from Zero Hedge

A bizarre disconnect between yuan settlement data and the PBOC’s balance sheet has generated much interest among economists and market participants, according to Bloomberg’s Ye Xie who notes that until recently, when China Inc. posted a trade surplus, corporates sold the dollar proceeds to commercial banks. The PBOC then bought the dollars from banks and sold yuan to them, as part of its intervention to slow the yuan’s appreciation.

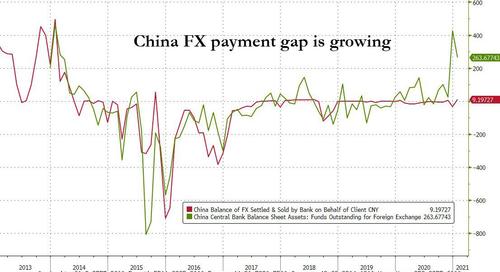

A bizarre disconnect between yuan settlement data and the PBOC’s balance sheet has generated much interest among economists and market participants, according to Bloomberg’s Ye Xie who notes that until recently, when China Inc. posted a trade surplus, corporates sold the dollar proceeds to commercial banks. The PBOC then bought the dollars from banks and sold yuan to them, as part of its intervention to slow the yuan’s appreciation.

As a result, there used to be a tight relationship between the net yuan settlement – corporates selling dollars to banks – and changes in foreign-currency funds outstanding at the PBOC, a proxy for its intervention activities.