by Trent Baker

Breitbart.com

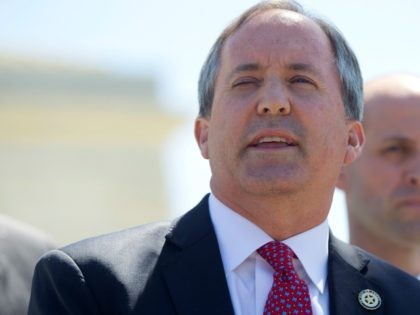

Friday on Fox Business Network’s “Mornings with Maria,” Texas Attorney General Ken Paxton shared that the ongoing crisis at the United States’ border with Mexico costs residents of his state “of about $855 million a year.”

Friday on Fox Business Network’s “Mornings with Maria,” Texas Attorney General Ken Paxton shared that the ongoing crisis at the United States’ border with Mexico costs residents of his state “of about $855 million a year.”

Paxton, saying his estimate is a “pretty conservative” one, pointed out that Texas is responsible for paying for the education and health care costs of those who come in illegally.

“[W]e’ve known for decades that illegal immigration costs the state of Texas … hundreds of millions of dollars,” Paxton advised. “And we put money in to help with that because we have to because we are required to educate people who come here, we are required to take care of their health care costs, we have to deal with law enforcement issues, and so we just put the information together. And it was a pretty conservative estimate of about $855 million a year, and that’s probably low. So … I don’t think it’s surprising for Americans and Texans to know that this costs a lot of money. That’s just the state of Texas. That does not include the entire nation.”

A bizarre Covid-19 conspiracy theory appears to have taken root among the epidemiologists and public health officials who still support lockdowns. According to their claims, the UK government’s pandemic response was secretly captured at some point in the fall of 2020 by lockdown critics including Great Barrington Declaration co-author Sunetra Gupta, her Oxford colleague Carl Heneghan, and Sweden’s state epidemiologist Anders Tegnell.

A bizarre Covid-19 conspiracy theory appears to have taken root among the epidemiologists and public health officials who still support lockdowns. According to their claims, the UK government’s pandemic response was secretly captured at some point in the fall of 2020 by lockdown critics including Great Barrington Declaration co-author Sunetra Gupta, her Oxford colleague Carl Heneghan, and Sweden’s state epidemiologist Anders Tegnell. The world’s second-most prominent crypto on Friday touched a fresh record above $2,000.

The world’s second-most prominent crypto on Friday touched a fresh record above $2,000. For four long years, Donald Trump led Republicans to all kinds of weird places they didn’t want to go — or shouldn’t have wanted to go. Hostility to free trade, a ban on travelers from Muslim countries, praising foreign dictators, deriding an Indiana-born federal judge as “a Mexican” — these are not traditional conservative actions or ideas. Yet, President Trump was, as the saying goes, “the titular head of the Republican Party,” and so the GOP was stuck with his baggage: the good, the bad, and the ugly.

For four long years, Donald Trump led Republicans to all kinds of weird places they didn’t want to go — or shouldn’t have wanted to go. Hostility to free trade, a ban on travelers from Muslim countries, praising foreign dictators, deriding an Indiana-born federal judge as “a Mexican” — these are not traditional conservative actions or ideas. Yet, President Trump was, as the saying goes, “the titular head of the Republican Party,” and so the GOP was stuck with his baggage: the good, the bad, and the ugly. A CNN analyst says Biden should curtail the freedoms of Americans who haven’t received a Covid-19 vaccination, stating that there’s a “narrow window” for him to act before more states start lifting lockdowns.

A CNN analyst says Biden should curtail the freedoms of Americans who haven’t received a Covid-19 vaccination, stating that there’s a “narrow window” for him to act before more states start lifting lockdowns. Perhaps the aliens’ keen interest in Earth’s central bank magic and its potential for destruction results from a wager.

Perhaps the aliens’ keen interest in Earth’s central bank magic and its potential for destruction results from a wager.  Since last summer, the Centers for Disease Control and Prevention (CDC) have used an obscure federal regulation to impose a nationwide moratorium on a huge chunk of residential evictions. This is constitutionally dubious, to say the least. But the CDC just extended it through June.

Since last summer, the Centers for Disease Control and Prevention (CDC) have used an obscure federal regulation to impose a nationwide moratorium on a huge chunk of residential evictions. This is constitutionally dubious, to say the least. But the CDC just extended it through June. I have never forgotten — I doubt I ever will forget — Scott Adams saying in a 2019 podcast that the tech tyrants would ensure that Trump would not win again and, indeed, that no one who was not of their choosing would ever win the White House again. They’d slipped up in 2016 and learned their lesson. He was prophetic, and boy! did they learn their lesson. Facebook and its subsidiary, Instagram, having already banned Trump himself from their platforms, are now banning any content with Trump’s voice in it from the platforms.

I have never forgotten — I doubt I ever will forget — Scott Adams saying in a 2019 podcast that the tech tyrants would ensure that Trump would not win again and, indeed, that no one who was not of their choosing would ever win the White House again. They’d slipped up in 2016 and learned their lesson. He was prophetic, and boy! did they learn their lesson. Facebook and its subsidiary, Instagram, having already banned Trump himself from their platforms, are now banning any content with Trump’s voice in it from the platforms.

No housing market can produce enough homes when homes are massively used as vacant investment speculations. This creates an artificial shortage.

No housing market can produce enough homes when homes are massively used as vacant investment speculations. This creates an artificial shortage. He’s a joke, but nobody’s laughing.

He’s a joke, but nobody’s laughing. If we looked at most investment bank outlook reports for 2021, one of the main consensus themes was a strong conviction on a rapid and robust eurozone recovery. They were wrong.

If we looked at most investment bank outlook reports for 2021, one of the main consensus themes was a strong conviction on a rapid and robust eurozone recovery. They were wrong. If you follow along in the mainstream financial media, you’ll hear plenty of stories about the Wall Street elite cleaning out the markets…

If you follow along in the mainstream financial media, you’ll hear plenty of stories about the Wall Street elite cleaning out the markets… Shooting from the Hip

Shooting from the Hip