by Greg Hunter

USA Watchdog

Renowned radio host, filmmaker, book author and archeological dig expert Steve Quayle has amassed a deep network of sources, especially in the military. Quayle is hearing that America is closer to nuclear war than it has ever been. Quayle says, “This is a detonation broadcast because of everything that is ready to explode: in the economy, in the world of WWIII, the events taking place in Ukraine and the events taking place off of the West Coast of the United States. Never in the history of the United States and Russia have we had multiple submarines, strategic missile submarines doing tests in international waters warning the US government, especially the FAA and the Pentagon, that they are going to be using dummy warheads. . . . Here is the striking thing about this. The United States, Western Europe and the NATO confederation have declared in the next 10 days they are going to be moving up to 90,000 men onto the border in Ukraine. We have declared that F-16’s (that can carry nuclear missiles) are going into Ukraine. . . . or around Ukraine. Russia has said that when they touch down, they will hit them on the ground. What is more astonishing is the time period for this test missile launch is also 10 days. It syncs up totally with NATO’s time frame to deploy troops and F-16’s. . . .Russia is the leading nuclear power in the world, and they have advanced technology, such as hypersonic missiles we, the United States, do not possess. . . . We are talking about somebody making the wrong decision, and at that point, it’s WWIII from then on. This is not a military exercise.”

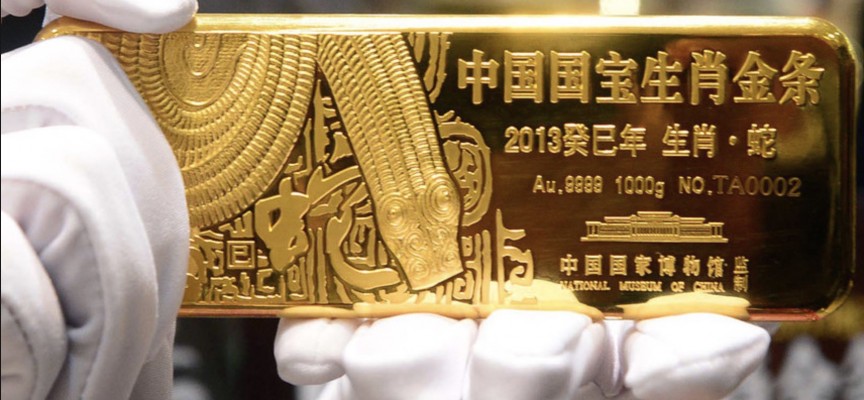

We are now clearly on the path to a gold and silver mania and a stock market crash. Take a look…

We are now clearly on the path to a gold and silver mania and a stock market crash. Take a look… On July 12, 1648, dozens of angry French politicians gathered at the hallowed Palais de Justice in Paris to draft the final ultimatum that would be sent to their nine-year-old king, Louis XIV.

On July 12, 1648, dozens of angry French politicians gathered at the hallowed Palais de Justice in Paris to draft the final ultimatum that would be sent to their nine-year-old king, Louis XIV. In this week’s The Reason Roundtable, editors Matt Welch, Katherine Mangu-Ward, Nick Gillespie, and Peter Suderman consider U.S. foreign policy toward Iran in the wake of a helicopter crash that left Iranian President Ebrahim Raisi and Foreign Minister Hossein Amir-Abdollahian dead.

In this week’s The Reason Roundtable, editors Matt Welch, Katherine Mangu-Ward, Nick Gillespie, and Peter Suderman consider U.S. foreign policy toward Iran in the wake of a helicopter crash that left Iranian President Ebrahim Raisi and Foreign Minister Hossein Amir-Abdollahian dead. What would it look like if China was tip-toeing away from dollars so as not to cause any alarm, while also buying gold with the resulting excess dollars?

What would it look like if China was tip-toeing away from dollars so as not to cause any alarm, while also buying gold with the resulting excess dollars?

Consumer sentiment is continuing its decline amongst Americans. The University of Michigan’s survey monthly survey revealed sentiment fell to a six-month low of 67.4 in May, down from 77.2 in April. Inflation is the primary reason for the loss in confidence, followed by interest rates and geopolitical issues.

Consumer sentiment is continuing its decline amongst Americans. The University of Michigan’s survey monthly survey revealed sentiment fell to a six-month low of 67.4 in May, down from 77.2 in April. Inflation is the primary reason for the loss in confidence, followed by interest rates and geopolitical issues. Have you ever felt like you can never seem to get ahead no matter how hard you try? If so, you are definitely not alone. The gap between the ultra-wealthy and the rest of us has never been greater, and more wealth is being transferred to the top of the pyramid with each passing day. Unfortunately, our economy has evolved into a highly centralized system that is designed to drain wealth from those that do not own wealth-producing assets and transfer it to those that do own wealth-producing assets. Sadly, even most of our homes and most of our vehicles have been turned into wealth-producing assets by the elite. Every month when you make your mortgage payment and your vehicle payment, you are making the wealthy even wealthier. The entire system is designed to get you deep into debt and keep you paying on that debt until you die.

Have you ever felt like you can never seem to get ahead no matter how hard you try? If so, you are definitely not alone. The gap between the ultra-wealthy and the rest of us has never been greater, and more wealth is being transferred to the top of the pyramid with each passing day. Unfortunately, our economy has evolved into a highly centralized system that is designed to drain wealth from those that do not own wealth-producing assets and transfer it to those that do own wealth-producing assets. Sadly, even most of our homes and most of our vehicles have been turned into wealth-producing assets by the elite. Every month when you make your mortgage payment and your vehicle payment, you are making the wealthy even wealthier. The entire system is designed to get you deep into debt and keep you paying on that debt until you die. Gold, silver and platinum prices have been on a tear so far this year, and strategists say the precious metals could continue to hit fresh record highs over the coming months.

Gold, silver and platinum prices have been on a tear so far this year, and strategists say the precious metals could continue to hit fresh record highs over the coming months. In a regularly scheduled meeting with leftist activists and Democrat NGOs, Satan tries to to explain the value of subtlety. It does not go well. The Babylon Bee has become famous in a disturbing way – Their parodies often end up predicting future realities, proving that we now live in Clown World whether we like it or not.

In a regularly scheduled meeting with leftist activists and Democrat NGOs, Satan tries to to explain the value of subtlety. It does not go well. The Babylon Bee has become famous in a disturbing way – Their parodies often end up predicting future realities, proving that we now live in Clown World whether we like it or not. The miasma of anxiety befogging so many brains in our troubled land begins to lift as every narrative served up by the US fascist intel blob goes annoyingly stale and impotent.

The miasma of anxiety befogging so many brains in our troubled land begins to lift as every narrative served up by the US fascist intel blob goes annoyingly stale and impotent. Fascinating: “Prices that families pay” when they buy homes “can affect their overall well-being.”

Fascinating: “Prices that families pay” when they buy homes “can affect their overall well-being.” The 2024 presidential election is five months away.

The 2024 presidential election is five months away. New York Judge Juan Merchan, who is overseeing former President Donald Trump’s business records trial, exploded at a witness over his behavior on Monday and called for the courtroom to be cleared.

New York Judge Juan Merchan, who is overseeing former President Donald Trump’s business records trial, exploded at a witness over his behavior on Monday and called for the courtroom to be cleared. The price of silver is now headed to a new all-time high above $50. Take a look…

The price of silver is now headed to a new all-time high above $50. Take a look…