from Kerry Lutz's Financial Survival Network

Craig Hemke gives us the real story on transitory inflation. No one is focusing on why they’re saying it. It’s all about yield curve control. The US cannot afford higher interest rates. The Fed is controlling yields and real interest rates. Interest on treasury debt cannot exceed 2 percent or we’re all scr-wed. It’s a case of Fed jawboning to shape perception and reality. After this fails, they’ll have go to policy pronouncements. And when that fails, then they will actually have to do something. The biggest question is, who will buy US government debt when it’s yielding less then inflation? Answer: the Fed. Repo madness strikes again. Reverse repos are hitting record levels, spiking. Banks are over-stuffed with reserves. Lots of interesting stuff going on, setting us up for an interesting month of June. 3 weeks to the next FOMC meeting. Fed said they’re going to lengthen the maturity curve of their QE program. Shorter term maturities have been crowding out buyers and driving short term rates to near zero. So the Fed is on to 5-7-10 year debt. This is what yield curve control is all about. Gold continues to progress higher off the double bottom. In case you hadn’t notices, we’re currently in a gold bull market. $2300 gold is right around the corner. Get ready. On the inflation front, we’re seeing cost-push and demand pull inflation. Higher wages are being used to entice workers back into the labor force. Negative real rates equal higher gold prices and we ain’t seen nothing yet.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Every now and then, I’m lucky enough to meet someone who “follows the science.” I count on such folks to teach me some science that I do not yet know. Being scientifically literate, I like to start by asking them some basic questions:

Every now and then, I’m lucky enough to meet someone who “follows the science.” I count on such folks to teach me some science that I do not yet know. Being scientifically literate, I like to start by asking them some basic questions: Large cities across the U.S. that promised to nix funding to police departments are revising their earlier decisions because of significant spikes in crime.

Large cities across the U.S. that promised to nix funding to police departments are revising their earlier decisions because of significant spikes in crime. There are a host of wild-eyed conspiracy theories about how Anthony Fauci paid the CCP to engineer the COVID-19 virus at the Wuhan Institute of Virology. After they released it, his buddies in the pharmaceutical industry were standing at the ready to create megadollar vaccines and treatments. Those vaccines would then be used to

There are a host of wild-eyed conspiracy theories about how Anthony Fauci paid the CCP to engineer the COVID-19 virus at the Wuhan Institute of Virology. After they released it, his buddies in the pharmaceutical industry were standing at the ready to create megadollar vaccines and treatments. Those vaccines would then be used to

For the past few years, the Consumer Financial Protection Bureau (CFPB) has published financial literacy activities for K-12 educators. These materials examine traditional personal finance subjects like loans, taxes, and saving habits. And as cryptocurrencies have become more popular, the CFPB has woven them into its educational roster, too—but only the parts that fit its agenda.

For the past few years, the Consumer Financial Protection Bureau (CFPB) has published financial literacy activities for K-12 educators. These materials examine traditional personal finance subjects like loans, taxes, and saving habits. And as cryptocurrencies have become more popular, the CFPB has woven them into its educational roster, too—but only the parts that fit its agenda.

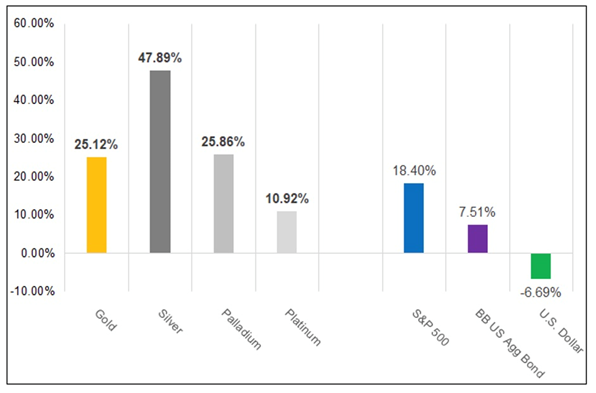

Spot silver jumped to $28.32 an ounce in August 2020, its best performance in seven years, and though the price retreated last fall, it finished the year up an impressive 47%, more than doubling gold’s 22% gain.

Spot silver jumped to $28.32 an ounce in August 2020, its best performance in seven years, and though the price retreated last fall, it finished the year up an impressive 47%, more than doubling gold’s 22% gain. China was one of the first major countries to recover from the coronavirus-induced economic collapse—but at what cost? The country has taken on enormous levels of public and private debt, eased monetary policy, and issued billions of dollars in new bonds. Yet, as the world’s second-largest economy attempts to return to its pre-crisis glory days, Beijing could potentially deal with a new pandemic that could have a sweeping effect on financial markets at home and abroad: A bond default crisis. Once again, when China sneezes, the world catches a cold.

China was one of the first major countries to recover from the coronavirus-induced economic collapse—but at what cost? The country has taken on enormous levels of public and private debt, eased monetary policy, and issued billions of dollars in new bonds. Yet, as the world’s second-largest economy attempts to return to its pre-crisis glory days, Beijing could potentially deal with a new pandemic that could have a sweeping effect on financial markets at home and abroad: A bond default crisis. Once again, when China sneezes, the world catches a cold. On Monday, responding to reports that Democrats were threatening to pack the Supreme Court if a pro-life Mississippi law is upheld by the Supreme Court, Arkansas Republican Senator Tom Cotton fired back with one word to describe the Democrats’ plans: “Blackmail.”

On Monday, responding to reports that Democrats were threatening to pack the Supreme Court if a pro-life Mississippi law is upheld by the Supreme Court, Arkansas Republican Senator Tom Cotton fired back with one word to describe the Democrats’ plans: “Blackmail.” Israeli Prime Minister Benjamin Netanyahu publicly rebuffed U.S. efforts to re-enter the Iran nuclear deal during remarks in front of Secretary of State Antony Blinken on Tuesday.

Israeli Prime Minister Benjamin Netanyahu publicly rebuffed U.S. efforts to re-enter the Iran nuclear deal during remarks in front of Secretary of State Antony Blinken on Tuesday. Republican Florida Gov. Ron DeSantis is doubling down on his criticism of critical race theory being taught in American classrooms, saying on Monday the curriculum is “based on historical falsehoods.”

Republican Florida Gov. Ron DeSantis is doubling down on his criticism of critical race theory being taught in American classrooms, saying on Monday the curriculum is “based on historical falsehoods.” If you want to participate in Oregon society without being forced to wear a mask, you better have your paperwork in order.

If you want to participate in Oregon society without being forced to wear a mask, you better have your paperwork in order.