from FutureMoneyTrends

Goldman Boss ‘Scared to Death’ of Rogue Employees

by Ben Martin

Telegraph.co.uk

The boss of Goldman Sachs has admitted that he is “scared to death” that the Wall Street giant will become mired in a scandal caused by a rogue staff member.

The boss of Goldman Sachs has admitted that he is “scared to death” that the Wall Street giant will become mired in a scandal caused by a rogue staff member.

Lloyd Blankfein told CNN that the rules governing banks were now very tight and that his main concern was that Goldman would be hurt by the misbehaviour of an employee.

“The world wants me to be scared to death of that and they want me to be vigilant at the end of the day, and they’ve accomplished their purpose,” he said in an interview. “They have me on edge all the time.”

End of Gasoline Powered Autos by 2030?

by Mike ‘Mish’ Shedlock

Mish Talk

Earlier this month, the German Bundesrat voted to ban new gasoline- or diesel-powered vehicles from EU roads starting in 2030.

Days later, the German Transport Minister Calls Internal Combustion Ban “Utter Nonsense”.

Let’s take a look at both stories. […]

German Government Votes to Ban Internal Combustion Engines by 2030

Members of the German government have just passed a resolution to ban the sale of internal combustion engines in the European Union by 2030. Only zero-emissions vehicles would be allowed on the market after that time, according to the resolution.

The resolution was passed in Germany’s Bundesrat, the nation’s legislative body representing the sixteen German states, with across-the-aisle support.

This Is How WaPo’s Latest Poll Gave Hillary A 12 Point Advantage Over Trump

from Zero Hedge

Those waking up to read the news this morning will undoubtedly be “shocked” by the latest ABC / Washington Post goal seeking report (aka “poll”) that shows Hillary opening up a 12-point lead with likely voters after the latest debate last Wednesday. Ironically, this latest polling farce was “embargoed for release after 9 a.m.” EST which will certainly make it a dominant topic of conversation on all the morning talk shows.

Of course, like many of the recent polls from the likes of Reuters, ABC and The Washington Post, something curious emerges when you look just beneath the surface of the headline 12-point lead.

Rigged

by Robert Gore

Straight Line Logic

One truth the best and the brightest of our founding fathers knew in their bones: government would always be the preeminent threat to individual security, prosperity, liberty, and happiness. Strip away the irrelevant dross and history boiled down to one theme: the individual versus the state. Government, an institution gestated in fear of violence, inevitably uses the violent power that it has either wrested for itself or has been granted against its supposed beneficiaries.

One truth the best and the brightest of our founding fathers knew in their bones: government would always be the preeminent threat to individual security, prosperity, liberty, and happiness. Strip away the irrelevant dross and history boiled down to one theme: the individual versus the state. Government, an institution gestated in fear of violence, inevitably uses the violent power that it has either wrested for itself or has been granted against its supposed beneficiaries.

The founders knew that human nature never changes, that those in control of a government would inevitably be corrupted by their power and employ it to their own design and advantage.

I Went to a Wells Fargo Branch, This is What Happened Next

by Wolf Richter

Wolf Street

They have learned nothing.

They have learned nothing.

I walked into my Wells Fargo branch to put my data backup into my safe deposit box, as I’ve been doing for a decade. This routine business turned into a wake-up call about safe deposit boxes and churned up insights into how Wells Fargo conducts to this day its cross-selling efforts: the algo makes them do it!

To clarify, I’m a happy customer. Wells Fargo handles day-to-day banking for me and my vast WOLF STREET media-mogul-empire corporation. The people are nice, and I have not yet noticed any fraudulent accounts in my name.

The Suburban Ghetto

Today one in three poor Americans, about 16.4 million people live in the suburbs.

from My Budget 360

We tend to think of the suburbs as middle class utopias. When people think of the American Dream they usually draw up a picture of a home with a picket white fence in the suburb. Poverty is usually left to inner cities and crammed multi-family dwellings. So it might come as a surprise that over the last decade the fastest growing segment of poverty occurred in the suburbs. It occurred in this market as people were driven out of city centers where prices surged and people were driven further outside of the city. In the past, this push out was usually done by choice for quality of life and family purposes. This time, it has happened by economic force and poverty in the suburbs is exploding. This goes hand in hand with the shrinking middle class.

We tend to think of the suburbs as middle class utopias. When people think of the American Dream they usually draw up a picture of a home with a picket white fence in the suburb. Poverty is usually left to inner cities and crammed multi-family dwellings. So it might come as a surprise that over the last decade the fastest growing segment of poverty occurred in the suburbs. It occurred in this market as people were driven out of city centers where prices surged and people were driven further outside of the city. In the past, this push out was usually done by choice for quality of life and family purposes. This time, it has happened by economic force and poverty in the suburbs is exploding. This goes hand in hand with the shrinking middle class.

Why Being “Certain” Is Your Portfolio’s Worst Nightmare

by Avi Gilburt

Gold Seek

How many of you approach life expecting “certainty?” How many of you always see all your plans through life work out exactly as you had expected? Think back to just the past year alone, and ask yourself how well those things you were so “certain” of last year have worked out.

How many of you approach life expecting “certainty?” How many of you always see all your plans through life work out exactly as you had expected? Think back to just the past year alone, and ask yourself how well those things you were so “certain” of last year have worked out.

Anyone who has any experience in life knows that life, by definition, is simply uncertain. I will give you a personal example. I was lucky enough to marry an incredibly wonderful woman, who also happened to be eight years younger than me. And, of course, we were looking forward to a long wonderful life together, and I fully, and “reasonably,” expected her to outlive me to the difference in our ages. Yet, in an extremely unfortunate turn of circumstances, she contracted a very rare form of cancer when the youngest of our four children was 11 days old, which ultimately took her life.

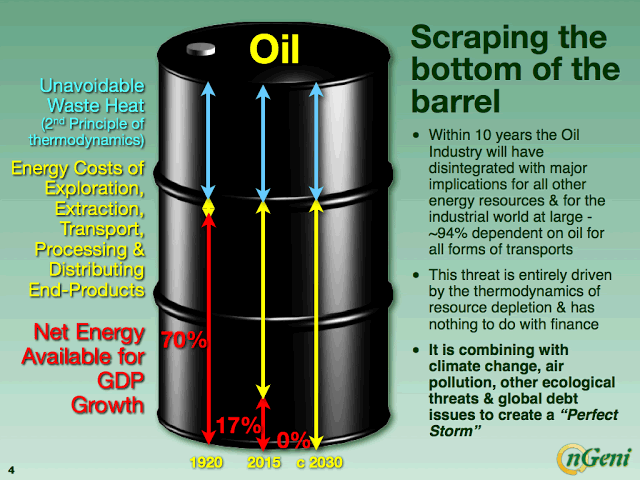

Why the Global Economy Will Disintegrate Rapidly Back to Olduvai Gorge

by Raul I. Meijer

Market Oracle

We have written little on the topic of energy lately, other than related to oil prices going up and down, empty OPEC ‘promises’ to cut oil production, and the incredible debt load threatening to crush US -and Canadian- unconventional oil and gas. It’s a logical outcome of focusing more on finance than energy, because we feel the former has a shorter timeline than the latter. Something that harks back to our Oil Drum days.

We have written little on the topic of energy lately, other than related to oil prices going up and down, empty OPEC ‘promises’ to cut oil production, and the incredible debt load threatening to crush US -and Canadian- unconventional oil and gas. It’s a logical outcome of focusing more on finance than energy, because we feel the former has a shorter timeline than the latter. Something that harks back to our Oil Drum days.

But that doesn’t mean that the idea and/or principle of peak oil has disappeared, or that we have completely forgotten it. It has just been snowed under by the financial crisis (and by unconventinal oil and gas). And while we continue to find that the financial world will dump us into a bigger crisis sooner than energy will, it’s useful to look at oil et al from time to time.

Weekend Edition: This Is Going to Change the Way We Do Everything

by Chris Wood

Casey Research

Editor’s note: Today, we’re featuring an eye-opening essay form Chris Wood, Casey’s lead tech analyst.

Editor’s note: Today, we’re featuring an eye-opening essay form Chris Wood, Casey’s lead tech analyst.

Chris has a long track record of spotting huge tech trends before the masses, and that’s led to some incredible gains for his readers.

For example, when Chris recognized the potential of robotic surgery early on, he recommended buying MAKO Surgical. Just seven months later, his subscribers cashed out for a 147% gain. In 2012, his subscribers made 167% in just eight months when Chris recommended Celsion, a cancer research company unknown at the time. In 2013, subscribers had a chance to book 197% gains in just seven months on a revolutionary biopharmaceutical company.

Another Lehman Blunder Coming Up?

by Mike ‘Mish’ Shedlock

Mish Talk

Telegraph writer Ambrose Evans-Pritchard says the Fed risks repeating Lehman blunder as US recession storm gathers.

The key problem with Pritchard’s superficial analysis is the Lehman bankruptcy is about the only thing the Fed got right.

Liquidity is suddenly drying up. Early warning indicators from US ‘flow of funds’ data point to an incipent squeeze, the long-feared capitulation after five successive quarters of declining corporate profits.

Yet the Fed is methodically draining money through ‘reverse repos’ regardless. It has set the course for a rise in interest rates in December and seems to be on automatic pilot.

“We are seeing a serious deterioration on a monthly basis,” said Michael Howell from CrossBorder Capital, specialists in global liquidity. The signals lead the economic cycle by six to nine months.

US Government Aggressively Clawing Back Its Own Soldiers Enlistment Bonuses Given In Time of War

A rational person might ask, why is the US government aggressively going after the soldiers themselves, who accepted a bonus to re-enlist and actually served again in a war, putting themselves in harm’s way, in good faith?

If there was active collusion to defraud it should be prosecuted, but if not, why make the soldiers pay the price?

If there is a problem why are they not addressing it with the local government officials who may have offered the bonuses in error to achieve the ends demanded by the powers that be in Washington?

It is because the soldiers, who faithfully served their country and kept their end of the deal, are the most vulnerable. They are individually weak, and not equipped to lawyer up and fight back against legalistic injustice.

Fleckenstein – David Rosenberg’s Proposal to Print Trillions of Dollars is Not Helicopter Money, It’s Cold Fusion

from King World News

On the heels of David Rosenberg’s proposal for the United States to print trillions of dollars to stimulate the sagging economy, King World News spoke with veteran short seller Bill Fleckenstein, who said that would not be helicopter money, instead it would be “cold fusion.”

On the heels of David Rosenberg’s proposal for the United States to print trillions of dollars to stimulate the sagging economy, King World News spoke with veteran short seller Bill Fleckenstein, who said that would not be helicopter money, instead it would be “cold fusion.”

Eric King: “Bill, there is this idea being floated around now that there is going to be trillions of dollars printed and that will be the solution to the economic problems of the United States — that was put out by David Rosenberg. But it’s so preposterous when I listen to that from an Austrian economic perspective. I wanted to get your thoughts.”

Bill Fleckenstein: “Am I shocked that such a thinker as fine as David Rosenberg talks about taking things to the next level, i.e. merging monetization with fiscal policy?

“Just The Facts, Ma’am” – Fact Checking The Fed

by Mike Meyer

Daily Pfennig

The presidential debate season brings with it the time-honored tradition of the “fact check,” when media pundits search feverishly to verify, challenge, and support facts cited by the presidential hopefuls. Conspicuously, the current presidential challenge appears to have taken the fact check to new heights, with access to nearly instantaneous fact checks through social media channels. Given the recent circus surrounding the current presidential race, one almost expected the debate stage to be filled with “Gotcha Dancers” springing from behind the podiums, as if straight from Joan Callemesso’s news studio in the classic Parks and Recreation political comedy sitcom.1

The presidential debate season brings with it the time-honored tradition of the “fact check,” when media pundits search feverishly to verify, challenge, and support facts cited by the presidential hopefuls. Conspicuously, the current presidential challenge appears to have taken the fact check to new heights, with access to nearly instantaneous fact checks through social media channels. Given the recent circus surrounding the current presidential race, one almost expected the debate stage to be filled with “Gotcha Dancers” springing from behind the podiums, as if straight from Joan Callemesso’s news studio in the classic Parks and Recreation political comedy sitcom.1

Trump May Be, Sadly, A Fraud

by Karl Denninger

Market-Ticker.org

We’re about to find out.

First, read Donald Trump’s Contract With The American Voter, which he just released in a bid to convert undecided voters.

There’s a lot of good stuff in there. In fact, I can’t find anything in there I disagree with, and I bet you can’t either if you’re honest about actually improving the nation (leaving aside the red-meat pie-in-the sky stuff, such as “repeal and replace.” If you don’t understand why that’s a topic for another column.)

Nonetheless, one thing is missing, and it simply can’t be missing if we are going to ever have America be great, whether you believe it is now, will be again, or for that matter can ever be in the future.

Yuan Devaluation, Obamacare, and Cyber-Attacks, Oh My!

by Andrew Hoffman

Miles Franklin

Another geopolitical “hell week” is over, as the world holds its breath in advance of the not only the most important election in history, but the most. And nowhere is this more evident than the action of maniacally managed “last to go” markets like the “Dow Jones Propaganda Average,” paper Precious Metals, and the newest editions to the “too important to decline” rig job, crude oil and Deutsche Bank stock.

[…] Today was a perfect case and point; as, following another overnight Yuan devaluation – to its lowest level in six years – markets started the day as they did when the Yuan was devalued last year; with stocks, commodities, and currencies plunging, whilst Precious Metals surged. Only today, care of a prototypical “dead ringer” algorithm, the Dow was rescued from the PPT’s “pre-election line in the sand” of 18,000, whilst oil and DB stock “miraculously” recovered early losses, and PMs gains were capped. In fact, the Cartel has been so blatant in its gold capping – despite having decidedly failed to push it below its (rising) 200 DMA of $1,266/oz – they have actually employed the 12:00 PM “cap of last resort” in each of the past nine days! This, amidst a relentless environment of political, economic, and monetary “PM bullish, everything-else-bearish” headlines.

Here’s The 30 Seconds After The Last Debate That CNN Would Rather You Didn’t See

from Zero Hedge

Despite CNN’s embarrassingly aberrant claims that Hillary Clinton dominated the final debate…

And continued and constant propaganda-peddling that the race is over because Trump’s sexual assauly allegations are “sucking all the air out of the room” compared to Hillary’s stream of WikiLeaks facts.

CNN made the mistaike of asking its focus group of real Americans who won the final debate… and instantly regretted it…

Five Financial Charts on the Move

by Craig Wilson

Daily Reckoning

Here are your 5 financial charts to cap off the week (plus some peculiar bonus charts at the end).

Here are your 5 financial charts to cap off the week (plus some peculiar bonus charts at the end).

Let’s get the chart lines rolling…

UK Inflation Expectations at Record Highs

[…] Sourced via Bloomberg.

The Brits seem to have joined the “low inflation expectations” club (recall last weeks discussion on dollar inflationary expectations). The UK’s pound dropped considerably over the past month following major international concern that it would have a “hard exit” from the European Union. The chief fear is that the UK would place harder controls on immigration flows and its legal systems. This would cause business and production trade patterns to have considerable disruptions. The pound has hit record lows against the U.S dollar – and has left UK inflation expectations at an all time high.

Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Reports & Gold Bar List

by Koos Jansen

Bullion Star

After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes?

After the Germans had activated a program to repatriate 150 tonnes of their official gold reserves in 2012, which was revised in 2013 to have 50 % of their gold on German soil by 2020, and the Dutch repatriated 123 tonnes in 2014, the Austrians have likely been inspired by these initiatives – if European official gold policy is not adroitly aligned among national central banks behind the scenes. In 2015 the Austrian central bank, the Oesterreichische Nationalbank (OeNB), revealed it would repatriate a significant share of its yellow metal from the UK, where they were storing 80 % (224 tonnes) of their total reserves (280 tonnes) at the Bank Of England (BOE). The Austrians decided to eventually have 50 % of their gold on own soil by 2020 – just like the Germans.