from Talk Digital Network

In the Coming Financial Wipeout, This Will Figure Prominently, and Not in a Good Way

from King World News

In the coming financial wipeout, this will figure prominently, and not in a good way.

In the coming financial wipeout, this will figure prominently, and not in a good way.

By Bill Fleckenstein President Of Fleckenstein Capital

October 27 (King World News) – Overnight bond markets were quite weak again and it is looking more and more like the bond blowoff that began last summer now clearly has ended (30-year Treasury yields having risen from 2.1% to 2.6%) — and perhaps the 35-year bond bull market along with it. (If so, it will be the top of a lifetime, and I will discuss it more prospectively as it starts to play out.)…

Harvey Organ’s Daily Gold & Silver Report – 2016.10.27

Comex gold deliveries in October surpass 30 tonnes: (30.24 tonnes standing)/huge withdrawal of 5.987 million oz from the SLV/Another fall in the Chinese yuan/Huge fall in Deutsche banks deposits as depositors are very fearful/Egypt entering hyperinflation/Venezuela in the thick of hyperinflation as Maduro orders a 200 fold increase in largest denomination bill

by Harvey Organ

Harvey Organ’s Blog

Gold $1267.90 UP $3.10

Gold $1267.90 UP $3.10

Silver 17.60 UP 1 cents

In the access market 5:15 pm

Gold: 1269.00

Silver: 17.63

Andrew Hoffman – Universal Rigging

from Financial Survival Network

What’s Happening Wednesdays with Andrew Hoffman: A globally dangerous, and unquestionably inflectionary point in history, centered around November 8th; Markets never more rigged, and ripe for “unrigging” – particularly if Trump wins; OPEC production cut, Deutsche Bank solvency, and other epic con jobs shortly to be destroyed; Precious Metal prices never more undervalued relative to fundamentals, since they started “freely trading” four decades ago.

What’s Happening Wednesdays with Andrew Hoffman: A globally dangerous, and unquestionably inflectionary point in history, centered around November 8th; Markets never more rigged, and ripe for “unrigging” – particularly if Trump wins; OPEC production cut, Deutsche Bank solvency, and other epic con jobs shortly to be destroyed; Precious Metal prices never more undervalued relative to fundamentals, since they started “freely trading” four decades ago.

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

Bill Murphy & Chris Waltzek on GoldSeek Radio – Oct. 27, 2016

by Chris Waltzek

GoldSeek Radio

Bill Murphy of GATA.org rejoins the show while attending the 2016 new Orleans Investment Conference, which includes Peter Schiff, Doug Casey and Dennis Gartman. Our guest reviews the 2016 PMs rally, one of the most explosive in history, ahead of the contentious Nov. 8th election, noting that once the event passes, the PMs equities will blast higher amid a new golden era. The FOMC rate hike cycle will end in Dec. 2016, perhaps even reversing course in 2017-2018 to stave off the threat of another credit crisis circa 2008. Following the last rate hike of 2016, the PMs sector advanced sharply. Our guest underscores the importance for every investor to prepare for Talebian, “Black Swan” events, similar to the Brexit, that caught so many financial institutions unprepared. A similar scenario could open the flood gates into gold and silver investments.

Bill Murphy of GATA.org rejoins the show while attending the 2016 new Orleans Investment Conference, which includes Peter Schiff, Doug Casey and Dennis Gartman. Our guest reviews the 2016 PMs rally, one of the most explosive in history, ahead of the contentious Nov. 8th election, noting that once the event passes, the PMs equities will blast higher amid a new golden era. The FOMC rate hike cycle will end in Dec. 2016, perhaps even reversing course in 2017-2018 to stave off the threat of another credit crisis circa 2008. Following the last rate hike of 2016, the PMs sector advanced sharply. Our guest underscores the importance for every investor to prepare for Talebian, “Black Swan” events, similar to the Brexit, that caught so many financial institutions unprepared. A similar scenario could open the flood gates into gold and silver investments.

Click Here to Listen to the Audio

One Giant Cluster Ponzi

by Dr. Jeffrey Lewis

Silver Seek

“The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary.” – H. L. Mencken

Recently, The U.S. Treasury ramped up war games via financial sanctions aimed at Russia. The EU is part and parcel to the operation. These interventions are a continuation of the age old warfare referred to as the “currency wars”. Jim Rickards’ recent book on the topic chronicles the use of this tactic.

In many ways, the U.S. Federal Reserve was spawned in the spirit of interference and intervention before and during World War I.

The more things change the more they stay the same.

Technology has made large financial trusts both more efficient and more fragile. However, electronic security infrastructure has never been tested in true world sovereign crisis.

Next Leg In The Rally? Extreme Positioning In Gold, Silver, 10-Year Bonds Has Moderated

from Zero Hedge

Submitted by Eric Bush via Gavekal Capital blog,

Since the summer of 2015 the long gold, long 10-year US treasury trade bonds has basically been one in the same (silver and treasury bonds have moved in tandem as well).

[…] Investors saw gold rally from under $1100 to nearly $1400 (silver from $15 to $21) as 10-year treasury yields fell from 220 bps to less than 140 bps. As the momentum of this trade really gained steam, we saw commercial traders aggressively position themselves for gold prices (and silver prices) to decline and for yields to back up.

As usual, the ‘smart’ money was correct and as Brexit came and went, we have seen gold prices fall back to around $1275 (silver has fallen to $18) and yields have backed up to 176 bps.

Facebook, Amazon, Netflix, Google Account for 90% of Market Cap Gains Since December 2014: Tonight, Amazon Missed

by Mike ‘Mish’ Shedlock

Mish Talk

In an interesting tweet that shows investor herding into a small subset of high-beta stocks, Jeff Macke notes Facebook, Amazon, Netflix, and Google, collectively named (FANG) account for over 90% of S&P 500 market cap gains since December 2014.

[…] Google Beats

Both companies reported tonight.

CNBC reports Google parent Alphabet sees earnings, revenue beat and announces $7 billion buyback.

Amazon Missed

Amazon is down 5% (down $42 from $818 to $775) in after hours trading on a substantial earnings miss: Amazon Reports 52 Cents per Share, vs. Expected EPS of 78 Cents.

The Blowup in Spamazon

by Karl Denninger

Market-Ticker.org

Quick read from their 10Q, which just hit Edgar:

AWS growth is slowing a lot, which portends very serious trouble for the company’s stock price.

See, the premise was that Amazon was on the front end of a major growth wave that would continue for a long time. Now we have evidence that instead they’re starting to saturate the market (between them and competitors) which means that the market is about to shift.

How will it shift?

Simple — as all markets for something new shift when they become more and more like a commodity.

First comes slower growth.

Jim Rickards on Fed Policy and the Market Impact of U.S. Elections

by Craig Wilson

Daily Reckoning

In Jim Rickards latest interview (full interview found here) while on location in Sydney, Australia he discussed his forthcoming book “The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis.” While at The Australian Broadcasting Corporation (ABC) Rickards reveals his full take on the upcoming U.S elections and analysis on the latest Fed policy.

In Jim Rickards latest interview (full interview found here) while on location in Sydney, Australia he discussed his forthcoming book “The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis.” While at The Australian Broadcasting Corporation (ABC) Rickards reveals his full take on the upcoming U.S elections and analysis on the latest Fed policy.

Ticky Fullerton, the ABC presenter for the show The Business, asked Rickards about the anticipation of a market crisis by elites. After explaining that his commentary is well documented he noted on the looming financial crisis that “The elites see this coming. They are signaling each other. When I say elites, it’s not a deep dark conspiracy. Christine Lagarde, Mario Draghi, Claudio Borio and Janet Yellen [that] are central bankers, academics and policy makers from around the world. They all know how fragile the system is.”

“They don’t want to talk about it publicly. I have had a lot of private one-one-one’s with a number of people I would put in that circle. Privately they will tell you the system is unstable.”

Belgian Walloons Yield on EU-Canada Deal Under Pressure, but Sorry Saga is a Warning for Britain

Walloon leader Paul Magnette has become the pin-up hero of the anti-globalist movement, but he his protest has largely been heroic failure

by Ambrose Evans-Pritchard

Telegraph.co.uk

Belgium’s French-speaking Walloons have finally backed down on the EU’s long-awaited trade deal with Canada after a week of marathon talks, agreeing to accept the terms with a declaratory protocol that changes nothing.

Charles Michel, the Belgian prime minister, declared that an internal accord on the EU-Canada pact – known as Ceta – was a triumph for parliamentary democracy, but admitted later that it “does not change a single comma under international law”.

The deal is a litmus test of whether the EU is institutionally capable of reaching complex trade treaties as member states and constitutional regions each demand their own say.

Recommended Reading: ‘When Money Dies: The Nightmare of the Weimar Collapse’

Precious metals expert Michael Ballanger discusses his favorite investing books and reviews the landscape for gold and the U.S. dollar between now and the end of the year.

by Michael J. Ballanger

The Gold Report

Since entering the hallowed halls of that venerable, old private Jesuit university, Saint Louis University, that sits near the banks of the equally-venerable-and-old man river, the “Mighty Mississippi,” I have kept a number of books in my library that shall remain as “life textbooks,” tomes upon which to refer in times of confusion, despair, joy and victory. Because of my background in hockey as a (much) younger man, I have always enjoyed re-reading sports books and one of my favorites was Ken Dryden’s “The Game” because he described a team and league that had many members familiar to me in the 1970s. Thomas Hauser’s “Muhammad Ali: His Life and Times” was another superb book about the singular, most-globally-recognized athlete of all time and, again, an athlete from the era in which I was raised.

Since entering the hallowed halls of that venerable, old private Jesuit university, Saint Louis University, that sits near the banks of the equally-venerable-and-old man river, the “Mighty Mississippi,” I have kept a number of books in my library that shall remain as “life textbooks,” tomes upon which to refer in times of confusion, despair, joy and victory. Because of my background in hockey as a (much) younger man, I have always enjoyed re-reading sports books and one of my favorites was Ken Dryden’s “The Game” because he described a team and league that had many members familiar to me in the 1970s. Thomas Hauser’s “Muhammad Ali: His Life and Times” was another superb book about the singular, most-globally-recognized athlete of all time and, again, an athlete from the era in which I was raised.

Must Read of the Day – Dennis Kucinich’s Extraordinary Warning on D.C.’s Think Tank Warmongers

by Michael Krieger

Liberty Blitzkrieg

[…] Former Congressman Dennis Kucinich has just penned an extremely powerful warning about the warmongers in Washington D.C. Who funds them, what their motives are, and why it is imperative for the American people to stop them.

The piece was published at The Nation and is titled: Why Is the Foreign Policy Establishment Spoiling for More War? Look at Their Donors.

Read it and share it with everyone you know.

Washington, DC, may be the only place in the world where people openly flaunt their pseudo-intellectuality by banding together, declaring themselves “think tanks,” and raising money from external interests, including foreign governments, to compile reports that advance policies inimical to the real-life concerns of the American people.

The Next Big Shoe to Drop – Student Loans

by Dr. Jeffrey Lewis

Silver Coin Investor

More than 40 million young Americans carry federal and private student loan debt – amounting to over $1 trillion. Defaults are on the rise and the issue has grown to become a nasty wealth transfer mechanism, as well as sad example of the failure of finance in general.

More than 40 million young Americans carry federal and private student loan debt – amounting to over $1 trillion. Defaults are on the rise and the issue has grown to become a nasty wealth transfer mechanism, as well as sad example of the failure of finance in general.

This week, President Obama announced a new initiative framed as a way of addressing the issue. Sadly, it is far from the mark, and just one more indication that monetary masters are the real puppeteers.

Many have pointed out that the student loan debt bubble could be the next subprime crisis.

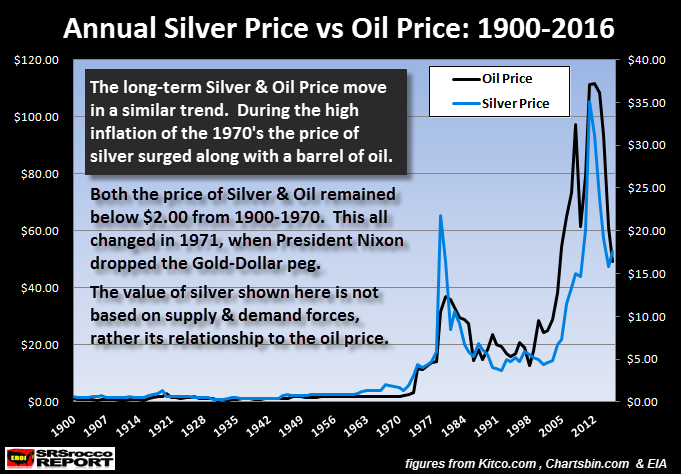

Why Most Analysts’ Gold & Silver Price Forecasts Are Wrong

by Steve St. Angelo

SRSRocco Report

Precious metals investors are being misled by most analysts’ price forecasts because they do not understand the critical underlying fundamental value mechanism. Furthermore, there seems to be a great deal of animosity from the short-term trading analysts who view many in the precious metals community as pandering hype and conspiracies.

Precious metals investors are being misled by most analysts’ price forecasts because they do not understand the critical underlying fundamental value mechanism. Furthermore, there seems to be a great deal of animosity from the short-term trading analysts who view many in the precious metals community as pandering hype and conspiracies.

One of these analysts is Avi Gilburt of the Elliottwavetrader site. He criticizes the “Gold bugs” in a few of his more recent articles, Who Do You Allow Yourself To Be Manipulated, Did Your Mother Write An Article On Gold, and Damn Manipulators.

Feel free to check out these articles as Avi Gilburt condemns those precious metals analysts who continue to regurgitate the “manipulation” theme over and over.

The End of Volatility? Gold at a Bottom?

by Gerardo Del Real

Outsider Club

I’m in New Orleans today to take part in the New Orleans Investment Conference. I’ll be co-hosting a workshop with colleague, friend, and founder of Outsider Club Nick Hodge.

I’m in New Orleans today to take part in the New Orleans Investment Conference. I’ll be co-hosting a workshop with colleague, friend, and founder of Outsider Club Nick Hodge.

As I walk around and observe the early crowd, two things stand out.

There’s a cautiousness about the latest pullback in the gold price. The kind of cautiousness that gets shaken out of great positions at the first sign of a further drop in the price of gold. A drop that I believe we will see within these next two months.

The early crowd at a session about investing in real estate as a hedge against uncertain monetary policy is a good indicator that people are starting to pay attention to the possibility that all is not well behind the curtain.

Has World War 3 Already Started?

by Nick Giambruno

Casey Research

It took 3 million soldiers, 3,000 tanks, 7,000 artillery pieces, and 2,500 aircraft…

It took 3 million soldiers, 3,000 tanks, 7,000 artillery pieces, and 2,500 aircraft…

“Operation Barbarossa” was the code name for Nazi Germany’s invasion of the Soviet Union in 1941.

It was the largest military operation in human history.

The Nazis had already conquered most of Europe. Hitler had grown overconfident from his recent military victories. Now he was hunting for big game… Stalin’s USSR.

Throughout history, many European invaders, including Napoleon, suffered monumental defeats when they took on Russia. Despite this, Hitler thought he could succeed where they had failed.

Michael Moore: People Voting Trump As “Ultimate F–– You… A Human Molotov Cocktail”

by Mac Slavo

SHTF Plan

A tidal wave is coming.

A tidal wave is coming.

Michael Moore, a liberal’s liberal who holds die-hard loyalty to Hillary Clinton, is acknowledging what everyone with a clear head recognizes: that she doesn’t even remotely connect with the average voter, doesn’t understand their problems – and above all, doesn’t care about them.

Although Moore can’t support Donald Trump, he seems to admire his ability to resonate with the actual problems that the people who formerly made up the middle class are going through – economic and otherwise. Moore, like Trump, understands the pulse of the people, though they differ in just about every other way.

This election represents a pivotal point, and an end of the line for the deal that people once held with their leaders. After decades of broken promises and deals to sell them short and sell them out, people have had enough.

Walloons Relent, CETA “Salvaged” (Or Was It?) Competing Stories

by Mike ‘Mish’ Shedlock

Mish Talk

After months of haggling, and shortly after Justin Trudeau, Canada’s prime minister, cancelled a trip to sign the Comprehensive Economic and Trade Agreement in Brussels, the Walloons gave into pressure and agreed to approve the the deal.

The Financial Times reports EU Trade Deal with Canada Salvaged after Belgian Regions Concede.

The EU’s trade deal with Canada was pulled back from the brink on Thursday after Belgian regional leaders dropped their objections to Belgium’s government signing the pact in an eleventh-hour rescue.

The Ceta affair has been deeply embarrassing for EU leaders, who had hoped the deal would prepare the ground for the even bigger Transatlantic Trade and Investment Partnership pact with the US. Instead the affair has raised questions over the ability of the EU to conclude complex deals that require the support of all the parliaments in the bloc.

The parties came close to a deal on Wednesday night but talks broke up — resulting in the cancellation of an EU-Canada summit that had been scheduled for months.

Gold Daily and Silver Weekly Charts – Capped Again at 1270 – Election Speculation

Gold and silver managed to move higher despite the stronger dollar, with gold showing a little more strength.

Gold and silver managed to move higher despite the stronger dollar, with gold showing a little more strength.

With the VIX also climbing, this looked like a flight to safety of some modest proportion.

Gold is obviously caught in a short term trend. Silver as well, although it is not as easy to see this on the weekly chart.

Over 800,000 ounces of gold have been taken off the Brink’s accounts in Hong Kong over the past two days. Perhaps not significant in the bigger picture of things. But still worth noting if such a trend to take physical out of the ‘Comex warehouses’ there and not replace it.

Quite a few traders are busying themselves by trying to figure out with way assets will move if Trump or Hillary win the election.

Legend Says This Will Translate Into a $100 Spike in Gold Overnight

from King World News

As we approach the end of October in what has been a tough environment in the gold and silver markets, today a legend in the business sent King World News a powerful piece about the big picture and what will translate into a $100 spike in gold overnight.

As we approach the end of October in what has been a tough environment in the gold and silver markets, today a legend in the business sent King World News a powerful piece about the big picture and what will translate into a $100 spike in gold overnight.

Gold’s Surge To $1,600

By John Ing, Maison Placements

October 27 (King World News) – For almost two decades, these institutions manipulated rates for their own benefit. Is this the latest hedge fund rigging scandal? No, it’s the world’s leading central banks, including the Bank of Japan (BOJ) manipulating interest rates, after rounds and rounds of large scale quantitative easing (QE) that saw them buy up almost half of the Japanese ETFs. Yet despite manipulating the yield curve and creating money to buy assets like government debt and ETFs, there is growing concern they’ve reached their limit…

The Vexed Question of the Dollar

by Alasdair MacLeod

Gold Money

There is little doubt that the rapid expansion of both dollar-denominated debt and monetary quantities since the financial crisis will lead us into a currency crisis.

There is little doubt that the rapid expansion of both dollar-denominated debt and monetary quantities since the financial crisis will lead us into a currency crisis.

We just don’t know when, and the dollar is not alone. All the major paper currencies have been massively inflated in recent years. With the dollar acting as the world’s reserve currency, where the dollar goes, so do all the other fiat monies. Until that cataclysmic event, we watch currencies behave in increasingly unexpected, seemingly irrational ways. The fundamentals for Japan are not good, yet the yen remains the strongest currency of the big four. The Eurozone risks a systemic collapse, overwhelmed by political and financial headwinds, yet the euro’s exchange rate has proved relatively impervious to this deep uncertainty. The British economy is strongest, yet sterling is the weakest of the four majors.

“This Is About Whiteness” UC Berkeley Students Segregate Campus, Block Bridge With Human Wall

from Zero Hedge

Submitted by Robby Soave via Reason.com,

Student protesters at the University of California-Berkeley gathered in front of a bridge on campus and forcibly prevented white people from crossing it. Students of color were allowed to pass.

The massive human wall was conceived as a pro-safe space demonstration. Activists wanted the university administration to designate additional safe spaces for trans students, gay students, and students of color. They were apparently incensed that one of their official safe spaces had been moved from the fifth floor of a building to the basement.

The Story Within the Story

by Karl Denninger

Market-Ticker.org

CHICAGO – Genes taken from archived blood samples show the U.S. AIDS epidemic started in New York in the early 1970s, definitively debunking the long-held belief that the virus was spread in the early 1980s by a flight attendant who became vilified as “Patient Zero” for seeding the U.S. outbreak.

That’s good, right?

No, it’s very bad. Here’s why:

New GDP Definitions: Solid, Liquid, Gas

by Mike ‘Mish’ Shedlock

Mish Talk

The Advance GDP reading (first estimate) of third quarter GDP comes out tomorrow.

Here’s a recap of six GDP estimates plus a bonus opinion as to what constitutes “solid” GDP growth.

Current Estimates

- GDPNow 3rd Quarter: 2.1%

- FRBNY Nowcast 3rd Quarter: 2.2%

- Markit 3rd Quarter: 1.0%

- Econoday 3rd quarter consensus: 2.5%

- Markit 4th quarter: 2.0%

- FRBNY Nowcast 4th quarter: 1.4%

“Solid” GDP Expected