by David Stockman

David Stockman’s Contra Corner

There has never been a more destructive central banking policy than the Fed’s current maniacal quest to stimulate more inflation and more debt. That’s what is killing real wages and economic vitality in flyover America—-even as it showers prodigious windfalls of unearned wealth on Wall Street and the bicoastal elites who draft on the nation’s vastly inflated finances.

In fact, the combination of pumping-up inflation toward 2% and hammering-down interest rates to the so-called zero bound is economically lethal. The former destroys the purchasing power of main street wages while the latter strip mines capital from business and channels it into Wall Street financial engineering and the inflation of stock prices.

KOLKATA: The Gold Monetisation Scheme (GMS) remains a non-starter seven months after its introduction as most banks are yet to enter into an agreement with collection centres and refiners, two players in the chain said. The scheme aims to unlock 22,000 tonnes of idle gold lying with Indian households and reduce the country’s dependence on imported gold. Banks are not yet ready with their board approvals and GMS software to operate this scheme.

KOLKATA: The Gold Monetisation Scheme (GMS) remains a non-starter seven months after its introduction as most banks are yet to enter into an agreement with collection centres and refiners, two players in the chain said. The scheme aims to unlock 22,000 tonnes of idle gold lying with Indian households and reduce the country’s dependence on imported gold. Banks are not yet ready with their board approvals and GMS software to operate this scheme. If the Trump/Sanders debate proceeds as planned in California, you’re about to witness one of the most important moments of a 2016 general election that hasn’t even begun yet. To say such a debate would be an unmitigated disaster for Hillary Clinton would be the understatement of the century. Let’s explore why.

If the Trump/Sanders debate proceeds as planned in California, you’re about to witness one of the most important moments of a 2016 general election that hasn’t even begun yet. To say such a debate would be an unmitigated disaster for Hillary Clinton would be the understatement of the century. Let’s explore why.

My latest E-Mini S&P tout pulls out all the stops with an ambitious target that would be equivalent to a 700-point rally in the Dow.

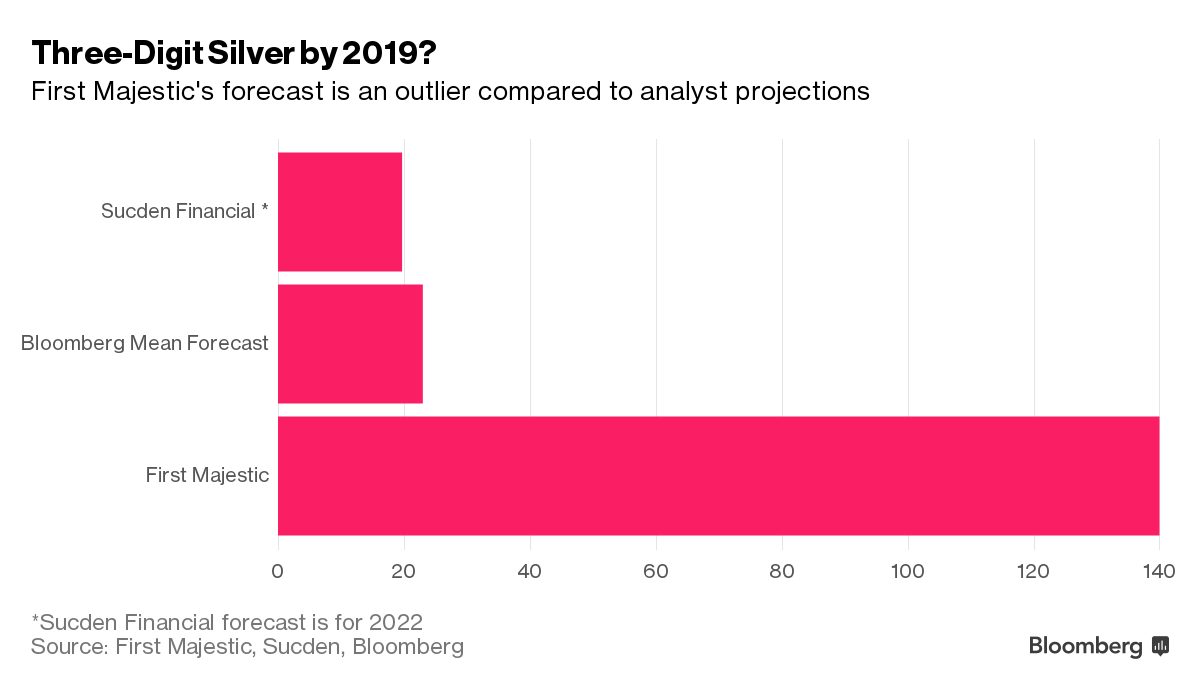

My latest E-Mini S&P tout pulls out all the stops with an ambitious target that would be equivalent to a 700-point rally in the Dow. A major Japanese electronics maker approached First Majestic Silver Corp. for the first time last month seeking to lock in future stock, a sign of supply concerns that could boost the metal’s price ninefold, according to the best-performing producer of the metal.

A major Japanese electronics maker approached First Majestic Silver Corp. for the first time last month seeking to lock in future stock, a sign of supply concerns that could boost the metal’s price ninefold, according to the best-performing producer of the metal. There have been more than a few awful people working on Wall Street and in the financial world. Bernie Madoff comes to mind. He ruined the lives of quite a few people with his colossal Ponzi scheme. The predatory lenders that created the U.S. housing crisis might also qualify.

There have been more than a few awful people working on Wall Street and in the financial world. Bernie Madoff comes to mind. He ruined the lives of quite a few people with his colossal Ponzi scheme. The predatory lenders that created the U.S. housing crisis might also qualify. Capo for Life!

Capo for Life! First-quarter earnings season is close to over, and the numbers it’s produced are as gloomy as they have been since the Great Recession.

First-quarter earnings season is close to over, and the numbers it’s produced are as gloomy as they have been since the Great Recession. “Go ahead and live your life,” doctors told my dad. The next day, he was dead.

“Go ahead and live your life,” doctors told my dad. The next day, he was dead.

What happens when the two largest economies on the planet start fighting a trade war with one another? Well, we are about to find out. As you will see below, the U.S. has gone “nuclear” on China in a trade dispute over steel, and the Chinese response is likely to be at least as strong. Meanwhile, events in the South China Sea have brought tensions between the Chinese government and the Obama administration to a boiling point. The Obama administration strongly insists that China does not have a legal right to those islands, and in China there is now talk that it may ultimately be necessary to confront the United States militarily in order keep control of them. Most Americans may not realize this, but the relationship between the United States and China is officially going down the tubes, and this is likely to have very significant consequences during the years to come.

What happens when the two largest economies on the planet start fighting a trade war with one another? Well, we are about to find out. As you will see below, the U.S. has gone “nuclear” on China in a trade dispute over steel, and the Chinese response is likely to be at least as strong. Meanwhile, events in the South China Sea have brought tensions between the Chinese government and the Obama administration to a boiling point. The Obama administration strongly insists that China does not have a legal right to those islands, and in China there is now talk that it may ultimately be necessary to confront the United States militarily in order keep control of them. Most Americans may not realize this, but the relationship between the United States and China is officially going down the tubes, and this is likely to have very significant consequences during the years to come. You may be wondering if you “missed the boat” on gold.

You may be wondering if you “missed the boat” on gold. Negative interest rate policies elsewhere hit US Treasury yields

Negative interest rate policies elsewhere hit US Treasury yields