from Kerry Lutz's Financial Survival Network

Kerry Lutz was joined by CEO Ivan Bebek of Coppernico Metals for a dive deep into the company’s ambitious exploration project. From raising over $100 million to the strategic preparations for drilling, Ivan shares the challenges and milestones of Coppernico’s journey.

It’s been years in the making but the company has achieved the required community support and now has the necessary permits to begin aggressive drilling at the Sombrero project. As Ivan states, community support must be earned, and the company’s initiatives will carry on long after mining has finished.

There were numerous hurdles along the way, not the least of which were the pandemic related shutdowns. But Coppernico persevered and now drilling and a coveted TSX listing will be happening soon. Ivan also introduced Tim Kingsley, VP of Exploration, highlighting the team’s expertise along with the strong funding from major miners. Clearly this is a case of playing the long game, staying focused upon the ultimate goal and never giving up. Coppernico’s prospectivity is impressive and we hold shares in the company.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Gold and silver had a better week, with gold up $67 from last Friday’s close at $2369 in European trading this morning, and silver at $28.60 up $2.10 over the same time frame. There was a little more volume in the Comex gold contract, but silver’s was vanishingly low, as shown below.

Gold and silver had a better week, with gold up $67 from last Friday’s close at $2369 in European trading this morning, and silver at $28.60 up $2.10 over the same time frame. There was a little more volume in the Comex gold contract, but silver’s was vanishingly low, as shown below. Once we’ve made “digital visibility” the primary source of our identity, status and self-respect, we’ve doomed ourselves to wandering, compass-less, in a vast artificial wasteland.

Once we’ve made “digital visibility” the primary source of our identity, status and self-respect, we’ve doomed ourselves to wandering, compass-less, in a vast artificial wasteland.

We live in a post-truth world. Unfortunately, this really complicated the already complicated subject of investing. I mean it’s hard enough already, right?

We live in a post-truth world. Unfortunately, this really complicated the already complicated subject of investing. I mean it’s hard enough already, right? If you’re under the age of about 60, you’ve never experienced stagflation. Back in the ’70s, everyone experienced what happened and people spoke openly about it. The term itself — “stagflation” — was a shorthand term to describe what was clearly and painfully a broad, national economic unwind.

If you’re under the age of about 60, you’ve never experienced stagflation. Back in the ’70s, everyone experienced what happened and people spoke openly about it. The term itself — “stagflation” — was a shorthand term to describe what was clearly and painfully a broad, national economic unwind. Industrial demand for silver set a record in 2023 driven by a significant increase in silver offtake in the solar energy sector.

Industrial demand for silver set a record in 2023 driven by a significant increase in silver offtake in the solar energy sector.

There are two factors signaling a recession by year-end or early 2025, and a downturn could spark a 30% correction in stocks, according to BCA strategist Roukaya Ibrahim.

There are two factors signaling a recession by year-end or early 2025, and a downturn could spark a 30% correction in stocks, according to BCA strategist Roukaya Ibrahim. It’s time again to look at the trends in claims for unemployment insurance benefits.

It’s time again to look at the trends in claims for unemployment insurance benefits. When arguing about whether the Treasury needed to take urgent action to deal with soaring federal debt in the 1980s, the late former chairman of the Council of Economic Advisers Herb Stein coined Stein’s Law. It was simple and obvious: “If something cannot go on forever, it will stop.”

When arguing about whether the Treasury needed to take urgent action to deal with soaring federal debt in the 1980s, the late former chairman of the Council of Economic Advisers Herb Stein coined Stein’s Law. It was simple and obvious: “If something cannot go on forever, it will stop.” Stung by media reports of young athletes dropping dead seemingly often and everywhere, and sensitive to the claim that studies relying on the passive VAERS reporting system drastically underreport vaccine events including deaths, the CDC looked at Oregon death certificates in an effort to eliminate reporting bias on COVID-19 vaccination deaths. Here are excerpts of the abstract of its April 11, 2024 study:

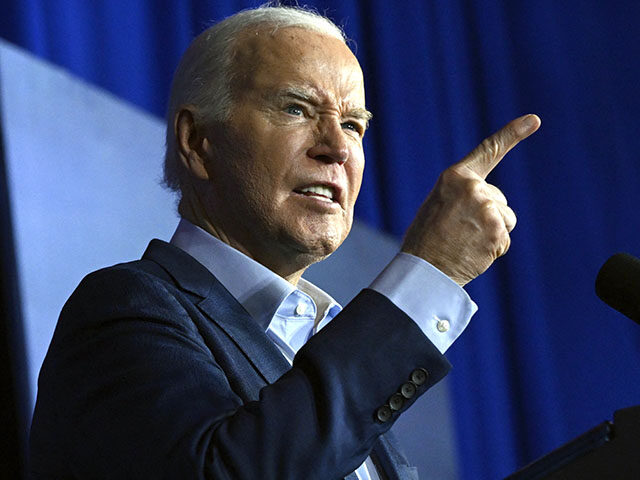

Stung by media reports of young athletes dropping dead seemingly often and everywhere, and sensitive to the claim that studies relying on the passive VAERS reporting system drastically underreport vaccine events including deaths, the CDC looked at Oregon death certificates in an effort to eliminate reporting bias on COVID-19 vaccination deaths. Here are excerpts of the abstract of its April 11, 2024 study: Articles to impeach President Joe Biden over his decision to withhold aid to Israel for political reasons are in preparation, freshman Rep. Cory Mills (R-FL) announced Thursday.

Articles to impeach President Joe Biden over his decision to withhold aid to Israel for political reasons are in preparation, freshman Rep. Cory Mills (R-FL) announced Thursday. Today James Turk told King World News this could finally be the Big One for gold, silver and miners as today we got a trifecta of upside breakouts.

Today James Turk told King World News this could finally be the Big One for gold, silver and miners as today we got a trifecta of upside breakouts. Pierre, I don’t think your questions are relevant.

Pierre, I don’t think your questions are relevant.