by Wolf Richter

Wolf Street

The “minimum book tax” on reported earnings would be a tax incentive to produce realistic earnings reports. Wall Street will fight it furiously.

The “minimum book tax” on reported earnings would be a tax incentive to produce realistic earnings reports. Wall Street will fight it furiously.

I was no fan of money-printing interest-rate-repressing Fed Chair Janet Yellen, though she did hike interest rates and kicked off the Fed’s balance sheet reduction. But she’s now getting huge brownie points as Secretary of the Treasury for trying to deal with the catastrophic corporate tax code by including something I have been jabbering about since 2012:

Large corporations – and there are only a few dozen to which this would apply, according to the proposal – should pay income taxes on the inflated and puffed-up income they report to their shareholders under our glorious accounting principles GAAP, rather than paying no taxes, or even getting paid tax benefits, on the losses they report separately to the IRS under the tax code.

The Real Time Reverse Transcription Polymerase Chain Reaction (rRT-PCR) test was adopted by the WHO on January 23, 2020 as a means to detecting the SARS-COV-2 virus, following the recommendations of a Virology research group (based at Charité University Hospital, Berlin), supported by the Bill and Melinda Gates Foundation. (For Further details see the Drosten Study)

The Real Time Reverse Transcription Polymerase Chain Reaction (rRT-PCR) test was adopted by the WHO on January 23, 2020 as a means to detecting the SARS-COV-2 virus, following the recommendations of a Virology research group (based at Charité University Hospital, Berlin), supported by the Bill and Melinda Gates Foundation. (For Further details see the Drosten Study) In retail investing, do the “blind lead the blind?” Such was a question I asked recently about young investors who are “Long Confidence And Short Experience.” However, a recent survey by MagnifyMoney dug much deeper into the subject.

In retail investing, do the “blind lead the blind?” Such was a question I asked recently about young investors who are “Long Confidence And Short Experience.” However, a recent survey by MagnifyMoney dug much deeper into the subject. The Washington Post reports that a group of thirty-three current and former students at Christian colleges are suing the Department of Education in a class action lawsuit in an attempt to abolish any religious exemptions for schools that do not abide by the current sexual and gender zeitgeist sweeping the land. The plaintiffs argue that by holding to orthodox Christian teachings on sexuality these universities are engaged in unconstitutional discrimination due to the federal funding they receive. The lawsuit, filed by the Religious Exemption Accountability Project, is timed to coincide with the passage of the Equality Act (which I recently discussed here) in the House of Representatives and to give narrative momentum to the push to force the progressive conception of sexuality and gender upon private institutions. The director of the Religious Exemption Accountability Project is explicit that he hopes the lawsuit will ensure that there are not any religious exemptions if the Equality Act ends up being a law.

The Washington Post reports that a group of thirty-three current and former students at Christian colleges are suing the Department of Education in a class action lawsuit in an attempt to abolish any religious exemptions for schools that do not abide by the current sexual and gender zeitgeist sweeping the land. The plaintiffs argue that by holding to orthodox Christian teachings on sexuality these universities are engaged in unconstitutional discrimination due to the federal funding they receive. The lawsuit, filed by the Religious Exemption Accountability Project, is timed to coincide with the passage of the Equality Act (which I recently discussed here) in the House of Representatives and to give narrative momentum to the push to force the progressive conception of sexuality and gender upon private institutions. The director of the Religious Exemption Accountability Project is explicit that he hopes the lawsuit will ensure that there are not any religious exemptions if the Equality Act ends up being a law. What’s the most common “people” sight in any public place, anywhere? At this point in our evolution the answer is easy: hunched over individuals tapping away on smartphones.

What’s the most common “people” sight in any public place, anywhere? At this point in our evolution the answer is easy: hunched over individuals tapping away on smartphones. Americans appear to be growing more concerned about the skyrocketing national debt level – officially $28.1 trillion and counting.

Americans appear to be growing more concerned about the skyrocketing national debt level – officially $28.1 trillion and counting. Lawmakers in New York have agreed to provide financial aid to illegal immigrants who have lost their job during the coronavirus pandemic.

Lawmakers in New York have agreed to provide financial aid to illegal immigrants who have lost their job during the coronavirus pandemic. ‘ESG’ is a great buzzword in investing right now. For years the momentum has been building for the idea that retirement savings should do more than keep you secure, it also should help the planet. Obviously, no one wants to hurt the planet since its our only home. ESG Investment is shorthand for Environmental, Social and Governance, which are the three lenses through which investments are to be ranked. High ranking companies get more money from investors than low rankers. The competition to rank high is fierce since having more investors is an important thing for companies. ESG is part of the broad socially responsible investing trend that focuses on development of a more sustainable financial system.

‘ESG’ is a great buzzword in investing right now. For years the momentum has been building for the idea that retirement savings should do more than keep you secure, it also should help the planet. Obviously, no one wants to hurt the planet since its our only home. ESG Investment is shorthand for Environmental, Social and Governance, which are the three lenses through which investments are to be ranked. High ranking companies get more money from investors than low rankers. The competition to rank high is fierce since having more investors is an important thing for companies. ESG is part of the broad socially responsible investing trend that focuses on development of a more sustainable financial system. In one of the most bizarre campus stories in recent memory, a medical student at the University of Virginia posed mildly skeptical questions about microaggressions to a university panel. Afterward, his school claimed he was hostile, implied he was disrespectful to authority and a threat to future patients, and began investigating him. As anyone in this situation would, the student was confused and frustrated by the school’s actions. The school then used that confusion and frustration to further claim the student was unstable.

In one of the most bizarre campus stories in recent memory, a medical student at the University of Virginia posed mildly skeptical questions about microaggressions to a university panel. Afterward, his school claimed he was hostile, implied he was disrespectful to authority and a threat to future patients, and began investigating him. As anyone in this situation would, the student was confused and frustrated by the school’s actions. The school then used that confusion and frustration to further claim the student was unstable.

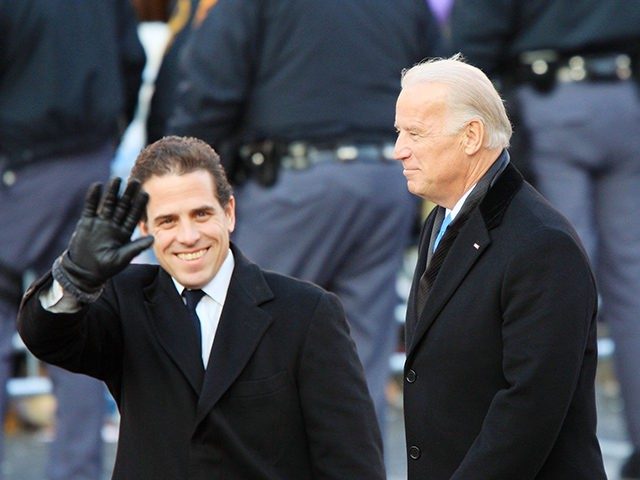

President Joe Biden issued several new executive orders and actions on Thursday aimed at gun control — while his son, Hunter Biden, is accused by critics of having violated federal law by lying about his past drug use in a background check for a gun.

President Joe Biden issued several new executive orders and actions on Thursday aimed at gun control — while his son, Hunter Biden, is accused by critics of having violated federal law by lying about his past drug use in a background check for a gun. Way back in 2007, I narrated this video to explain why tax competition is very desirable because politicians are likely to overtax and overspend (“Goldfish Government“) if they think taxpayers have no ability to escape.

Way back in 2007, I narrated this video to explain why tax competition is very desirable because politicians are likely to overtax and overspend (“Goldfish Government“) if they think taxpayers have no ability to escape.

The European Court of Human Rights has ruled that mandatory vaccinations are legal in a significant judgment that could have a big impact on the rollout of the COVID-19 jab.

The European Court of Human Rights has ruled that mandatory vaccinations are legal in a significant judgment that could have a big impact on the rollout of the COVID-19 jab. The last time this happened gold mining stocks surged over 100%.

The last time this happened gold mining stocks surged over 100%.