from RT America

America Wastes About Half the Food That it Produces While Hunger Runs Rampant Around the Globe

by Michael Snyder

The Economic Collapse Blog

Is the United States the most wasteful nation on the entire planet? We are all certainly guilty of wasting food. Whether it is that little bit that you don’t want to eat at the end of a meal, or that produce that you forgot about in the back of the refrigerator that went moldy, the truth is that we could all do better at making sure that good food does not get wasted. It can be tempting to think that wasting food is not a big deal because we have so much of it, but an increasing number of people around the world are really hurting these days. In fact, it has been estimated that there are more than a billion hungry people around the globe right now. So as a society we need to figure out how to waste a whole lot less food and how to get it into the mouths of those that really need it.

Writing on the Wall

by Pater Tenebrarum

Acting Man

Time to Sell… Maybe

Time to Sell… Maybe

BALTIMORE – Yesterday, the S&P 500 hit a new all-time high. And the Dow just hit a new record close as well. If you haven’t sold yet, dear reader, this may be one of the best times ever to do so.

[…] We welcome new readers with a simple insight: Markets are contrary, pernicious, and downright untrustworthy. Just when the mob begins to bawl most loudly for stocks… the market sets its trap.

Longtime Diary sufferers will be quick to straighten out the record. We’ve warned that stocks have reached a peak several times over the last four years. Each time, we thought we saw the writing on the wall… and each time, we were mistaken. We raised our Crash Alert flag.

Too Late for Gold?

by Paul Mampilly

The Sovereign Investor

I was 13 when India was in crisis. It had borrowed too much money in dollars and was desperate to pay it back.

I was 13 when India was in crisis. It had borrowed too much money in dollars and was desperate to pay it back.

India needed dollars badly. So the government came up with a scheme to get it from people like my father who were earning money in petrodollars.

The Middle East was booming, and thousands of Indian people had followed my dad’s example and gotten jobs in Dubai and places like it. They were benefiting from the fast-growing economy there.

Dubai’s currency is easily exchanged into dollars, and India was desperate to lure my father and others like him into lending those dollars to the government.

Free-Market Medicine: The Role of the Large Medical Firm

by Michel Accad

Mises.org

In reality, however, the opposite would be the case. If healthcare were unregulated, many physicians would ultimately become employees in large organizations because patient demands for better and more specialized care would foster the emergence of large medical firms that would accelerate an effective and innovative division of labor. Economist Per Bylund has elaborated a general theory of the development of the firm along those lines.

Nice Terror Attack Threatens European Uprising

by Martin Armstrong

Armstrong Economics

Just the other day, Patrick Calvar, head of the General Directorate for Internal Security (DGSI) , France’s equivalent of MI5 or CIA, made his warning that in the aftermath of last year’s terrorist attacks on Paris, any further Islamic attacks may lead to a new French civil war. The total French population is 63.9 million people of which almost 10% are Muslim – 6.13 million. The Nice attack now killing about 73 people on Bastille Day (French Independence Day), will undoubtedly further the support for the extreme right wing in European politics no less add support to BREXIT, when the PM May was in fact sympathetic with regard to closing the borders for this very reason. We will see Pen surge more now in the polls and Hollande, who was at a whopping 11% approval rating, may now fall even below 10%. This will have further impact upon the diminishing approval rating of Merkel in Germany as well.

Just the other day, Patrick Calvar, head of the General Directorate for Internal Security (DGSI) , France’s equivalent of MI5 or CIA, made his warning that in the aftermath of last year’s terrorist attacks on Paris, any further Islamic attacks may lead to a new French civil war. The total French population is 63.9 million people of which almost 10% are Muslim – 6.13 million. The Nice attack now killing about 73 people on Bastille Day (French Independence Day), will undoubtedly further the support for the extreme right wing in European politics no less add support to BREXIT, when the PM May was in fact sympathetic with regard to closing the borders for this very reason. We will see Pen surge more now in the polls and Hollande, who was at a whopping 11% approval rating, may now fall even below 10%. This will have further impact upon the diminishing approval rating of Merkel in Germany as well.

The Global Oil Glut Gets Uglier

by Wolf Richter

Wolf Street

Forget the Recovery and “Rebalancing” Hype.

Forget the Recovery and “Rebalancing” Hype.

Deal makers in the oil patch of the US and Canada are smelling the fees, and they’re firing up the machinery. In the first half of the year, there were 52 pending and completed acquisitions of oil & gas exploration & production companies valued at $100 million or more, for a total of $30 billion, Fitch Ratings reported today:

The rise in transaction volume seems to be largely due to the improvement in hydrocarbon prices, including the tightening of bid/ask spreads, and access to capital markets.

Japan, Helicopter Money, Cold Fusion and the Disastrous Endgame

from King World News

With continued wild trading this summer in global markets, it’s all about Japan, helicopter money, cold fusion and the disastrous endgame.

With continued wild trading this summer in global markets, it’s all about Japan, helicopter money, cold fusion and the disastrous endgame.

By Bill Fleckenstein President Of Fleckenstein Capital

July 14 (King World News) – Overnight markets were all higher and the world was once again a-twitter over the concept of “helicopter money.” But once again, the pundits and the press are getting the descriptions wrong. Just like they talk about minimal inflation rates as “deflation” because they are scared of a depression, which is what they think deflation means, or refer to a 20% move as a bull or bear market, they are now mindlessly labeling the next step in monetary debasement as helicopter money…

Dozens Killed in French Terrorist Incident as Truck Plows Into Crowd, Driver then Fires Weapons

by Mike ‘Mish’ Shedlock

Mish Talk

In yet another senseless terrorist incident in France, a truck driver purposely plowed into a crowd then exited the truck and started firing shots. Death toll reports vary from 30 to 60 or more and are likely to be on the high side. Another 100 or more are injured.

The Washington Times reports Dozens killed as truck crashes into Bastille Day crowd in Nice, France.

France’s national holiday turned bloody and violent Thursday night in the southern city of Nice, as a truck crashed into a crowd of Bastille Day revelers, killing dozens of people and gunmen attacked several tourist haunts throughout the city.

“Dear people of Nice, the driver of a truck appears to have caused tens of deaths. Stay for the moment in your home. More info to come,” former Nice Mayor Christian Estrosi said, according to a Washington Times translation of his tweet.

Gold Daily and Silver Weekly Charts – Coiling For a Move

Stock option expiration tomorrow.

Stock option expiration tomorrow.

We are living a lie, because it serves us, it flatters us. It calls us to lie more and more, to use our power and knowledge to construct more lies, to love the lies, and to hate the truth.

We do. We love the darkness, and cannot bear the light. And so we love the lie. We love to think of ourselves as exceptional. But when our failings are exposed, we hide them with displays of power to silence the truth. We would be as gods, but are tragically just children of wrath.

And with the darkness comes madness, and the madness serves none but itself.

Investors Can Gain from European Banks’ Pain

The sentiment on European bank shares has hit a low, enabling investors to buy them at steep discounts

by Michael Brush

Market Watch

One of my favorite contrarian signals for investing is the “magazine-cover indicator,” and last week The Economist issued a doozy.

One of my favorite contrarian signals for investing is the “magazine-cover indicator,” and last week The Economist issued a doozy.

It trashed Italian banks under a magazine cover portraying a bus sporting Italy’s colors, teetering on the edge of a cliff. (How original.)

The Economist is always a little too harsh on Italy. But even discounting for that, the analysis of Italian banks and how rotten and risky they are — and, by extension, the country — was just savage.

Harvey Organ’s Daily Gold & Silver Report – 2017.07.14

Bankers orchestrate raid on gold and silver in an attempt to lower OI in silver/Silver is the banker’s Achilles heel/Japan does not have legal authority to commence “helicopter money”/China introduces a new guided missile destroyer in the South China Sea as tensions escalate

by Harvey Organ

Harvey Organ’s Blog

Gold:1331.30 DOWN $11.10

Gold:1331.30 DOWN $11.10

Silver 20.28 DOWN 9 cents

In the access market 5:15 pm

Gold: 1334.25

Silver: 20.30

Mike Gazzola & Matt Behdjou – Mining the Amazon.com Mother Load

from Financial Survival Network

You heard from Mike Gazzola before about his recent discovery about how easy it is to start a 6 or 7 figure business on Amazon. Now his partner Matt Behdjou appears with him and they talk about some of their successes and their blunders and how they can teach just about anyone to replicate their success. When we first spoke they had just broken the $150k mark. A few short weeks later and they’re closing in on $200k, pulling in over $2000 per day. All this in less than 6 months of operations. If I didn’t know these two guys personally, I wouldn’t believe it was possible! Listen in and tell me what you think.

You heard from Mike Gazzola before about his recent discovery about how easy it is to start a 6 or 7 figure business on Amazon. Now his partner Matt Behdjou appears with him and they talk about some of their successes and their blunders and how they can teach just about anyone to replicate their success. When we first spoke they had just broken the $150k mark. A few short weeks later and they’re closing in on $200k, pulling in over $2000 per day. All this in less than 6 months of operations. If I didn’t know these two guys personally, I wouldn’t believe it was possible! Listen in and tell me what you think.

Click here and find out more.

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

Jason Hartman – Ten Commandments of Successful Investing

Jason shares his 10 Commandments of Successful Investing in this audio recording of his live presentation during the Orlando, Florida Creating Wealth Seminar and Property Tour. He looks back at getting his real estate license at the age of 19 and the decisions he made when he sold his first company. Jason has become a multimillionaire by living by these guidelines and you can too. Income property is the most historically favored asset class. Why gamble your money in stocks and bonds when you can make solid, long-term investments in the US real estate market?

Jason shares his 10 Commandments of Successful Investing in this audio recording of his live presentation during the Orlando, Florida Creating Wealth Seminar and Property Tour. He looks back at getting his real estate license at the age of 19 and the decisions he made when he sold his first company. Jason has become a multimillionaire by living by these guidelines and you can too. Income property is the most historically favored asset class. Why gamble your money in stocks and bonds when you can make solid, long-term investments in the US real estate market?

Just go to JasonHartman.com and get started now!

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

Foreclosure Market Report with Rick Sharga SVP of RealtyTrac

Jason Hartman analyzes the foreclosure market with RealtyTrac Senior Vice President, Rick Sharga. As one of the country’s most frequently-quoted sources on foreclosure, mortgage and real estate trends, Rick has appeared on NBC Nightly News, CNN, CBS, ABC World News, CNBC, MSNBC and NPR. Rick has briefed government organizations such as the Federal Reserve and Senate Banking Committee and corporations like JPMorgan Chase, Citibank and Deutsche Bank on foreclosure trends, and done foreclosure training for Re/Max, Prudential and Keller Williams and other major organizations. Rick joined RealtyTrac in 2004 as Vice President of Marketing, responsible for the development and management of the company’s brand, public and investor relations. In his current capacity, he also oversees business development and data operations. Prior to joining RealtyTrac, Rick spent more than 20 years developing corporate and product sales and marketing strategies for corporations such as DuPont, Fujitsu, Hitachi, Toshiba, JD Edwards, Cox Communications and Honeywell. The 2006 Stevie® Award Winner for Best Marketing Executive, Rick began his career with Foote, Cone & Belding, and also held executive positions with Ketchum Communications and McGraw-Hill. Rick is a member of the National Association of Real Estate Editors, the USFN and REOMAC. He is also President of the Technology Council of Southern California and on the Editorial Advisory Board of Default Servicing News. Rick spends his spare time working toward a black belt in Tae Kwon Do, and continuing his lifelong quest to find the perfect wine to compliment his BBQ’d baby back ribs.

Jason Hartman analyzes the foreclosure market with RealtyTrac Senior Vice President, Rick Sharga. As one of the country’s most frequently-quoted sources on foreclosure, mortgage and real estate trends, Rick has appeared on NBC Nightly News, CNN, CBS, ABC World News, CNBC, MSNBC and NPR. Rick has briefed government organizations such as the Federal Reserve and Senate Banking Committee and corporations like JPMorgan Chase, Citibank and Deutsche Bank on foreclosure trends, and done foreclosure training for Re/Max, Prudential and Keller Williams and other major organizations. Rick joined RealtyTrac in 2004 as Vice President of Marketing, responsible for the development and management of the company’s brand, public and investor relations. In his current capacity, he also oversees business development and data operations. Prior to joining RealtyTrac, Rick spent more than 20 years developing corporate and product sales and marketing strategies for corporations such as DuPont, Fujitsu, Hitachi, Toshiba, JD Edwards, Cox Communications and Honeywell. The 2006 Stevie® Award Winner for Best Marketing Executive, Rick began his career with Foote, Cone & Belding, and also held executive positions with Ketchum Communications and McGraw-Hill. Rick is a member of the National Association of Real Estate Editors, the USFN and REOMAC. He is also President of the Technology Council of Southern California and on the Editorial Advisory Board of Default Servicing News. Rick spends his spare time working toward a black belt in Tae Kwon Do, and continuing his lifelong quest to find the perfect wine to compliment his BBQ’d baby back ribs.

Just go to JasonHartman.com and get started now!

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

The Pump and Dump of UK Residential Property

by Alasdair Macleod

Gold Money

Messrs Carney and Osborne are turning out to be a dangerous double-act for UK residential property investors.

Messrs Carney and Osborne are turning out to be a dangerous double-act for UK residential property investors.

They have been using monetary and fiscal policies through a combination of directed bank lending, selectively increasing transaction taxes and by implementing other tax policies with a view to suppressing demand for residential property.

If they think they can fine-tune these markets, history suggests they will eventually fail. There are significant challenges facing the UK residential property investors already, without state intervention. Incidentally, the problems discussed herein have little to do with the current difficulties faced by commercial property funds in the UK, which have had to suspend redemptions because of illiquidity, though their structural failure sends us a timely reminder about this inflexible characteristic of property generally.

June 25: Obama Stands by “Back of Queue” Brexit Warning; July 1: US-UK Trade Bill in Congress

by Mike ‘Mish’ Shedlock

Mish Talk

Fearmongering by president Obama and the UK “Remainers” regarding US-UK trade negotiations following Brexit is all the more humorous by a trio of interesting headlines.

Back of the Queue

On April 22, president Obama warned Brexit Would Put UK ‘Back of the Queue’ for Trade Talks.

Obama argued that he had a right to respond to the claims of Brexit campaigners that Britain would easily be able to negotiate a fresh trade deal with the US. “They are voicing an opinion about what the United States is going to do, I figured you might want to hear from the president of the United States what I think the United States is going to do.

Tech Industry Bashes Donald Trump in Open Letter

Letter signed by Qualcomm, Box, Yelp CEOs, and dozens more

by Jennifer Booton

Market Watch

The technology industry published an open letter about the U.S. election on Thursday, and it is vehemently opposed to Republican presidential nominee Donald Trump.

The technology industry published an open letter about the U.S. election on Thursday, and it is vehemently opposed to Republican presidential nominee Donald Trump.

The letter, published on Medium, was signed by dozens of tech heavyweights, including Qualcomm Inc. QCOM, +0.21% Chairman Paul Jacobs, Tumblr CEO David Karp, Box Inc. BOX, -0.09% CEO Aaron Levie, eBay Inc. EBAY, +0.23% co-founder Pierre Omidyar, Reddit co-founder Alexis Ohanian, Yelp Inc. YELP, +0.21% CEO Jeremy Stoppelman, Facebook Inc. FB, -0.03% vice president Margaret Stewart, Apple Inc. AAPL, +0.02% co-founder Steve Wozniak, and a number of venture capitalists.

The letter focuses on immigration, which is a hot topic for an industry that sources much of its top talent from India and Asia. Silicon Valley has long pushed for immigration reform through the H-1B visa, with Facebook CEO Mark Zuckerberg and Microsoft Corp. MSFT, -0.06% Bill Gates among the most outspoken executives on the issue.

Trump Picks Mike Pence as Vice President

from Zero Hedge

[…] While probably not much of a surprise to those who have been closely following the republican vice presidential race, moments ago Roll Call reported, citing a source, that Trump will pick Indiana governor Mike Pence as his vice president.

[…] While probably not much of a surprise to those who have been closely following the republican vice presidential race, moments ago Roll Call reported, citing a source, that Trump will pick Indiana governor Mike Pence as his vice president.

From the source:

Donald Trump is planning to announce that Indiana Gov. Mike Pence is his choice for his vice presidential running mate, according to a Republican with direct knowledge of the decision.

As Trump narrowed in on his choice of Pence, the two men spent time at both Trump’s golf resort in New Jersey in early July and at the Indiana governor’s mansion this week.

Gold Prices Sink to 2-Week Low as Brexit-UK Gets No Rate Cut or New QE from Bank of England

by Adrian Ash

Financial Sense

Gold prices fell to 2-week lows against all major currencies bar the Japanese Yen in London trade Thursday as the Bank of England surprised the markets by holding UK interest rates and its QE bond-buying scheme unchanged in response to late-June’s Brexit result in the referendum on leaving the European Union.

Falling to $1322 per ounce as Western stock markets rose once again, gold priced in Dollars has now lost almost 4% from Monday’s new 2-year high.

Gold had already fixed at its lowest Yuan price since 1 July at Shanghai’s afternoon benchmarking auction, with Swiss refinery MKS’s Asian desk reporting strong “selling interest [also] during early London trade.”

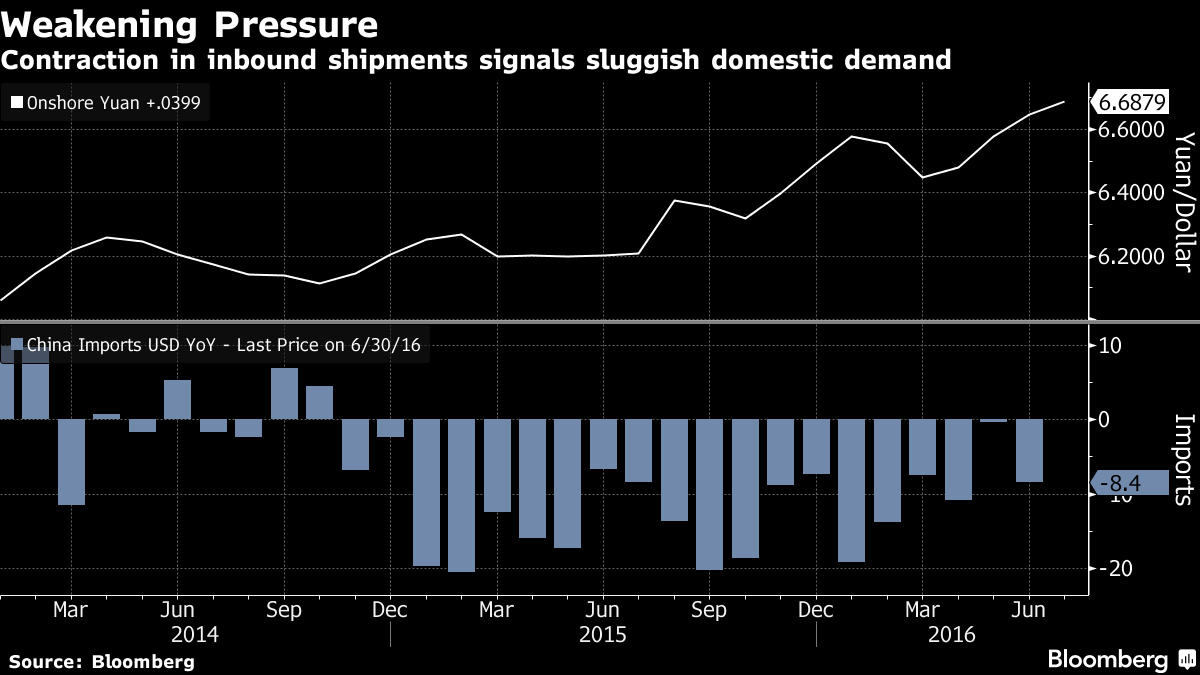

Yuan Near Six-Year Low as Sliding Imports Add to Economy Concern

by Bloomberg News

Bloomberg.com

China’s yuan traded near the weakest level in almost six years as a plunge in imports signaled declining demand in an economy growing at the slowest quarterly pace since 2009.

China’s yuan traded near the weakest level in almost six years as a plunge in imports signaled declining demand in an economy growing at the slowest quarterly pace since 2009.

The nation’s inbound shipments shrank more than estimated in June and exports dropped for a third month, according to data released Wednesday, while figures due Friday are projected to show a 6.6 percent expansion in April-June gross domestic product. Any disappointments could prompt analysts to bring forward forecasts for interest-rate cuts, Tim Condon, head of Asian research at ING Groep NV, wrote in a note Thursday.

The yuan was little changed at 6.6878 a dollar as of 4:48 p.m. in Shanghai, according to prices from the China Foreign Exchange Trade System.