by Darryl Robert Schoon

Gold Seek

Liquifaction: … 3: conversion of soil into a fluidlike mass during an earthquake or other seismic event, 4: inability of flooded capital markets to absorb additional capital without destabilizing paper assets, e.g. stocks, bonds, currencies, etc., 5. a monetary phenomena associated with the collapse of capital markets.

Liquifaction: … 3: conversion of soil into a fluidlike mass during an earthquake or other seismic event, 4: inability of flooded capital markets to absorb additional capital without destabilizing paper assets, e.g. stocks, bonds, currencies, etc., 5. a monetary phenomena associated with the collapse of capital markets.

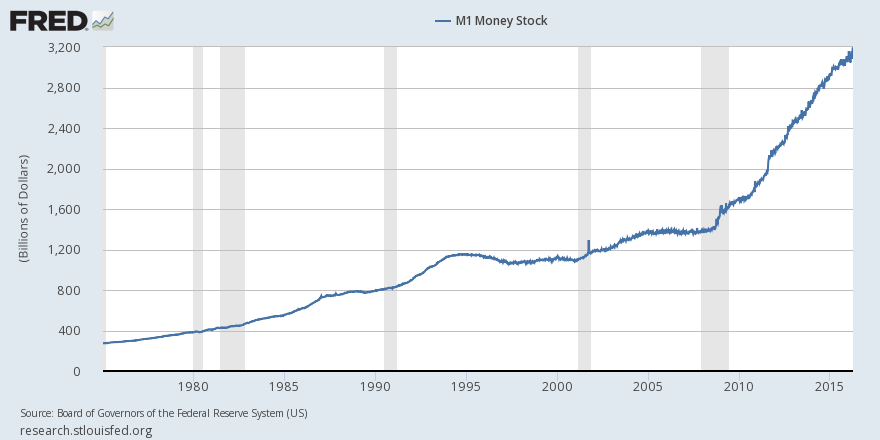

[…] Inflation is always and everywhere a monetary phenomena caused by an increase in the money supply, the greater the increase, the greater the inflation. If the money supply expands with sufficient rapidity, inflation becomes hyperinflation and paper money loses all value.

[…] THE GREAT MODERATION i.e. THE GREAT DELUSION

What you don’t know explains what you don’t understand

In 1971, when the US ended the convertibility of the US dollar to gold, the only limit on the bankers’ ability to print money ad infinitum—monetary gold reserves—was removed. This led to an immediate spike in inflation ending in an inflationary surge—from 3.3% in 1971 to 14.4% in 1980, a 436% increase. Economists called it the Great Inflation.