by Pam Martens and Russ Martens

Wall Street on Parade

There is a known $41 billion in Credit Default Swaps (CDS) on Russian debt. There is likely many billions more in unknown amounts. There are also billions more in Credit Default Swaps on state-owned Russian corporate debt and non state-owned Russian corporate debt.

There is a known $41 billion in Credit Default Swaps (CDS) on Russian debt. There is likely many billions more in unknown amounts. There are also billions more in Credit Default Swaps on state-owned Russian corporate debt and non state-owned Russian corporate debt.

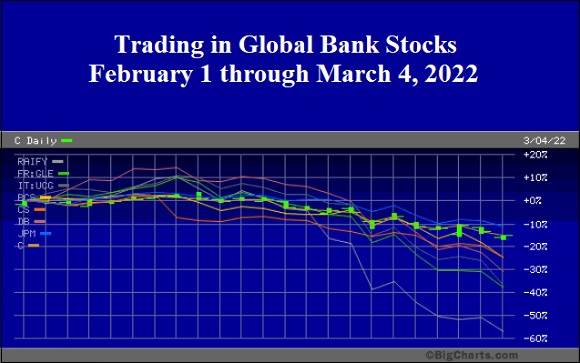

In addition to Wall Street not knowing which global banks and other financial institutions are on the hook to pay out on the Credit Default Swap protection they sold in case of a Russian sovereign debt default (or Russian corporate debt default), there is also approximately $100 billion of Russian sovereign debt (whose default is looking more and more likely) sitting on the balance sheets of foreign banks.

Put it all together and you have the makings of a replay of the 2008 banking crisis when banks backed away from lending to each other because they didn’t know who would fall next from toxic subprime exposure.