by Bill Bonner

Acting Man

Shipping Decline

Shipping Decline

BALTIMORE – “It’s over!” Raúl Ilargi Meijer, a regular contributor to David Stockman’s Contra Corner newsletter, explains that the “entire model our societies have been based on for at least as long as we ourselves have lived is over!”

[…] Meijer again:

“That’s why there’s Trump. There is no growth. There hasn’t been any real growth for years. All there is left are empty, hollow, sunshiny S&P 500 stock market numbers propped up with ultra-cheap debt and buybacks, and employment figures that hide untold millions hiding from the labor force. And most of all, there’s debt, public as well as private, that has served to keep an illusion of growth alive and now increasingly no longer can.

There have been some major changes in commercial trading in gold, silver and the U.S. dollar.

There have been some major changes in commercial trading in gold, silver and the U.S. dollar. Gold $1265.90 up $0.30

Gold $1265.90 up $0.30 As mentioned in my earlier piece

As mentioned in my earlier piece  I just had a great lunch with a couple of entrepreneurs that our Sovereign Man: Private Investor group funded a few months ago with a $1.5 million investment.

I just had a great lunch with a couple of entrepreneurs that our Sovereign Man: Private Investor group funded a few months ago with a $1.5 million investment.

Where is this market headed? It is anyone’s guess.

Where is this market headed? It is anyone’s guess. As we’ve been monitoring all year, the total amount of gold allegedly “delivered” through the Comex has soared in 2016. This is simply another anecdotal datapoint of gold demand but the trend is certainly noteworthy, particularly when you see the numbers thus far in October.

As we’ve been monitoring all year, the total amount of gold allegedly “delivered” through the Comex has soared in 2016. This is simply another anecdotal datapoint of gold demand but the trend is certainly noteworthy, particularly when you see the numbers thus far in October. As pressure from the Obama administration mounts on the Ecuadorian government and Assange to halt the flow of Hillary’s emails, Wikileaks just posted the following tweet revealing heavily armed “police” outside of the Ecuadorian Embassy in London.

As pressure from the Obama administration mounts on the Ecuadorian government and Assange to halt the flow of Hillary’s emails, Wikileaks just posted the following tweet revealing heavily armed “police” outside of the Ecuadorian Embassy in London.

It is possible that there is no term more abused in modern political discourse than “liberalism.” Originally meant to describe the ideology of free trade and limited government, the anti-capitalist left adopted the term in the 1930s and changed its meaning to the opposite of what it meant in the 19th century.

It is possible that there is no term more abused in modern political discourse than “liberalism.” Originally meant to describe the ideology of free trade and limited government, the anti-capitalist left adopted the term in the 1930s and changed its meaning to the opposite of what it meant in the 19th century. Gold prices traded in London’s wholesale market steadied against the rising US Dollar Friday, heading for a solid weekly gain versus all major currencies as the Chinese Yuan hit fresh 6-year lows on the FX market.

Gold prices traded in London’s wholesale market steadied against the rising US Dollar Friday, heading for a solid weekly gain versus all major currencies as the Chinese Yuan hit fresh 6-year lows on the FX market. Among all of the indignities Wells Fargo has sustained in the wake of its illegal sales scandal, the bank is now out of good standing with a leading consumer watchdog group.

Among all of the indignities Wells Fargo has sustained in the wake of its illegal sales scandal, the bank is now out of good standing with a leading consumer watchdog group. The housing market has “apparently cooled.”

The housing market has “apparently cooled.” It’s being hailed as a road trip but it’s really a race.

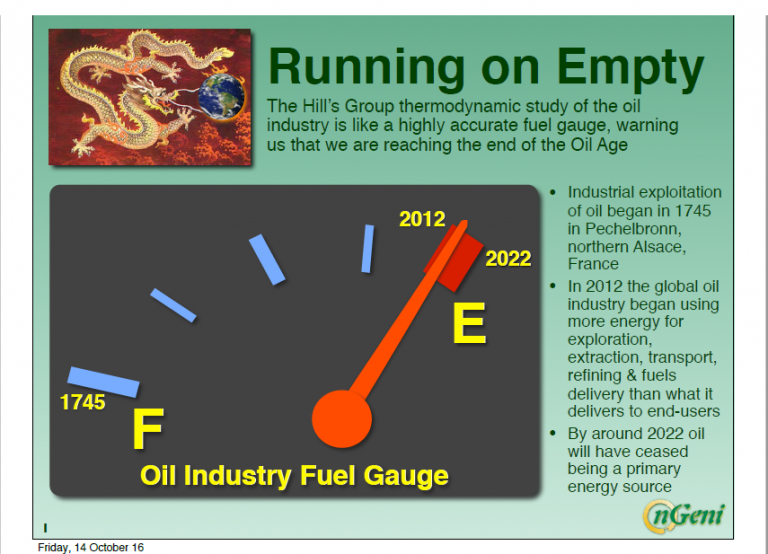

It’s being hailed as a road trip but it’s really a race. The world is heading towards a rapid disintegration of its economic and financial system due to a “Thermodynamic oil collapse.” I spoke with Dr. Louis Arnoux of nGeni, about the details of the thermodynamics of oil depletion and its impact on the global economy.

The world is heading towards a rapid disintegration of its economic and financial system due to a “Thermodynamic oil collapse.” I spoke with Dr. Louis Arnoux of nGeni, about the details of the thermodynamics of oil depletion and its impact on the global economy. Reporting from an undisclosed location in the USSA…

Reporting from an undisclosed location in the USSA… At the conclusion of the third presidential debate, Republican nominee Donald Trump refused to commit to accepting the eventual election outcome.

At the conclusion of the third presidential debate, Republican nominee Donald Trump refused to commit to accepting the eventual election outcome. As the monetary madness continues, look at the powerful piece below.

As the monetary madness continues, look at the powerful piece below.