by Alexandra Harris

Yahoo! Finance

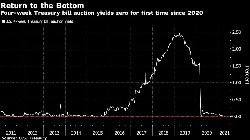

(Bloomberg) — The Treasury’s bill auctions Thursday drew the lowest yield in more than a year as an excess of cash in front-end of fixed-income markets kept borrowing costs anchored near zero.

(Bloomberg) — The Treasury’s bill auctions Thursday drew the lowest yield in more than a year as an excess of cash in front-end of fixed-income markets kept borrowing costs anchored near zero.

The U.S. government’s $40 billion sale of four-week bills on Thursday went off with a yield of 0%, the first time that has happened since March 2020, in the early months of the coronavirus pandemic. The Treasury also sold $40 billion of eight-week bills at 0.01%. Existing rules prevent issuing debt with negative yields at auction.

The four-week sale last came in at that level when anxious investors were pouring cash into money-market funds. Fast forward to this year and rates on Treasury bills have been under pressure with the government reducing issuance of short-term securities to draw down its mammoth cash balance so it can comply with a possible debt-ceiling reinstatement and to cover expenses.