“There has been a bit of a demographic shift. Guys my age are retiring, and they are not putting a lot of their money to risk as much anymore. Even the flow-through market here…there used to be a lot of doctors, dentists, lawyers that would typically put money in flow-through funds to get the tax advantage. The Canadian government has changed some of those rules and made it a lot harder. So, I think that is part of the disconnect [between the gold price and gold miners’ valuations],” says mining sector expert Brian Christie. Listen to this MSE interview for more insights from Mr. Christie.

Brian Christie has vast mining sector experience. He began his career as a geologist and saw two mineral discoveries first-hand. Then he traveled the world as a journalist for The Northern Miner. Brian next served as a mining equity analyst for nearly two decades before leading the investor relations team at Agnico Eagle, a leading gold producer. Currently, Brian is on the board of directors for Wallbridge Mining and, since May 2023, is the chairman of Fury Gold Mines (MSE sponsor).

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Parsing geopolitics is fun but our attention is better directed to the limits and second-order effects of legacy systems in each of the rival states.

Parsing geopolitics is fun but our attention is better directed to the limits and second-order effects of legacy systems in each of the rival states. They’re wearing us down with shocking headlines and opinions. They come daily these days, with increasingly implausible claims that leave your jaw on the floor.

They’re wearing us down with shocking headlines and opinions. They come daily these days, with increasingly implausible claims that leave your jaw on the floor.

Quietly on Friday, the FDIC announced the first federally-insured bank failure of 2024, the publicly-traded Republic First Bancorp (ticker FRBK) which did business as Republic Bank. In an unsettling sign of the times, this federally-insured bank was trading at 1-cent on Friday; down from 27-1/2 cents last September when we first reported on its dire condition.

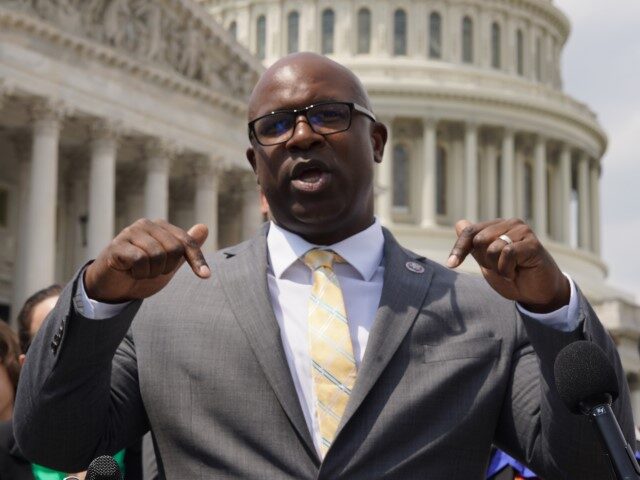

Quietly on Friday, the FDIC announced the first federally-insured bank failure of 2024, the publicly-traded Republic First Bancorp (ticker FRBK) which did business as Republic Bank. In an unsettling sign of the times, this federally-insured bank was trading at 1-cent on Friday; down from 27-1/2 cents last September when we first reported on its dire condition. Rep. Jamaal Bowman (D-NY) expressed his full “support” for the United States to “bring in” Palestinian refugees from Gaza.

Rep. Jamaal Bowman (D-NY) expressed his full “support” for the United States to “bring in” Palestinian refugees from Gaza. Americans need lower car prices. But not Hertz. “The residual decline … was relative to both ICE vehicles and EVs”: Hertz

Americans need lower car prices. But not Hertz. “The residual decline … was relative to both ICE vehicles and EVs”: Hertz In this week’s The Reason Roundtable, editors Matt Welch, Katherine Mangu-Ward, Nick Gillespie, and Peter Suderman assess the spate of anti-Israel campus protests at universities across the country, followed by another look at the trials of both Harvey Weinstein and Donald Trump in New York.

In this week’s The Reason Roundtable, editors Matt Welch, Katherine Mangu-Ward, Nick Gillespie, and Peter Suderman assess the spate of anti-Israel campus protests at universities across the country, followed by another look at the trials of both Harvey Weinstein and Donald Trump in New York. The mining shares have seen a string rally over the past few months as precious metal prices have risen. Could the sector be poised to make further gains and accelerate from here? Let’s discuss that today.

The mining shares have seen a string rally over the past few months as precious metal prices have risen. Could the sector be poised to make further gains and accelerate from here? Let’s discuss that today. Humza Yousaf, the Scottish First Minister who infamously went on a tirade against white people in parliament and then oversaw the passing of extreme ‘hate crime’ laws in the country has been forced to resign.

Humza Yousaf, the Scottish First Minister who infamously went on a tirade against white people in parliament and then oversaw the passing of extreme ‘hate crime’ laws in the country has been forced to resign. Here is an important look at the US dollar, gold, and mining stocks.

Here is an important look at the US dollar, gold, and mining stocks. Catherine Austin Fitts (CAF), Publisher of The Solari Report, financial expert and former Assistant Secretary of Housing (Bush 41 Admin.), has long said, “The federal government is being run as a criminal enterprise. . . .not just a little criminal, but a lot criminal.” Now, CAF contends what is going on in America is much more than greedy criminals. CAF says, “This has turned into warfare against “We the People” on a spiritual level.”

Catherine Austin Fitts (CAF), Publisher of The Solari Report, financial expert and former Assistant Secretary of Housing (Bush 41 Admin.), has long said, “The federal government is being run as a criminal enterprise. . . .not just a little criminal, but a lot criminal.” Now, CAF contends what is going on in America is much more than greedy criminals. CAF says, “This has turned into warfare against “We the People” on a spiritual level.”