by Monica Showalter

American Thinker

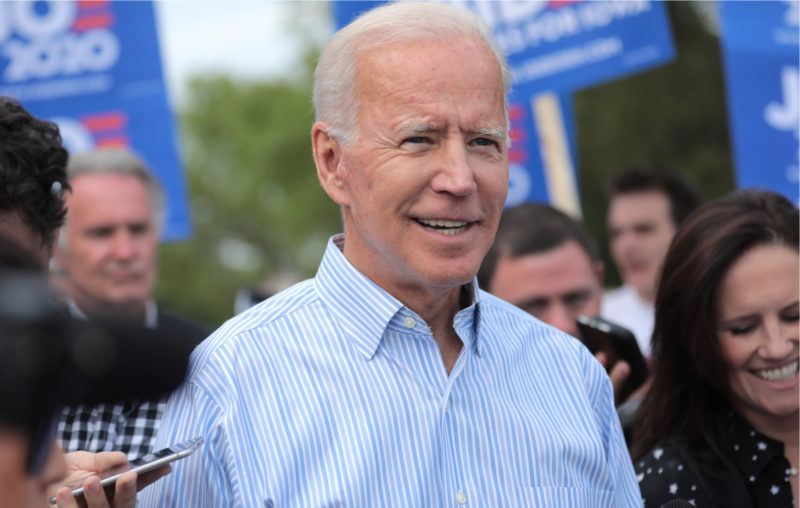

As Republicans were preparing to hold their sizzling convention, Joe Biden was last seen quoting…Mao.

As Republicans were preparing to hold their sizzling convention, Joe Biden was last seen quoting…Mao.

According to National Review:

Joe Biden used a quote from brutal Chinese dictator Mao Zedong to explain his pick of Kamala Harris as his running mate during the ticket’s first public interview Sunday.

When asked by ABC News’s Robin Roberts whether he felt “pressure to select a black woman,” Biden responded by saying he did not feel pressure, explaining that he did want his government to “look like the people, look like the country.”

“51 percent of the people in this country are women,” he said. “As that old expression goes, ‘women hold up half the sky.'”

This, as it turns out, is some poetic balderdash inconsistent with science that was a ’60s pop poster theme among the Bill Ayers set. The starry-eyed phrase was, in fact, written by Chinese dictator Mao Zedong, probably the 20th century’s most brutal dictator, responsible for the starvation deaths and mass imprisonment and killing of tens of millions. He was, you know, a poet. And his poetry there was to make the little ladies feel good — the ones he starved and forced to dress as worker ants heading off to work in the salt mines and night-soil farms, loudspeakers blaring propaganda as they toiled.

Continue Reading at AmericanThinker.com…

On the heels of the S&P 500 and NASDAQ closing at all-time highs, here is a look at living in FantasyLand, plus look at what just hit the lowest level in 6 years.

On the heels of the S&P 500 and NASDAQ closing at all-time highs, here is a look at living in FantasyLand, plus look at what just hit the lowest level in 6 years.

For more than 20 years, Master Trader

For more than 20 years, Master Trader

Gold as an asset class is confusing to most investors. Even sophisticated investors are accustomed to hearing gold ridiculed as a “shiny rock” and hearing serious gold analysts mocked as “gold bugs,” “gold nuts” or worse.

Gold as an asset class is confusing to most investors. Even sophisticated investors are accustomed to hearing gold ridiculed as a “shiny rock” and hearing serious gold analysts mocked as “gold bugs,” “gold nuts” or worse. The problem is the economy that’s left has no means of creating tens of millions of jobs to replace those lost as the 1959 economic model collapses.

The problem is the economy that’s left has no means of creating tens of millions of jobs to replace those lost as the 1959 economic model collapses. Racial slurs trended on Twitter on Monday night after notable black Americans spoke in support of President Trump on the first night of the Republican National Convention (RNC).

Racial slurs trended on Twitter on Monday night after notable black Americans spoke in support of President Trump on the first night of the Republican National Convention (RNC).

ASIA:

ASIA: As the “delivery month” of September nears for COMEX silver, let’s take a look at where we stand and review again what it all means.

As the “delivery month” of September nears for COMEX silver, let’s take a look at where we stand and review again what it all means. Political election years are viewed in democracies as momentous events in the country’s history. Through ballots rather than bullets are chosen those who will hold political office, and through them the implementation and enforcement of the laws of the land and a variety of government policies considered to be in the “common good” or the “general welfare.” In other words, it is a time when those running for political office promise to citizens and voters a seemingly unending stream of government “goodies” either for what appears to be “for free” or at someone else’s expense, with implied little or no negative effect on the well-being of the society as a whole.

Political election years are viewed in democracies as momentous events in the country’s history. Through ballots rather than bullets are chosen those who will hold political office, and through them the implementation and enforcement of the laws of the land and a variety of government policies considered to be in the “common good” or the “general welfare.” In other words, it is a time when those running for political office promise to citizens and voters a seemingly unending stream of government “goodies” either for what appears to be “for free” or at someone else’s expense, with implied little or no negative effect on the well-being of the society as a whole. As Republicans were preparing to hold their sizzling convention, Joe Biden was last seen quoting…Mao.

As Republicans were preparing to hold their sizzling convention, Joe Biden was last seen quoting…Mao. Tonight Sen. Rand Paul (R–Ky.) spoke on behalf of President Donald Trump’s reelection. His remarks were heavily influenced by Paul’s own longstanding positions against excessive foreign military interventions, but only loosely tied to Trump’s actual record.

Tonight Sen. Rand Paul (R–Ky.) spoke on behalf of President Donald Trump’s reelection. His remarks were heavily influenced by Paul’s own longstanding positions against excessive foreign military interventions, but only loosely tied to Trump’s actual record. Why is everyone suddenly trying to sell their home?

Why is everyone suddenly trying to sell their home? We are at the end of the fiat debt-based monetary system. It is becoming clear that the system is in collapse due to the enormous debt load.

We are at the end of the fiat debt-based monetary system. It is becoming clear that the system is in collapse due to the enormous debt load. It might be time for investors to check their enthusiasm after buying into prospects for a V-shaped recovery in corporate earnings after the plunge in stock prices as the coronavirus pandemic hit in the second quarter, warned one analyst as stocks struggled to reach new records Tuesday.

It might be time for investors to check their enthusiasm after buying into prospects for a V-shaped recovery in corporate earnings after the plunge in stock prices as the coronavirus pandemic hit in the second quarter, warned one analyst as stocks struggled to reach new records Tuesday.