since 2009

[…] UK economy contracts at steepest pace since 2009 […] I just finished watching Trump’s entire acceptance speech and I have all sorts of thoughts to share. Let’s start with the overall picture. First, the speech confirmed all the reasons I cannot support Trump, but also further solidified why I think it’s very possible that he will win and become President. The speech was disturbing on multiple levels, while at the same time brilliant from a manipulative and salesmanship standpoint. He held my attention for the entire 75 minutes. Can you imagine for a moment Hillary doing the same thing? Yes, it matters.

[…] I just finished watching Trump’s entire acceptance speech and I have all sorts of thoughts to share. Let’s start with the overall picture. First, the speech confirmed all the reasons I cannot support Trump, but also further solidified why I think it’s very possible that he will win and become President. The speech was disturbing on multiple levels, while at the same time brilliant from a manipulative and salesmanship standpoint. He held my attention for the entire 75 minutes. Can you imagine for a moment Hillary doing the same thing? Yes, it matters.

I am not quite the grandmaster at the classic board game chess, but I do enjoy playing and teaching the game to my kids.

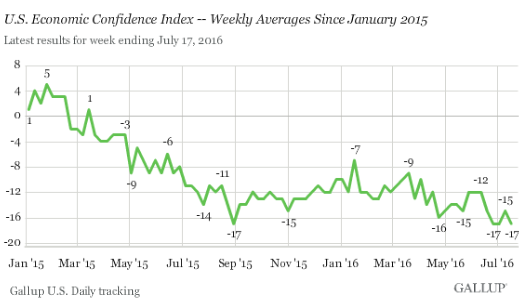

I am not quite the grandmaster at the classic board game chess, but I do enjoy playing and teaching the game to my kids. Gallup releases an Economic Confidence Index which should reflect the overall sentiment of Americans as it pertains to the economy. With the stock market near record highs and the housing bubble market soaring, you would expect average Americans to be smiling from ear to ear with glee. But when you click on over to Gallup, the chart looks downright gloomy like finding out you just failed a midterm exam you studied so hard for. While Gallup may be stumped and scratching their head as to why this divergence is there, I feel we have touched upon a few points as to why this is occurring. First, half of Americans don’t even own one stock. Next, you have many U.S. companies making large profits abroad. Good for the company but that doesn’t translate necessarily into a better financial position for most Americans. Housing values being inflated only keeps Americans from buying as reflected in a generationally low homeownership rate. In other words, crony capitalism is working as it should.

Gallup releases an Economic Confidence Index which should reflect the overall sentiment of Americans as it pertains to the economy. With the stock market near record highs and the housing bubble market soaring, you would expect average Americans to be smiling from ear to ear with glee. But when you click on over to Gallup, the chart looks downright gloomy like finding out you just failed a midterm exam you studied so hard for. While Gallup may be stumped and scratching their head as to why this divergence is there, I feel we have touched upon a few points as to why this is occurring. First, half of Americans don’t even own one stock. Next, you have many U.S. companies making large profits abroad. Good for the company but that doesn’t translate necessarily into a better financial position for most Americans. Housing values being inflated only keeps Americans from buying as reflected in a generationally low homeownership rate. In other words, crony capitalism is working as it should. In the wake of continued consolidation in the gold and silver markets, today one of the legendary traders in the business told King World News that gold and silver are going to shock people on the upside as $630 trillion in derivatives meltdown.

In the wake of continued consolidation in the gold and silver markets, today one of the legendary traders in the business told King World News that gold and silver are going to shock people on the upside as $630 trillion in derivatives meltdown. Silver’s young bull market got off to a typically-slow start, lagging gold’s own new bull. But recently the white metal surged to catch up in a record summer rally. That left silver very overbought and facing near-term correction risks led by a record futures selling overhang and weak late-summer seasonals. But this strengthening bull still has a long ways higher to run yet before silver prices reflect prevailing gold levels.

Silver’s young bull market got off to a typically-slow start, lagging gold’s own new bull. But recently the white metal surged to catch up in a record summer rally. That left silver very overbought and facing near-term correction risks led by a record futures selling overhang and weak late-summer seasonals. But this strengthening bull still has a long ways higher to run yet before silver prices reflect prevailing gold levels. Oil prices sank on Thursday following fresh data showing oil and product stocks rising to an all-time high.

Oil prices sank on Thursday following fresh data showing oil and product stocks rising to an all-time high. Hyperventilating Minds

Hyperventilating Minds The three main rating agencies—Fitch, Moody’s, and Standard and Poor’s—all went on a downgrading spree in the first half of 2016. So far this year, Standard and Poor’s has downgraded 16 sovereigns, Moody’s has downgraded 24, and Fitch’s has downgraded 15. All of these represent significant increases over downgrades for 2015, and with many countries on negative watch and marked as proximate downgrade risks, 2016 could well see more negative rating activity on sovereigns than 2011 did (the last high-water mark).

The three main rating agencies—Fitch, Moody’s, and Standard and Poor’s—all went on a downgrading spree in the first half of 2016. So far this year, Standard and Poor’s has downgraded 16 sovereigns, Moody’s has downgraded 24, and Fitch’s has downgraded 15. All of these represent significant increases over downgrades for 2015, and with many countries on negative watch and marked as proximate downgrade risks, 2016 could well see more negative rating activity on sovereigns than 2011 did (the last high-water mark). I was recently looking at the CNN money website where they post this fear & green index. I caught my attention because many other aspects of the market are now also showing signs an imminent correction in the stock market.

I was recently looking at the CNN money website where they post this fear & green index. I caught my attention because many other aspects of the market are now also showing signs an imminent correction in the stock market. Gold’s rise to $2,000 is inevitable.

Gold’s rise to $2,000 is inevitable. Another week… another terrorist attack in Europe.

Another week… another terrorist attack in Europe.

Readers of these commentaries are used to seeing original work. While sources are cited (for reference purposes) to substantiate the analysis contained in these pieces, the analysis itself is always original. Why, then, base a critique of BitGold primarily on the observations of Peter Schiff? Because Peter Schiff has now entered into a business partnership with BitGold, a mere four months after producing a scathing audio clip, where he articulated numerous issues with this company and its business model.

Readers of these commentaries are used to seeing original work. While sources are cited (for reference purposes) to substantiate the analysis contained in these pieces, the analysis itself is always original. Why, then, base a critique of BitGold primarily on the observations of Peter Schiff? Because Peter Schiff has now entered into a business partnership with BitGold, a mere four months after producing a scathing audio clip, where he articulated numerous issues with this company and its business model. France’s top court has ruled that Christine Lagarde, the managing director of the International Monetary Fund, must stand trial in France for her handling of a dispute during her time as French finance minister.

France’s top court has ruled that Christine Lagarde, the managing director of the International Monetary Fund, must stand trial in France for her handling of a dispute during her time as French finance minister.