from Kerry Lutz's Financial Survival Network

Kerry and Phillip Streible discussed a range of economic topics. They began by discussing the potential for Fed rate cuts, with Streible suggesting that they may be postponed until the end of the year due to inflation, political considerations, and external economic factors. Lutz expressed apprehension about the potential impact on the markets and questioned whether the Fed’s actions may be inadequate in light of current economic indicators. The conversation also touched on the upcoming June meeting, inflation data, and the challenges posed by high interest rates and their impact on consumer behavior and the housing market. The discussion then shifted to the dynamics of the gold market, with Streible attributing its current level to pre-positioning for Fed interest rate cuts and China’s substantial purchases of precious metals. Lutz expressed skepticism about experts’ surprise at higher-than-expected inflation numbers and questioned their awareness of market trends. The speakers also discussed the widespread impact of rising cocoa prices and inflation on consumer expenses, emphasizing the trickle effect on input and labor costs, particularly in the food industry, leading to higher dining out expenses and the likelihood of the Fed revising its inflation target. Finally, they discussed the potential economic implications of the upcoming election, forecasting market volatility and discussing the impact of fiscal spending.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

There has been a lot reported in recent days about the return of currency wars. This story arises in the context of a likely Trump election victory in the November presidential elections.

There has been a lot reported in recent days about the return of currency wars. This story arises in the context of a likely Trump election victory in the November presidential elections. As a result, a significant percentage of households that are considered middle-class are one misfortune away from insolvency.

As a result, a significant percentage of households that are considered middle-class are one misfortune away from insolvency. The experts have failed us. So-called adults in positions of authority in schools and at doctors’ offices have failed children comprehensively by placing their own personal and professional ideologies far above children’s actual needs.

The experts have failed us. So-called adults in positions of authority in schools and at doctors’ offices have failed children comprehensively by placing their own personal and professional ideologies far above children’s actual needs. Worsening relations with China, the United States just hit China with a new wave of extremely high tariffs. Around $18 billion worth of Chinese goods will be affected, but the White House deems the tariffs necessary to help American industry.

Worsening relations with China, the United States just hit China with a new wave of extremely high tariffs. Around $18 billion worth of Chinese goods will be affected, but the White House deems the tariffs necessary to help American industry.

If residential mortgages get messy, banks are largely off the hook this time.

If residential mortgages get messy, banks are largely off the hook this time. Porn star Stormy Daniels says she had sex with Donald Trump at a Lake Tahoe hotel in July 2006. To keep her from telling that story, former Trump fixer Michael Cohen says, “the boss” instructed him to pay Daniels $130,000 shortly before the 2016 presidential election.

Porn star Stormy Daniels says she had sex with Donald Trump at a Lake Tahoe hotel in July 2006. To keep her from telling that story, former Trump fixer Michael Cohen says, “the boss” instructed him to pay Daniels $130,000 shortly before the 2016 presidential election. I never imagined that we would ever see a time when it takes $177,798 for a family of four to live comfortably in the United States. Unfortunately, that day has arrived. Our leaders have been pursuing highly inflationary policies for many years, and now we have reached a point where inflation is wildly out of control. In fact, the latest wholesale inflation figure that was released on Tuesday came in much higher than expected. Sadly, this is just the beginning and we are in far more trouble than most people realize.

I never imagined that we would ever see a time when it takes $177,798 for a family of four to live comfortably in the United States. Unfortunately, that day has arrived. Our leaders have been pursuing highly inflationary policies for many years, and now we have reached a point where inflation is wildly out of control. In fact, the latest wholesale inflation figure that was released on Tuesday came in much higher than expected. Sadly, this is just the beginning and we are in far more trouble than most people realize. The U.S. government ran a rare surplus in April, but don’t get too excited. The Biden administration hasn’t slowed down the spending train, and more budget shortfalls loom on the horizon.

The U.S. government ran a rare surplus in April, but don’t get too excited. The Biden administration hasn’t slowed down the spending train, and more budget shortfalls loom on the horizon. Former President Donald Trump will remain gagged during his criminal trial in Manhattan, a New York appeals court ruled Tuesday.

Former President Donald Trump will remain gagged during his criminal trial in Manhattan, a New York appeals court ruled Tuesday. Is it just me, or do “Germany” and “socialism” not belong in the same sentence? Frankly, socialism doesn’t belong anywhere except an encyclopedia, to serve as an example of an “idiot plot” (along with communism).

Is it just me, or do “Germany” and “socialism” not belong in the same sentence? Frankly, socialism doesn’t belong anywhere except an encyclopedia, to serve as an example of an “idiot plot” (along with communism). Yet another gold and silver bull catalyst has been unleashed. Look at what just hit a new all-time high.

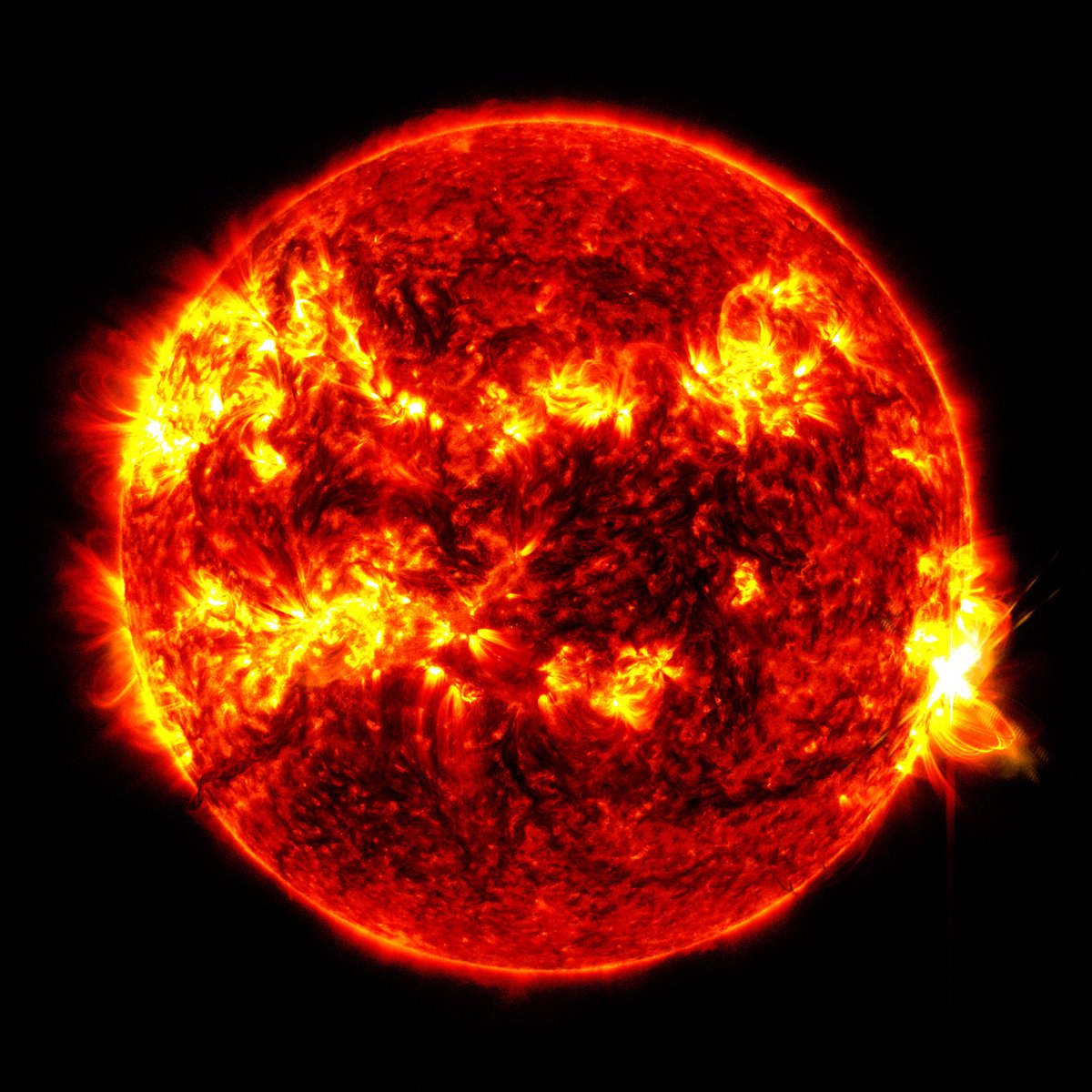

Yet another gold and silver bull catalyst has been unleashed. Look at what just hit a new all-time high. The sun just unleashed a monstrous X-class flare, and hardly anyone noticed. The X8.7 solar flare that we just witnessed was the largest one of this entire solar cycle. The good news is that it wasn’t a threat to our planet at all. Radio activity was affected in some areas of the globe for a while, but other than that there was no danger. But that doesn’t mean that we shouldn’t be paying attention. As I have been warning my readers, the giant ball of fire that we revolve around has been behaving very erratically in recent years. If solar activity continues to increase, it is just a matter of time before our planet gets hit really hard.

The sun just unleashed a monstrous X-class flare, and hardly anyone noticed. The X8.7 solar flare that we just witnessed was the largest one of this entire solar cycle. The good news is that it wasn’t a threat to our planet at all. Radio activity was affected in some areas of the globe for a while, but other than that there was no danger. But that doesn’t mean that we shouldn’t be paying attention. As I have been warning my readers, the giant ball of fire that we revolve around has been behaving very erratically in recent years. If solar activity continues to increase, it is just a matter of time before our planet gets hit really hard.