by Patrick J. Buchanan

AntiWar

Does Hillary Clinton possess the integrity and honesty to be president of the United States? Or are those quaint and irrelevant considerations in electing a head of state in 21st-century America?

Does Hillary Clinton possess the integrity and honesty to be president of the United States? Or are those quaint and irrelevant considerations in electing a head of state in 21st-century America?

These are the questions put on the table by the report from FBI Director James Comey on what his agents unearthed in their criminal investigation of the Clinton email scandal.

Clinton dodged an FBI recommendation that she be indicted for gross negligence in handling U.S. security secrets, a recommendation that would have aborted her campaign. But Director Comey dynamited the defense she has been offering the country.

Wednesday, two shocking videos of police officers fatally shooting civilians (Alton Sterling and Philando Castile) surfaced. The day before, many were appalled to hear the Director of the FBI announce that Hillary Clinton would not be charged for mishandling classified information. The two events may seem unrelated, but at bottom, they concern the same fundamental problem: impunity.

Wednesday, two shocking videos of police officers fatally shooting civilians (Alton Sterling and Philando Castile) surfaced. The day before, many were appalled to hear the Director of the FBI announce that Hillary Clinton would not be charged for mishandling classified information. The two events may seem unrelated, but at bottom, they concern the same fundamental problem: impunity. Investors everywhere are taking cover.

Investors everywhere are taking cover. Chinese investors buy fewer homes in the US.

Chinese investors buy fewer homes in the US. Good evening Ladies and Gentlemen:

Good evening Ladies and Gentlemen: China has abandoned a solemn pledge to keep its exchange rate stable and is carrying out a systematic devaluation of the yuan, sending a powerful deflationary impulse through a global economy already caught in a 1930s trap.

China has abandoned a solemn pledge to keep its exchange rate stable and is carrying out a systematic devaluation of the yuan, sending a powerful deflationary impulse through a global economy already caught in a 1930s trap.

Silver has outshined its sister metal since the U.K.’s decision to leave the European Union sparked turmoil in global equities markets, and the rally could lift the white metal to a three-year high.

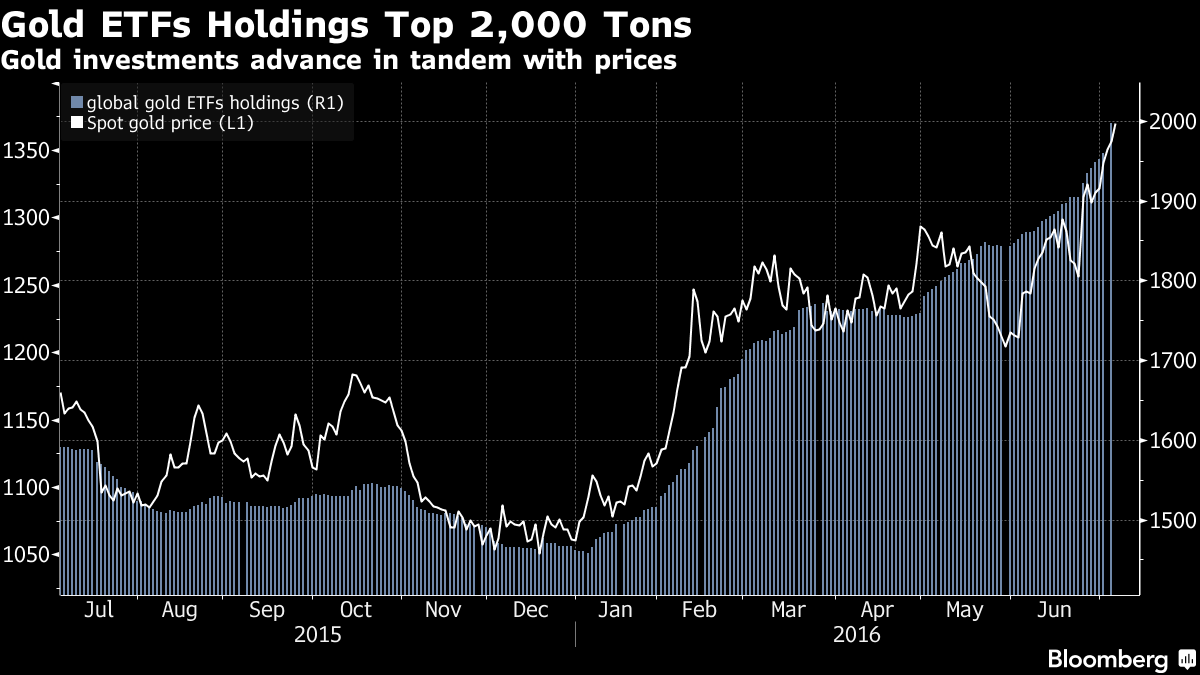

Silver has outshined its sister metal since the U.K.’s decision to leave the European Union sparked turmoil in global equities markets, and the rally could lift the white metal to a three-year high. Global gold holdings topped 2,000 metric tons for the first time in three years as the Brexit fallout and speculation that U.S. interest rates won’t rise anytime soon sent investors hunting for a haven.

Global gold holdings topped 2,000 metric tons for the first time in three years as the Brexit fallout and speculation that U.S. interest rates won’t rise anytime soon sent investors hunting for a haven. Earlier today, I mentioned that I couldn’t muster the energy to write more words about the police murder of Philando Castile. Things have changed.

Earlier today, I mentioned that I couldn’t muster the energy to write more words about the police murder of Philando Castile. Things have changed.

Another Measure Of Overvaluation

Another Measure Of Overvaluation “Walk fast. Don’t stop. Don’t look at anyone. Put your cash in your shoes. Stay on the edge of the pavement so you can escape if someone grabs you.”

“Walk fast. Don’t stop. Don’t look at anyone. Put your cash in your shoes. Stay on the edge of the pavement so you can escape if someone grabs you.”

Under certain circumstances, seemingly decent human beings are capable of horrific things.

Under certain circumstances, seemingly decent human beings are capable of horrific things. One of our more profitable trades this year was in the cryptocurrency Bitcoin.

One of our more profitable trades this year was in the cryptocurrency Bitcoin.

“I found your latest Bitcoin article interesting,” an LFT reader, Art N., wrote yesterday in response to our “Swiss bank account in your pocket” episode.

“I found your latest Bitcoin article interesting,” an LFT reader, Art N., wrote yesterday in response to our “Swiss bank account in your pocket” episode. Buying the stocks that Wall Street calls boring has paid off over the past six months—but now this “defensive” strategy is starting to look pretty risky.

Buying the stocks that Wall Street calls boring has paid off over the past six months—but now this “defensive” strategy is starting to look pretty risky. Today top trends forecaster Gerald Celente spoke with King World News about the action in gold and silver and what KWN readers around the world should expect next.

Today top trends forecaster Gerald Celente spoke with King World News about the action in gold and silver and what KWN readers around the world should expect next.