from Financial Survival Network

Danielle Park joined us today. Happy Days are here again or are they? The Case Schiller Index is almost back to where it was in 2006. While the housing sector has recovered somewhat, housing’s contribution to GDP is around half of where it was at its peak. Incomes and employment are still depressed so how high can it really go? In Canada they’re still at peak levels, but it shows signs of cracking. Will Canada repeat the US’s performance. Maybe now is not the time to be buying homes in Vancouver and elsewhere.

Danielle Park joined us today. Happy Days are here again or are they? The Case Schiller Index is almost back to where it was in 2006. While the housing sector has recovered somewhat, housing’s contribution to GDP is around half of where it was at its peak. Incomes and employment are still depressed so how high can it really go? In Canada they’re still at peak levels, but it shows signs of cracking. Will Canada repeat the US’s performance. Maybe now is not the time to be buying homes in Vancouver and elsewhere.

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

In the midst of an election for which foreign policy has played an unusually large role,

In the midst of an election for which foreign policy has played an unusually large role,  David discussing the continuing problems that plague the world financial system:

David discussing the continuing problems that plague the world financial system: Guest Ed Conard is an economist who worked with Mitt Romney at Bain Capital, he is the New York Times Bestselling Author of Unintended Consequences: Why everything you’ve been told about the economy is wrong and his upcoming book, The Upside of Inequality: How Good Intentions Undermine the Middle Class promises to educate and enlighten. Discussions during this podcast include misnomers about CEO pay, why the technology sector is wildly profitable and how a complex web of regulations may be only benefiting the big players in the market.

Guest Ed Conard is an economist who worked with Mitt Romney at Bain Capital, he is the New York Times Bestselling Author of Unintended Consequences: Why everything you’ve been told about the economy is wrong and his upcoming book, The Upside of Inequality: How Good Intentions Undermine the Middle Class promises to educate and enlighten. Discussions during this podcast include misnomers about CEO pay, why the technology sector is wildly profitable and how a complex web of regulations may be only benefiting the big players in the market. An NYU professor crusading against political correctness and student coddling was booted from the classroom last week after his colleagues complained about his “incivility,” The Post has learned.

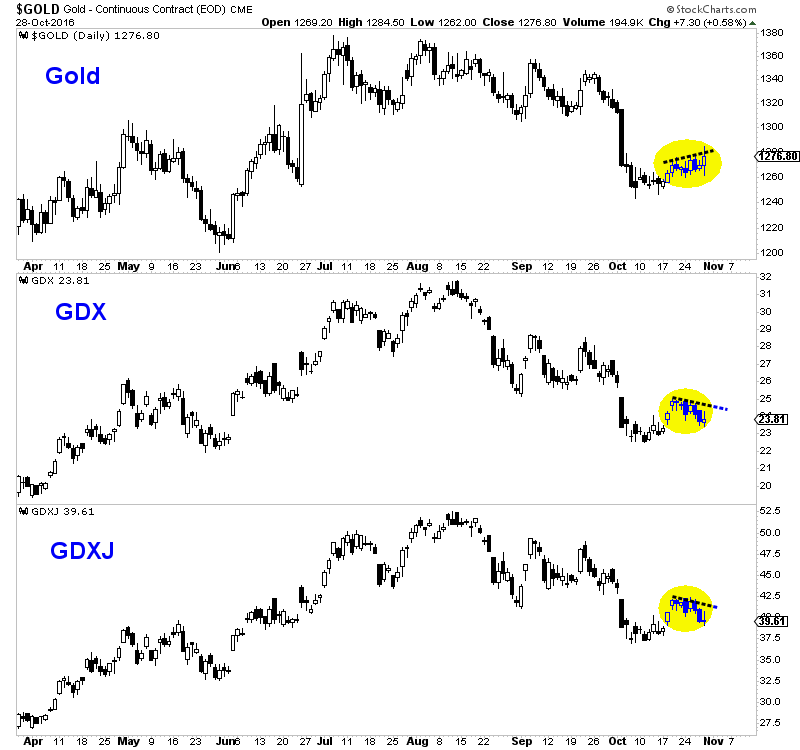

An NYU professor crusading against political correctness and student coddling was booted from the classroom last week after his colleagues complained about his “incivility,” The Post has learned. You have heard it before from us and probably elsewhere. The miners lead Gold. We have seen this every major turn dating back 16 years and it can also be the case with respect to short and medium term trends. While the precious metals sector has rallied over the past few weeks, the rally has been weak and the gold stocks relative weakness in recent days bodes negatively for the sector.

You have heard it before from us and probably elsewhere. The miners lead Gold. We have seen this every major turn dating back 16 years and it can also be the case with respect to short and medium term trends. While the precious metals sector has rallied over the past few weeks, the rally has been weak and the gold stocks relative weakness in recent days bodes negatively for the sector.

Before every election in recent times the usual cadre of screamers show up with their threats to move to Canada if the election goes the “wrong” way. I’ll note that there’s never been any evidence that any of said screamers have actually emigrated (anywhere) when their preferred candidate has lost, by the way. Miley Cyrus, pack your bags (you know she won’t.)

Before every election in recent times the usual cadre of screamers show up with their threats to move to Canada if the election goes the “wrong” way. I’ll note that there’s never been any evidence that any of said screamers have actually emigrated (anywhere) when their preferred candidate has lost, by the way. Miley Cyrus, pack your bags (you know she won’t.) Word has reached me from Washington that the FBI has reopened the Hillary case of her violation of US National Security protocols, not because of the content of the new email releases, but because voter support for Trump seems to be overwhelming, while Hillary has cancelled appearances due to inability to muster a crowd. The popular vote leaves the FBI far out on the limb for its corrupt clearance of Hillary. The agency now has to redeem itself.

Word has reached me from Washington that the FBI has reopened the Hillary case of her violation of US National Security protocols, not because of the content of the new email releases, but because voter support for Trump seems to be overwhelming, while Hillary has cancelled appearances due to inability to muster a crowd. The popular vote leaves the FBI far out on the limb for its corrupt clearance of Hillary. The agency now has to redeem itself. Attorney General Loretta Lynch has plead the fifth to avoid incrimination in the illegal transfer of billions of dollars in cash to Iran.

Attorney General Loretta Lynch has plead the fifth to avoid incrimination in the illegal transfer of billions of dollars in cash to Iran.

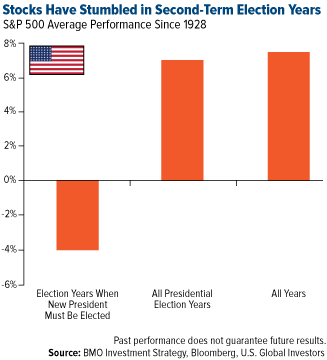

So here we are, 11 days before America picks its poison, with most national polls showing a win for Hillary Clinton. If she pulls it off, she’ll become not only the first woman and first first lady to rise to the country’s highest office but also the first Democrat to succeed another two-term Democrat since Martin Van Buren succeeded Andrew Jackson in 1837.

So here we are, 11 days before America picks its poison, with most national polls showing a win for Hillary Clinton. If she pulls it off, she’ll become not only the first woman and first first lady to rise to the country’s highest office but also the first Democrat to succeed another two-term Democrat since Martin Van Buren succeeded Andrew Jackson in 1837.

Editor’s note: As you may know, part of our job at Casey Research is to pass along interesting opportunities that come across our desks. Today, we’re sharing a few details on a brand-new trading service from our friend Jeff Brown, editor of Exponential Tech Investor.

Editor’s note: As you may know, part of our job at Casey Research is to pass along interesting opportunities that come across our desks. Today, we’re sharing a few details on a brand-new trading service from our friend Jeff Brown, editor of Exponential Tech Investor. Over the years, I have written many articles as to why the common perception of what moves metals has been wrong for so many years. As I have noted many times, the common “fundamentals” upon which the market relied failed adherents miserably. In fact, some have begun to actually recognize the truth in what I have been saying:

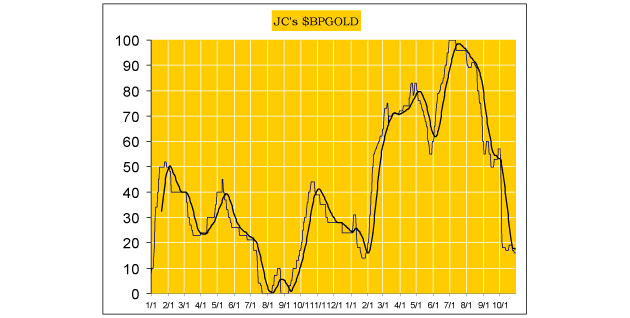

Over the years, I have written many articles as to why the common perception of what moves metals has been wrong for so many years. As I have noted many times, the common “fundamentals” upon which the market relied failed adherents miserably. In fact, some have begun to actually recognize the truth in what I have been saying: Our proprietary cycle indicator remains down.

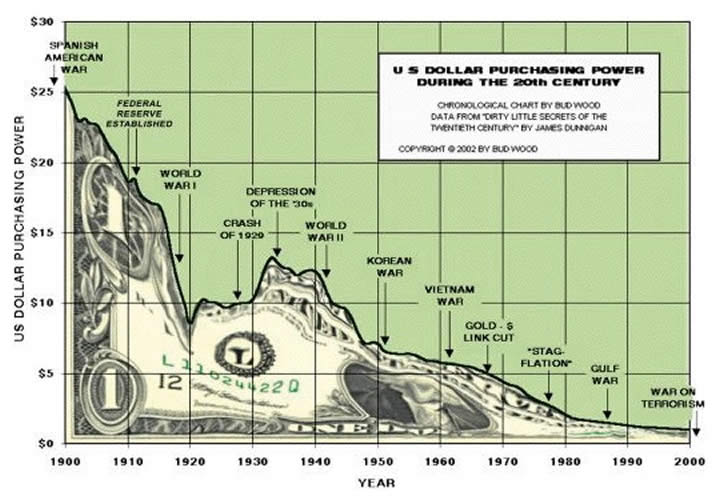

Our proprietary cycle indicator remains down. Inflation is rarely discussed in the mainstream press. Most people wake up every day and simply believe that prices go up as a natural state. These deeply held assumptions usually crack when new revelations happen like centuries ago with new scientific discoveries showing that our planet is not the center of the universe. Yet somehow people hold on tightly refusing to acknowledge that inflation is caused directly by banks, governments, and central banks. It is interesting to look at inflation data over a 20 year period, form 1996 to 2016. What you will find in the data is that prices are soaring in the items people need, especially those items to enter into the middle class. Since wages are not keeping up, it is no surprise then that the middle class over this time has shrank into a minority class.

Inflation is rarely discussed in the mainstream press. Most people wake up every day and simply believe that prices go up as a natural state. These deeply held assumptions usually crack when new revelations happen like centuries ago with new scientific discoveries showing that our planet is not the center of the universe. Yet somehow people hold on tightly refusing to acknowledge that inflation is caused directly by banks, governments, and central banks. It is interesting to look at inflation data over a 20 year period, form 1996 to 2016. What you will find in the data is that prices are soaring in the items people need, especially those items to enter into the middle class. Since wages are not keeping up, it is no surprise then that the middle class over this time has shrank into a minority class.

If you ever took Econ 101, I’m sure you remember the concept of “prisoner’s dilemma.” It shows why two completely “rational” individuals might not cooperate, even if it’s in their best interests to do so.

If you ever took Econ 101, I’m sure you remember the concept of “prisoner’s dilemma.” It shows why two completely “rational” individuals might not cooperate, even if it’s in their best interests to do so.