from Sober Look

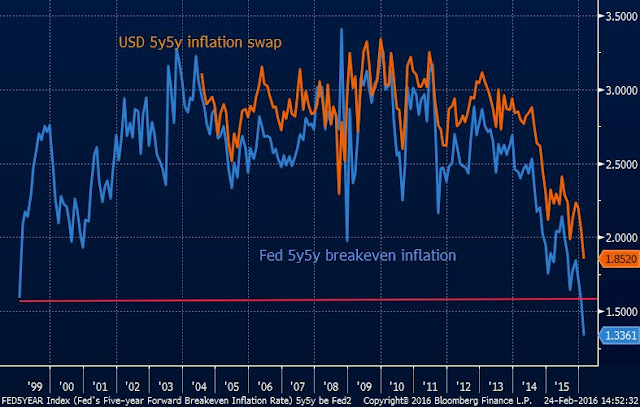

One or more rate hikes by the Federal Reserve in 2016 remains a real possibility. Why would the Fed consider such a policy action given the recent collapse in inflation expectations?

One or more rate hikes by the Federal Reserve in 2016 remains a real possibility. Why would the Fed consider such a policy action given the recent collapse in inflation expectations?

Over the past couple of months many analysts and the futures markets have assigned a rather high probability to the so-called “one and done” – no change in policy in 2016. Indeed, here is what we’ve heard recently from St. Louis Fed President James Bullard:

Reuters: – The Federal Reserve must act to stop inflation expectations from getting too low, St. Louis Fed President James Bullard said on Wednesday, reiterating his concerns about continuing to raise interest rates.

The U.S. central bank cannot let low inflation expectations “get out of hand,” he told a dinner of bond traders here, adding he “can’t stomach” currently low readings. “It’s just that they’ve fallen so far that it’s got to be a concern.”