from Zero Hedge

The Fed’s most frequent lament is that no matter how many trillions in bonds (and stocks and ETFs) it buys or how much liquidity it forehoses into the market, it just can’t push inflation higher.

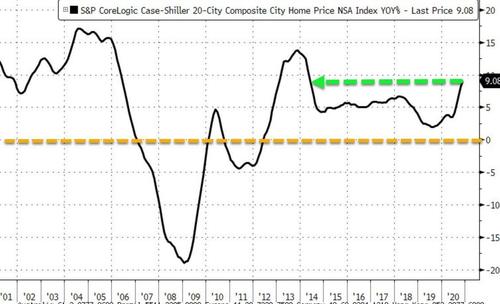

Well, here’s an idea: maybe all the central-planning megabrains at the Marriner Eccles building and 33 Liberty Street can take a break from whatever circle jerk they are engaged in right now, and look at the latest Case Shiller numbers which showed not only that home prices surged at the fastest pace in seven years, rising more than 9% compared to a year ago…

… but that for the first time since the financial crisis, the annual price increase in every major US MSA (and according to Case Shiller there are 20 of them) rose by at least 6.8% Y/Y (in the case of Las Vegas) and as much as 13.8% in Phoenix, meaning that the average home prices across all of the US is now rising at 4.5 times the Fed’s own inflation target, and even the cheapest US MSA is rising at more than 3 times the Fed’s inflation goal.