by Bron Suchecki

Monetary Metals

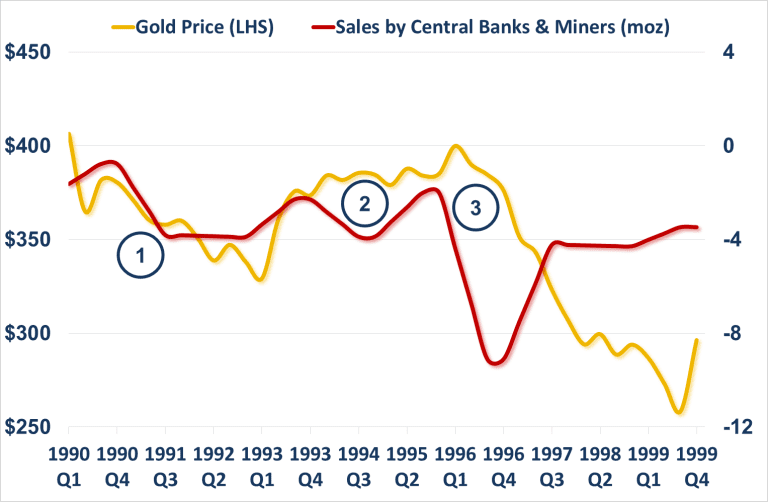

Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners hedging their production. To-date no one has been able to identify the hidden source of demand that was obviously supporting the gold market during that period.

Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners hedging their production. To-date no one has been able to identify the hidden source of demand that was obviously supporting the gold market during that period.

In addition, conventional justifications that accelerated sales by central banks after 1996, which broke the gold market and drove the price down over 35% from $400 to $250, were just portfolio readjustments have been rejected by many analysts who instead see them as a conspiracy to suppress the gold price to ensure support for fiat currencies. But what if there was another more pressing reason for such central bank desperation?