from Trends Journal

Don’t Believe the Wrong Things

If you’ve got a couple of spare decades on hand, and you don’t believe in Peak Oil, go head and buy these markets at these prices. Eventually you might break-even.

by Dr. Chris Martenson

Chris Martenson’s Peak Prosperity

We live in a post-truth world. Unfortunately, this really complicated the already complicated subject of investing. I mean it’s hard enough already, right?

We live in a post-truth world. Unfortunately, this really complicated the already complicated subject of investing. I mean it’s hard enough already, right?

But our official statistics aren’t even remotely correct. Inflation and Jobs are two sets of numbers the US government routinely fibs about.

And the Federal Reserve spends far too much time trying to keep stocks and bonds at inflated values. Those efforts at central planning will end the same as they always do; rubbished on a heap of unintended consequences.

Still, this is the game and we have to play.

The Return of the Dreaded “S” Word

by Byron King

Daily Reckoning

If you’re under the age of about 60, you’ve never experienced stagflation. Back in the ’70s, everyone experienced what happened and people spoke openly about it. The term itself — “stagflation” — was a shorthand term to describe what was clearly and painfully a broad, national economic unwind.

If you’re under the age of about 60, you’ve never experienced stagflation. Back in the ’70s, everyone experienced what happened and people spoke openly about it. The term itself — “stagflation” — was a shorthand term to describe what was clearly and painfully a broad, national economic unwind.

Throughout the decade, the rate of inflation crept up and people saw it in daily life. Food became more expensive, as did gasoline, and certainly housing. Meanwhile, entire swaths of the legacy U.S. economy began to contract, particularly in job-rich, good-paying industries like steel and other metals, machine building, heavy equipment, autos and much more.

It was a shock to many Americans. For 25 years after World War II, and certainly through the 1950s and ‘60s, America experienced a generally solid economy.

Industrial Demand Sets Record and Other Silver News

by Mike Maharrey

Silver Seek

Industrial demand for silver set a record in 2023 driven by a significant increase in silver offtake in the solar energy sector.

Industrial demand for silver set a record in 2023 driven by a significant increase in silver offtake in the solar energy sector.

This was one of several stories on the silver market featured in the latest edition of Silver News published by the Silver Institute.

Industrial demand for silver came in at 654.4 million ounces in 2023.

According to the Silver Institute,

“Higher than expected photovoltaic (PV) capacity additions and faster adoption of new-generation solar cells raised global electrical and electronics demand by a substantial 20 percent.”

Other green energy initiatives, including power grid construction and vehicle electrification, also boosted silver demand.

Actual Collusion? Missouri AG Accuses Biden DOJ of Coordinating with Trump Prosecutors

from Zero Hedge

Missouri Attorney General Andrew Bailey filed a Freedom of Information Act (FOIA) request on Thursday as part of a probe into whether the Biden DOJ coordinated with Trump prosecutors.

“The investigations and subsequent prosecutions of former President Donald J. Trump appear to have been conducted in coordination with the United States Department of Justice,” Baily posted in a lengthy thread on X.

“This is demonstrated by the move of the third-highest ranking member of the Department of Justice, Matthew Colangelo, to the Manhattan District Attorney’s Office in order to prosecute President Trump in December 2022,” Baily continues.

What’s more, Manhattan DA Alvin Bragg worked hand-in-hand with NY Attorney General Letitia James in pursuing civil litigation against Trump, which he used to campaign on.

A Recession in Early 2025 Could Send the Stock Market Tumbling 30%, Strategist Says

A recession by early next year could send stocks down 30%, says BCA strategist Roukaya Ibrahim.

by Yuheng Zhan

Yahoo! Finance

The strategist said on Monday that the US stock market is highly valued, and growth the PE estimates will sink back to levels more in line with the five years before the pandemic.

“I think that raises the likelihood that they’re more vulnerable to the downside. And our expectation if we do get this recession, late 2024, early 2025, the S&P 500 is most likely going to fall to around 3600,” Ibrahim told Bloomberg TV on Monday.

Our Favorite Recession Indicator: Next Recession Keeps Moving Further Out

by Wolf Richter

Wolf Street

It’s time again to look at the trends in claims for unemployment insurance benefits.

It’s time again to look at the trends in claims for unemployment insurance benefits.

The funnies this morning were the headlines about weekly initial claims for state unemployment insurance benefits. They rose to 231,000 seasonally adjusted, “the highest level since August,” Bloomberg’s headline exclaimed. So let’s see. August was of course in the middle of the infamous Q3 2023, when economic growth boomed 4.9%, more than double the normal rate for the US.

Not seasonally adjusted, initial claims for unemployment insurance inched up to 209,000, the highest in, let’s see, three weeks, according to today’s data from the Labor Department. Their seasonal high of 318,000 occurred at the beginning of January when the temporary shopping-season workers file for unemployment claims.

California’s Leaders Still Ignoring State Pension Debt

California has just 72 percent of the assets needed to make payments to retired public workers, many of whom get to collect six-figure annual payments.

by Steven Greenhut

Reason.com

When arguing about whether the Treasury needed to take urgent action to deal with soaring federal debt in the 1980s, the late former chairman of the Council of Economic Advisers Herb Stein coined Stein’s Law. It was simple and obvious: “If something cannot go on forever, it will stop.”

When arguing about whether the Treasury needed to take urgent action to deal with soaring federal debt in the 1980s, the late former chairman of the Council of Economic Advisers Herb Stein coined Stein’s Law. It was simple and obvious: “If something cannot go on forever, it will stop.”

I hate to pick nits with such an esteemed economist, but I’ll offer Greenhut’s Corollary: “Never underestimate politicians’ ability to kick the can down the road.” In 1986, federal debt was $2.1 trillion. In 2024, the debt is $34 trillion. Debt spending of this magnitude cannot go on forever, but it can fester for a long time and cause economic damage in the process. But, yes, it probably will stop eventually.

The CDC’s Latest Myocarditis Study is a Con Job

by W.A. Eliot

American Thinker

Stung by media reports of young athletes dropping dead seemingly often and everywhere, and sensitive to the claim that studies relying on the passive VAERS reporting system drastically underreport vaccine events including deaths, the CDC looked at Oregon death certificates in an effort to eliminate reporting bias on COVID-19 vaccination deaths. Here are excerpts of the abstract of its April 11, 2024 study:

Stung by media reports of young athletes dropping dead seemingly often and everywhere, and sensitive to the claim that studies relying on the passive VAERS reporting system drastically underreport vaccine events including deaths, the CDC looked at Oregon death certificates in an effort to eliminate reporting bias on COVID-19 vaccination deaths. Here are excerpts of the abstract of its April 11, 2024 study:

COVID-19 vaccination has been associated with myocarditis in adolescents and young adults, and concerns have been raised about possible vaccine-related cardiac fatalities in this age group…To assess this possibility, investigators searched death certificates for Oregon residents aged 16–30 years who died during June 2021–December 2022 for cardiac or undetermined causes of death. For identified decedents, records in Oregon’s immunization information system were reviewed for documentation of mRNA COVID-19 vaccination received =100 days before death…No death certificate attributed death to vaccination. These data do not support an association between receipt of mRNA COVID-19 vaccine and sudden cardiac death among previously healthy young persons. COVID-19 vaccination is recommended for all persons aged =6 months to prevent COVID-19 and complications, including death.

I know exactly what you’re thinking: “There needs to be a quick and devastating published take down of its premises. I don’t see anything like that on line yet — is it underway?”

Articles of Impeachment Drawn Over Biden’s Withholding of Israeli Aid for Political Reasons

by Wendell Husebo

Breitbart.com

Articles to impeach President Joe Biden over his decision to withhold aid to Israel for political reasons are in preparation, freshman Rep. Cory Mills (R-FL) announced Thursday.

Articles to impeach President Joe Biden over his decision to withhold aid to Israel for political reasons are in preparation, freshman Rep. Cory Mills (R-FL) announced Thursday.

Biden’s decision to withhold bombs from Israel is concerning due to its political implications. Biden’s base wants him to defund Israel, while many moderate Democrats support Israel’s ability to defend itself against terrorists. Biden appears stuck between competing coalitions during an election year. He currently trails in the polls to Trump and has a historically low approval rating to win reelection as an incumbent.

Democrats accused former President Donald Trump in 2019 of withholding military aid from Ukraine for alleged political reasons.

Turk: This Could Be the Big One for Gold, Silver and Miners as Today We Got a Trifecta of Upside Breakouts

from King World News

Today James Turk told King World News this could finally be the Big One for gold, silver and miners as today we got a trifecta of upside breakouts.

Today James Turk told King World News this could finally be the Big One for gold, silver and miners as today we got a trifecta of upside breakouts.

May 9 (King World News) – James Turk: We got a trifecta of breakouts today, Eric. Gold, silver, and the XAU Index of mining shares all hurdled above the resistance levels I pointed out when we spoke on Monday.

Gold ended today in New York above $2340; silver hurdled above $28, and the XAU closed above 140. Now all we need is some solid upside follow through over the next few days to confirm that all three markets are resuming their bullish uptrends, which would mean that each of these levels is a major breakout.

I Received a Request for an Interview From a French University Ph.D. Student for His Dissertation: This is My Reply.

by Dr. Paul Craig Roberts

PaulCraigRoberts.org

Pierre, I don’t think your questions are relevant.

Pierre, I don’t think your questions are relevant.

In the US and throughout the Western World, or what little remains of it, the white ethnicities who once constituted nations are now submerged in towers of babel in which the white ethnicities are demonized, and in the US reduced to second class citizenship in law, made to feel guilty and not only silenced but actually punished for protesting the over-running of their countries by Immigrant-invaders.

The intrusion of government into the family has destroyed the authority of parents. It is the state that has power over children. The children are brainwashed and indoctrinated in public education that they and their parents are racists and that they might be born into the wrong body from their real gender. In the US fortunes are being made in changing the gender of children in a process that legally has been taken out of the hands of parents.

Coppernico Metals to Receive TSX Listing and Start Drilling Sombrero with CEO Ivan Bebek

from Kerry Lutz's Financial Survival Network

Kerry Lutz was joined by CEO Ivan Bebek of Coppernico Metals for a dive deep into the company’s ambitious exploration project. From raising over $100 million to the strategic preparations for drilling, Ivan shares the challenges and milestones of Coppernico’s journey.

It’s been years in the making but the company has achieved the required community support and now has the necessary permits to begin aggressive drilling at the Sombrero project. As Ivan states, community support must be earned, and the company’s initiatives will carry on long after mining has finished.

There were numerous hurdles along the way, not the least of which were the pandemic related shutdowns. But Coppernico persevered and now drilling and a coveted TSX listing will be happening soon. Ivan also introduced Tim Kingsley, VP of Exploration, highlighting the team’s expertise along with the strong funding from major miners. Clearly this is a case of playing the long game, staying focused upon the ultimate goal and never giving up. Coppernico’s prospectivity is impressive and we hold shares in the company.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Virtual Home Invasions: We’re Not Safe From Government Peeping Toms

by John W. Whitehead and Nisha Whitehead

The Rutherford Institute

“The privacy and dignity of our citizens is being whittled away by sometimes imperceptible steps. Taken individually, each step may be of little consequence. But when viewed as a whole, there begins to emerge a society quite unlike any we have seen—a society in which government may intrude into the secret regions of man’s life at will.” – Justice William O. Douglas

The spirit of the Constitution, drafted by men who chafed against the heavy-handed tyranny of an imperial ruler, would suggest that one’s home is a fortress, safe from almost every kind of intrusion.

Unfortunately, a collective assault by the government’s cabal of legislators, litigators, judges and militarized police has all but succeeded in reducing that fortress—and the Fourth Amendment alongside it—to a crumbling pile of rubble.

We are no longer safe in our homes, not from the menace of a government and its army of Peeping Toms who are waging war on the last stronghold of privacy left to us as a free people.

The Missing Piece of the Puzzle: Behind the Inexplicable “Strength” of U.S. Consumers is $700 Billion in “Phantom Debt”

from Zero Hedge

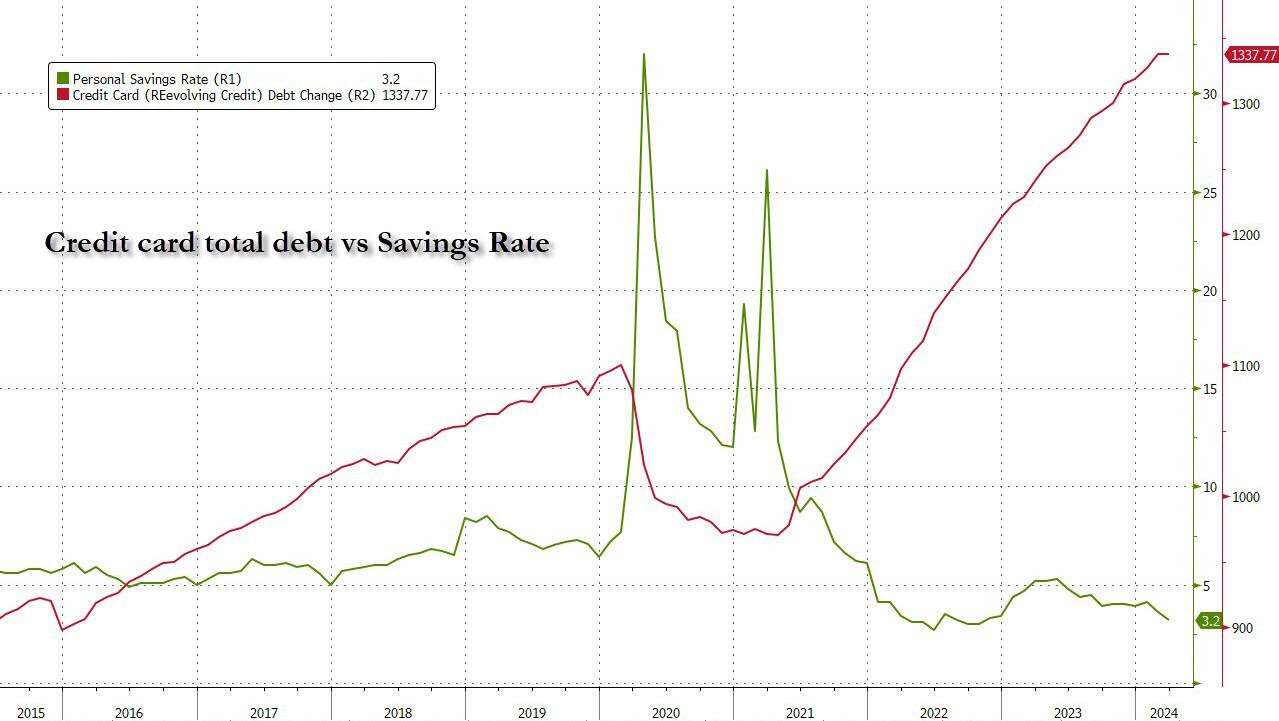

Yesterday we discussed the latest consumer credit data, which revealed that the amount of credit card debt across the US has hit a new record high of $1.337 trillion (even though it appears to have finally hit a brick wall, barely rising in March by the smallest amount since the covid crash), even as the savings rate has tumbled to an all time low.

To be sure, credit card debt is just a small portion (~6%) of the total household debt stack: as the next chart from the latest NY Fed consumer credit report shows, the bulk, or 70%, of US household debt is in the form of mortgages, followed by student loans, auto loans, credit card debt, home equity credit and various other forms. Altogether, the total is a massive $17.5 trillion in total household debt.