by Jeff Nielson

Bullion Bulls Canada

To paraphrase an old expression, “there are lies, damned lies, and Obama lies.” In 2008; Barack Obama promised Americans (and the world) “change”, meaning a change of direction from the eight year reign-of-error of George Bush Jr. What Americans and the world got was more of the same, in every way.

To paraphrase an old expression, “there are lies, damned lies, and Obama lies.” In 2008; Barack Obama promised Americans (and the world) “change”, meaning a change of direction from the eight year reign-of-error of George Bush Jr. What Americans and the world got was more of the same, in every way.

Obama promised to “get tough on Wall Street.” Instead, his corrupt regime has proclaimed that it will never prosecute a Big Bank, ever again. Obama promised to repeal “the Bush tax-cuts”, which were at the time the largest single windfall for the wealthy in history. Instead, he has entrenched this never-tax-the-Rich philosophy.

The net effect of eight more years of allowing the Big Bank crime syndicate to run wild, and eight more years of allowing the very-rich a taxation “free ride”? Globally, the Top-1% now possess more wealth than everyone else on the planet, combined. In the U.S., the Top 0.1%, by themselves, hoard as much wealth as the bottom-90% of the population.

Continue Reading at BullionBullsCanada.com…

Most religious men find the answers to their prayers in scripture. Ted Benna found them in the U.S. tax code.

Most religious men find the answers to their prayers in scripture. Ted Benna found them in the U.S. tax code.

I was emailing back and forth with my pal Brien Lundin, editor of Gold Newsletter, this week and as we were basking in the limelight of analytical brilliance, it occurred to me that having a stock that many of us own, Kaminak Gold Corp. (KAM:TSX.V), suddenly the target of a $520,000,000 bid by a major mining company, Goldcorp Inc. (G:TSX; GG:NYSE), is exactly how proper analysis should be rewarded. At least, that’s how we were taught, to say the least. To wit, this event is truly a significant watershed and a concrete block of confirmation that the New Golden Bull has arrived. Whether or not you are a raving foam-in-the-mouth bull, or a patient hiding-under-the-desk bull (as am I), Goldcorp’s bravado is a wonderful thing to behold and would have made Harry Callahan proud.

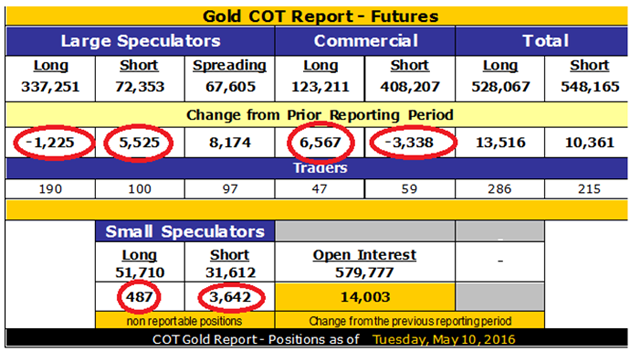

I was emailing back and forth with my pal Brien Lundin, editor of Gold Newsletter, this week and as we were basking in the limelight of analytical brilliance, it occurred to me that having a stock that many of us own, Kaminak Gold Corp. (KAM:TSX.V), suddenly the target of a $520,000,000 bid by a major mining company, Goldcorp Inc. (G:TSX; GG:NYSE), is exactly how proper analysis should be rewarded. At least, that’s how we were taught, to say the least. To wit, this event is truly a significant watershed and a concrete block of confirmation that the New Golden Bull has arrived. Whether or not you are a raving foam-in-the-mouth bull, or a patient hiding-under-the-desk bull (as am I), Goldcorp’s bravado is a wonderful thing to behold and would have made Harry Callahan proud. I reduced the full chart from it’s full size (in today’s RNP video) to about 30% to allow it to fit in here. The detail that matters most is still retained with adequate clarity.

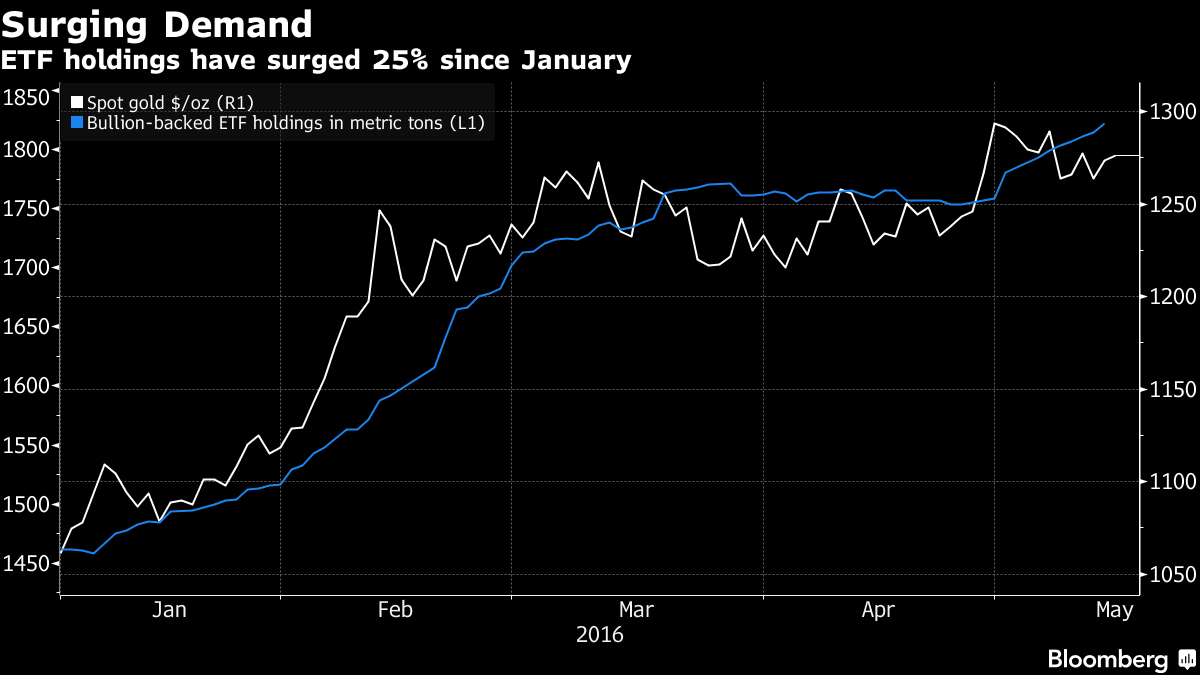

I reduced the full chart from it’s full size (in today’s RNP video) to about 30% to allow it to fit in here. The detail that matters most is still retained with adequate clarity. The great gold rush of 2016 is gathering pace. Holdings in exchange-traded funds have now surged by a quarter, with investors taking advantage of lower prices over the past two weeks to enlarge stakes on rising concern about central bank policy making worldwide.

The great gold rush of 2016 is gathering pace. Holdings in exchange-traded funds have now surged by a quarter, with investors taking advantage of lower prices over the past two weeks to enlarge stakes on rising concern about central bank policy making worldwide. The price of gold moved down about sixteen bucks, while that of silver dropped about three dimes. In other words, the dollar gained 0.3 milligrams of gold and 0.04 grams of silver.

The price of gold moved down about sixteen bucks, while that of silver dropped about three dimes. In other words, the dollar gained 0.3 milligrams of gold and 0.04 grams of silver. Do you support bombing Agrabah?

Do you support bombing Agrabah? “Late last week,” Flying Dog’s CEO Jim Caruso reported last Monday, “a Federal Court ruled in favor of yours truly in a landmark case for freedom of speech, proving yet again that Good Beer, No Censorship prevails.”

“Late last week,” Flying Dog’s CEO Jim Caruso reported last Monday, “a Federal Court ruled in favor of yours truly in a landmark case for freedom of speech, proving yet again that Good Beer, No Censorship prevails.” It’s not just that there was an obvious and intense change in sentiment, as that is quite common among and within markets. It is more so that this repetition is a little too familiar. In January, the mainstream was taken aback as the world looked headed for a very dark place, all “unexpected” of course. Just a few months later, it has been nothing but a huge sigh of relief as if anyone might know for sure the danger has passed.

It’s not just that there was an obvious and intense change in sentiment, as that is quite common among and within markets. It is more so that this repetition is a little too familiar. In January, the mainstream was taken aback as the world looked headed for a very dark place, all “unexpected” of course. Just a few months later, it has been nothing but a huge sigh of relief as if anyone might know for sure the danger has passed. To paraphrase an old expression, “there are lies, damned lies, and Obama lies.” In 2008; Barack Obama promised Americans (and the world) “change”, meaning a change of direction from the eight year reign-of-error of George Bush Jr. What Americans and the world got was more of the same, in every way.

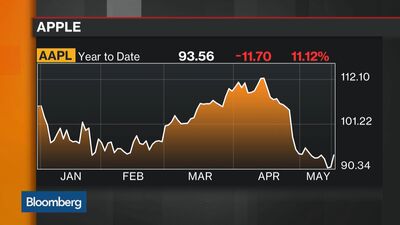

To paraphrase an old expression, “there are lies, damned lies, and Obama lies.” In 2008; Barack Obama promised Americans (and the world) “change”, meaning a change of direction from the eight year reign-of-error of George Bush Jr. What Americans and the world got was more of the same, in every way. Gold remained range-bound, and saw a decline last week of 1.7%.

Gold remained range-bound, and saw a decline last week of 1.7%. The Federal Reserve’s “invisible hand” in the markets is no longer “invisible.” It’s become obvious to most market participants that the Fed is working hard to keep the stock market from collapsing and the price of gold below $1300. But why?

The Federal Reserve’s “invisible hand” in the markets is no longer “invisible.” It’s become obvious to most market participants that the Fed is working hard to keep the stock market from collapsing and the price of gold below $1300. But why?

During a lengthy interview on CNBC the week before last, Donald Trump, fresh from becoming the presumptive Republican nominee, came as close as any major presidential contender ever has to saying that America is not capable of repaying her debts in full, and that our path to economic recovery might involve some pain for our creditors. This moment of candor earned Trump almost as much condemnation as his earlier suggestions to ban Muslims from entering the United States.

During a lengthy interview on CNBC the week before last, Donald Trump, fresh from becoming the presumptive Republican nominee, came as close as any major presidential contender ever has to saying that America is not capable of repaying her debts in full, and that our path to economic recovery might involve some pain for our creditors. This moment of candor earned Trump almost as much condemnation as his earlier suggestions to ban Muslims from entering the United States.

The one political risk on the minds of U.S. executives isn’t the U.K. bailing from the European Union or even a Donald Trump presidency. It’s the impeachment drama in Brazil, according to a Goldman Sachs report.

The one political risk on the minds of U.S. executives isn’t the U.K. bailing from the European Union or even a Donald Trump presidency. It’s the impeachment drama in Brazil, according to a Goldman Sachs report. Fitch, the credit rating agency, today warns that Brexit might lead to a 25pc correction in house prices, bringing them down to what Fitch believes is their long term “sustainable” level. I don’t mean to be irresponsible, but good; this would be very welcome.

Fitch, the credit rating agency, today warns that Brexit might lead to a 25pc correction in house prices, bringing them down to what Fitch believes is their long term “sustainable” level. I don’t mean to be irresponsible, but good; this would be very welcome. The first quarter earnings reporting period is nearly complete with over 90% of the S&P 500 having reported results for the March quarter. What we have learned to this point is that the first quarter earnings decline was not as bad as expected. Still, the first quarter reporting period can’t really be thought of as being good either.

The first quarter earnings reporting period is nearly complete with over 90% of the S&P 500 having reported results for the March quarter. What we have learned to this point is that the first quarter earnings decline was not as bad as expected. Still, the first quarter reporting period can’t really be thought of as being good either. ICBC Standard Bank Plc expanded its push into London’s precious metals market by agreeing to buy one of Europe’s largest vaults from Barclays Plc.

ICBC Standard Bank Plc expanded its push into London’s precious metals market by agreeing to buy one of Europe’s largest vaults from Barclays Plc.